There is one really hot stock in the Agriculture space right now. That stock is RiceBran Technologies (RIBT). I have had many readers ask me to include them in future Agriculture sector roundups. I took a look at the company and immediately spotted a nice looking chart. A reversal pattern set up which I mentioned in a roundup on May 13th 2022. A week later and we confirmed the breakout that I was calling for. RiceBran Technologies made an appearance in last week’s roundup as it was one of the top 3 agriculture stocks of the week.

My technical analysis was well received on Twitter, and that is where I saw the popularity of this stock. I don’t recall seeing a small cap stock with such a popular following in recent times. Readers know that I believe agriculture is going to provide some great returns for investors. With the recent stock market sell off, I am looking to pick up beat down stocks. This is where the technicals can come in as I hunt for bottoming/reversal setups. What gets me even more excited is when you have the deadly duo combination.

When the technicals and the fundamentals align, you have a high probability of getting a success on an investment. I am here to say that RiceBran Technologies fits the bill. The technicals have confirmed a breakout, and in this article I will talk about what I want to see next. The fundamentals for agriculture are bullish for ag stocks. I am talking about rising food prices, supply chain issues, potash and fertilizer shortages, and unpredictable weather patterns impacting growing and harvesting. I do hope I am incorrect with this prediction, but I do think come Fall of this year, we will be hearing about food shortages and seeing more empty supermarkets.

How about news that is rice related? Recently, India has been banning exports of agriculture. A protectionist move. Bloomberg recently put out an article citing that India might be considering a rice export restriction. India is the world’s top rice shipper accounting for 40% of trade. A restriction on rice exports may exacerbate the food crisis and cause rice prices to spike.

RiceBran Technologies

Market Cap ~ $ 35.76 Million

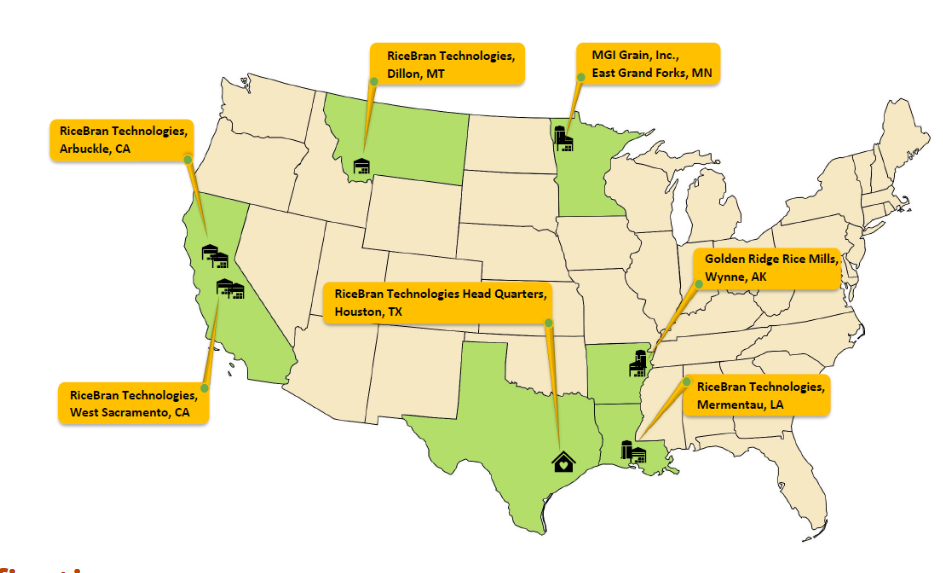

RiceBran Technologies is an innovative specialty ingredient company focused on producing healthy, natural and nutrient dense products derived from rice, stabilized rice bran and other small grains such as oats and barley. The company delivers these high quality products for customers in food, nutraceutical, pet care and animal feed markets.

RiceBran’s technology, facilities and years of experience gives them an edge in providing these quality sourced ingredients to customers.

So what exactly is rice bran? Good question, and from someone who eats rice almost on a daily basis, I was happy to learn something new!

Rice bran is one of the main byproducts in the process of rice milling. It is the outer layer of rice. Rice bran is a popular ‘healthy oil’ in Japan, Asia, and India. From the docs over at webmd:

Rice bran oil contains substances that might decrease how much cholesterol the body absorbs. Rice bran might also decrease calcium absorption, which might help prevent certain types of kidney stones from forming.

People use rice bran for high cholesterol, diabetes, high blood pressure, athletic performance, and many other purposes, but there is no good scientific evidence to support many of these uses.

Rxlist mentions this:

Rice bran is used for treating diabetes, high blood pressure, high cholesterol, alcoholism, obesity, and AIDS; for preventing stomach and colon cancer; for preventing heart and blood vessel (cardiovascular) disease; for strengthening the immune system; for increasing energy and improving athletic performance; for improving liver function; and as an antioxidant.

RiceBran Technologies stabilizes fresh and raw rice bran. Their proprietary process ensures their rice bran products are minimally processed, a source of vegan protein, dietary fiber and essential fatty acids. The process also allows RiceBran’s products to retain vitamins, minerals, phytosterols and antioxidants. Nutritious and contributing zero trans fat. This is ‘clean label’ stuff meaning non-GMO and gluten free, as well as contributing no major allergens. Very important in this market as consumers are spending more on healthy and natural food products.

Rice bran can be applied in many ways. Below is just a list for human nutrition, but RiceBran Technologies products can be applied to nutraceuticals and animal nutrition.

There are many high quality specialty ingredients that RiceBran offers. All of these are sustainable and cost-effective. And all are certified gluten-free, halal, kosher and produced with sustainable non-GMO ingredients. Below is a nice list from their website, but other products include organic pearled barley and organic oat flakes and a multiple of rice, barley and oat grain products:

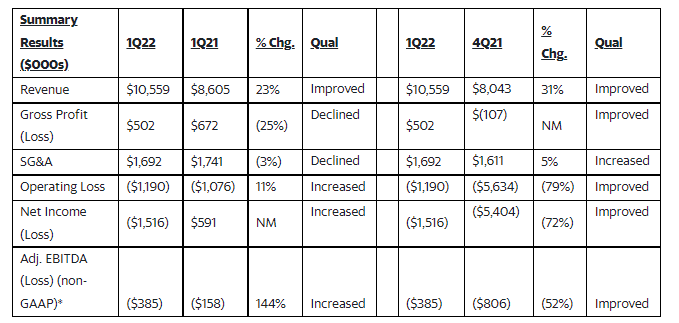

On April 28th 2022, RiceBran Technologies released financial results for the first quarter ended March 31st 2022.

“The first quarter’s results built upon the momentum we began to see in December and bodes well for the year to come,” said RiceBran’s Executive Chairman Peter Bradley. “We are aligned with healthy living trends and benefitting from having high quality domestically sourced products in a difficult global supply chain environment. Strong growth in the quarter for our core-SRB and milling businesses reflects improved execution, while plans to introduce new products and expand production should support continued revenue growth and a transition to sustainable profitability, validating our strategic shift to a high value-add specialty ingredients focus.”

RiceBran Technologies delivered strong growth and a return to positive gross profits bringing in $10.6 Million in Q1 22, up from 23% Q1 21.

Positive momentum underpinned by strong demand and improved execution. RiceBran saw growth for its core business.

Value add to offer upside to revenue and profits in the coming quarters.

Revenue momentum remains strong, and the balance sheet strengthened with total cash at $5.9 million driven by positive operating cash flow, lower capital expenditures, and an increase in short-term borrowing.

Getting the fundamentals out of the way, let’s explore the chart.

Regular readers of my work, and Discord members probably get the gist of the type of set ups I love. I trade and invest in the exact same patterns because market structure just repeats itself. I look for set ups that have been beaten up in a long downtrend, but then show signs of selling exhaustion. We tend to see a range or some sort of bottoming pattern. This occurred on RiceBran Technologies in Q1 2022. We printed a bottoming pattern known as the inverse head and shoulders. The break above $0.40 and subsequent follow through after pulling back, was the signal that the downtrend was over. Now, RiceBran is in a new uptrend.

The major breakout I was looking for was a close above $0.6250. This occurred on May 18th 2022 with strong volume of 12,243,500. This is what you want to see for a breakout: a large green candle backed by strong volume. The retest on May 20th shows typical breakout and retest price action. We managed to see buyers jump in and take the daily candle close back above $0.6250. The uptrend continues as long as the price remains above this level.

Recently, the stock has not been able to sustain momentum for a further push into the $0.90-$1.00 zone. We seem to be finding some interim resistance at $0.77. Even though the stock is well supported above $0.6250, it would be prudent to jump in or add to your position when we get a daily candle close above $0.77. This is for two reasons. Firstly, this would confirm what is called a higher low. Meaning the stock continues its uptrend and building momentum. Secondly, if we do not get this breakout, the stock could end up ranging here, or worse, seeing a drop back below our support as traders lose patience due to the lack of momentum.

In summary, the stock sees plenty of volume per day. This is definitely a hot stock in the ag space. The technicals look VERY good with a lot of room to the upside, and the fundamentals remain bullish for agriculture stocks in general.