The price of gold has once again rejected my $1920 resistance level, but remains above my target support at $1850. Is there more downside? Perhaps. But the US dollar is showing signs of ranging around 104. Gold and the dollar have a negative correlation. If the dollar does reverse from here, then we can expect gold to head the opposite way. To the upside.

I am not going to say this is the bottom. I am not in the business of picking tops and bottoms. I just ride the trends. If I am to go back fully bullish on gold in the short-medium term, then I would need to see a daily candle close back above $1920. As of now, we do not have that. When it comes to the long term…then yes, I remain bullish on gold (and silver). Inflation right now is still being discussed through the lens of non-monetary inflation. Supply chains, rising oil prices etc. As someone who follows classical economics/Austrian school, I am in gold and silver because of the monetary inflation.

I will discuss how the Fed has kept monetary inflation low in a future article. It deals with topics such as reverse repo and Basel III. Things that I am sure will have people aghast at how crazy the financial alchemy is these days. But long story short, buy gold and silver. There could be some pain with a stronger dollar, but gold will have its day to shine against the USD and CAD.

By the way, go take a look at gold vs other fiat. XAUCHF, XAUEUR, XAUHKD are just some other currencies where gold is knocking on the doors of new record highs. This has already happened with the Bank of Japan. Oh a side note. Read my take on gold vs bitcoin featuring the Japanese yen here. Guess where the Japanese put their money in order to protect their purchasing power with the Yen seeing lows not seen since 2002?

You know what I will be doing if prices drop. I shop as if it’s a sale. Readers know I love my royalty and streamers, but there are a few juniors that I believe warrant your attention based on what I see on their stock charts. Both have small market caps with big upside potential.

Falcon Gold (FG.V)

Market Cap ~$ 10 Million

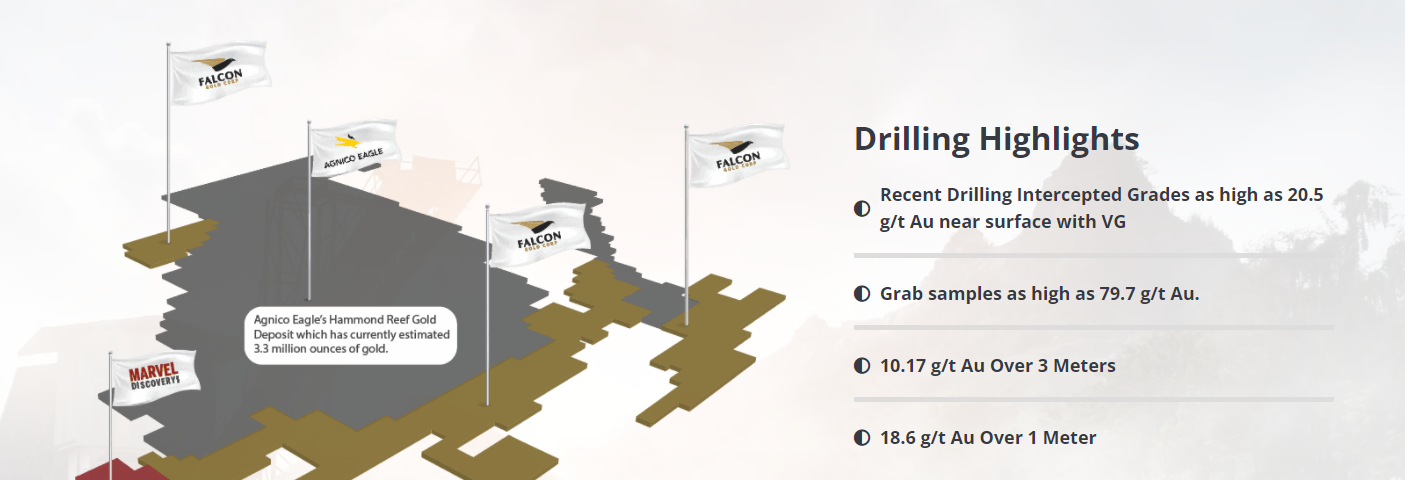

Falcon Gold (FG.V) is a junior explorer that acquires, explores, and advances quality mining projects in the Americas. Their assets are in Canada, Chile and Argentina with their flagship project being Central Canada and bordering Agnico Eagle Mines 4.6 million ounce Hammond Reef deposit.

The majority of their properties are next to large proven deposits. Which means the veins could extend onto their land. This creates an exciting prospect for drill results. Major catalysts for the stock price. The hope is one of these assets hits something big and more drilling begins to unveil a resource. Then, perhaps a larger miner jumps in with a joint venture, or just straight up buys the asset.

Recent news details Falcon gold acquiring a large and prospective land position in the Valentine Lake South area. This new land position consisting of 605 claims (15,300 hectares) is contiguous to Marvel Discovery Corp, Matador Mining, and Tru Precious Metals Corp (TRU). The Property also lies along strike from the Valentine gold deposit which hosts 6.8 million ounces of gold, and is now under development.

Jody Vance recently sat down with Falcon Gold CEO Karim Rayani to discuss the company’s prospective mineral properties, value proposition, and potential for growth.

I also want to remind readers that there is a major catalyst upcoming. Falcon gold is beginning their phase III drill program at the Central Canada property this month. To date Falcon has completed 26 diamond drill holes totaling 4,058m since 2020. Phase III is planned for 3 holes totaling approximately 1,000m. This is very important given what we see on the technical charts.

We were all over this stock when it broke out above $0.075. In technical terms, the uptrend remains as long as we hold above this price level. Recently, Falcon Gold stock attempted to break above the $0.12 resistance. We made it to $0.115 before turning around. With the current broader market sell off, Falcon Gold is retesting our major uptrend line. The stock has bounced from this trendline three times in the past.

I am also watching the support at $0.09 which was the top of the ascending triangle pattern. What the heck am I talking about? Take a look at my last Falcon Gold technical update for details.

Kermode Resources (KLM.V)

Market Cap ~ $ 2 Million

Kermode Resources (KLM.V) is a junior miner that engages in the exploration, acquisition and development of natural resource properties in Canada. It holds 15% interests in Eastgate Gold property located northeast of the Rawhide Mine, and east of Fallon in Churchill, County, Nevada. The company also entered into an option agreement to acquire a 100% interest in the Vidette Lake gold project in British Columbia.

CEO Peter Bell recently spoke with Jody Vance. He discussed his battle to wrestle the company out of the hands of previous management, and the company’s new mandate and future plans.

The stock recently had a major performance day on April 29th 2022. Closed up 14% for the day with 2,908,400 shares traded. Read Kieran Robertson’s piece on Kermode Resources and you will understand the excitement. Kieran details Kermode’s Little Bay acquisition, and the prospects of drilling in this unexplored and under-explored area situated nearby four mines.

“This is an aggressive deal with bullish partners. When I first joined the Board of Directors of Kermode in January 2020, I attempted to do a deal with the prospectors behind this Little Bay Copper deal but it didn’t happen.

I am grateful that I can now do my first deal as CEO of Kermode with this crew. Our plans include an immediate campaign of prospecting with marketing videos showing selective sampling as we hunt for high-grade copper at the known mineral occurrences on the project,” said Peter Bell, CEO of Kermode.

On the stock charts, we nearly got a breakout above resistance at $0.045 on the 29th of April. Unfortunately we sold off. Understandably as some people were sitting on 100% plus gains and wanted to take profits.

We are heading back to the $0.02 support zone once again, and I expect there to be buyers there. In my last technical coverage of Kermode, I mentioned the breakdown below $0.02. It was a bearish signal, but we recovered. Kermode pulled off a false breakdown recovery. That in itself is bullish, and tells us that there are buyers in the $0.02 zone. For more upside, we need the candle close above $0.045 resistance. The stock could easily test levels at $0.075 on the break.

A company with a low market cap that is primed for a large move as new management takes over and gets things done!