Are you an ESG investor? Do you believe the world will have to take steps to head to a zero carbon world? Do you believe there will be a transition from fossil fuels over to an energy source that emits zero greenhouse gases? Well then Hydrogen might be for you.

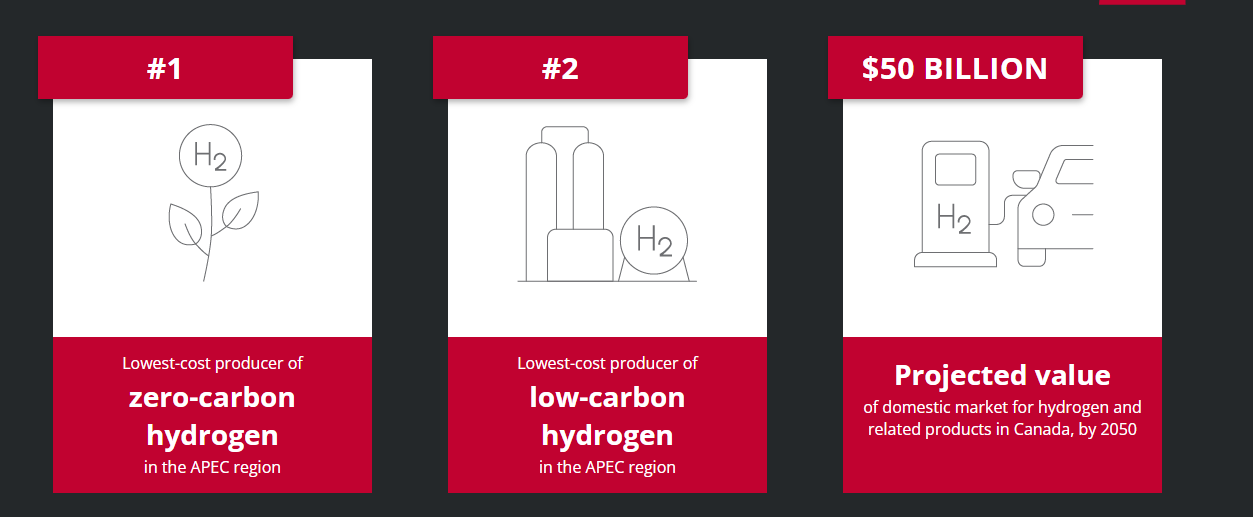

Even better if you are a Canadian, as Canada is one of the top 10 global hydrogen producers. In fact, Canada wins on two fronts:

So what exactly is hydrogen energy and hydrogen fuel? According to science direct, hydrogen energy involves the use of hydrogen and/or hydrogen containing compounds to generate energy to be supplied to all practical uses needed with high energy efficiency. As noted, this is a zero-carbon fuel burned with oxygen.

Hydrogen fuel cells produce electricity by combining hydrogen and oxygen atoms. Hydrogen reacts with oxygen across an electrochemical cell similar to that of a battery to produce electricity, water, and small amounts of heat.

Currently, hydrogen is used for refining petroleum, treating metals, producing fertilizers and processing foods. But in the future, we are hoping they will be used to power electricity.

What is holding this back? The production of hydrogen right now isn’t really environmentally friendly. The way we produce hydrogen in its gaseous form emits greenhouse gases.

Most hydrogen these days is “gray hydrogen,” which is made using fossil fuels. Then there’s “green hydrogen,” made with renewably produced electricity that’s used to separate water into hydrogen and oxygen using a tool called an electrolyzer.

Hydrogen itself has ways to go before its environmentally friendly. But as we improve the technology and develop its scale, some forecasts peg the green hydrogen market to be as much as $10 TRILLION.

Powertap Hydrogen Capital (MOVE.NE)

Market Cap ~ $80.24 Million

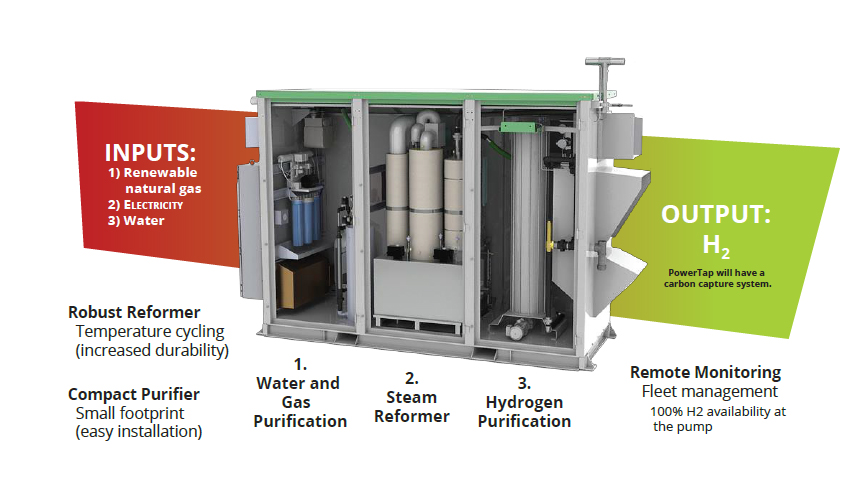

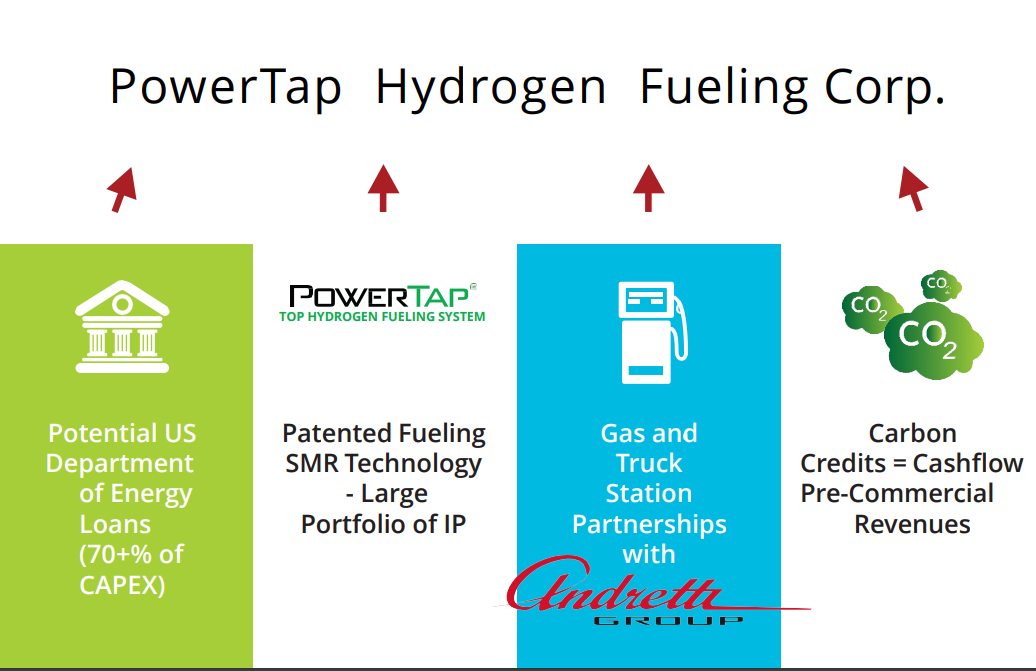

Powertap is aspiring to build North America’s largest hydrogen fueling network. They are leading the shift to a greener world by innovating clean, cutting edge hydrogen fueling technology.

Think of PowerTap hydrogen fueling as your gas stations…or in this case, fuel stations. The company has partnerships with major fueling networks to install hydrogen fuel technology at existing locations. The tech allows for low cost, green and onsite hydrogen fueling. With installation and PowerTap being the first mover, comes the benefits of carbon credits as a revenue source.

There are 14 installed PowerTap stations in the United States. These stations are using the previous PowerTap H2 tech and are stations not owned by PowerTap. The company is also making strategic investments across the renewable spectrum of Hydrogen production. Including Next Hydrogen, FusionOne and Advanced Electrolyser Systems.

The stock itself is in a downtrend. There are signs of the downtrend bottoming out. The stock has begun to range with buyers stepping in at $0.20 and sellers at $0.25. We need a breakout to determine direction. A range indicates that the selling pressure could be over. Those who are bullish on PowerTap could get interested if the stock breaks above $0.25. That would be a range breakout and the stock could begin a new uptrend after a very long downtrend.

Bloom Energy (BE)

Market Cap ~ $2.6 Billion

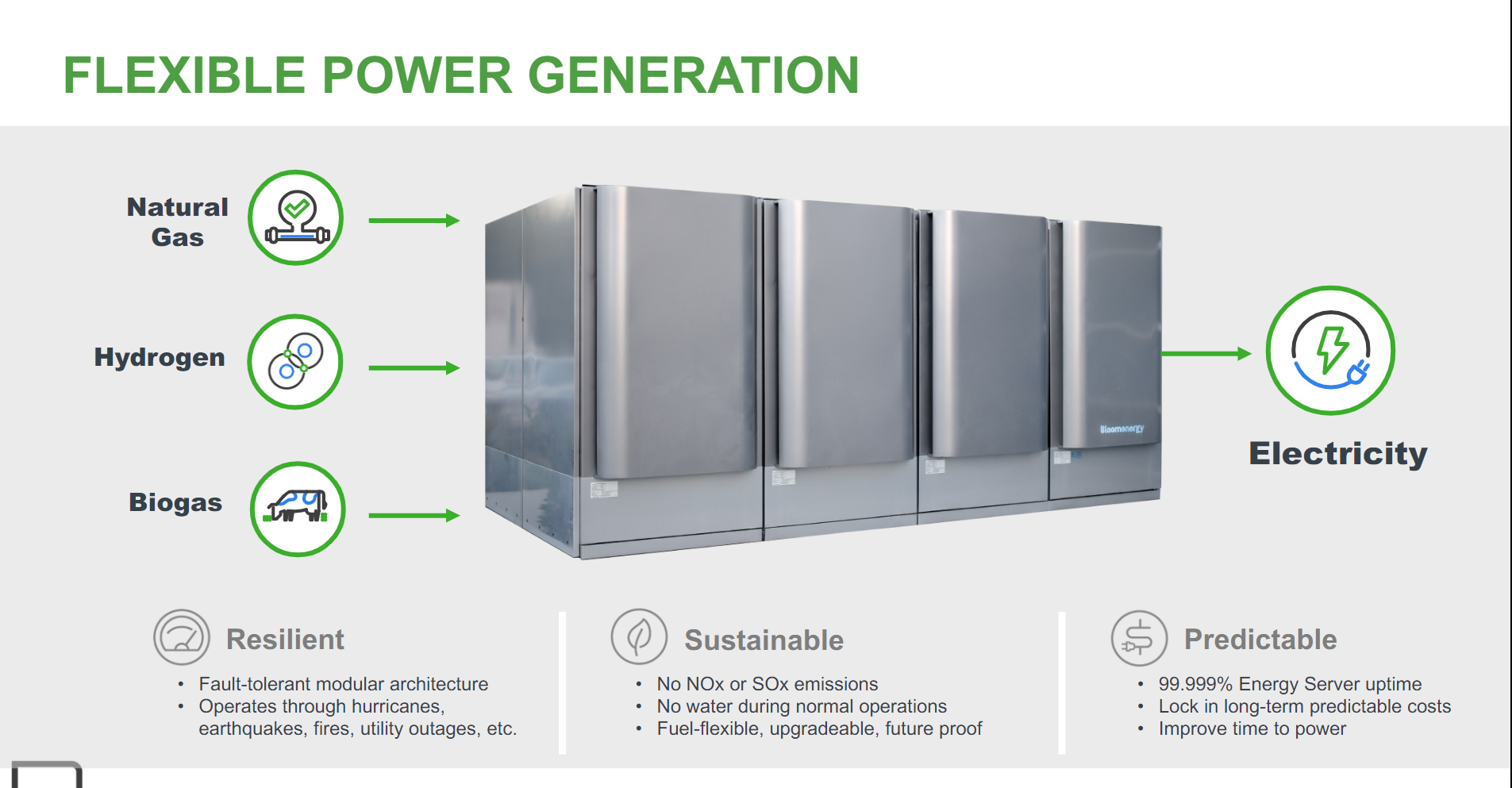

Bloom Energy is building an energy platform that unlocks multiple pathways to zero-carbon. The company is on a mission to decarbonize the world. We are talking about electrolyzers, hydrogen fuel cells, biogas, certified gas, carbon capture and marine tech.

The company’s Bloom Electrolyzer is the most efficient electrolyzer to produce clean hydrogen to date and 15 to 45% more efficient than any product on the market today.

The Bloom Electrolyzer relies on the same, commercially proven and proprietary solid oxide technology platform used by Bloom Energy Servers to provide on-site electricity at high fuel efficiency. Highly flexible, it offers unique advantages for deployment across a broad variety of hydrogen applications, using multiple energy sources including intermittent renewable energy and excess heat.

Bloom Energy also has a partnership with the large Korean company SK. One of the largest Chaebol. This partnership will help South Korea achieve its Hydrogen economy roadmap goals.

Bloom Energy stock recently gapped down on missing earnings expectations. The stock then filled the gap right after and found resistance at $20. With stock markets falling under pressure, Bloom Energy may feel that pressure. A gap fill is usually very bullish, but in this case, there was no momentum given the broader stock market. There is a potential Bloom Energy could pull back to retest $12 once again. For upside momentum, a break above $20 gets us over a key technical level.

Ballard Power Systems (BLDP.TO/BLDP)

Market Cap ~$ 2.29 Billion

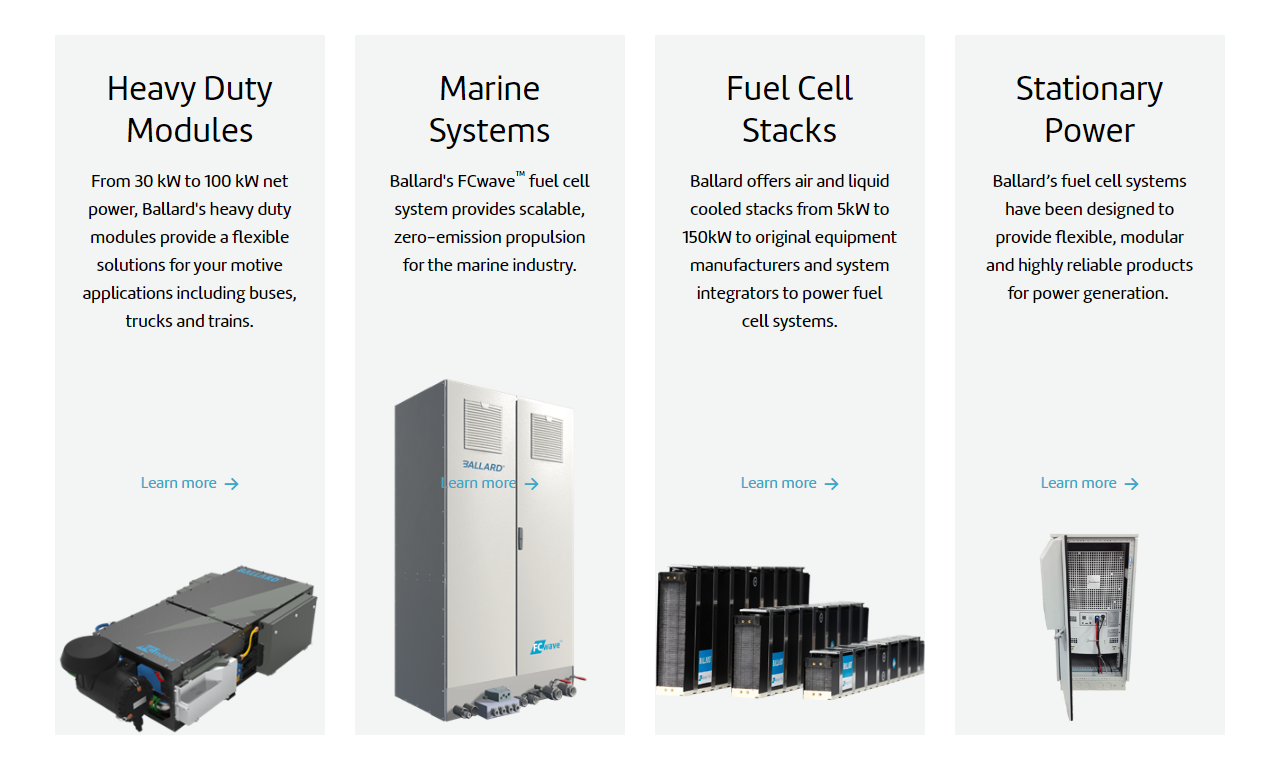

Now to the big boys. Ballard has 40+ years developing industry leading hydrogen Proton Exchange Membrane (PEM) fuel cell technologies, sitting on 1,400 patents and applications. The company is well diversified with operations in Europe, China and North America.

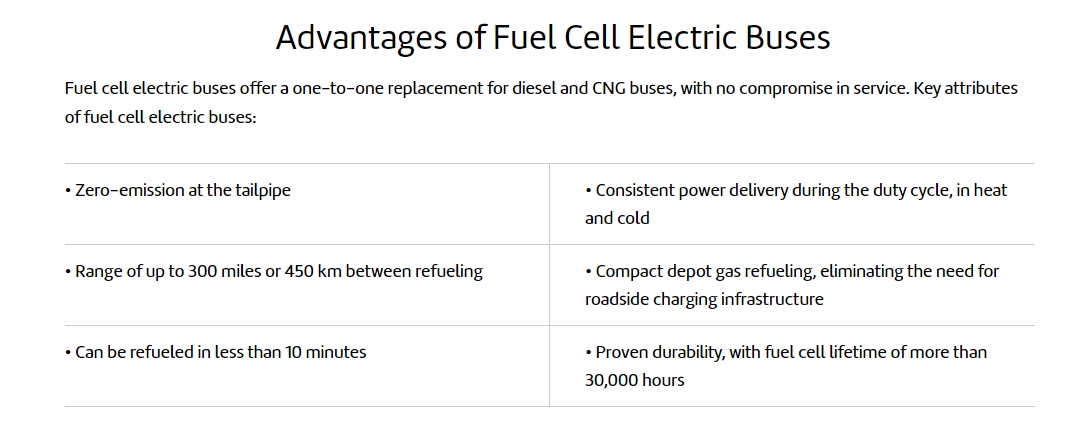

I like the focus on transportation like transit and railway. Fuel cells improve the performance of electric buses by generating onboard power from hydrogen to recharge the batteries. Perhaps you have seen hydrogen fuel cell electric buses in your city.

Ballard power systems is traded on both the US and Canadian exchanges. Above is the chart of the Canadian listing. We closed at a very key support level yesterday. The stock needs to remain above $7.50 to have any potential of a near term upwards move. As of now, I really want to see a close above $10 to begin any new trend.

Keep in mind these stocks are seeing major sell offs as the broader stock market falls. This fall will provide opportunities for those who are bullish on decarbonizing the world as a future investment. As of now, I expect to see more downside as markets react to inflation and rising rates. However, I myself am keeping tabs on oil. If oil prices take off, that might be the big catalyst required for governments and companies to start shifting to cheaper renewable/clean energy sources. In other words, there might be some more pain before we see the real gains.