Getting Down and Dirty

- $387.235B Market Capitalization

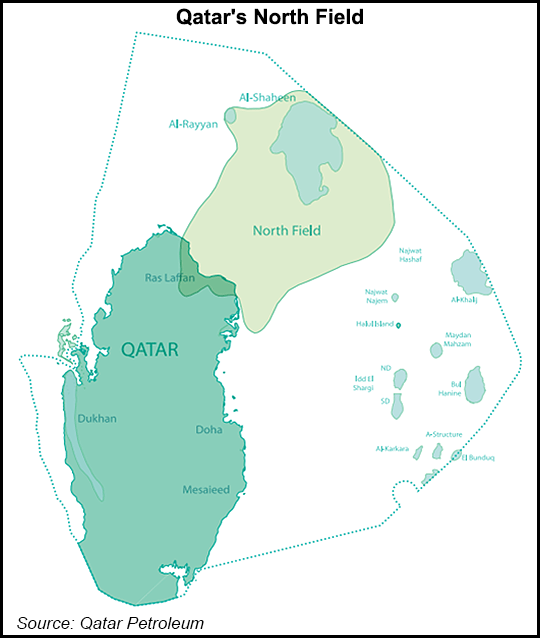

Exxon Mobil Corporation (XOM.NYSE) announced today that it has signed an agreement with QatarEnergy to advance Qatar’s North Field East project. This is expected to expand Qatar’s annual LNG capacity from 77 million tonnes to 110 million tonnes by 2026. The deal itself was announced at QatarEnergy’s headquarters in Doha, Qatar, and will award Exxon with a 25% interest in the Joint Venture (JV).

“ExxonMobil has a long history of working in Qatar, responsibly producing energy, and we look forward to continuing our relationship for the benefit of all of our stakeholders,” said Darren Woods, Chairman and Chief Executive Officer for Exxon.

For context, LNG refers to liquefied natural gas. With this in mind, the North Field East LNG project is claimed to be one of the largest non-associated natural gas fields in the world. The project is located in Ras Laffan, which is northeast of Qatar, and is owned entirely by QatarEnergy. In total, QatarEnergy operates 14 LNG trains with an overall production capacity of 77 million metric tonnes per annum (Mtpa).

With the first LNG from North Field East expected for 2026, QatarEnergy has been keeping itself busy with multiple JVs. Earlier this month, QatarEnergy announced that it had selected TotalEnergies as its first partner for the North Field East project. According to the terms of the agreement, TotalEnergies will become a new JV company, holding a 25% interest.

More recently, on June 19, 2022, QatarEnergy signed an additional partnership with Eni under the same terms. As you probably could have guessed, the company’s latest JV partnership with Exxon is identical. Under the terms of the agreement, QatarEnergy will hold a 75% interest with Exxon holding the remaining 25%. In total, this JV will represent 25% of the entire North Field East project.

Today, we are signing a partnership agreement with ExxonMobil, with whom we have enjoyed successful and fruitful relations in Qatar and across the globe. This is primarily due to the mutual trust and confidence between both parties, and to the State of Qatar’s safe and stable investment climate,” said His Excellency Mr. Saad Sherida Al-Kaabi, President and Chief Executive Officer of QatarEnergy.

This includes four LNG trains with a combined nameplate capacity of 32 million Mtpa. For context, nameplate capacity refers to the intended full-load sustained output of a facility, such as an LNG train. It should be noted that an LNG train isn’t a literal train. Instead, an LNG train is an LNG liquefaction and purification facility, which enables the practical and commercially viable transportation of natural gas between countries.

With gas supplies put in a vice following Russia’s invasion of Ukraine, the world has scrambled to find an alternative. QatarEnergy’s North Field East project could very well be that alternative, however, until the gas starts flowing in 2026, we are still left with quite the pickle.

Interestingly, Darren Woods has stated, “we are collaborating with QatarEnergy on North Field East to accelerate the production of secure, affordable, and cleaner energy our world needs.” Based on Exxon’s history, Darren’s statement is pretty off-brand. While I am not here to slander Exxon, it should be noted that the Company is quite notorious for greenwashing.

Exxon was supposedly aware of climate change as early as 1977, however, the Company has invested over $39 million in climate denial organizations since 1998. Either way, Exxon is positioned to make a pretty penny off of the nearly $30 billion North Field East project expansion. To be more specific, the Company will receive a 6.25% stake in the North Field East expansion.

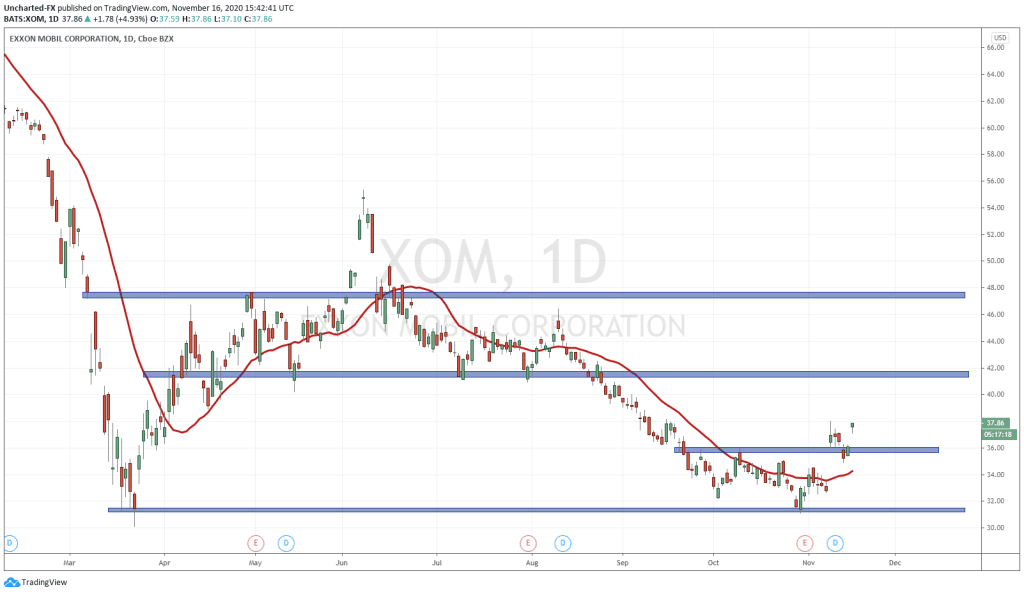

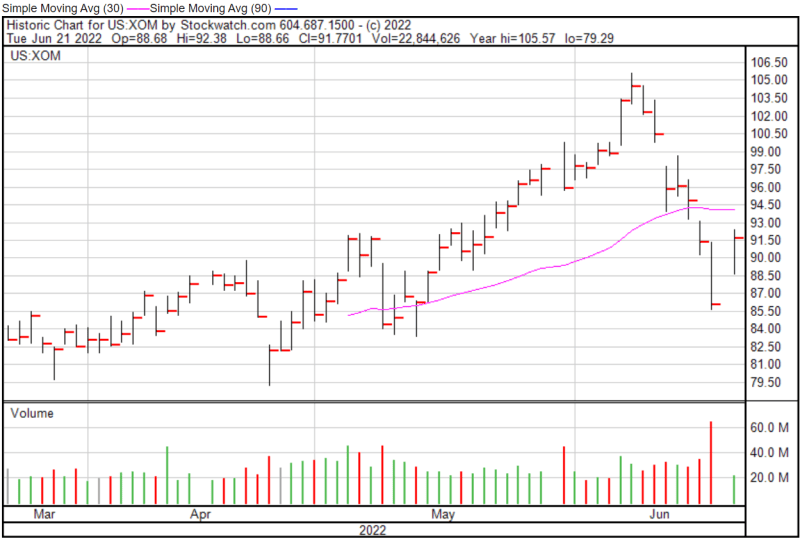

Exxon’s share price opened at $88.58 today, up from a previous close of $86.12. The Company’s shares were up 6.93% and were trading at $92.08 as of 2:16 PM EST.