Medexus Pharmaceuticals (MDP.TO) is a specialty pharma company that has been making big moves on the charts. The company is not a biotech company. They do not do research and development, but instead bring over drugs that are already licensed in Western Europe to North America which sees them carve out a nice and profitable niche.

I say this because if you look at the chart of Medexus, it has been trading like a biotech stock. Yes, FDA related news with Treosulfan is what caused the stock to gap down and drop hard, but we have reminded investors that this is a company with a strong core business which has been breaking records with recent quarter revenue releases.

It is Medexus week on Equity Guru and I suggest investors to check out all our content posted on the home page. I put out an article titled, “Medexus Pharmaceuticals (MDP.TO) is not just a Treosulfan stock” where I explain that Q2 2023 revenues will be a major catalyst especially since Medexus’ Q1 2023 was record breaking.

Today, Medexus announced preliminary revenue results for fiscal Q2 2023.

Medexus expects total revenue between $27 million and $27.5 million (all dollar amounts are in US dollars) which will represent the strongest fiscal quarter in the company’s history. This amounts to an increase of at least 51% compared to the $17.9 million in revenues in Q2 2022, and an increase of at least 17% compared to $23 million in Q1 2023.

The primary driver? Organic increases in net sales across Medexus’s portfolio, which is now including 100% of revenue from Gleolan sales in the US starting September 2022.

Key highlights expected from the Q2 2023 are as follows:

- IXINITY: Positive trend in sales, reflecting new patient conversions on top of a stable, existing base of patients.

- Rasuvo: Continued strong performance, maintaining the product’s leading position in the moderately-growing U.S. branded methotrexate market with a limited sales force allocation.

- Rupall: Continued demand growth, reflecting the peak of Canada’s allergy season during the quarter and successful execution of the company’s sales and marketing initiatives, and sustaining the product’s strong performance over the five years since launch.

- Gleolan: Continued U.S. sales performance in line with expectations, reflecting successful execution of a seamless transition to full U.S. commercial responsibility and putting Medexus in position to successfully execute its commercial plan, including improved sales and marketing initiatives.

“We remain focused on delivering strong revenue growth and improved overall performance across our portfolio of products in both the United States and Canada, and we are very pleased with the continued strength and stability we have seen in our base business,” commented Ken d’Entremont, Chief Executive Officer of Medexus. “IXINITY sales have normalized and are now in line with patient demand. With the manufacturing improvements Medexus and our contract manufacturer have been undertaking, we continue to expect operational efficiencies going forward. We also continue to see strong performance in the rest of our portfolio, particularly Rasuvo and Rupall.”

Mr d’Entremont continued: “We have also now assumed full responsibility for commercializing Gleolan in the United States. We began shipping Medexus-labeled product to customers across the country in August, meaning that September 2022 will be the first full month, and fiscal Q3 2023 the first full fiscal quarter, in which Medexus recognizes 100% of Gleolan net sales. Gleolan sales since March 2022, when we acquired exclusive U.S. commercialization rights to the product, have been in line with our expectations, and we expect to continue that strong performance over the coming months.”

The market loves the preliminary estimates.

The stock is currently up over 22% with more than 87,000 shares traded. As we have been saying in our Medexus coverage, this company is NOT just a Treosulfan stock. It has a real growing business making record revenues. Currently, the market cap is under CAD $27 million, and the company is expected to bring in more than US $27 million. You can understand why long term and value investors are buying the recent drop in the stock.

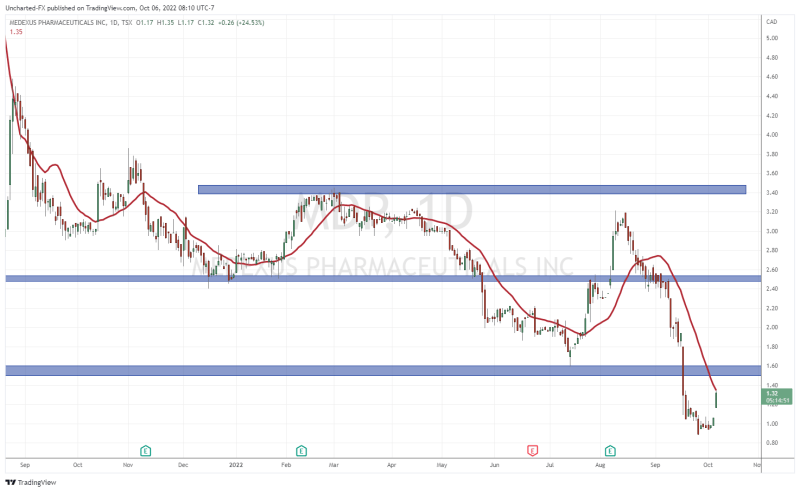

The stock printed all time record lows at $0.88 but has bounced nearly 50% from that low. From a technical analysis perspective there are two things which stand out. First, the major $1.00 psychological zone has been taken out. This is an area I reported as resistance in my recent Medexus article. We are well above that now.

Secondly, I will be watching the major resistance ahead at the $1.60 zone. This is a big zone because it was the lows and support Medexus was holding onto for years. We recently saw a big bounce from this support starting on July 14th 2022. If Medexus can reclaim $1.60, it would be a major technical reversal and I would be looking for more upside.

Keep in mind this $1.60 zone is currently broken resistance which means it is entirely possible for the stock to hit it and then see an influx of sellers. Just typical breakdown retest price action. What the stock needs is a catalyst to break through this level. Official Q2 2023 numbers could be just the catalyst we need.

Full Disclosure: Medexus Pharmaceuticals is an Equity.Guru marketing client.