When Rogers Communications (RCI) announced they intended to merge with Shaw Communications (SJR) back in March, 2021, the shot rang out across the country as a thinly veiled attempt to further consolidate a Canadian telecom industry that was already perceived as a monopoly.

A bumpy ride followed this announcement as outlined in an earlier EG article which resulted in the deal deadline being extended from July 31, 2022 to December 31, 2022.

As per conditions set out by the Competition Bureau, Rogers had yet to successfully divest Freedom Mobile to Videotron, a subsidiary of Quebecor.

Today’s press release from Rogers announced that it, Shaw Communications and Quebecor had signed a definitive agreement for the Freedom transaction.

Pierre Karl Peladeau, president and CEO of Quebecor commented, “We are very pleased with this Agreement, and we are determined to continue building on Freedom’s assets. Quebecor has shown that it is the best player to create real competition and disrupt the market. Our strong track record combined with Freedom’s solid Canadian footprint will allow us to offer consumers in British Columbia, Alberta and Ontario more choice, value, and affordability through discounted multiservice bundles and innovative products.”

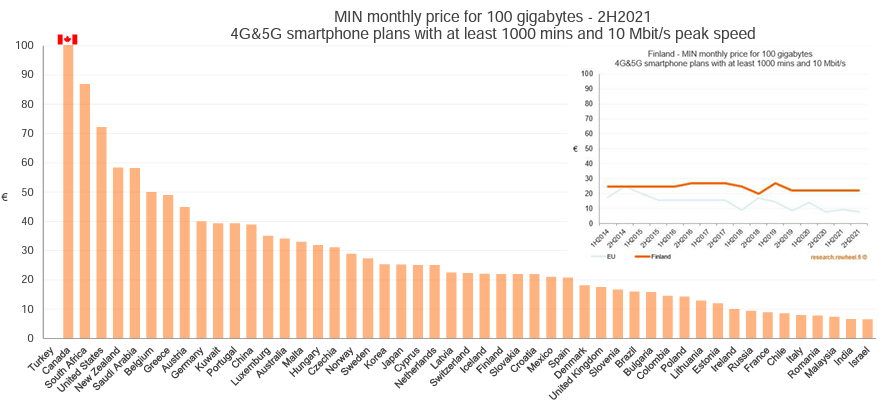

Canadians spent $25 billion on mobile wireless services in 2021 and according to a recent report, they are charged the most out of 50 countries for 4G/5G smartphone plans with at least 1000 minutes and 10 Mbits/s peak speed. (see below)

These staggering rates are a result of there only being four major cell phone providers in Canada, Telus, Rogers, Shaw and Bell. This non-competitive collusion limits choice and degrades performance.

Opponents of the Rogers/Shaw merger suggest that another consolidation in an already monopolistic sector would create an even more costly environment for consumers and a further degradation in services.

Francois-Philippe Champagne, Canada’s Minister of Innovation, Science and Industry, tooted the government’s horn back in January, stating the government efforts to reduce the cost of mid-range wireless plans by 25% to benchmark pricing over two years from 2020, had reached its target three months early.

Will this trend continue, or is it the sugar on the spoon shoving the Shaw/Rogers merger down our collective throat?

It should be known that the Freedom Mobile transaction is still subject to clearance under the Competition Act as well as the Minister of Innovation, Science and Industry. Freedom’s sale is also contingent on the Shaw/Rogers deal going through.

As such, the December 31, 2022 deal deadline for the merger is open for another extension to the end of January next year at the option of either merger partner, on the condition Rogers is able to secure financing to close the transaction.

There’s still a chance the merger will not go through as it is still subject to a review by the Competition Tribunal and the application to reject the transaction by the Commissioner of Competition remains open.

The future of telecommunications is upon us, will it be a Canadian nightmare?

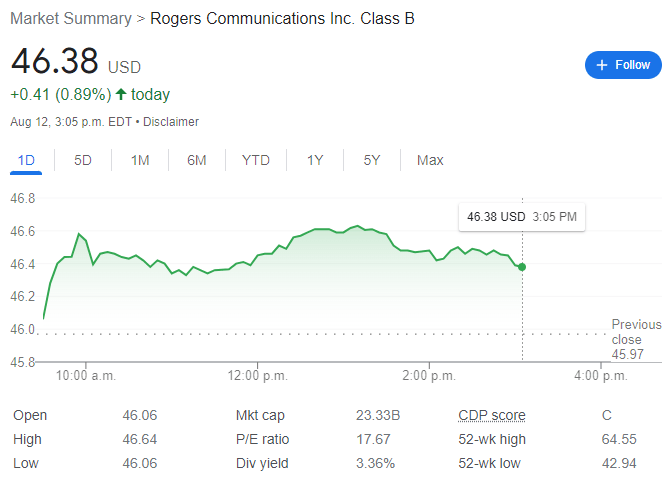

Rogers currently trades at $46.48 USD on the NYSE for a market cap of $23.33 billion.

–Gaalen Engen