Thanks to Electric Vehicles (EVs) and all things mobile – lithium demand is projected to increase 300% in the next 8 years.

It’s no longer just Tesla’s game: Legacy automakers are reporting staggering growth in EV sales. In fact, some are having a hard time keeping up with demand.

“We’re selling EVs as fast as we can make them,” stated Ford’s CEO. In 2022, Ford expects to have a run rate of 600,000 EVs and 2 million/year by 2026.

In the next 8 years, Mercedes-Benz plans to go all-electric. General Motors (GM) is going all in on EVs, as is Hyundai.

Automakers scaling EV production on a global scale is creating an overwhelming demand for Lithium, a critical mineral used in EV batteries.  Here are 5 Canadian Lithium companies with leverage to lithium demand and EV sales.

Here are 5 Canadian Lithium companies with leverage to lithium demand and EV sales.

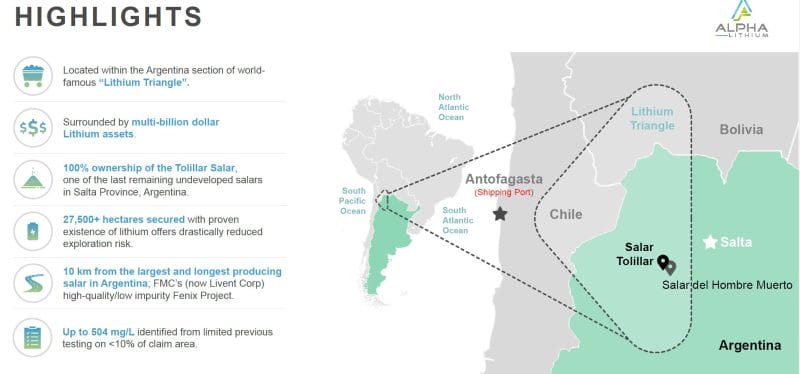

Alpha Lithium (ALLI.V) is $181 million company developing the Tolillar and Hombre Muerto Salars.

In Tolillar, ALLI has assembled 100% ownership in one of Argentina’s last undeveloped lithium salars, encompassing 27,500 hectares (67,954 acres). The project is surrounded by multi-billion-dollar lithium players in the heart of the renowned “Lithium Triangle”.

In Hombre Muerto, ALLI is expanding its foothold in a high quality, mature (long producing), lithium salar.

On July 19, 2022 ALLI announced that is undertaking detailed engineering for a lithium pilot plant to be located in one of the Company’s primary asset locations, the Tolillar Salar in Argentina’s Lithium Triangle.

Additionally, ALLI has undertaken a bidding process to produce a Preliminary Economic Assessment (PEA) on a scalable, commercial production facility capable of producing up to 40,000 tonnes per year of high-purity lithium carbonate.

The company has about $44 million in cash, is well-funded to continue working towards its lithium carbonate production objectives in Argentina.

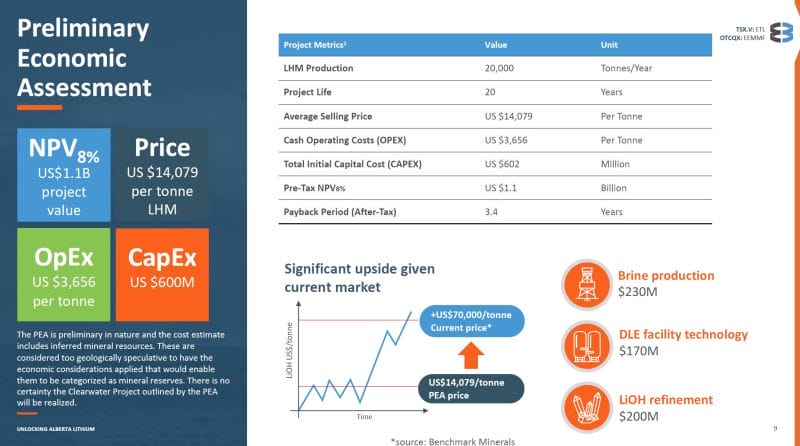

E3 Lithium (ETL.V) is a $142 million company with 24.3 million tonnes of lithium carbonate equivalent (LCE) inferred mineral resources in Alberta.

As outlined in E3’s Pre-liminary Assessment, the Clearwater Lithium Project has an NPV8% of USD 1.1 Billion with a 32% IRR pre-tax and USD 820 Million with a 27% IRR after-tax.

Through the successful scale up its DLE technology towards commercialization, E3 Lithium’s goal is to produce high purity, battery grade lithium products.

Direct Lithium Extraction (DLE) has lower CAPEX and OPEX compared to conventional evaporation methods, smaller environmental footprint and makes the operation quicker-to-cash-flow.

On July 28, 2022, E3 Lithium oversaw the successful manufacture of its first quantity of continuously produced, commercial scale sorbent, critical to the success and commercialization of its ion-exchange DLE technology.

E3 Lithium (E3) worked with a third-party equipment design and manufacturer using their in-house development equipment to produce an initial 20 kgs of E3’s proprietary sorbent in a single continuous run.

Prior to producing this commercial quantity, E3’s development team produced in-house sorbent in quantities less than a kilogram to support internal test work.

The goal of this commercial production was to validate the transition from small scale batch production in the lab to commercial scale continuous production, which has been achieved to successful results.

E3 has analyzed the sorbent produced from this continuous scale production equipment against the batch produced in-house and found the new product to have equal, if not better performance with rapid and high lithium recovery rates of more than 97 per cent.

This 20 kg test run demonstrated that large scale production is possible using this equipment and positions E3 to achieve its goals of:

- Having the vendor produce several tonnes of sorbent for use in E3’s field pilot project

- Designing the equipment to be implemented in the commercial processing facility as part of E3’s Clearwater Project

“We are extremely pleased with the results of our first commercial production of sorbent and its high lithium recovery rates,” stated Chris Doornbos, President and CEO of E3. “This commercially-produced sorbent provides confidence in the viability of scaling up E3’s production to deliver the larger volumes of high-quality sorbent needed for commercial operations.”

Critical Elements Lithium (CRE.V) is a $337 million company advancing the 100%-owned high purity Rose lithium project in Québec. Rose is CRE’s first lithium project to be advanced within a land portfolio of over 700 square kilometers.

On August 11, 2022 CRE announced completion of an Engineering Study for a Lithium Hydroxide Monohydrate plant.

This strategic milestone could enable Critical Elements to become an important player in the North American Lithium market, as this could help optimize the outcome of discussions with potential strategic investors and end-users.

The Engineering Study for a Lithium Hydroxide Monohydrate plant is based on a yearly production of 30,670 tonnes of high-quality battery grade lithium hydroxide monohydrate from 220,587 tonnes of spodumene concentrate purchased solely on the world market on long term contract basis.

The study does not rely on or is not based on any purchases of spodumene concentrate from the Corporation’s Rose Lithium-Tantalum project. The operating parameters for the Engineering Study were taken from the joint Metso Outotec and Critical Elements Lithium Corporation piloting programs.

Metso Outotec technologies result in a compact footprint lithium hydroxide production plant with optimized energy-efficiency

The infrastructure supporting Metso Outotec’s lithium hydroxide process plant was designed by WSP and includes the following areas:

- Site Earthwork (road, industrial pad, buried services, parking, etc.);

- Administration building and warehouse;

- Boiler, compressors, and cooling tower building;

- Spodumene handling and storage;

- Analcime sand handling and storage;

- Electrical substation.

Critical Elements continues to work closely with its financial advisor, Cantor Fitzgerald, to evaluate ongoing interest from global strategic partners that seek to accelerate the Rose Lithium-Tantalum project to production.

The after-tax internal rate of return for the Project is estimated at 82.4%, with an estimated after-tax net present value of US$1.9 B at an 8% discount rate.

The Corporation also has a formalized relationship with the Cree Nation.

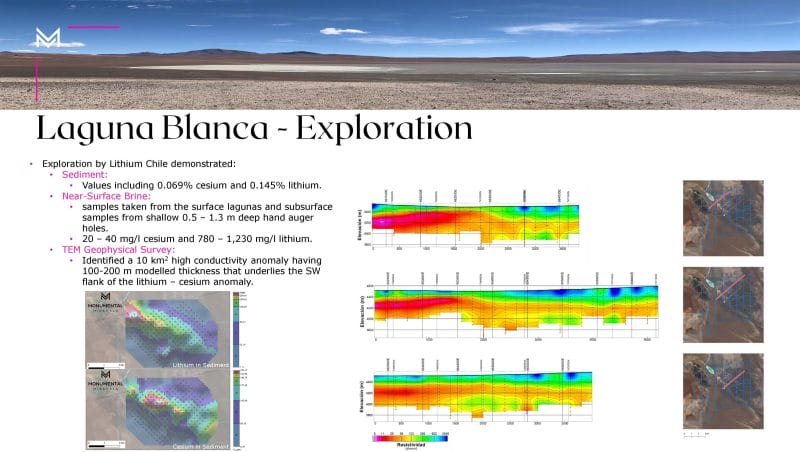

Monumental Minerals (MNRL.V) is a $7.6 million company developing raw materials for the global energy transition, simultaneously advancing two projects: the Jemi HREE project in Mexico and the Laguna Blanca cesium-lithium brine project located in Chile.

On June 29, 2022 Monumental laid out its plans for the next phase of exploration work at the Laguna Blanca lithium (Li) brine and cesium (Cs) sediment project located within the Lithium Triangle in northern Chile.

Recent Laguna Blanca sediment samples returned values of 1160 ppm lithium, and 175 ppm cesium.

The Laguna Blanca Project lies within the eastern Andean Geomorphic Belt of Chile’s Central Andean Altiplano and is located 120 km from the Salar de Atacama, the largest producing salar in the world.

In June, 2022 MNRL’s CEO Jamil Sader and the Chilean geological team were on the ground at Laguna developing drilling targets by “confirming existing areas of interest and by establishing additional targets within the concessions that fall under the Company’s option agreement with Lithium Chile”.

Monumental’s Chilean team includes:

Caracle Creek Chile SpA: A local Chilean exploration consulting and project management group, Caracle has “specialized expertise in lithium and rare-element exploration.”

The company offers program design and guidance on regional exploration techniques, design and manage QA/QC programs; independent QA/QC reviews of assays and independent Technical Report Writing.

Atacama Water SpA: Hydrogeological site characterization and brine resource evaluation. The company offers baseline surface water and groundwater monitoring programs, community water usage evaluation, guidelines for sustainable water and brine abstraction.

Satelite SpA: Aligns legal, community and environmental strategies in order to achieve the development of sustainable projects in social, technical, environmental and financial terms, with a local vision.

“We look forward to advancing our Laguna Blanca Project utilizing TEM geophysics and near-surface brine and sediment geochemistry,” stated Sader, “The results from this exploration work program will be quickly translated into the delineation of multiple drilling targets.”

“Monumental’s high-performance Chilean team have been instrumental in the planning of our field work program,” added Sader, “and they are a key part of our success in Chile to date and will be in the future.”

Cesium is a little-known high-value alkali metal that melts at room temperature. It is used in the oil & gas sector to lubricate drill bits, and also in atomic clocks.

The presence of cesium could boost the economics MNRL’s lithium brine project. It sells for about $100/gram, making a single wheelbarrow of Cesium worth $12 million.

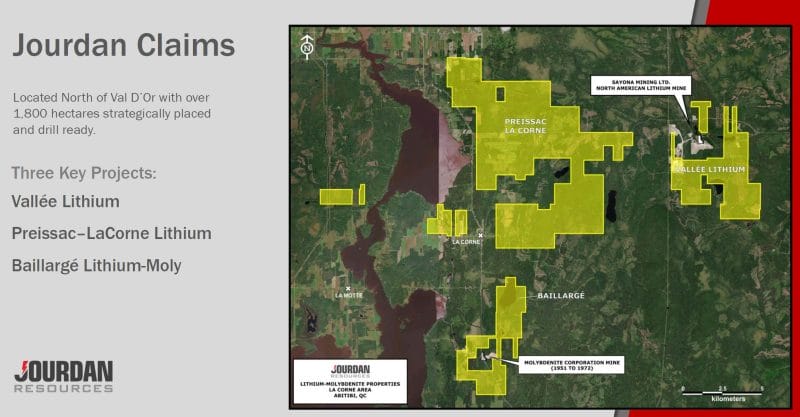

Jordan Resources (JOR.V) is a $17 million company developing lithium properties in Quebec, Canada, primarily in the spodumene-bearing pegmatites of the La Corne Batholith, around North American Lithium’s producing Quebec Lithium Mine.

On July 25, 2022 JOR announced that is began a soil sampling program on the majority of its claims located in the long-established lithium mining district of Preissac-La Corne, which is approximately 35km north of Val-d’Or in Quebec, Canada.

The sampling program is being conducted on a 400m x 200m regional grid and represents a pre-cursor to a potential future drilling program.

A field crew consisting of geological and exploration technicians has been mobilized to the area and has begun collecting soil samples.

The soil sampling program is aimed at finding new lithium anomalies and showings in areas of known lithium mineralization at Baillargé, Preissac-La Corne, Duval Lithium in La Motte, as well as Vallée Lithium.

Sample data collected includes UTM location, depth of sample, color, moisture content, texture (sand, silt, clay), and percentage, angularity and lithology of pebbles and or cobbles.

“We are not only committed to the establishing an initial mineral resource at Vallée, our flagship property, but we are focussed on the further exploration at our Baillargé and Preissac-LaCorne properties,” said Dr. Andreas Rompel, Jourdan’s executive Chairman.

JOR recently completed diamond drilling program of 3,629m was intended to follow up on the results of a 40-tonne bulk sample collected in 2018, the fence line drilled in 2011, and follow-up drilling in 2021 along the western side of the Company’s Vallée property, which borders the North American Lithium mine.

As anticipated, the drilling program substantially extended the known deposit at the Company’s Vallée property eastwards. Since February 2022, 18 holes of approximately 200m depth have been drilled, each aimed at the pegmatite swarm identified by the trenching of the bulk sample collected on the Vallée property in 2018.

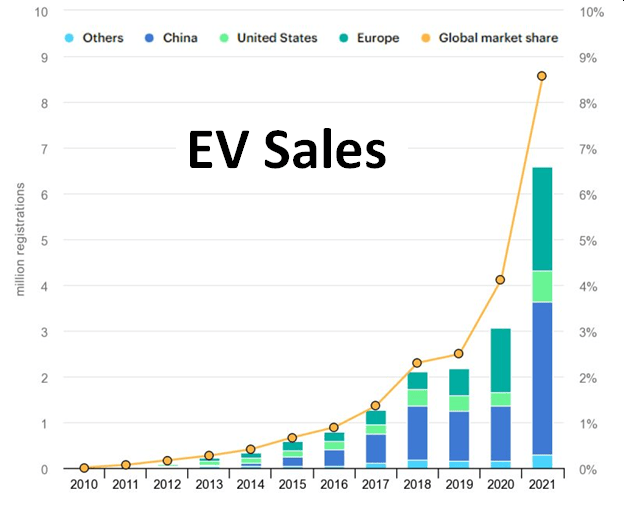

According to Research and Market’s Lithium Mining Market – Growth Trends and Market Forecast Report (2021 – 2025), the global lithium market will expand at 26% CAGR from 2021-2025, reaching US $1 billion.

“With many governments and businesses committing to reducing emissions, S&P Global Market Intelligence estimates that global lithium demand will grow to 2 million metric tons (mt) per year by 2030 from 640,000 mt/year in 2022,” states Clean Energy News, “84% of all lithium produced is expected to go into battery making”.

“Automakers sold 6.6 million plug-in vehicles in 2021,” states Green Car Reports, “More than double the 3 million sold in 2020, and more than triple the 2.2 million sold in 2019, according to the International Energy Agency (IEA)”.

According to new forecasts, the lithium market is expected to double by 2030 as soaring EV demand accelerates.

Alpha Lithium (ALLI.V), E3 Lithium (ETL.V), Critical Elements Lithium (CRE.V), Monumental Minerals (MNRL.V), Jourdan Resources (JOR.V) are positioned to benefit from exploding Electric Vehicle sales.