Short sellers still have a concerning percentage of the share float at TD Bank (TD.T), totalling 22% as of May 31, 2023 according to the Short Sale Trading Summary Report published by the Investment Industry Regulatory Organization of Canada or IIROC.

TD Bank already made headlines when the Canadian-based financial institution was reported as the planet’s most shorted bank back at the beginning of April. Equity Guru’s own Vishal Toora did a deep dive of the event and the response was as strong as the bank’s short position. Some were panicked, but many others said the bank was being manipulated by short sellers looking to generate fear and profit from their short trades.

Toora explored the question whether the bank was in crisis. The pro-short argument was TD had exposed itself to the vulnerable American regional bank market through its Charles Schwab investment, its acquisition of Cowen and its proposed merger with First Horizon.

This theory was refuted by many readers indicating the financial institution and the Canadian banking system was robust and could weather most any storm that the American regional banks were being buffeted by. The idea of TD Bank imploding was ridiculous – the short sellers were wrong.

But is there something these optimists may be missing? Maybe the danger facing TD wasn’t from south of the border, perhaps it was festering in our own backyard. The Canadian real estate market was casually mentioned as a possible reason short sellers took up a large position at TD, but that conversation faded with the original short sellers story. Should it be re-started?

The central banks have had a rough go of it over the last three years, the quantitative easing rebound we had after the 2007 financial crisis, created something I like to call the Everything Bubble as I described in an article I wrote back in December 2019.

Now the proverbial chickens have come home to roost and the US Fed/BoC et al, have no tools left in their collective box to contain the damage. Our stock market is wildly overvalued, inflation remains, and the global economy continues to slow.

Real estate was the go-to for stable long-term investment, but leading up to 2007 and since, it has been speculated out of control where homeowners are paying millions for something they would have paid a couple hundred thousand for just thirty years ago.

This disparity in value wasn’t a problem when the interest rates were artificially stamped into the basement, the only thing that changed was a twenty-five mortgage in Canada became basically a lease to the bank.

Bank of Canada or BoC, was more than aggressive with raising interest rates in order to combat inflation. It seems for the moment that they may have brought it down from its peak 8.1% last summer to 5.9% in January. The goal is still 2% inflation, however unachievable that might be, so rates may still go up.

In an attempt to feed a faltering economy built on consumerism, household debt in North America has skyrocketed. In fact, household debt in Canada now sits at 107% of our GDP. This was a rapid and alarming increase from 80% of GDP reported in 2008.

Home loan borrowers are now spending 7.66% of their disposable income servicing their mortgages. This is a forty-year record high. Total average debt service to income ratio climbed from 16% to more than 19% last year.

According to a recent survey, in 2021, 47% of Canadian households live paycheque to paycheque with a yearly net savings of around $9,972.

The BoC has expressed serious concerns over Canadians’ collective household debt and the current trend of mortgage rates.

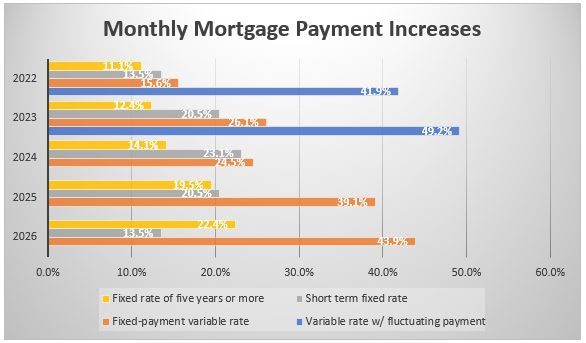

Since paying off your mortgage within your lifetime has become a virtual impossibility, that means mortgage renewals. BoC has predicted those Canadian mortgage holders will most likely be paying a lot more by 2026 as illustrated in the chart below.

TD reported a net income of 3.8 billion CAD in Q2 2023 with total deposits of $1.19 billion. The financial institution carries $238.82 billion in uninsured residential mortgages. Over the next five years, the bank expects $181.76 billion worth of its residential mortgages to reach contractual maturity.

According to the Canadian Mortgage Housing Corporation or CMHC, the average Canadian residential mortgage as of Q1 2023 is $320,298. The average Canadian monthly mortgage payment in 2019 was $1,322. If you renewed that mortgage this year, your monthly payments might total anywhere between $1,496 to $1,972 per month.

The average Canadian salary in 2022 was $59,300 or $4,942 per month. In British Columbia, this would leave you with $3,866 per month net income.

If you have purchased a car, the average payment for that is between $400 and $800 a month. Food costs per month comes to around $320. Utilities come to approximately $170 per month. Monthly leisure expenses total approximately $230. Credit card payments average $430 a month. So, the monthly cost of living would total $600 + $320 + $170 + $230 + $400 = $1720. Add in a mortgage payment of $1,322 and your total is $3,042 per month, leaving approximately $842 for saving, extraneous costs and emergencies.

Renewing your mortgage in 2023 and beyond, could very well push you to the point of bankruptcy and default. There are approximately five million outstanding residential mortgage loans in Canada and at the beginning of 2022, 56.9% of those were variable rate mortgages. This could be very troubling for homeowners.

TD Bank controls about 10% of Canada’s outstanding residential mortgages and has approximately $7.6 billion set aside for delinquent mortgage loans. It would take about 5% of their loan portfolio to default for TD to breach their safety contingency and seriously impact their financial standing.

What is unsettling here, isn’t that TD Bank could be hit hard by a collective default. It’s that the financial institution’s pain would be felt country wide, upsetting Canada’s banking sector in general and driving the economy further into a recession.

This is by no means an eventuality, but a sobering possibility and may be the reason short sellers have stuck in on TD. In the end, we have made this bed with our lax attitude toward household debt and adherence to an ultimately destructive consumerist economy, is there a way we can extricate ourselves from this predicament before it has a chance to come to horrible fruition?