In this summary report, we will take a quick look at the top 5 gainers and losers up or down double digits on the Canadian stock markets.

Here is a summary of the intraday action of assets:

Top 5 Gainers

Benton Resources (BEX.V)

Market Cap ~ $15 million

Benton Resources Inc. engages in the acquisition, exploration, and development of mineral properties. It explores for gold, silver, nickel, copper, platinum group elements, lithium, and cesium assets.

The stock is up 100% on news the Company has hit multiple high grade copper zones in its first two holes including 8.31% Cu over 13m at the Great Burnt Copper Gold project in Newfoundland.

It appears that this pop is occurring just as a cup and handle reversal pattern was developing. This reversal pattern has triggered with today’s price action. A close above $0.09 today would be bullish. The next resistance comes in at $0.15.

Ramm Pharma Corp (RAMM.C)

Market Cap ~ $9 million

RAMM Pharma Corp. engages in the research and development, production, and sale of cannabinoid pharmaceutical formulations, pharmaceuticals, cosmetics, and nutraceutical products in Uruguay, Italy, Poland, Brazil, and internationally. The company also engages in the resale of medical supplies products; and sale of medical devices and consumables, and veterinarian products. It offers XALEX, a prescription pharmaceutical formulation for the treatment of refractory epilepsy; Cannabipiel Nite, Cannabipiel Body Lotion, Cannabipiel Hair Conditioner, Cannabipiel Liquid Soap, Cannabipiel Tite, Cannabipiel Cleaning Emulsion, Cannabipiel Shampoo, Cannabipiel Lite, and Cannabipiel Facial Tonic; and NETTAVET, a cannabis-based oral solution for dogs.

The stock is up 50% on no news.

The stock is gapping up at support and could be setting up a reversal pattern. Bulls should watch for a break above $0.10 for the trigger.

Sonoro Energy (SNV.V)

Market Cap ~ $35 million

Sonoro Energy Ltd. explores for, appraises, develops, and produces oil and gas resources in Southeast Asia. The company holds a 25% interest in the Selat Panjang Production Sharing Contract covering an area of approximately 940 square kilometers located in Riau province, Central Sumatra.

The stock is up 32% on no news.

The stock is in a triangle pattern range and is waiting for a breakout. Today’s price action could do it, but we need to wait for the close confirmation.

Carbon Streaming Corporation (NETZ.NE)

Market Cap ~ $51.6 million

Carbon Streaming Corporation operates as an environmental, social, and governance principled investment vehicle that provides investors with exposure to carbon credits. The company focuses on acquiring, managing, and growing a diversified portfolio of investments in projects and/or companies that generate or are actively involved, directly, or indirectly with voluntary and/or compliance carbon credits. It invests capital through carbon credit streaming arrangements with project developers and owners to accelerate the creation of carbon offset projects.

The stock is up 19% on no news.

The stock is battling at the important $1.00 zone. A trend shift looks likely with a close above this zone and the break above a downtrend line.

Homerun Resources (HMR.V)

Market Cap ~ $32 million

Homerun Resources Inc. engages in the exploration and development of mineral properties in Canada. The company has an option to acquire a 100% interest in the Tatooine Silica project that covers an area of approximately 3,019 hectares located in Brisco, British Columbia; and the Homathko gold project that covers an area of 30,970 hectares located in the Caribou regional district of British Columbia.

The stock is up 13% on no news.

The stock has bounced at support at $0.50. The lower high comes in at $0.75 and if the stock can close above this level, it will be able to take out recent highs.

Top 5 Losers

Corsa Coal Corp (CSO.V)

Market Cap ~ $53 million

Corsa Coal Corp. mines, processes, and sells metallurgical coal. The company is also involved in the exploring, acquiring, and developing coal resource properties. It produces and sells metallurgical coal used for the production of coke from its mines in the Northern Appalachia coal region of the United States.

The stock is down 27% on the release of its Q3 2023 financials. Details can be found here.

The stock printed a head and shoulders pattern and has broken down below the neckline with a gap down and breaking of support. A lot of bearish signs.

Katipult Technology (FUND.V)

Market Cap ~ $3.9 million

Katipult Technology Corp. operates as a financial technology company in Canada, the United States, the United Kingdom, and internationally. The company offers a cloud-based software infrastructure that allows firms to design, set up, and operate an investment platform, which enables firms to offer debt and real-estate financing; and securities on a prospectus-exempt basis to various types of investors. Its platform automates various components of investor and investment management, including components of financial transactions, investment marketing, and dividend payouts, as well as manages regulatory requirements in various geographic jurisdictions. The company’s platform includes modules for various user types, including investors, issuers, administrators, and auditors.

The stock is down 21% on no news.

The stock is breaking below recent lows at $0.08 and the next level is major support at $0.04.

Organto Foods (OGO.V)

Market Cap ~ $7 million

Organto Foods Inc. engages in the sourcing, processing, packaging, distribution, and marketing of organic and value-added fruit, and vegetable products. The company’s products include vegetable and fruit products comprising asparagus, avocado, blueberries, ginger, herbs, mango, limes, raspberries, snow peas, sugar snaps, fine green beans, and other products under the I AM Organic, Awesome, Fresh Organic Choice brands.

The stock is down 19% on no news, but yesterday, the Company announced it had entered into a strategic partnership with Mexico based Alpasa Farms S. De R.L. de CV (“Alpasa”).

The stock continues its downtrend with no relief. Support is upcoming at $0.20, perhaps here is where selling pressure will exhaust.

Highland Copper Company (HI.V)

Market Cap ~ $40 million

Highland Copper Company Inc., together with its subsidiaries, engages in the acquisition, exploration, and development of mineral properties in the United States. The company explores for copper deposits. Its primary properties include the Copperwood project; and the White Pine North project located in the Upper Peninsula of Michigan.

The stock is down 15% on no news.

The stock has dropped to major support. Bulls do not want to see this level breakdown.

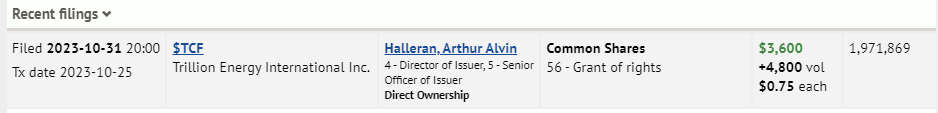

Trillion Energy International (TCF.C)

Market Cap ~ $23 million

Trillion Energy International Inc. operates as an oil and gas exploration and production company with assets in Turkey and Bulgaria. It owns 49% interests in the SASB natural gas field covering an area of 12,387 hectares; 19.6% ownership interest in the Cendere oil field; and 50% operating interest in the Bakuk gas field located near the Syrian border.

The stock is down 14.7% o no news. It should be noted that two days ago, the Company announced an update on its three well perforation program at the SASB gas field. An insider report was also released today:

The stock continues its decline and has found some buyers at $0.225. This is where major support is when you zoom out on the chart. Bulls want to see the price remain above this level.