Rogers Communications (RCI) and Shaw Communications (SJR), two of Canada’s small cadre of telecommunications companies providing countrywide internet and phone services, announced today the outside date of their proposed merger would be pushed to December 31, 2022.

Back in March 2021, the two telecom giants announced they were going to merge in a $26 billion CAD transaction.

The proposed deal would see Shaw fold into Rogers, creating a super telco. According to the press release, the combined entity would now possess the scale, assets and capabilities to drive massive infrastructure upgrades in both wireless broadband and phone networks.

The newly formed company would then invest $2.5 billion in 5G networks across Western Canada as well as a new $1.0 billion Rogers Rural and Indigenous Connectivity Fund dedicated to bringing high-speed internet and critical connectivity to rural, remote, and Indigenous communities across Canada.

Shaw shareholders agreed to the deal in an overwhelming vote announced May 21, 2021, but later in November, Bell Media threw a wrench into the works when it urged the CRTC to reject the deal because it created an unhealthy monopoly in the sector.

That didn’t stop the CRTC approving the acquisition in March 2022, with a list of conditions, but following that, the Competition Bureau filed an application to block the purchase in May 2022 because it felt that the merger would damage service and ramp up pricing for consumers.

Rogers and Shaw agreed to sit in on a mediation with the Bureau in July to negotiate the terms of the merger.

The two-day affair commenced on July 4, 2022, with all parties attending, but ended on July 6, 2022, with no resolution.

Two days after the failed mediation, millions of Rogers customers experienced a nationwide blackout as a software glitch in a system update broke the network, even preventing Rogers customers from calling emergency services.

This network failure was met with outrage from the public as well as government officials decrying the monopolistic state of Canada’s communications network. Social media was alight with posts pleading governing bodies to prevent the proposed merger as it would shrink the playing field even further creating even greater operational risk.

The original deadline to close the deal was July 31, 2022. With Rogers still working on the divesture of Freedom Mobile to Quebecor, an unsuccessful mediation with the Competition Bureau and public sentiment at new lows, the merger became lodged in the mud with little hope it would close at the end of July.

Now that the date has been moved to the end of the year, there may be enough time to complete the Freedom Mobile deal with Quebecor and assuage the Competition Bureau. If not…

There is something to be said about the narrow scope of Canada’s telecommunications competition field. We pay some of the highest rates for cell phones and internet connectivity in the industrialized world. Would things get better if we opened to the doors to companies like AT&T and Comcast, instead of allowing the consolidation of our already monopolistic telecommunications market?

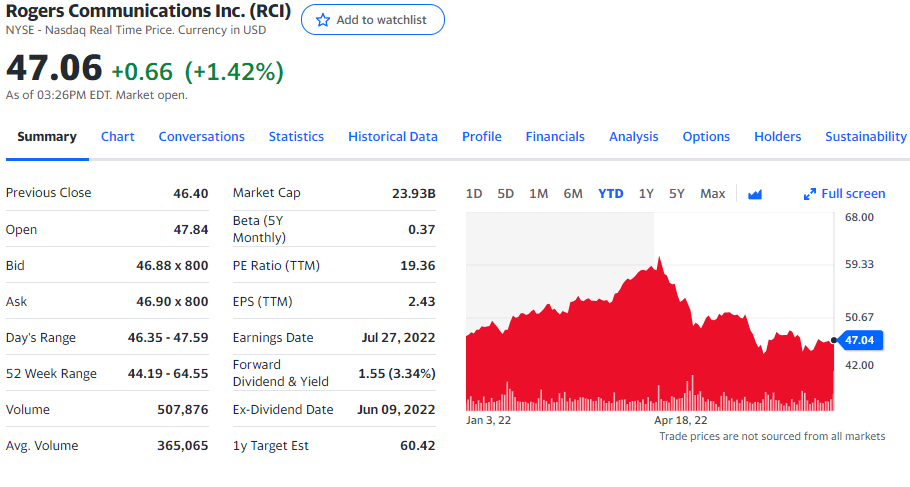

Rogers announced a 35% increase in revenues in the most recent second quarter before their network went black. The company currently trades at $47.00 per share USD for a market cap of $2393 billion on the NYSE.

Shaw Communications currently trades at $27.08 per share for a market cap of $13.56 billion on the NYSE.

–Gaalen Engen