Long term. You have probably heard or read those two words more times than you can remember in the past few days. Stock markets are selling off hard, bond yields are spiking, the US Dollar is rallying, and the financial world awaits the Federal Reserve rate decision. A lot of volatility and a lot of uncertainty frustrating traders. At a time like this, it is best to remember why you are investing in certain sectors for the long term.

Readers know me as that commodity guy. With recent inflation and central bank news, I have been picking up commodities. Oil, gold, silver and uranium. I know some macro traders who are going all in on commodities right now given the price action in the bond markets. This isn’t meant to be a macroeconomics post (but if you are interested, check out my Market Moment posts), but hard assets/commodities tend to do well in times of inflation. Some investors are betting that central banks are way behind the curve and won’t catch up to tame inflation. Others are betting that central banks fail and reverse policy allowing for inflation to worsen over fears of the price action in the debt markets.

Sounds crazy? Well, just yesterday the European Central Bank held an emergency meeting after Italian yields spiked. Just a month before they were set to raise interest rates, it appears as if they have capitulated. What policy could they use to bring down yields? Hmmm probably what they have always done. Buy bonds.

When it comes to uranium, we have a pretty strong fundamental reason for being bullish. As Bill Gates (can I call him Bull Gates when it comes to uranium?) has said, nuclear energy is required to combat the climate crisis as it is the only CO2 free energy which can handle baseload power and our energy needs. That we should be building MORE nuclear power plants rather than shutting them off.

And it seems most of the world is starting to get it:

As our very own Lukas Kane said in his outstanding Uranium article:

Attempting to beat global warming without nuclear energy is like The Edmonton Oilers trying to win The Stanley Cup without Connor McDavid. A valiant enterprise with hopeful subplots – but unlikely to succeed.

Nuclear power plants produce no greenhouse gas emissions during operation,” reports the World Nuclear Organisation, “and over the course of its life-cycle, nuclear produces about the same amount of carbon dioxide-equivalent emissions per unit of electricity as wind”, and even less than solar.

Sorry Oilers fans.

As the necessity for nuclear power becomes more obvious, the price of uranium has been rising. Geopolitics has also played a role. The Russians are not just a major player in uranium, but also in enrichment. Marin Katusa’s book, “The Colder War” is a must read for those wanting to understand Russia’s role in Uranium.

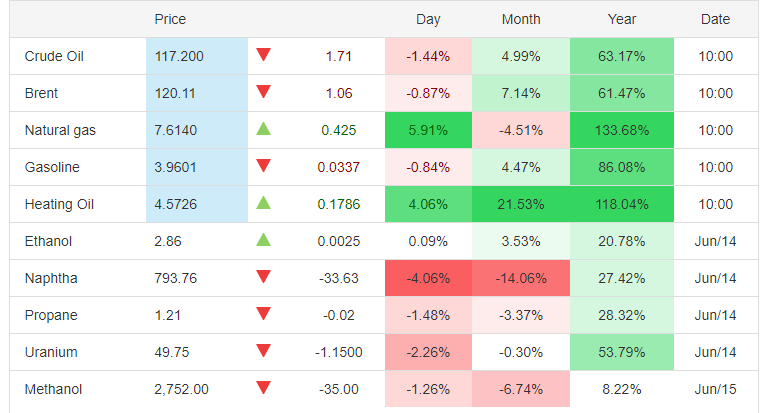

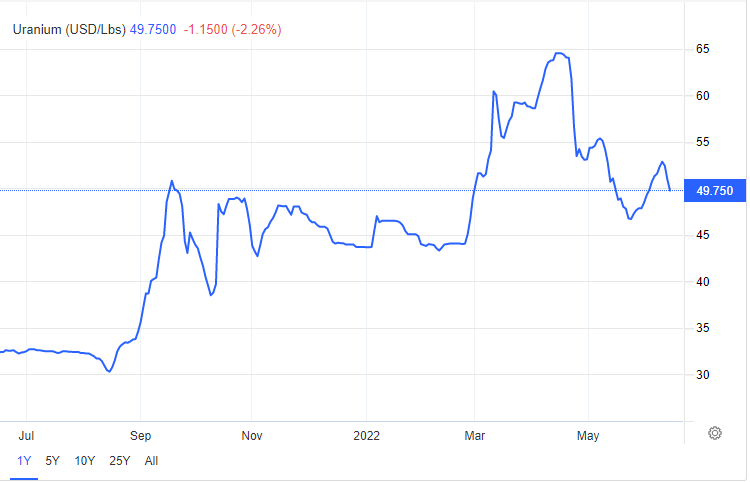

Uranium is still up 53.79% for the year, but is experiencing a pullback. For those who have read my recent Uranium article, this pullback to support was highlighted. Since then, we have seen a nice bounce around the $45 support zone, and uranium is looking to reclaim the $50 psychological level.

From a long term perspective, that is on the monthly and weekly chart, I remain bullish long term as long as uranium prices stay above $43.

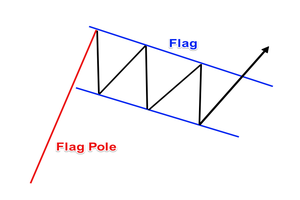

Just looking at the Uranium daily chart above, I see the developments of a bullish flag. To the left is how this pattern looks. You can draw the same structure on uranium and it remains above $45. The breakout trigger would be confirmed if we take out recent highs. I would say a break and close above $55 gets the uranium uptrend back into action.

Short term noise, long term bullish. This move lower in uranium stocks presents an opportunity to pick up some miners at discount prices. Here are a few uranium stocks that I have my eyes on.

Searchlight Resources (SCLT.V)

Market Cap ~$ 9.5 Million

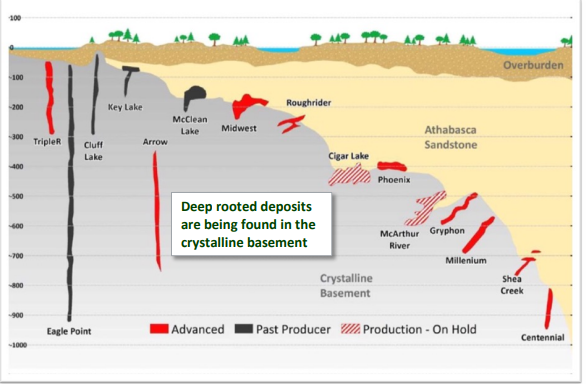

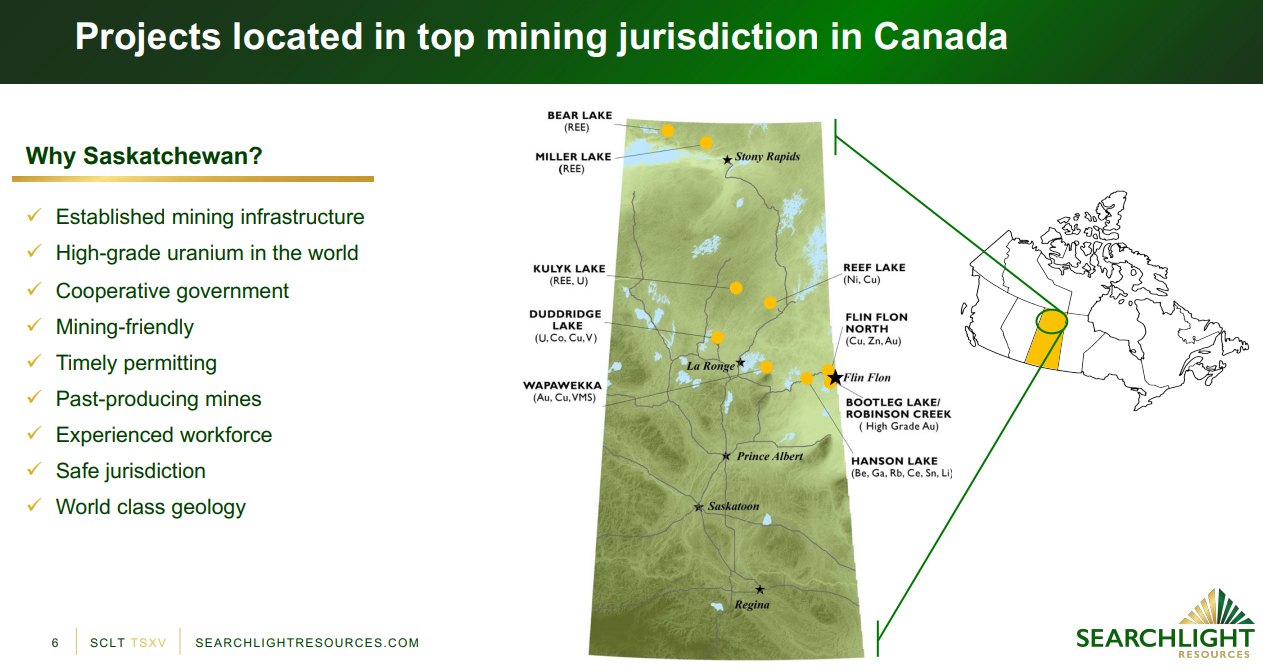

Searchlight Resources is a Canadian junior explorer and development company with a prime focus in the great jurisdiction that is Saskatchewan, Canada. A province familiar with uranium investors since that is where the Athabasca basin is located. Where the highest grade uranium on the planet is found. Well Searchlight is focusing on deposits in the Wollaston Domain, a belt of crystalline basement rocks that underlie the uranium mines in eastern Athabasca Basin. Over $4 Billion in market value has been found in these types of deposits.

Searchlight holds over 1300 square kilometres of claims in the Canadian province.

Recent news shows that Searchlight is focused on their Uranium asset at Duddridge Lake. Searchlight has identified uranium targets from an airborne survey.

“The Duddridge Lake project hosts a suite of Critical Elements including copper, cobalt, and vanadium in association with a known uranium deposit. In past exploration the focus has been on uranium, though we see potential for a multi-metal exploration focus”, says Stephen Wallace, Searchlight’s CEO

Searchlight also has some gold projects that they are working on. Since this is a uranium article, I won’t cover the news at the Robinson Creek project, but readers should know this project has a compilation of 70 drill holes from the 1940s and 1980s.

The stock has been in a range since 2020. We are near the bottom support of this range just below $0.06. However, at time of writing, we are seeing a 14% pop as the stock ranges for days between $0.065 and $0.075. This type of price action could see the stock returning to test the upper portion of resistance at $0.12. A major catalyst is what will be required for the breakout.

Searchlight is an early stage company. However if uranium prices continue their long term trajectory higher, these types of companies with a smaller market cap will have big upside. Are juniors speculative? Sure, but from a risk vs reward perspective, nothing will beat the gains to be made from smaller cap stocks in a uranium bull market.

Fortune Bay (FOR.V)

Market Cap ~ $ 16.3 Million

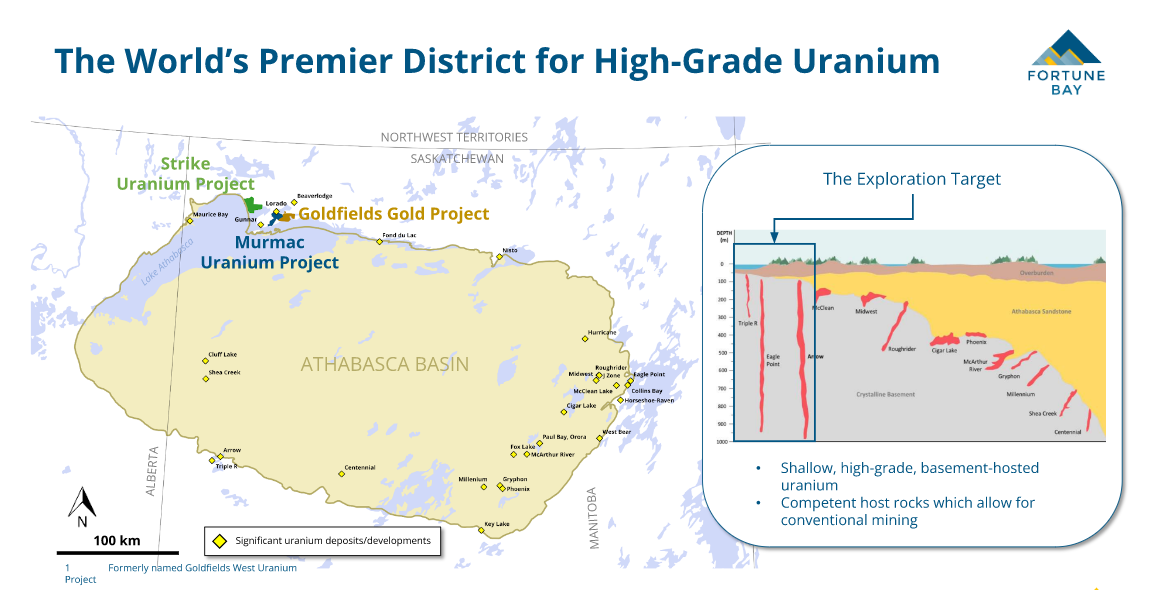

Fortune Bay Corp is an exploration and development company that has a 100% ownership in two advanced gold projects in Canada and Mexico, and also owns the 100% owned Strike and Murmac uranium exploration projects, located near the Fortune’s Goldfields gold project, which have high-grade potential typical of the Athabasca Basin.

I had the chance to speak with CEO Dale Verran, and Technical Director Gareth Garlick at VRIC. Both are bullish on uranium, and were quite surprised the stock was seeing a sell off given the assets they hold. But I think their story needs to be told.

If you like gold and uranium both, like I do, Fortune Bay is worth the look. Their gold projects actually are quite advanced, even development ready, with a drill defined resource. I know I said I will focus on uranium, but this is such a great bonus for the stock. Expect a PEA out this year for the Goldfields project!

When it comes to uranium, Fortune Bay is targeting high grade basement hosted deposits similar to Arrow (Nexgen Energy) and Triple R (Fission Uranium). The company has the right ingredients for a high grade discovery with an experienced uranium exploration team and the right geological setup.

The Strike uranium project has a known uranium endowment. Historical results confirmed through recent surface rock assays highlighted by 1.75% U3O8 and 3.51% U3O8. Drill targets have been identified, and maiden drilling commenced near the end of May 2022.

Approximately 2,500 meters of drilling in 8 to 10 drill holes is planned at Strike. The program is expected to be results-driven, based upon drilling results and additional gravity surveying which is currently ongoing.

Dale Verran, CEO for Fortune Bay, commented, “We are pleased to have commenced the inaugural exploration drilling program at Strike for high-grade uranium. The drill targets identified exhibit the hallmarks for basement-hosted uranium deposits associated with the prolific Athabasca Basin, and we are looking forward to the results.”

The results will be a near term catalyst for the stock price.

I moved to the weekly chart so you can see this support zone more clearly. Fortune Bay is right at a major support zone and this week’s candle close is going to be very important. We do want to see the stock holding above $0.38.

Down on the daily chart, it would be great to see a few days of range just to indicate that selling pressure has exhausted and that we could begin to build some base here for a new trend. There is some work that has to be done though. As a technical trader, I really would like to see the stock build a base and then clear above $0.565. From a technical point, we take out what was once the previous lower high. It is the level which needs to be taken out to end this downtrend.

This is a more advanced company with high potential projects. Initial exploration for uranium is fully funded for drilling in 2022. The gold project also has a major catalyst with a PEA due out in Q4 this year. Overall, this is going to be a big year for Fortune Bay.

enCore Energy (EU.V)

Market Cap~ $ 374 Million

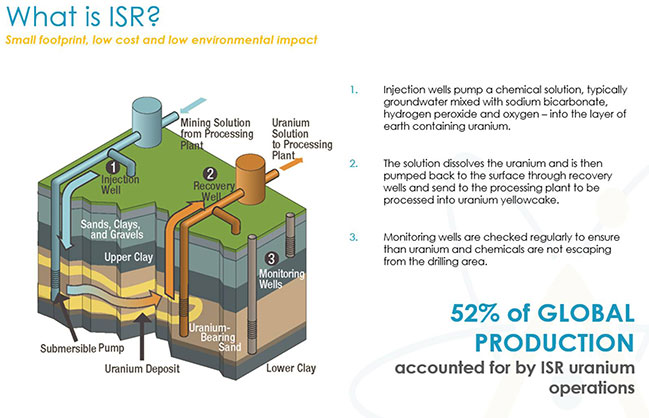

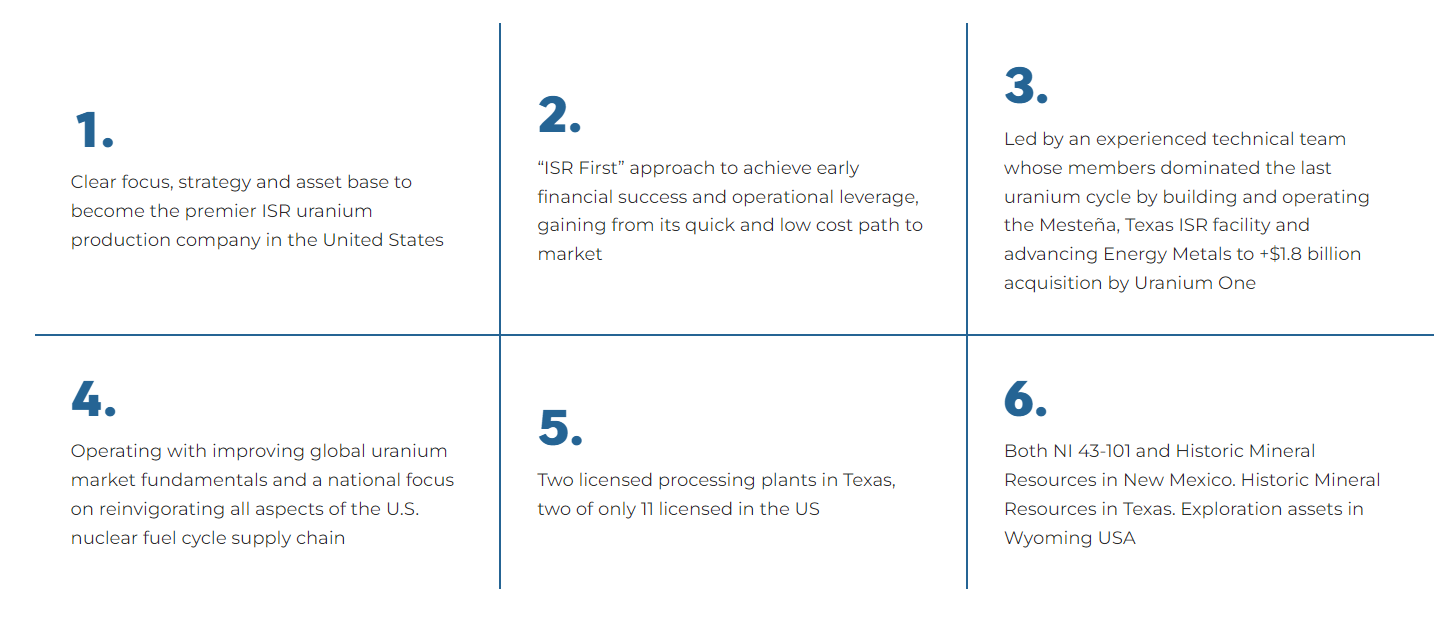

Let’s end with a big boy. enCore Energy is a diversified US domestic uranium developer focused on becoming a leading ISR uranium producer. What the heck is ISR mining you ask? ISR uranium mining stands for ‘in situ recovery’ which is a fancy term to describe a method of uranium extraction. It is one of the two primary extraction methods used to obtain uranium from the ground. ISR facilities recover uranium from low-grade ores where other mining and milling methods may be too expensive or environmentally disruptive.

enCore Energy holds a portfolio of uranium assets located in Texas, New Mexico, Wyoming, Utah and Arizona, USA. The portfolio is highlighted by the Rosita and Kingsville Dome licensed ISR uranium production facilities with combined nameplate capacity of over 1.6 million pounds of U3O8 in South Texas.

The advanced staged Dewey Burdock project in South Dakota and the Gas Hills project in Wyoming add to the large uranium resource endowments in New Mexico creating an outstanding asset base for long term growth and development opportunities with approximately 90 million pounds of U3O8 estimated in the measured and indicated categories and 9 million pounds of U3O8 estimated in the inferred category.

If you are someone who believes there will be a global realignment away from Russia in the nuclear fuel supply chain, start looking at some US based companies. enCore is one to keep on the list with two licensed processing plants in Texas with offtake agreements in place.

And enCore is well on its way to become the next producer of uranium in America. Recent news details the modernization and refurbishment of the 100% owned Rosita ISR processing plant in Texas. The processing plant is 90% complete with a completion date in May 2022. Once the modernization and refurbishment project is complete, enCore will commence commissioning work, expected to take approximately 30 days. Following commissioning work the Plant will be ready to start receiving loaded resin. There are other steps that need to be taken, but the plant will be producing in 2023.

The stock is at an interesting zone. Finding buyers just above the major psychological $1.00 zone. We have seen the stock range around here while stock markets were dropping hard. There was a big 16% pop on June 7th, but momentum was not sustained. The stock is continuing to range. I have some resistance above at $1.60 before seeing levels at $2.00.

This is an advanced company with a project coming online and exploration upside. They are well on the way to becoming a US producer. With uranium being a strategic asset in the US, and the supply and demand factors which will occur when nuclear energy becomes the prominent energy source, enCore Energy is sitting in a great position.