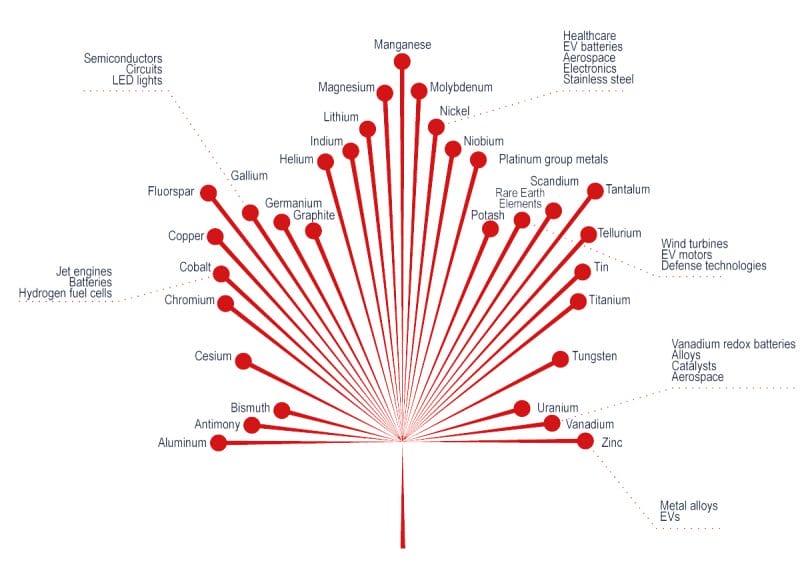

As the world accelerates its transition to green energy, the importance of critical minerals in powering this transformation cannot be overstated. Critical minerals, including rare earth elements (REEs), lithium, and cobalt, are indispensable components in technologies such as electric vehicles, wind turbines, and solar panels. With the global demand for these minerals projected to surge by 400-600 percent in the coming decades, ensuring a secure and resilient supply chain has never been more vital. However, with China dominating the market for processing and refining these critical minerals, the tenuous nature of our current supply chains could pose a significant risk to our clean energy future.

Critical minerals are mined in various locations worldwide, with lithium, for instance, being extracted from sources such as brine in South America and hard rock in Australia. While each mining method comes with its environmental challenges, it is the processing of these minerals into usable compounds that exposes the inherent vulnerabilities in our supply chains. Most lithium processing facilities are situated in China, which accounted for over 60% of the world’s lithium production in 2019. As a result, the global trade of lithium batteries and other essential products is heavily reliant on the existing supply chains.

Considering these challenges, securing the critical mineral supply chain has become a pressing concern for countries across the globe. By investing in the exploration, extraction, processing, and recycling of these valuable resources, nations can reduce their dependence on foreign sources and foster sustainable growth in their clean energy sectors. Additionally, establishing partnerships with Indigenous communities and adhering to the highest environmental, social, and governance (ESG) standards will be crucial in developing a responsible and resilient critical minerals value chain. The green energy revolution is upon us, and the time to act on securing our critical mineral supply chains is now.

Strategies

Countries worldwide, including Canada and the United States, are taking significant steps to secure their critical mineral supplies to bolster the transition to green energy. In Canada, the Critical Minerals Centre of Excellence (CMCE) is leading the development and coordination of policies and programs in collaboration with various stakeholders. Six focus areas have been identified: driving research, innovation, and exploration; accelerating project development; building sustainable infrastructure; advancing reconciliation with Indigenous peoples; growing a diverse workforce and prosperous communities; and strengthening global leadership and security.

To support these focus areas, Canada’s federal government has committed substantial funding to various aspects of the critical minerals value chain. Budget commitments from 2021 and 2022 include $79.2 million for public geoscience and exploration to better identify and assess mineral deposits, a 30% Critical Mineral Exploration Tax Credit for targeted critical minerals, $47.7 million for targeted upstream critical mineral R&D through Canada’s research labs, and $144.4 million for critical mineral research and development, and the deployment of technologies and materials to support critical mineral development for upstream and midstream segments of the value chain.

In the United States, President Biden signed Executive Order 14017 to review vulnerabilities in the critical mineral and material supply chains. The resulting first-of-its-kind supply chain assessment highlighted the national and economic security threats posed by over-reliance on foreign sources. Consequently, the administration is working to expand domestic mining, production, processing, and recycling of critical minerals and materials in collaboration with partners and allies, while adhering to strong labor, environmental, and community engagement standards.

Biden emphasized the importance of domestic production, stating, “We can’t build a future that’s made in America if we ourselves are dependent on China for the materials that power the products of today and tomorrow.”

Major investments in domestic production of key critical minerals and materials have been announced, including a $35 million award from the Department of Defense’s Industrial Base Analysis and Sustainment program to MP Materials for processing heavy rare earth elements in California. This investment will help establish a full end-to-end domestic permanent magnet supply chain. In addition, Berkshire Hathaway Energy Renewables will break ground on a new demonstration facility in California to test the commercial viability of sustainable lithium extraction from geothermal brine.

Furthermore, Redwood Materials is partnering with Ford and Volvo to pilot the collection and recycling of end-of-life lithium-ion batteries at its Nevada-based facilities, extracting lithium, cobalt, nickel, and graphite. The Department of Energy is also investing $140 million in a demonstration project to recover rare earth elements and critical minerals from coal ash and other mine waste, reducing the need for new mining and creating job opportunities in legacy coal communities. With these significant initiatives and investments, both Canada and the United States are working towards securing their critical mineral supply chains for a sustainable green energy future.

The Swiss Resource Capital Uranium Report – 2023 highlighted that the US government is taking further steps to reduce dependence on uranium imports from former Soviet Union successor states. The US Congress approved a budget that will provide $150 million annually over the next 10 years to create a strategic uranium reserve, which will come entirely from US mines. The Biden administration is even considering increasing this investment to $4.3 billion for the next 10 years.

However, in order to capitalize on the potential of their mining sectors, both Canada and the United States need to address challenges such as infrastructure development, regulatory frameworks, and workforce training. By doing so, they can build resilient critical mineral value chains that adhere to the highest environmental, social, and governance (ESG) standards, fostering a sustainable and prosperous future for their respective countries and the global community.

Market forecasts

This green energy future is only going to increase demand for critical minerals. For instance, the uranium market is expected to grow substantially over the next two decades, with a 27% increase in demand predicted for 2021-2030 and a 38% increase for 2031-2040, according to the World Nuclear Association’s Nuclear Fuel Report. This growth in demand is driven by increased reactor capacity and growing electricity demand.

The niobium market, valued at $1544.7 million in 2021, is also projected to grow at a CAGR of 3.61% to reach $1979.63 million by 2028, according to a report by Extrapolate. Niobium’s unique properties make it essential in various industries and applications, including renewable energy and electric vehicles.

The global market for lithium, valued at $7.49 billion in 2022, is expected to grow at a CAGR of 12.3% from 2023 to 2030. This growth is primarily driven by the electrification of vehicles, as lithium-ion batteries are increasingly used in electric vehicles (EVs).

Meanwhile, the global metal magnesium market, valued at $4.39 billion in 2021, is expected to grow at a CAGR of 5.3% from 2022 to 2030. The market growth is driven by the increasing demand for lightweight components in the automotive and aerospace sectors.

The players

These government initiatives and exploding demand have created an opportunity for domestic critical mineral explorers like Standard Uranium, Skyharbour Resources, NioCorp Developments, Azincourt Energy, Beyond Minerals, and West High Yield Resources.

Canadian junior uranium exploration company Standard Uranium (STND.V), is sniffing out uranium discoveries in the Athabasca Basin region of northern Saskatchewan. Its flagship Davidson River Project is located in the Patterson Lake Uranium District in the southwest Athabasca Basin, an area with high potential for further uranium discoveries.

Standard Uranium recently announced results from their 2022 geophysical surveys on each of the Company’s three eastern Athabasca basin projects. High-resolution ground gravity, IP/DC resistivity, and airborne TDEM surveys completed on Atlantic, Canary, and Ascent properties helped to define drill-ready target areas. The company is planning inaugural drill programs to follow up on prospective historical results coupled with newly identified geophysical anomalies.

Skyharbour Resources (SYH.V), has acquired Denison Mine’s Moore Uranium Project on the southeastern side of the Athabasca Basin in northern Saskatchewan. The project hosts multiple mineralized targets with strong discovery potential, and the company plans to test these targets with future drill programs.

The Vancouver-based uranium junior recently announced acquiring eight new prospective uranium exploration properties within the Athabasca Basin of Northern Saskatchewan by staking. These properties comprise 34,022 hectares and bring Skyharbour’s total land package to 492,074 hectares, one of the largest project portfolios in the region. Skyharbour will seek strategic partners to advance these assets as part of their prospect generator business.

NioCorp Developments (NB.T), a critical minerals explorer with a niobium project in Nebraska, is a U.S.-based mineral development company that plans to produce niobium, scandium, and titanium from a single ore body at its proposed Elk Creek, Nebraska Critical Minerals Mine.

Recently, NioCorp and L3 Process Developments announced a process breakthrough in niobium and titanium recovery at L3’s demonstration-scale processing plant in Trois-Rivieres, Quebec. This breakthrough points to a potentially more efficient way to process niobium and titanium into higher-purity products, which may open new markets for the company’s proposed Elk Creek Critical Minerals Project.

Azincourt Energy (AAZ.V), is focused on the alternative fuels/alternative energy sector with uranium exploration projects in the Athabasca Basin, Saskatchewan, Canada, and lithium/uranium projects on the Picotani Plateau, Peru.

The company recently announced the completion its 2023 exploration program at its flagship East Preston Uranium Project in the Athabasca Basin, Saskatchewan. The company drilled 3,066 meters in 13 holes and identified dravite clay alteration in K and H-Zones. Over 600 samples have been sent for analysis.

Beyond Minerals (BY.C), is the largest greenfield lithium exploration player in Ontario, with 64 high-potential greenfield lithium properties totaling over 150,000 hectares.

The lithium miner announced the expansion of its McKenzie Bay, Wapesi Lake, and Wapesi North properties by low-cost map staking. The new claims cover 5,169 additional hectares, connecting the properties to form one contiguous property covering 14,163 hectares. The expansion covers important interpreted geological trends and possible structural controls on these trends.

Lastly, West High Yield Resources (WHY.V), is focused on the acquisition, exploration, and development of mineral resource properties in Canada, including its Record Ridge magnesium, silica, and nickel deposit in British Columbia.

At the beginning of April, WHY provided updates on the status of its mining permit progress for the Record Ridge magnesium deposit located in Rossland, British Columbia, and the status of its nearby Midnight Gold drilling program. The company has submitted all material information, mine site engineering designs, and reports requested by the British Columbia Ministry of Mines. WHY is also initiating a formal Request for Proposal (RFP) process to invite interested groundworks contracting companies with expertise in mine site development and on-site road construction to submit their bids.

Why should I care?

Supply chain security is crucial in the global transition to clean energy and digital technologies. Therefore, countries like Canada and the United States are focusing on securing their critical mineral supply chains to reduce dependence on non-like-minded nations and foster sustainable growth. By investing in their respective mining sectors, strengthening regulatory frameworks, and promoting environmental, social, and governance (ESG) standards, these countries can build resilient value chains that contribute to job creation, economic prosperity, and the achievement of climate and nature protection objectives.

As such, critical mineral explorers, like the ones mentioned above, are not only contributing to the growth of the green energy economy and helping to secure a sustainable future for our planet, but they also offer significant potential value growth for investors in a rapidly expanding market. Win, win for everyone. What are you waiting for? Please remember to do your due diligence and speak with a registered financial professional before making any investment decision.

*Full disclosure: Standard Uranium, Skyharbour Resources, NioCorp Developments, Beyond Minerals, Azincourt Energy and West High Yield Resources are Equity Guru marketing clients