Canopy Growth (WEED.T), a Canadian diversified cannabis and cannabinoid-based consumer product company, announced today that it has extended its Ace Valley brand portfolio with the launch of Lust Cherry Rose and Thrust Watermelon Goji.

The new flavoured cannabis infused gummies are market firsts in Canada are meant to empower sexual positivity by enhancing personal experiences.

According to the release, an online survey revealed that 75% of participants said they use cannabis to enhance sex and 42% mentioned they already use cannabis to connect with their partner.

Apparently, these gummies are recommended for both solo and partnered play, so I assume that group activities are also included.

Each of the Ace Valley Lust Cherry Rose gummies are infused with 25 milligrams of cannabidiol and 2.5 milligrams of THC while the Ace Valley Thrust Watermelon Goji gummies are infused with 5 milligram of THC and a hint of naturally occurring caffeine.

Tara Rozalowsky, VP brand marketing, commented, “Ace Valley celebrates sex positivity, including those who are already combining cannabis and sex, as well as those who are curious about it. Lust and Thrust gummies were created with pleasure in mind, and both products are a natural extension of Ace Valley’s innovative portfolio, which elevates experiences and empowers consumers to use cannabis their way, on their terms.”

In early 2022, Ace Valley introduced another industry first for Canada with its Blackberry Lemon Dream gummies, Lust and Thrust are a complement to this brand extension effort.

Both Lust and Thrust are available for purchase through legal recreational cannabis e-commerce channels and retail locations in select regions.

Pomp and circumstance from a company leaning on the edge of further collapse. Canopy Growth Corporation sucked retail investors dry during the cannabis bubble and plunged them into oblivion when the sector burst in 2019.

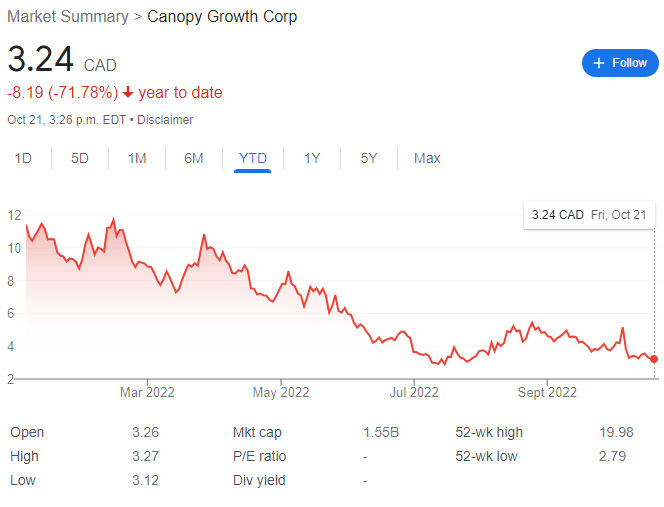

It hasn’t recovered since and is down over 95% since its high in April 2019. Releasing these sex positive gummies will do nothing to move the needle as it maintained a range of $3.24 CAD per share, a cent lower than yesterday’s close.

There is every possibility of more pain to come for shareholders and this spritz of glitz does next to nothing to help stop the plunge.

Canopy reported that it had $769.5 million in cash and cash equivalents as of June 30, 2022 with revenues of $122.86 million for the three months ending June 30, 2022 for a net loss of $2.08 billion for the quarter due to $1.7 billion in asset impairment and restructuring costs.

Should shareholders be concerned, and the investment community treat Canopy like a financial degenerative disease? Will Constellation Brands step in at some point with a scalpel to carve out whatever can be sold?

Equity Guru founder, Chris Parry, opened a blistering examination of Canopy in a recent three minute hits video well worth watching:

Canopy currently trades for $3.24 per share for a market cap of $1.55 billion.