And once again stock markets with record highs on the S&P 500 and the Nasdaq before the open, only to see those gains given up at the time of writing. My readers know that I have been in a Dow Jones and Russell 2000 long trade ever since the breakout of a major resistance level on the daily chart, however there are opportunities to enter if one has not already. We will go over that in just a second, but first some fundamentals which could drive these markets higher.

Firstly, we do have a Dow Jones shuffle upcoming, giving it a more tech heavy weighting. Salesforce.com (CRM) will replace energy giant Exxon Mobil inc (XOM), Amgen Inc (AMGN) will replace Pfizer Inc (PFE) and Honeywell International Inc. (HON) will replace Raytheon Technologies Corp. (RTX), -2.20%. The changes will take place Aug. 31.

President Trump announced a new plasma treatment yesterday, but so far the media has given it the HcQ treatment. Many large banks believe that positive treatment, or a vaccine is NOT priced into these markets yet. If a successful vaccine was to be announced, and this news is not priced in…one can just imagine the rally in stock markets.

Believe it or not, but apparently the US-China Phase 1 Trade Deal is still alive and is progressing. Last week, we saw this deal going great, and then being postponed with President Trump not wanting to talk to Beijing, to then being going well, to a phone call and both nations reaffirming their commitment to a deal. How long will the markets and algo’s keep believing this? Who knows, but any negative trade headlines will impact the markets.

The big one is Jerome Powell’s speech this Thursday at Jackson Hole. Last week, we were told Powell was going to be making an important announcement on Fed policy regarding inflation. Now, financial media is saying that Powell will be making a “profound statement”. They really are hyping this up. What we can predict is that Powell will say something positive for stock markets. The Fed will reassure market participants that the Fed will do what they need to in order to keep markets up, and that cheap money will be here for a longer time. It is possible that the stock market breakouts are already pricing this Fed news in.

Now onto the stock market charts of interest.

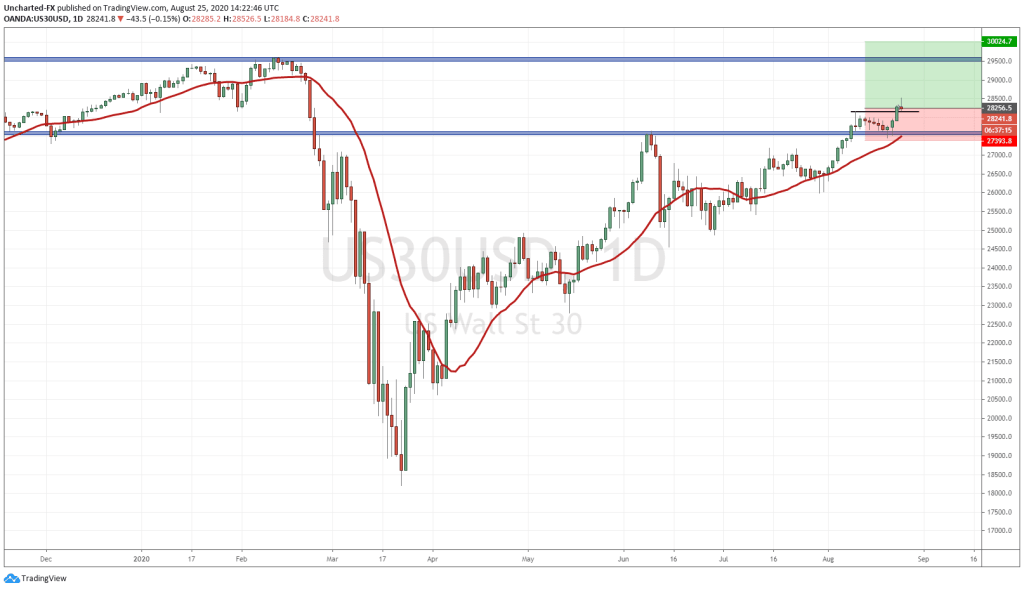

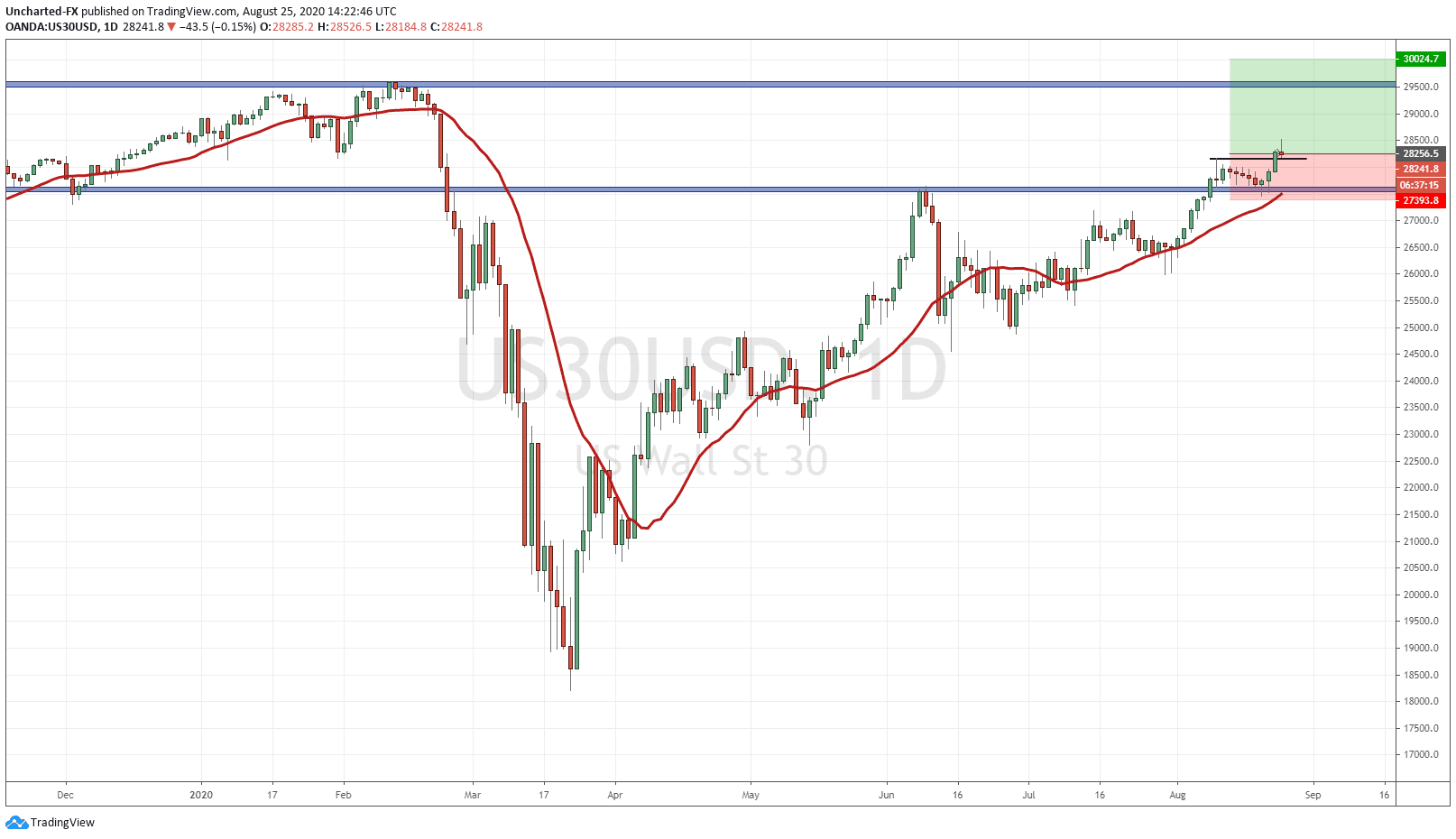

Our initial entry on the Dow/DJIA was the breakout above this resistance zone of 27500. This breakout candle can be seen to your left on August 10th. The problem is, we then had 9 trading days of the breakout carrying no momentum higher. This can be an issue for a trader since you are locking up your funds which could be used to trade other markets that have momentum carrying them forward. This is where a longer term outlook, and take profit targets come to play. The trade is already decided with a set stop loss and take profit once entered. Technically, we should have expected price to retrace back to retest our breakout zone. This is normal price action. As long as price remains above the breakout zone, the trade is still valid.

On Thursday, we had a nice green handle bouncing higher at the retest, followed by yesterday’s green candle which broke us above previous highs. With this new higher high, we have a confirmed higher low to work with. As long as price remains above this higher low, we remain in an uptrend. Hence why we are now placing our stop loss below this higher low. Targeting previous highs at 29,500 will not give us our 1:2 minimum risk vs reward ratio. New highs of 30,000 will do this.

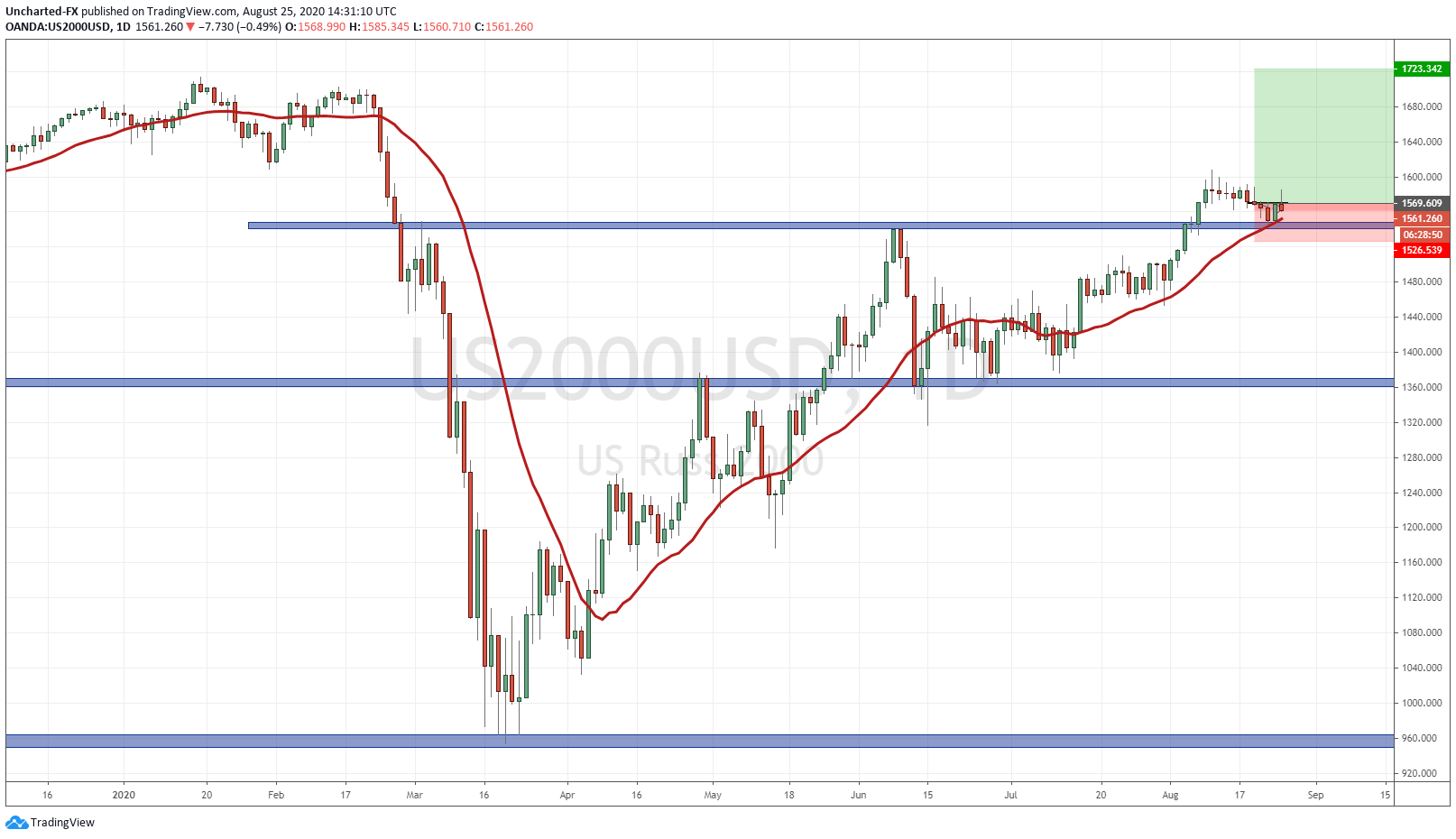

Perhaps a better risk vs reward is on the Russell 2000/IWM. Once again, we entered on the initial breakout above 1550, but just like the Dow, we ranged for more than a week. Yesterday’s green candle indicates that buyers are indeed stepping in at the retest of this breakout. Again this is normal price action. If we enter today, placing our stop loss below the lows of the breakout candle of August 7th and targeting a resistance zone at 1720 (which is NOT previous all time highs), we get a risk reward greater than 1:3.

It has been tough for people to fathom markets moving higher in this environment, but the truth is there is a difference between the real economy and the stock market. With central banks cutting interest rates, and are planning on keeping them lower for longer, stocks remain the only place to go for yield. Remember, our favourite money flow indicator is the 10 year yield, it is telling us currently that money is LEAVING the safety of bonds and is likely heading into the stock market.

As discussed in yesterday’s post, I do believe foreign money will come and chase US stocks now that the S&P 500 is officially in a new bull market. If you as a money manager missed the stock market run up because you thought the bottom was not in, you now have no excuse to miss this new bull market. Watch the US Dollar charts (DXY) for this. Also, the central banks will do whatever they have to in order to keep stock markets propped up. This is why all eyes will be on Powell come Thursday.