Kermode Resources (KLM.V) is a junior miner that engages in the exploration, acquisition and development of natural resource properties in Canada. It holds 15% interests in Eastgate Gold property located northeast of the Rawhide Mine, and east of Fallon in Churchill, County, Nevada. The company also entered into an option agreement to acquire a 100% interest in the Vidette Lake gold project in British Columbia.

The company has a market cap of around $2.183 million. For more info on the company, tune in to The Gauntlet, where Chris Parry questions Kermode CEO Peter Bell and his aspirations of turning things around and creating an active value-generating junior explorer.

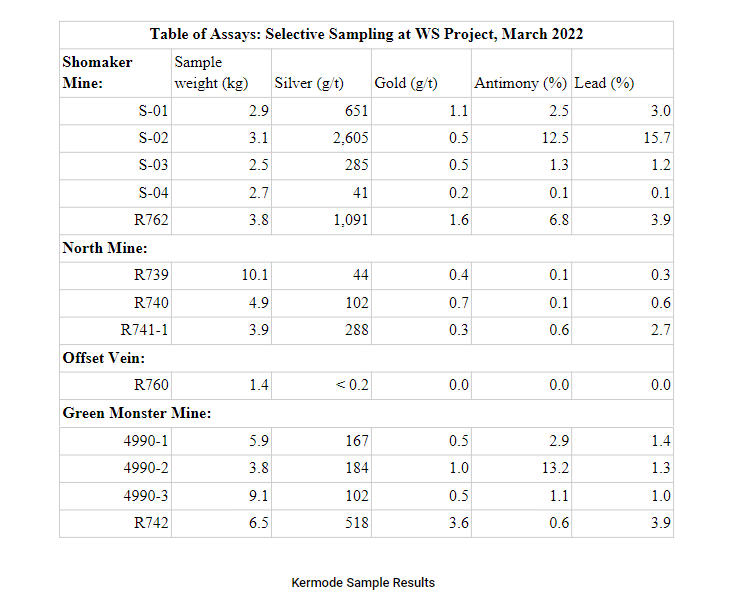

Recent news detailed initial results from geochemical sampling as due diligence under the letter of intent (LOI) for the Eye Patch project which resides in Nevada. For you silver fans (like me) one assay brought up to 2,605 grams per tonne silver g/t.

“In addition to the follow-up sampling at the face of the Shomaker mine and in the road at the Green Monster mine, I would like to undertake initial mineralogical and metallurgical testing of the high-grade material from the old mine to better understand what the old-timers may have been doing to recover the antimony,” commented Peter Bell, President & CEO of Kermode.

Kermode signed an LOI to lease the Rye Patch Mine silver mine from Gold Range company. The project comprises two land positions that are approximately 45 km apart. For more info, I suggest reading Kieran Robertson’s great breakdown of the geochemical sampling news which can be read here. The two land packages are named ALPHA and WS. The latter is ten claims in a package covering the Green Monster silver mine active intermittently from 1936 to 1967.

The thinking is that there is a Gold and Silver resource that previous companies and explorers did not uncover. Kermode resources is hoping to cash in on this negligence.

Look at the S-02 and R762 assay holes. Some nice silver finds there, and hopefully the resources extend.

When it comes to Gold and Silver, readers know I am a big fan. Not only are they the assets for betting against the debt based economic system and the upcoming confidence crisis, it will be the inflation trade to protect one’s purchasing power. Let’s also add in the geopolitical uncertainty to the mix.

The action on the metals recently is surprising some traders and investors. They don’t look like they are pricing in 6 interest rate hikes this year. Not crashing as many expected with the ten year yield rising. If rates were to be raised multiple times, one would expect the US Dollar to break out and both Gold and Silver to break down. They are holding strong, and more importantly, still holding above our major support zone.

Still looking good for anyone bullish the metals and mining stocks.

Before we look at the Kermode Resources chart, I must say that this is a company that is still in the early stages. For investing in the long term, I prefer royalty and streamers and more advanced mining stocks. But if Gold and Silver pop higher, the junior stocks will follow along, meaning big gains can be made. These stocks might be risky, but the return will be great.

When it comes to risk vs reward, I like Kermode Resources with a market cap of just around $2 million, and trading at low levels.

Let’s start off with a broader picture. I really like the structure I am seeing. We all know that markets move in three ways: a downtrend, a range, and an uptrend. We have had our downtrend, we then ranged from from 2015-2021, and then recently broke out. The breaking of the range indicates a new uptrend is beginning, and we should expect multiple higher highs and higher lows. Especially if Gold continues to catch a bid.

However, this new uptrend closed below an important inflection point. We were retesting the $0.02 support zone. What was once resistance is now acting as support.

Zooming a bit closer, and we can see who were the winners at the battle occurring at $0.02. We have bounced here twice in the last few months but could not bounce a third time. We closed below $0.02 breaking below major support and a minor uptrend line I drew.

The stock doesn’t see volume everyday, and a few thousand dollars will get the stock going. To be honest, I wouldn’t be surprised to see management buying more here trying to get the stock back above $0.02. From a risk vs reward stance it still looks very appealing. Can the stock go to 0? Sure, but it can also easily double back to $0.04 and higher. Upside return can be in the hundreds of percent.

The next major support zone comes in at $0.01, and at that price level, you really are betting on management to turn things around with the stock at such a cheap price. I am sure they will be buying more.

Overall the assays look prospective. This is the gamble though with junior miners and explorers. You just don’t know what could be in the ground. If there is something, the stock can go flying. If there isn’t…well the stock can just continue to range. This is why I prefer putting the majority of my investment money into more advanced companies, miners, and royalty and streamers. But these juniors will also rally if gold and silver prices take off.