What a time to be a precious metals bull. With inflation rising, many are frustrated that gold and silver aren’t heading higher. Not performing like the inflation hedge as many believed. Instead, with rising interest rates, it makes it less attractive to own precious metals which yield nothing when compared to bonds, the other risk off safety asset.

Now I know what you gold and silver bulls are saying. Vishal! When you consider real inflation as opposed to nominal, bonds are still yielding negative! And you would be absolutely correct. Herein lies the opportunity for holding gold and silver for the long term. But don’t just take it from me, take it from billionaire Ray Dalio who has been saying this for years. He holds gold because ‘cash is trash’. He also holds it due to what he believes central banks will have to do: print more money.

When you look around the world, you can see the many problems. It seems the only solution to keep this current system going is to lower rates and print more money. Inflation is being blamed on Russia and supply chains but it is very important to note the real definition of inflation: money supply increases more than the output. Or simply put, there is more money in the system competing for the same number of goods and services because productivity hasn’t increased. With the money printing that governments are currently implementing and will be implementing in months to come, inflation will stay elevated for longer than people think.

What I am trying to say is that it may be painful being a gold and silver cull right now, and the pain is likely going to increase with a stronger US dollar. But the central bank/monetary system end game points to higher precious metal prices.

Now, if you do not want to be in the business of predicting central bank pivots and capitulations and investing in monetary catalysts, then silver should be the metal for your portfolio.

In my humble opinion, silver is the most undervalued hard asset.

The gold/silver ratio is 86, meaning it takes 86 ounces of silver to equal 1 ounce of gold. Historically when silver was a monetary metal, this ratio was around 15-16. Some toss this ratio to the side and say it doesn’t mean silver is undervalued because silver isn’t money! However when you compare silver with gold (the monetary metal) and copper (the base metal), silver is more positively correlated with the monetary metal gold.

I like to say you get the best of both worlds: monetary and industrial. If money floods into gold because of monetary issues, the silver price will follow along. You may have heard the phrase, ‘silver is gold on steroids’. This is due to the positive correlation between the two and the fact that the silver market is 1/10th the size of the gold market. Meaning if/when money runs into silver, the move will be explosive because of the smaller market size.

The industrial case? Supply and demand when it relates to metals for the green energy shift. Silver is a green metal even though copper likes to hog the spotlight.

Silver is used in solar panels, and more silver will be required if solar panels want to handle base load power. A large portion of silvers industrials use comes from photovoltaics, the conversion of light into electricity using semiconducting materials. Silver carries electricity through a current, reaching a building or battery for storage. It is also helpful that silver is the most electricity-conducting metal on the planet. Think about this fact the next time you rock your silver jewelry and be proud.

According to Metals Focus’ statistics, the amount of silver used in solar cell production will exceed 3,900t (126Moz) this year, up 15% y/y. To put this into context, this will account for almost 25% of total silver industrial demand (forecast at 533Moz for this year).

With energy problems likely becoming mainstream headlines this Winter (especially in Europe), the quick transition to green energy by weaning off fossil fuels and nuclear will come under scrutiny. More money will be invested to make green energy viable with a focus on improving base load power of green energy. And there is one more large catalyst: the government.

With the economy slowing down and heading into recession, governments worldwide will be looking at ways to spur growth. In my opinion, the next major infrastructure project akin to the New Deal will be about electrifying the economy and building green/clean infrastructure. This is going to be the next major government project to spur the economy while it is in recession AND address climate and environmental issues. It will be a win-win for the government. Silver, alongside other metals, is set to thrive given supply and demand.

Silver deficits are already a reality. The Silver Institute forecasts that total silver supply in 2022 will reach 32,045 tons, and will not be enough to match the 34,270 tons of silver demanded. Industrial demand for silver will keep increasing the deficit. Over the longer term, meaning four to five years out, output will begin to decline unless sufficient investments are made.

This is the long term opportunity.

With silver prices under $20, and potentially breaking below $18, the price of silver will be below its production cost for many miners. This could exacerbate the supply portion of the market and would result in higher prices as long as demand does not fall with supply.

I am keenly watching the $18 support level on silver. As long as we hold above on the weekly chart, there is potential of creating a basing pattern in the next few weeks or months. If so, it would mean the bottom of this downtrend which kicked off in Spring 2022. But even if silver breaks below, it just looks even more attractive at that price point given all the fundamentals I have detailed above.

My love for silver is well known among regular Equity Guru readers. Not only do I stack, but I have a project where I am collecting a silver coin from every country in the world. A very rewarding project as I get to satisfy the investor in me but also the history buff. There’s just something about holding a physical silver piece that will get you hooked to the white metal.

My love for silver doesn’t just end there. A portion of my portfolio is holding mining stocks. I do prefer holding gold and silver royalties, but in recent months I have begun to increase my cash position in order to pounce on the silver opportunity. Given the fundamentals, I am looking for primary silver miners.

Many of these companies are in Mexico, as the country is the number 1 silver-producing country in the world. A factoid which you history buffs will enjoy: the mines that the Spanish conquistadores opened back in the 16th century are still producing silver today!

I recently attended the Metals Investor Forum in Vancouver, and those that know me know that I always scope out the silver companies. This time, I came across a silver company which truly has me excited.

What if I told you that Mexico’s fastest growing silver company has acquired multiple mines and has begun producing all within the last year and a half? This company is ramping up on silver production, just acquired three new mines in July 2022, and also has billionaire Eric Sprott as a shareholder.

Well readers, this is the truth and I do not think its story is being told. Let me introduce you all to Guanajuato Silver (GSVR.V) (pronounced: gwa-nah-hwah-toh) Mexico’s fastest growing silver company!

Guanajuato Silver is the leading claim holder in the Guanajuato Mining District, a silver camp which has a 500 year mining history (remember those Conquistadores?). The company’s assets are surrounded by multiple past and precious metals mines.

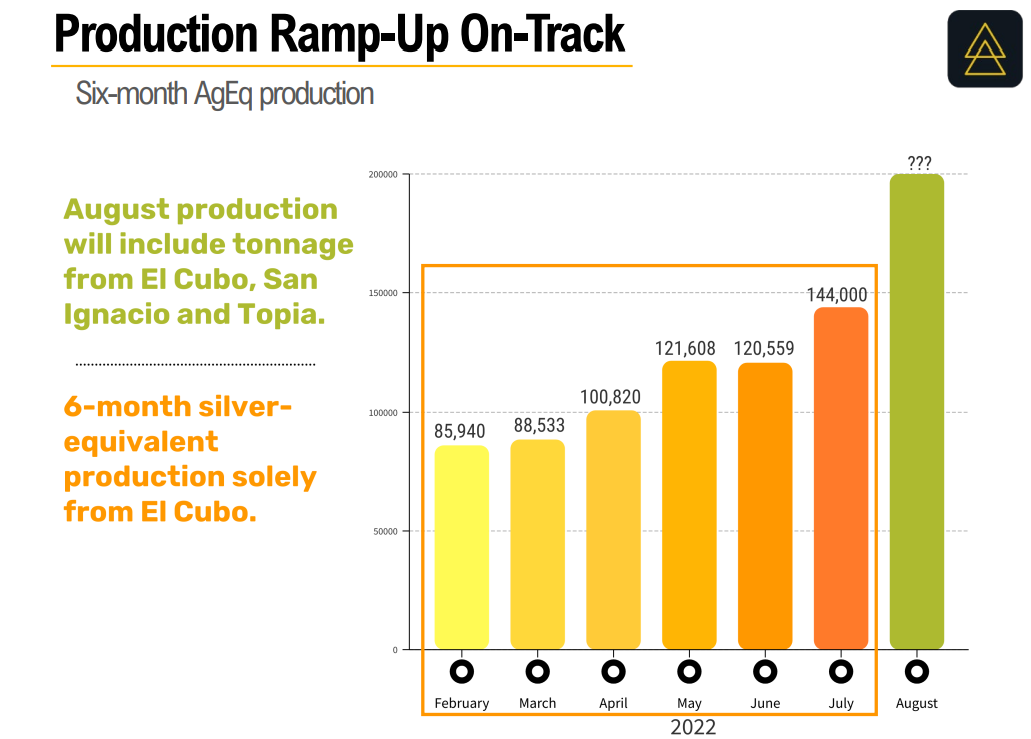

The flagship and primary mining asset is the El Cubo Mine which began the production of silver-gold concentrate in Q4 2021, with an upgraded and improved mill. This mine is key as Guanajuato intends to centre its “hub and spoke” strategy around El Cubo Mine.

Back in June 2022, Guanajuato Silver announced that it was acquiring 100% of Great Panther’s Mexican mining assets. This was done through a US $14 million debt and equity financing and Guanajuato acquired the producing Topia mine and production facility, the San Ignacio mine, and the Guanajuato Mine Complex (now called the Valenciana mine), and the Cata processing plant.

With this deal Guanajuato Silver picked up a producing mine (Topia) which produced 1,129,611 Ag equivalent ounces in 2021, and a 1,051,336 Ag equivalent ounces at the Valenciana and San Ignacio Mines and the Cata processing plant.

More importantly, Guanajuato Silver went from two mines and one production facility to five mines and three production facilities!

In August, the company announced a US $5 million concentrate pre-payment facility with Ocean Partners UK Limited, a metals off-take and trading firm. The company will sell 100% of its silver and gold concentrate produced from the Valenciana Mines Complex and San Ignacio Mine to Ocean Partners for a period of 24 months subject to a minimum delivery of 6,000 wet metric tonnes of concentrate. Additionally, the Company will sell to Ocean Partners 100% of all zinc concentrate produced from the Topia Mine over the same period, subject to a minimum of 7,800 wet metric tonnes.

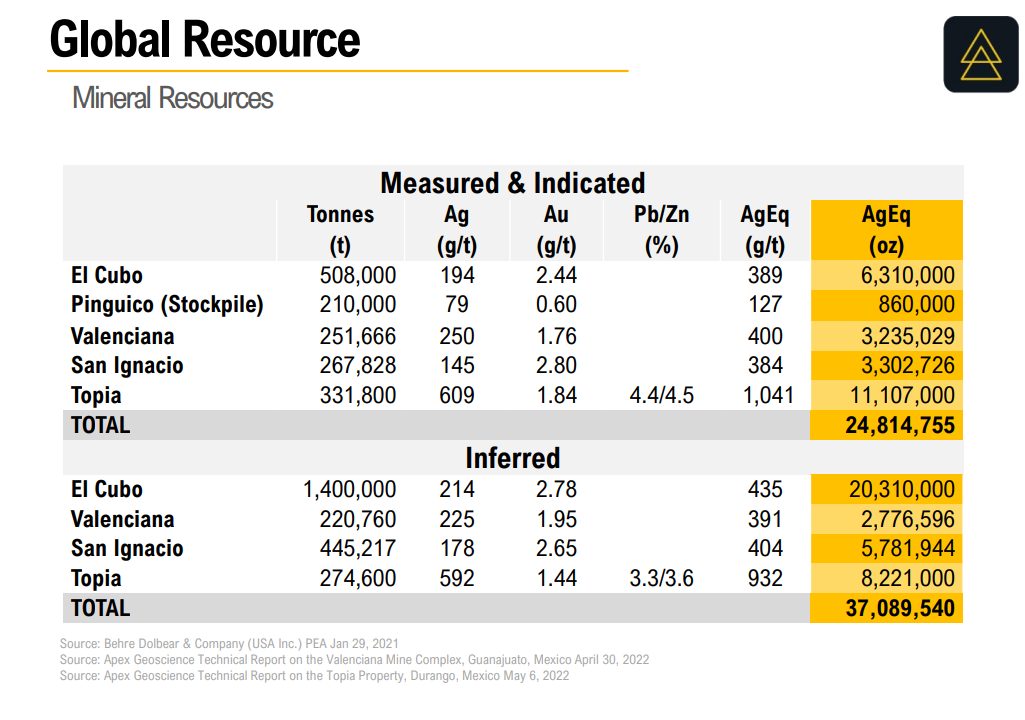

One thing to point out are the mineral resources. Many mining companies build up a resource before having to raise a large amount of money to go into production. Many don’t even go into production and just sit on their resource. I prefer the model of beginning to produce and ramping up while expanding the resource. This does a lot of things. Firstly, the cash that is generated can be reinvested into exploration and drilling. This provides an upside catalyst for the stock. We saw this recently with the press release announcing historical high-grade intercepts at Valenciana and the stock popping over 9% the following day.

Secondly, and this is crucial for anyone investing in mining, it gives credibility to management. The whole journey from the ‘roots up’ vibe to full fledged success displays how astute management is (and is a great ride for shareholders!). Many investors in this space look for experienced management who have had previous success in the industry. Looking at the management of Guanajuato Silver, I see a team with the pedigree and experience to get things done and increase shareholder value. They will do what they have promised to do.

When it comes to the technicals, the stock is at a very interesting point. The $0.425 zone is a significant resistance (price ceiling) zone for the stock. I have come to that conclusion by looking at the longer term weekly chart. This is an area that was once support, and has now become resistance. The stock attempted to reclaim this support back in early August 2022, but failed to sustain momentum. You can see the stock is seeing some selling pressure as it nears this major resistance zone once again.

One positive for technical traders is that I see the potential for a reversal pattern known as the cup and handle. It looks just as it sounds:

The resistance line for this pattern lines up with the resistance zone at $0.425, adding even more importance to this price level.

Keep in mind that the stock is leveraged to silver. With both gold and silver coming under pressure from a stronger US dollar, there could be more downside for Guanajuato Silver and other mining stocks. As I said in my fundamental portion earlier on in the article, this just presents a great buying opportunity given all the fundamentals both monetary and industrial. If the price of silver does indeed break below $18 and heads down to $15, Guanajuato Silver is likely to retest and take out the recent lows at $0.27.

But do not attribute this with the fundamentals of the company. The entire mining sector will feel the pain.

The long term opportunity for silver is immense and this drop could very well be the last great buying opportunity for silver. It is time to look for silver miners to add to your portfolio in the near future. If you are looking for a silver company with fundamental momentum and is growing with cash in the bank, then Guanajuato Silver deserves to be at the top of your list. It excites me and I am really looking forward to following this company and its developments!