Netflix earnings always garners interest. Ever since its big dumps on missing subscriber numbers, many analysts and traders like to say that Netflix earnings can make or break the markets. With earnings and current price action, you would expect it to save markets but that is not happening just quite yet. As I outlined yesterday, traders are jumping on the earnings reports but the big date is the November 2nd Fed day. Inflation and interest rates worries should not be lost in earnings season.

The Netflix pop isn’t driving markets. What is, remains the chart I have been mentioning many times here on Market Moment and our Discord group: the 10 year yield.

But let’s stick with Netflix.

At time of writing, Netflix stock is up over 15% with over 26 million shares traded. A Q3 2022 beat is the catalyst.

Here are the numbers:

- EPS: $3.10 vs. $2.13 per share, according to Refinitiv.

- Revenue: $7.93 billion vs. $7.837 billion, according to Refinitiv survey.

- Expected global paid net subscribers: Addition of 2.41 million subscribers vs. an addition of 1.09 million subscribers, according to StreetAccount estimates.

The big data point is the addition of 2.41 million subscribers which is more than doubles the adds the company had projected a quarter ago. This subscriber growth is key for Netflix (and many social media stocks as well!).

The majority of net subscriber growth came from the Asia-Pacific region which accounted for 1.43 million subscribers. The US-Canada region had the smallest growth contributing 100,000 net subscribers. Perhaps not a surprise as many people in US-Canada already have a Netflix account. Growth will depend on that Asia-Pacific region and perhaps is why you are seeing many new Asian shows (Indian, Turkish, Korean etc) streamED on Netflix.

“We’re still not growing as fast as we’d like,” Spencer Neumann, Netflix’s chief financial officer, said during the company’s earnings call. “We are building momentum, we are pleased with our progress, but we know we still have a lot more work to do.”

Next quarter will see Netflix no longer providing guidance for paid memberships but will continue to report those numbers during quarterly earnings release. Netflix forecast it would add 4.5 million subscribers during its fiscal first quarter and said it expects revenue of $7.8 billion, largely due to currency pressures overseas.

Shows and movies such as “Stranger Things”, “The Gray Man”, and “Purple Hearts” helped bring in the big numbers in Q3.

Netflix teased the addition of a new lower priced plan which would feature ads. It launches in 12 countries in November. Netflix is optimistic about this new tier but doesn’t expect this tier will add material contribution to Q4 results.

Netflix also said it would begin to crack down on password sharing next year and will allow people who have been borrowing accounts to create their own. The company will allow people sharing their accounts to create sub-accounts to pay for friends of family to use theirs.

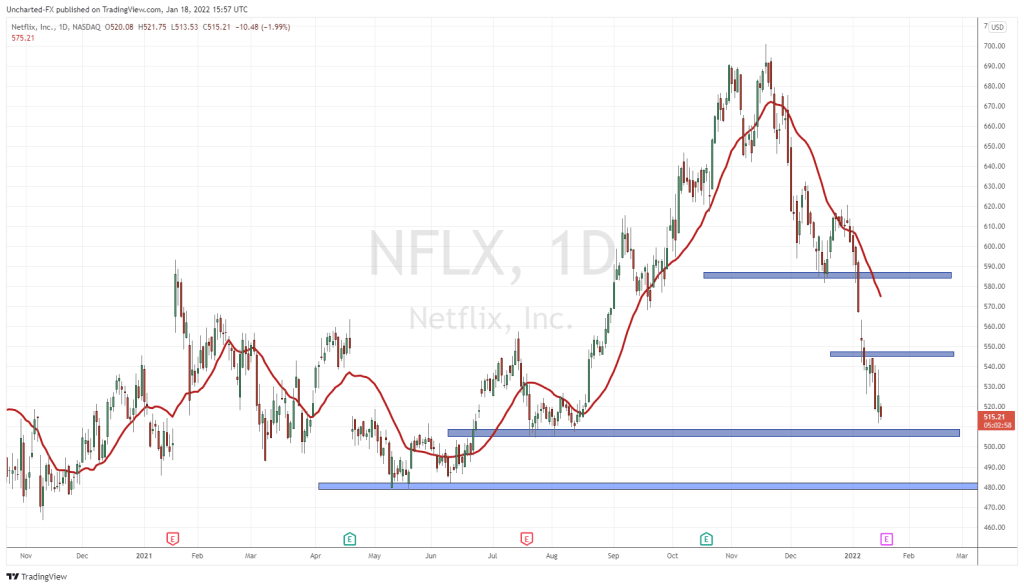

Netflix stock is popping. The stock tends to make big moves on earnings. You can see this on my chart as earnings are noted below in the “E” green box.

From a technical perspective, Netflix looks great. The stock has been ranging from $212-$250 since July of this year. The resistance has finally broken out due to earnings. Going forward, as long as the stock is above $250, it can continue this uptrend to the next resistance target level which comes in at $330.

How would I trade this? Personally, I would wait for some daily chart pullback. A red candle. I don’t chase FOMO and I don’t want to jump in a trade like this especially if I want to place my stop loss below the $250 support. Ideally, we see a pullback down to retest $250 which will present us with an opportunity to enter.

If momentum continues, the stock could rally some more before making a pullback. Patience is key for traders so await for a pullback regardless of how long it takes. If Netflix hits $330 without a pullback, we will move onto the next trade set up.

A range breakout can be summarized simply with this image: