Agriculture stocks remain at the fore front of many prudent investor’s minds. Food inflation, shortages, supply chain disruptions, geopolitics, unpredictable weather, and government rules are all affecting this sector. Fall is when I believe the real issues will begin to be seen on the shelves, but recent news from India is telling of what may be coming.

India has banned exports of certain agriculture products citing food security and soaring prices. This list includes wheat and sugar. Rumor has it, India may add rice to this list, which is huge as the country is the world’s top rice shipper accounting for 40% of trade. Over the weekend, it has come out that rice producer’s Thailand and Vietnam may hike rice prices. The government in Thailand said on Friday it planned with Vietnam to create a pact between the world’s second- and third-largest rice exporters to boost their bargaining power and help mitigate rising production costs. Vietnam has yet to confirm such a plan was being discussed. Keep all this in mind especially when we talk about Rice Bran Technologies.

The key takeaway is that producing nations are going to take advantage of this situation. They will have a huge bargaining chip. The Russians probably have the biggest with all their agriculture products. What we are seeing in India might be a common theme as well, where nation’s decide to keep their interests first ahead of the global community.

More agriculture headlines mean more money will be looking at this sector. Readers know I write a weekly agriculture sector roundup here on Friday. The key for me is looking for companies that use less inputs/resources (ie: water, land etc) to boost and increase crop yield. There are some really innovative companies in this space, and here are three that I think are poised for big gains.

Bee Vectoring (BEE.CN)

Market Cap ~ $25 Million

When it comes to a company looking to use less inputs for more yield, look no further than Bee Vectoring. In fact just last week we had Ashish Malik, CEO of Bee Vectoring, come on Maddy’s 5 easy questions and discussed the importance of using much less resources than traditional crop treatment. I highly suggest you watch the video below.

In terms of innovation, Bee Vectoring is revolutionizing agriculture and crop protection naturally through utilizing commercially-reared bees and their integral role in pollination.

I wrote a larger piece on the fundamentals for this company which can be read here.

The company’s patented bee vectoring technology uses commercially-reared bees to deliver targeted crop controls through the natural process of pollination. It provides natural pest and disease management solutions (meaning it can REPLACE pesticides and wasteful plant protection product spray) for various crops, such as strawberries, sunflowers, apples, tomatoes, canola crops, blueberries, and other crops.

Almonds is another crop Bee Vectoring is working with. Bee Vectoring announced it is conducting 10 almond trials in the 2022 growing season, which started during the almond bloom period (mid-February to mid-March) and will continue through harvest in the Fall. The locations are throughout California’s Central Valley, including in Bakersville, in the Fresno area, and in Northern California. This is the second year for BVT almond trials as farmers require multi-year data under local conditions for proof of efficacy.

California almond pollination is believed to be the largest single pollination event worldwide. Valued at over US$6 billion, almonds are California’s largest non-dairy crop in the state, with over 1.2 million acres in production. Almond growing is big business and the sector has key sustainability objectives: the Almond Board of California has committed to increasing adoption of environmentally-friendly pest management tools by 25% by 2025. A potential lucrative market for Bee Vectoring.

Bee Vectoring’s most recent news deals with its first stone fruit trial in the US Pacific Northwest. The trial is being conducted to achieve a proof of concept for greater yield with BVT’s natural precision agriculture system. It uses BVT’s proprietary Vectorite™ with CR-7 (Clonostachys rosea CR-7) biological fungicide, applied through the process of bee vectoring directly onto cherry blooms.

“This initial stone fruit trial marks BVT’s entry into the important US stone fruit market,” said Ashish Malik, CEO of BVT. “In addition to cherries, stone fruits include peaches, nectarines, plums, prunes, and apricots, all grown on more than 270,000 acres(4) of farmland in the US. This is a very attractive crop grouping for BVT because of their high use of paid pollination hives, with over 75% of cherry acres(5) using pollination services.”

The stock broke below previous all time lows at around $0.23 to print new lows at $0.195. However, as you can see from the breakdown, there was no momentum on the break. We broke, but then began to range for weeks. This is a positive sign because you tend to see follow through shortly when a breakdown has occurred. It appears as if a reversal is setting up.

We closed above my downtrend line which is a really good start. What is the sign I am looking for? A close back above $0.23 to reclaim what was once support. If you zoom out on the chart, you will see how important this $0.23 zone was, and if you are a regular reader, you know I have called this level out many times in previous articles.

CubicFarms (CUB.TO)

Market Cap ~ $94.5 Million

CubicFarms holds a special place in my heart as it was the first company I covered in my inaugural agriculture piece I wrote back in 2021. I provided the four fundamental reasons on why I am going all in on agriculture. They are all coming true.

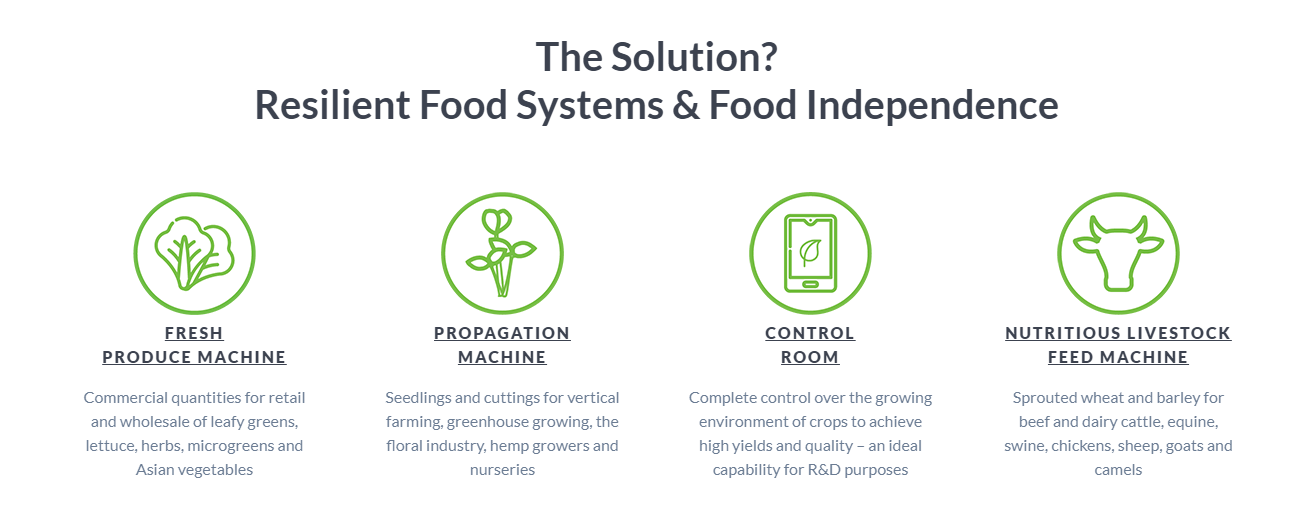

CubicFarms is your ESG, indoor farming company. The company provides indoor farming technologies which is automated, modular, onsite and indoor. Oh and it minimizes the environmental impact by maximizing cubic space. All automated, and with a click of a button, you can have a yield in six days. Even young people, and those that are tech savvy, will love and appreciate this technology.

Recently, CubicFarms reported Q1 2022 financial results. Here are some highlights:

- The Company currently has a total of 204 modules pending installation. System sales pending manufacturing and installation are valued at approximately USD $27.6 million.

- HydroGreen Certified Dealer commitments representing more than 100 machines for 2022 are valued at over $23 million.

- Revenue for the three months ended March 31, 2022, was $243,912.

- Net loss for the three months ended March 31, 2022, was $8,760,249, a 138% increase from the same period ending March 31, 2021

The stock has not had a great 2022. We are now testing an important psychological support level. The $0.50 support. I expect to see some buying here, and we saw some evidence of this with volume of 392,903 on Mat 27th printing a green candle and a wick at $0.50. I would really like to see CubicFarms close back above $0.60 cents. This used to be a major support area in the past, and if we can reclaim this, it will go a long way in initiating a new uptrend.

Rice Bran Technologies (RIBT)

Market Cap ~ $ 35.76 Million

Perhaps one of the hottest stocks in agriculture. I just wrote a piece on this company which came out last week. Still fresh so I suggest you read it if you want more information on the company and their products.

RiceBran Technologies is an innovative specialty ingredient company focused on producing healthy, natural and nutrient dense products derived from rice, stabilized rice bran and other small grains such as oats and barley. The company delivers these high quality products for customers in food, nutraceutical, pet care and animal feed markets.

RiceBran Technologies stabilizes fresh and raw rice bran. Their proprietary process ensures their rice bran products are minimally processed, a source of vegan protein, dietary fiber and essential fatty acids. The process also allows RiceBran’s products to retain vitamins, minerals, phytosterols and antioxidants. Nutritious and contributing zero trans fat. This is ‘clean label’ stuff meaning non-GMO and gluten free, as well as contributing no major allergens. Very important in this market as consumers are spending more on healthy and natural food products.

The technicals for this stock looks great, and remember earlier I spoke about rice? This is a company that has both fundamentals and technicals aligning for it.

Of all the charts I put up in this article, Rice Bran has the best. We have a reversal pattern confirmed, and now it is all about continuing the new uptrend. I expect more highs as long as we hold above $0.63. We are definitely doing a good job at this right now. Every time we drop below $0.63, buyers rush in and push the close above it. This is what we want to see to maintain a bullish stance. A daily close above the recent candle highs at $0.75 gets us going once again. Can this next leg take us to $1.00? Very possible given the fundamental news on rice.