For a few months I’ve been telling people, any time I get a chance, that Fansunite (FANS.T) is a tech company to watch. Why? Because it’s at the late stage of a long process shifting away from being a global betting platform and toward being a supplier of paying customers to betting platforms.

Here’s the deal in easy to understand details: For a while there, a few years back, the shift towards liberalizing global sports betting rules, online casinos, in-game betting and e-sports betting, saw a chunk of empty shellcos on the public markets suddenly become sports betting companies with massive ambition.

The problem is, betting as a business is a money pit, at least during the initial gold rush phase, when every company needs to spend more than a customer will spend with them, to get them to spend anything at all. To make money, you need a lot of customers and massive name recognition, because convincing someone to send you money to add to your casino account takes a lot of work, compliance, and consumer trust, while they’re being bombarded with marketing by your competitors.

We saw this early on in the process when the emergence of online daily fantasy sports saw the rise of Fan Duel and DraftKings, which spent just about every dollar they earned and more, battling each other in a Coke vs Pepsi marketing race to the bottom.

Add more states opening up and more companies getting in, and the last place you want to be in the betting business right now is competing with the big boys.

Fansunite figured this out and made a smart business pivot towards affiliate marketing for those big boys. In short, “I’ve got a bunch of betting customers.. who wants them and how much will you pay?”

FANS is the picks and shovels play for the gambling market.

Let’s break down the main points from the information:

What’s Happening?

Fansunite Entertainment Inc., a global sports entertainment and gaming company, has made a few strategic changes in its business.

The Changes:

- Selling Chameleon: On May 8, 2023, Fansunite sold the source code of their Chameleon platform to another company, Betr Holdings Inc, for a nice profit. This marks the end of Fansunite’s involvement in business-to-business platform licensing.

- Migration of DragonBet: Fansunite and DragonBet, a Wales-based sportsbook, have decided that DragonBet will move away from Fansunite’s Chameleon gaming platform by September 3, 2023, in conjunction with FANS selling the code to Betr. This step will make Fansunite’s operations more efficient, as it wa spending more than it was making on that business.

- Savings and Profits: By making these changes, Fansunite is expecting to save about $7.1 million annually. This will come from reduced salary spend and other general savings out of that business. After these moves, they’re anticipating having a positive cash flow (meaning they’ll be making more money than they’re spending) by the end of 2023 – which is SOON.

- New Focus: Now, Fansunite is placing more emphasis on its affiliate business segment. This part of their business made them $23 million out of $27.3 million in revenue in 2022, so it’s a significant money-maker for them and one they’re market leaders in. They also have a subsidiary that helps users navigate the financial sign on process, which can often be difficult considering the variations in international banking rules

- Change in Leadership: Jeremy Hutchings, the company’s chief technology officer and a big part of Chameleon, is leaving his position by the end of September 2023 due to the company’s shift in focus. However, he’ll still be around to give advice, especially on the potential selling of the Chameleon platform’s source code.

I love these changes because they’re not panic moves, nor are they desperation moves, they’re smart, streamlined realizations that there’s a good business to be had here, even if it’s not the business the company set out to engage in initially.

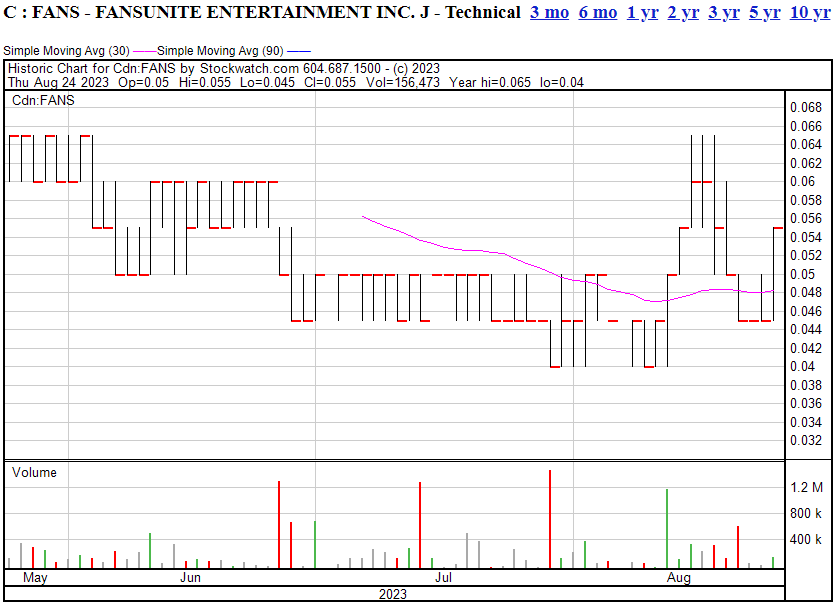

That’s called mature, responsible management, and the retail investor base is starting to realize that if FANS does indeed manage to become cash flow positive, it’ll have a likely outsized effect on the share price.

Watchlist this one. The upward move has already kicked off.

— Chris Parry

FULL DISCLOSURE: Fansunite is an Equity.Guru marketing client and we own the stock. We are also shareholders in Altrincham FC in the UK, and proudly serve on the board alongside FANS CEO Scott Burton.