Is the pain over? Are stock markets about to stop bleeding and reverse? In this Market Moment, I will analyze the technicals to give you an answer. In my personal opinion, the trend is still down, but I do see evidence of a bounce coming.

In terms of the market environment, there is more fear. Monkeypox, Russia-China sending jets to Japan to intimidate the US, and now negative forward guidance. Snap Inc moved ad-tech stocks with their poor guidance. Today, we heard from Dick’s Sporting Goods who cut their outlook for this year. Recession signs anyone? All it takes is one more negative quarter to confirm a US slowdown.

And then we heard from Bill Ackman…interestingly enough he said exactly what I have been telling readers here. He even used the word ‘confidence’ which is so crucial to avoid a confidence crisis. Let me highlight some things he said in his viral tweet:

Inflation is out of control. Inflation expectations are getting out of control. Markets are imploding because investors are not confident that The Fed will stop inflation.

The only way to stop today’s raging inflation is with aggressive monetary tightening or with a collapse in the economy.

In the last day or so, various current and former Fed members have waffled and made dovish remarks proposing a modest increase in rates and a pause in the fall.

The Fed has already lost credibility for its misread and late pivot on inflation. There is no economic precedent for 200 to 300 bps of fed funds addressing 8% inflation with employment at 3.6%.

Current Fed policy and guidance are setting us up for double-digit sustained inflation that can only be forestalled by a market collapse or a massive increase in rates. That is why I believe there are no buyers for stocks.

How does this downward market spiral end?

It ends when the Fed puts a line in the sand on inflation and says it will do ‘whatever it takes.’

Markets will soar once investors can be confident that the days of runaway inflation are over. Let’s hope the Fed gets it right.

Seems like Mr. Ackman has been reading my work! A few weeks ago, I warned readers that the Fed only has two options: they either must raise rates into the double digits to tame inflation bringing down the real economy a la Volcker, or stop raising rates to prevent the economy from breaking but inflation continues to surge to the point where the currency could hyperinflate. If the Fed really wants to tame inflation, we should be prepared for some more pain in the stock markets. Taking rates up to 3% will not be enough. The Fed and other central banks are way behind the curve.

What adds drama is the fact the US economy might go into recession. When the economy goes into recession, central banks tend to cut rates in order to spur the economy. But to tame inflation, the Fed may continue to hike rates. Paul Volcker raised interest rates into double digits which caused a recession. This recession helped tame inflation as it did bring down demand. Perhaps the same playbook awaits us. What makes things tricky is the blur between non-monetary and monetary inflation. Monetary inflation is easy. All the brrrrr. Non-monetary inflation takes into account price changes due to supply chains and shortages.

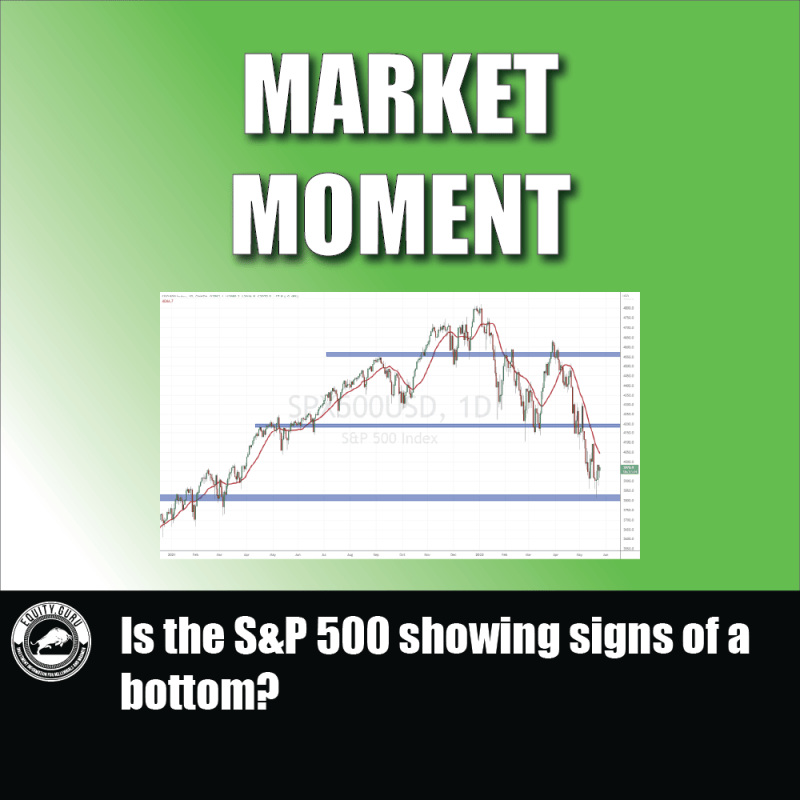

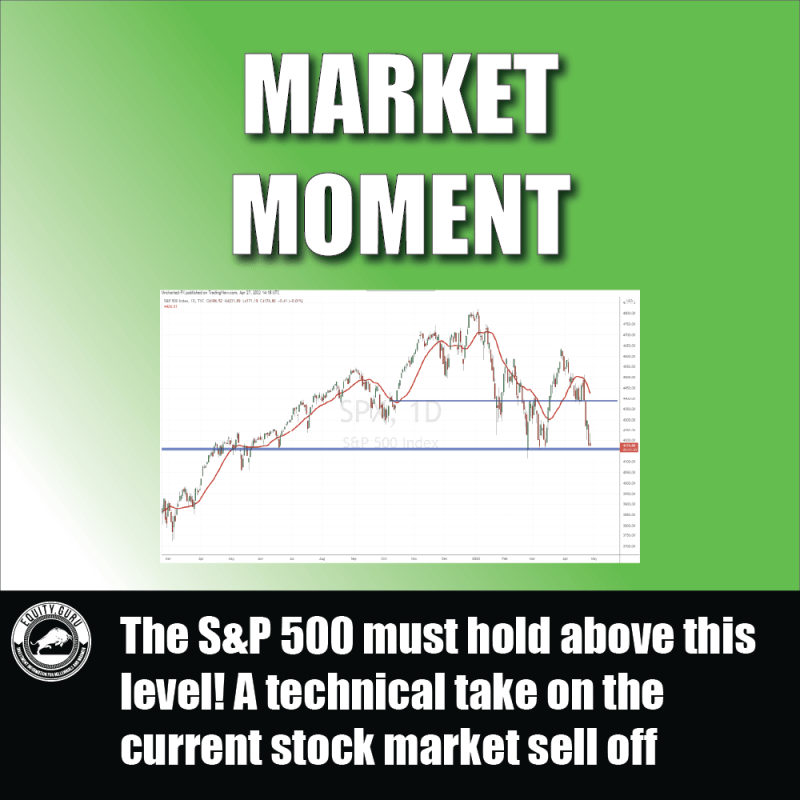

The S&P 500 is what I am following right now. This market enters and exits a bear market as it battles at the 20% from the highs threshold. The Nasdaq is already in a bear market. Rising interest rates won’t help as growth stocks tend to feel the pain.

But traders and investors will notice one thing when looking at the charts of the S&P 500, the Nasdaq and the Dow Jones. Markets have failed to take out the recent lows. The Nasdaq is holding it by a thread but nonetheless, still holding on. The Dow Jones actually had a very nice bounce with the last few days closing green.

Signs of a bottom and bounce are developing. However, I want to mention one key thing. Volume has been low on the day’s the stock market has been bouncing. On one hand, the charts are showing signs of selling exhaustion. On the other, we aren’t seeing evidence of buyers jumping in with strong conviction. Fear and uncertainty on the Fed’s next move still exists. It all goes back to the idea of the Fed not being able to tame inflation as Bill Ackman said.

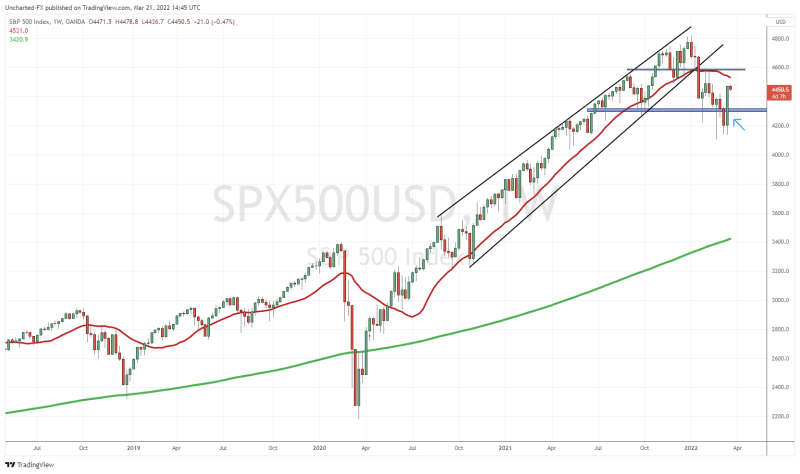

I want to take you all to the weekly chart of the S&P 500. This is the chart I am working with to determine whether the downtrend is over. Currently it is not. What needs to happen is a weekly candle close over 4200. The bottoming and bounce signals we are seeing could be the move that takes us to 4200. This is where the real battle for the future of the stock market will take place.

I know this might dishearten the bulls, but I am expecting a typical breakdown and retest price action. What do I mean by this? Well, whenever a technical breakdown or breakout occurs, price eventually pulls back to retest the breakdown or breakout zone. When we head back to 4200, expect to find a wall of sellers who have been waiting to enter a short based on the technicals. The key is whether the bulls can overpower the bears and reclaim 4200.

So in the next few weeks, it is likely the S&P 500 and other markets see a bounce. Only to take us to retest levels.

Speaking about breakdowns and retests, the US Dollar chart (DXY) current price action hints at a market bounce. We broke below the 102.50 support and have pulled back to retest it. Currently, we are seeing evidence of sellers jumping in on the retest as seen by the wick on today’s daily candle.

The Dollar looks like it is ready for a relief and pullback down to 100. This increases the probabilities for a stock market bounce.