Trillion Energy (TCF.CN) announced that it received a price increase for the sale of natural gas from its SASB gas field to US $30.68/Mcf effective September 1st 2022. This price increase accounts to a 47% price hike over the prior month, and a further increase of nearly 350% over the average price of $8.84/Mcf in 2021.

Regional natural gas prices have more than tripled since 2021. Trillion Energy attributes this price increase to a supply squeeze caused by the Nord Stream pipeline shut down, nuclear power shut down in Germany, the conflict in Ukraine and other factors restricting regional energy supply.

Arthur Halleran CEO stated:

“We believe the recent price increases will significantly enhance the economic performance of our seven well drilling program set to commence next week at the SASB gas field. With seven wells producing, we will supply the region with much needed natural gas in a time of acute shortages and high prices”.

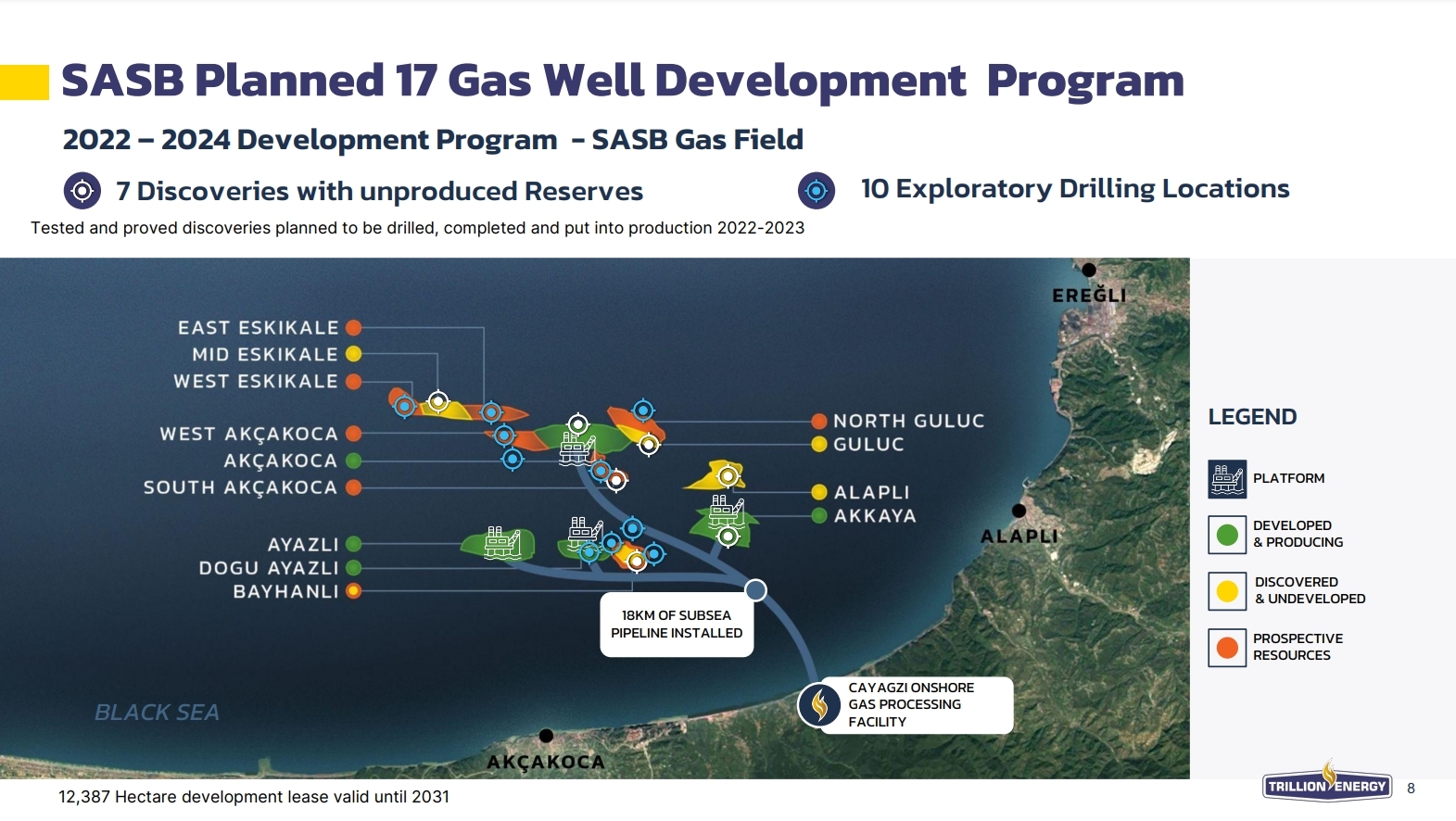

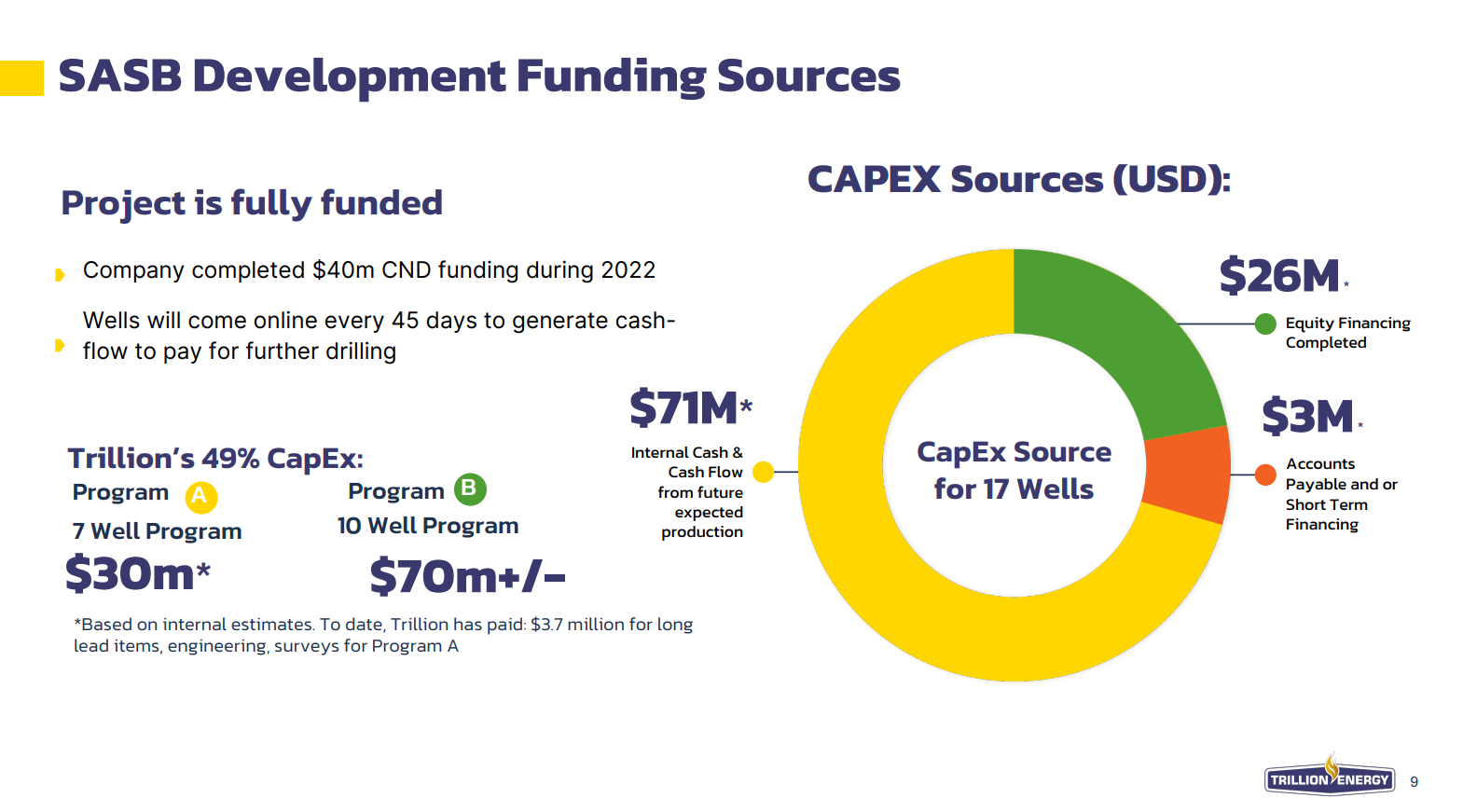

Trillion Energy is an oil and gas company with multiple assets throughout Turkey and Bulgaria. The company is a 49% owner of the SASB natural gas field, one of the Black Sea’s first and largest scale natural gas development projects. Trillion also has a 19.6% interest in the Cendere oil field.

Currently, the target is the Turkish market with Trillion Energy selling 100% of its production within Turkey. For a country that imports 90% if its natural gas, this is a great market for Trillion Energy.

A lot of positives on the chart. Trillion Energy is on the verge of confirming a major breakout. If the stock confirms a close above $0.45 by the end of today, we have a confirmed breakout of a resistance level which has held since April 2021.

Price action is very strong on the price hike news with big volume, but there is a chance the stock will pullback in upcoming days. As long as the stock remains above $0.45, we remain positive and expect to see a test of previous record highs at $0.66, and then new all time record highs.

Natural gas has been on a tear. Recently, gas has been ranging around $9.50. To me, this is an exhaustion pattern. Natural gas could be in for a pullback. Today’s price action is seeing a break below $9.00 and could close below my uptrend line. That would be a bearish trigger and would see gas fall to the $7.50 support zone.

But we need to account for the fundamentals. I expect to hear and see more headlines about gas, energy and Europe as the colder months come. These headlines will keep the natural gas market volatile. Be prepared Europe. Winter is coming.