Guanajuato Silver (GSVR.V), Mexico’s fastest growing silver economy, is reactivating past producing silver and gold mines in central Mexico. The company operates four mines and three processing facilities.

The Company produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango.

The silver miner recently announced it produced a record amount of silver in Q4 2022.

Today, the company announced drill results from the wholly owned San Ignacio mine, including a result of 6,981 g/t AgEq, the best drill hole the company has drilled at any of its mines.

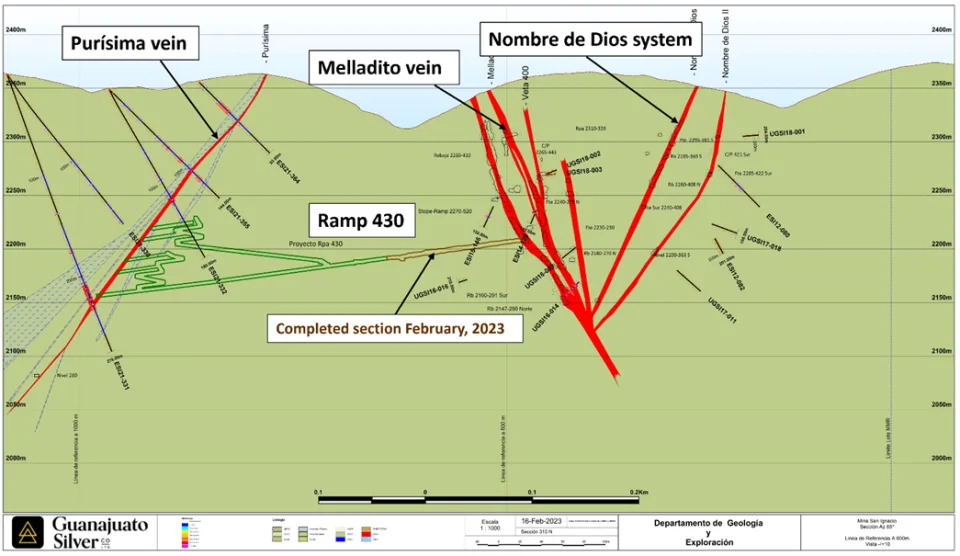

James Anderson, Chairman and CEO said, “SI22-006 is the best drill hole the Company has drilled at any of its mines recently acquired from Great Panther Mining in August of 2022. With almost five meters of true width intersecting 1,219 g/t AgEq, which includes 0.42m true width of 6,981 g/t AgEq, this may represent a game changing result for the mine. The primary focus of our most recent San Ignacio drill program was to target the Melladito vein system with the goal of extending silver and gold mineralization in the south and north areas of the mine. This outstanding result will be followed up with additional drill holes attempting to follow the down dip extension of the vein within the Company’s 2023 drill campaign. In parallel, we are in the midst of driving a 400-metre access ramp from Melladito to the analogous Purisima vein, which offers the potential for expanded production at San Ignacio.”

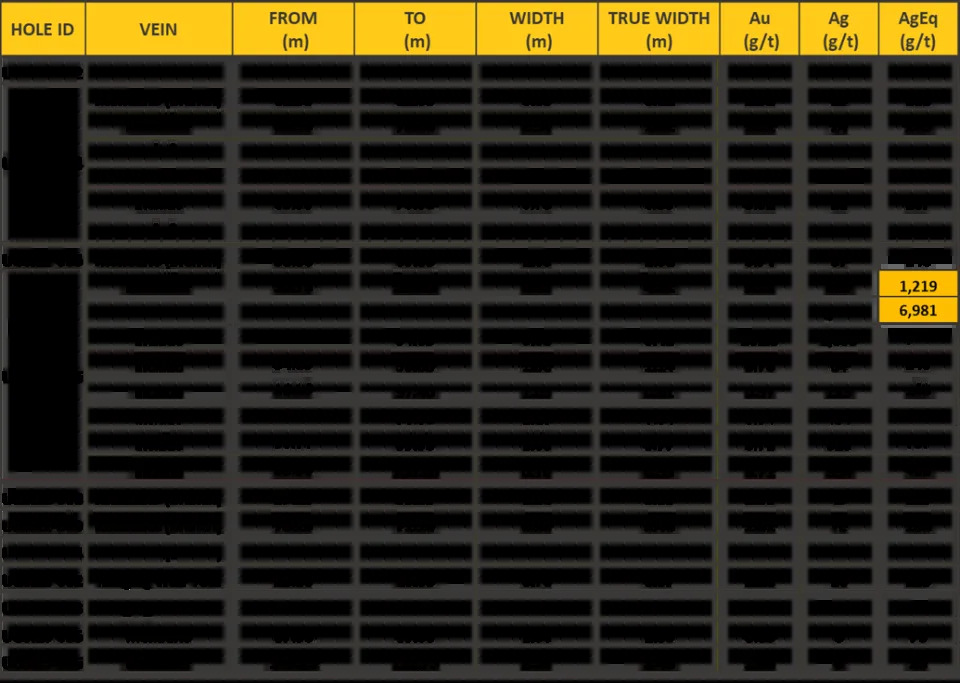

Here are the results accompanied with today’s press release:

It should be noted that current production from the San Ignacio mine comes mostly from the Melladito and the Nombre de Dios vein systems.

Guanajuato Silver is also getting ready to expand production. As part of the Company’s 2023 development program, Guanajuato is currently developing Ramp 430, which will allow for development and production from the Purisima vein located approximately 400 metres to the east of the Melladito vein. Approximately 40% of Ramp 430 has been completed. It is expected to be completed within six months, and will facilitate production of mineralized material from San Ignacio at an expanded rate of over 12,000 tonnes per month.

The stock broke below a major support zone in late 2022, and early 2023 saw the retest upheld. I am talking about the $0.425 level which will continue to be a major zone going forward. In 2023, we have seen the stock reject this zone on a breakdown retest, which has led to new lows in 2023. The stock is currently finding some support as evident by the range at a trendline.

If this trendline breaks, the stock can fall to the $0.30 zone. For bulls, a break back above $0.425 would be the price action you would want to see.

Something which may help the stock is that silver is currently at a major support zone of $21. It is too early to say, but I would look for the development of some sort of range or base which would signify the exhaustion of selling pressure, and thus a potential for a new uptrend.