Smart Watch, Healthy Heart

There was an opportunity for a pun in the headline and I took it. In this week’s sector roundup, we are going to be talking about Fitbit devices. On April 11, 2022, Google announced that it has received clearance from the US Food and Drug Administration (FDA) for its new photoplethysmography (PPG) algorithm to identify atrial fibrillation (AFib). Keep in mind, Fitbit is a Google-owned product.

Moving on, let’s talk about AFib, a type of arrhythmia, or abnormal heartbeat. AFib is an irregular and often very rapid heart rhythm that can lead to blood clots in the heart, increasing the risk of stroke, heart failure, and other heart-related complications. With this in mind, Google’s latest algorithm will power the company’s new Irregular Heart Rhythm Notifications (IHRN) feature on Fitbit.

How does it work? Google’s new PPG AFib algorithm passively assesses a user’s heart rhythm in the background while they are idle or asleep. If there is anything suggestive of AFib, users will be notified through Fitbit’s IHRN feature, allowing for prompt medical assistance and assessments. Google’s algorithm was first validated in the fully virtual Fitbit Heart Study in 2020.

This study recruited more than 455,000 participants who had never been diagnosed with AFib. Data was presented at the Americal Heart Association’s annual scientific sessions last November, demonstrating that the algorithm was able to accurately identify irregular heart rhythms and help diagnose previously undetected cases of AFib. Of those who received a notification from their Fitbit, 98% were diagnosed with AFib.

With this in mind, medical advancements are being made everywhere. Even smartwatches, which are used by thousands on a day-to-day basis, are making advances closer to home. Traditionally, AFib is difficult to detect, affecting approximately 35.5 million people around the world. That being said, Fitbit’s new IHRN feature could potentially save thousands of lives by detecting AFib. Now, let’s talk about some other medical news.

Akebia Therapeutics Inc.

- $95.071M Market Capitalization

Akebia Therapeutics Inc. (AKBA.Q) is a fully integrated biopharmaceutical company focused on achieving better outcomes for people with kidney disease. Vadadustat is the Company’s oral hypoxia-inducible factor prolyl hydroxylase (HIF-PH) inhibitor for the treatment of anemia due to chronic kidney disease (CKD). Vadadustat’s indication is also being expanded to include acute respiratory distress syndrome.

The Company is well-positioned to disrupt the $2 billion dialysis-dependent injectable erythropoiesis-stimulating agents (ESAs) market. ESAs are a group of medicines that help take the place of a hormone called erythropoietin (EPO), a hormone released by the kidneys to stimulate the production of red blood cells. However, people with CKD may not have enough EPO coming from their kidneys to generate more red blood cells, resulting in anemia.

Latest News

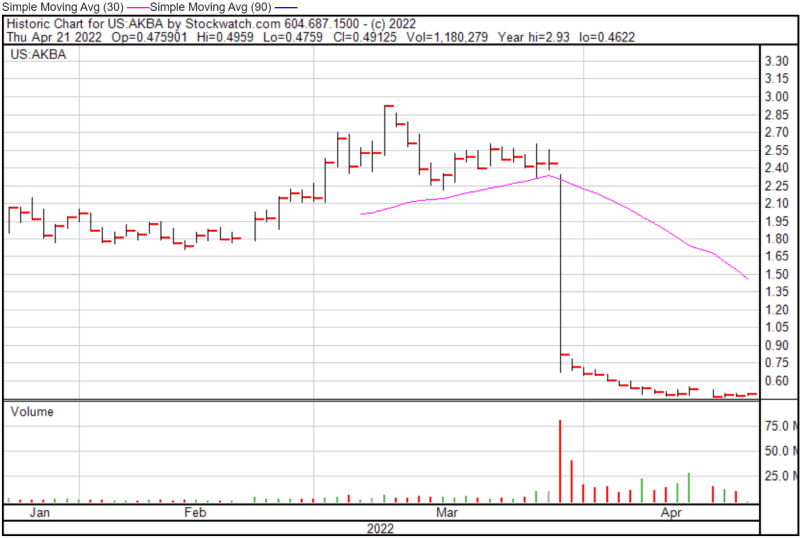

On April 1, 2022, a securities filing revealed that Akebia will be laying off 42% of its employees in Q2 2022. That’s quite the development, so let’s talk about what happened. On March 30, 2022, Akebia received a complete response letter (CRL) from the FDA regarding the Company’s new drug application (NDA) for vadadustat. To be blunt, Akebia’s NDA was rejected for a few reasons.

“We are extremely disappointed to receive a CRL for vadadustat, a therapy that has the potential to help patients with anemia due to CKD. We continue to believe the data are supportive of a positive benefit-risk assessment of vadadustat for patients with anemia due to CKD, particularly in dialysis patients,” said John P. Butler, Chief Executive Officer of Akebia.

The FDA concluded that the data in Akebia’s marketing application does not support a favorable benefit-risk assessment of vadadustat for dialysis and non-dialysis patients. Additionally, the FDA expressed safety concerns noting failure to meet non-inferiority in major adverse cardiovascular events (MACE) in the non-dialysis patient population, the increased risk of thromboembolic events driven by vascular access thrombosis in dialysis patients, and the risk of drug-induced liver injury.

As you would expect, the FDA suggested that Akebia could potentially explore new ways to demonstrate favorable benefit-risk assessment through new clinical trials. I guess it’s back to the drawing board for Akebia. However, it looks like the Company’s first order of business is to lay off almost 180 employees. Ouch. Moving forward, Akebia intends to discuss the details of the CRL with its partners and request a meeting with the FDA. Following the news, Akebia’s shares plummeted 67.60% to $0.79.

Akebia’s share price opened at $0.4825 on April 21, 2022, up from a previous close of $0.4799. The Company’s shares were up 3.35% and were trading at $0.4951 as of 10:51 AM EST.

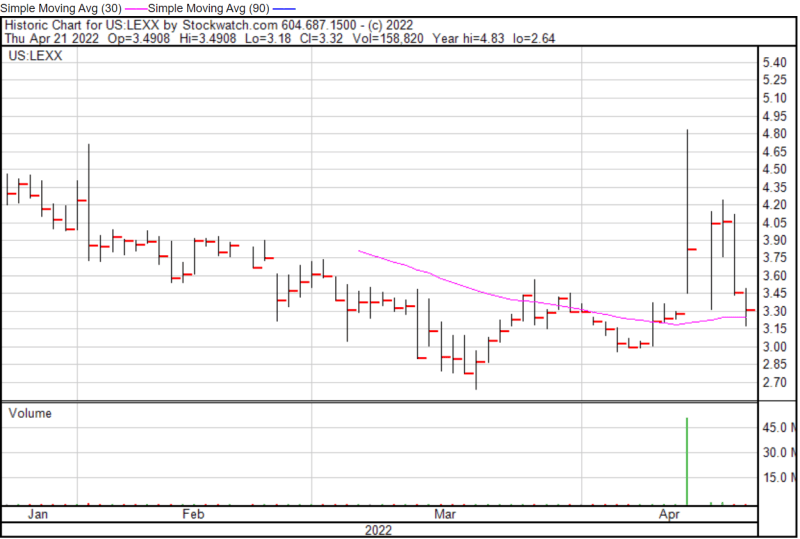

Lexaria Bioscience Corp.

- $19.817M Market Capitalization

Lexaria Bioscience Corp. (LEXX.Q) is a biotechnology company recognized for the development of DehydraTECH™, the Company’s proprietary drug delivery technology. In addition to enhancing the speed and efficiency of orally-delivered fat-soluble active molecules and drugs, the Company has also demonstrated early-stage effectiveness in improving delivery through human skin for the potential development of topically-administered products such as patches, creams, and lotions.

Development for DehydraTECH began in 2014 and has since blossomed into something quite impressive. Through various animal studies evaluating the quantity of drug delivery across the blood-brain-barrier (BBB) utilizing DehydraTECH technology, data suggests a gain of as much as 1,900%. With this in mind, Lexaria’s DehydraTECH has the potential to improve the delivery of certain central nervous system (CNS) targeted drugs against Alzheimer’s Disease, Parkinson’s Disease, and other CNS diseases.

Latest News

Lexaria is a fan favorite, and I am the fan. Lexaria’s advancements in this month alone are a testament to the Company’s commitment to developing effective drug delivery technologies. Starting on April 11, 2022, Lexaria announced that it has entered into new agreements with Altria Client Services LLC to evaluate the Company’s DehydraTECH powder-based nicotine formulations.

Shortly after, on April 12, 2022, Lexaria announced details of its upcoming human nicotine study, NIC-H22-1, which is expected to begin dosing this summer. The study will enroll a minimum of 36 participants and will evaluate the Company’s DehydraTECH nicotine pouch performance to that of existing leading brands currently sold in the US, including ON! and Zyn.

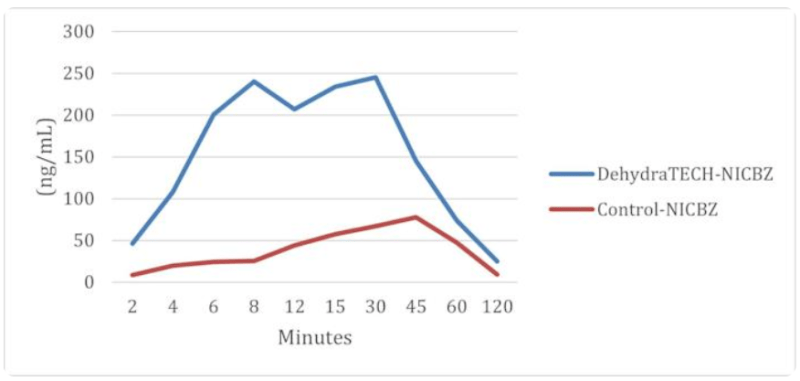

It is worth noting that on October 5, 2021, Lexaria demonstrated in NIC-A21-1, an animal study evaluating the Company’s DehydraTECH nicotine oral pouches, its DehydraTECH technology was 10-20 times faster in reaching peak delivery of nicotine to the bloodstream than controls. If that wasn’t enough, Lexaria also announced on March 8, 2022, that it has been granted a new patent entitled “Compositions Infused with Nicotine Compounds and Methods of Use Thereof.”

The new Australian patent expands upon the Company’s international intellectual property (IP) rights to apply DehydraTECH enhancements technology to most oral forms of nicotine, including pills, tablets, lozenges, capsules, pouches, gums, and sprays. Furthermore, the patent covers a variety of nicotine forms, such as freebase nicotine, nicotine salts, polymer resins of nicotine, and other forms of nicotine complexes.

Unfortunately, I can’t talk about everything Lexaria has done this month alone. Instead, let’s jump to the Company’s latest news. On April 21, 2022, Lexaria announced that it will receive its first-ever patent for the use of DehydraTECH technology in the enhanced delivery of antiviral drugs on April 26, 2022.

“This will be our 25th patent granted worldwide and another validation of the versatility of our DehydraTECH drug delivery technology…This new patent adds to our existing suite of granted patents in the EU, the U.S., India, Japan, and Australia, and continues to build value for Lexaria shareholders and clients,” said Chris Bunka, CEO of Lexaria.

On June 3, 2021, Lexaria announced that remdesivir and ebastine processed with DehydraTECH were effective at inhibiting the SARS-CoV-2 virus in the VIRAL-C21-3 study. Moreover, on June 15, 2021, the Company announced that antiviral drugs processed with DehydraTECH were able to reach peak blood concentration levels that were double those of non-DehydraTECH processed drugs and the overall amount delivered into the bloodstream was up to triple the amount of non-DehydraTECH processed drugs.

With this in mind, it’s no wonder Lexaria will be granted a patent for the enhanced delivery of antiviral drugs using DehydraTECH. Ultimately, this represents a significant milestone towards monetizing Lexaria’s DehydraTECH technology, something I have been hoping for since I first started covering the Company.

Lexaria’s share price opened at $3.37 on April 21, 2022, down from a previous close of $3.46. The Company’s shares were down -4.04% and were trading at $3.32 as of 11:25 AM EST.

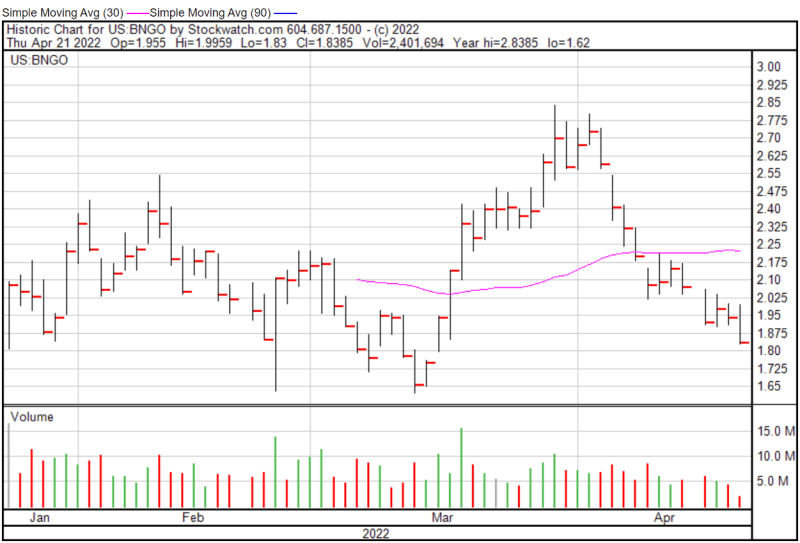

Bionano Genomics Inc.

- $531.44M Market Capitalization

Bionano Genomics Inc. (BNGO.Q) is a genomics company, credited for its Saphyr System. For context, genomics refers to an interdisciplinary field of biology focusing on the structure, function, evolution, mapping, and editing of genomes. The Company went public on August 21, 2018, with an Initial Public Offering (IPO) of 3.36 million units at $6.125 each. Following its IPO, Bionano was able to generate total gross proceeds of $20.58 million.

Bionano’s Saphyr System is an Optical Genome Mapping (OGM) platform intended to identify structural variations (SV). This enables scientists to isolate DNA and identify different codes as well as SVs. Keep in mind, some SVs are responsible for genetic diseases such as autism. Bionano’s Saphyr System is intended to identify these SVs in one streamlined workflow, compared to the overcomplicated process of traditional genome analysis methods.

Latest News

On April 14, 2022, Bionano announced that the United States Patent and Trademark Office (USPTO) has issued two new US patents to the Company as of April 5, 2022. Bionano’s first patent, titled “Photocleavage Method and Apparatus to Clean Fluidic Devices,” claims a novel apparatus and method for using a light source to minimize aggregation of biopolymers in or around a nanochannel.

“The patents issued last week provide further protection of our intellectual property and are expected to strengthen our global patent portfolio. We continue to strive to create powerful, scalable tools that can provide new insight into structural variants in key areas of clinical research, including cancer and constitutional genetic disease,” said Erik Holmlin, Ph.D., President, and Chief Executive Officer of Bionano Genomics.

Put simply, this is intended to enable multiple cycles of DNA loading, imaging, clearing, and reloading, making it a pivotal part of Bionano’s nanochannel arrays. On the other hand, Bionano’s second patent, titled “Integrated Analysis Devices Analysis Techniques,” builds upon the Company’s existing patent protection for its OGM technology.

The patent claims methods of identifying genomic sequences or SVs by linearizing target DNA molecules through a series of nanochannels within a nanochannel array and detecting specific signals that correlate with a property of the target DNAs. While this may not make sense, just know that Bionano now holds multiple patents covering its core technology in both the US and internationally.

Bionano’s share price opened at $1.955 on April 21, 2022, up from a previous close of $1.94. The Company’s shares were down -5.4% and were trading at $1.835 as of 11:53 AM EST.

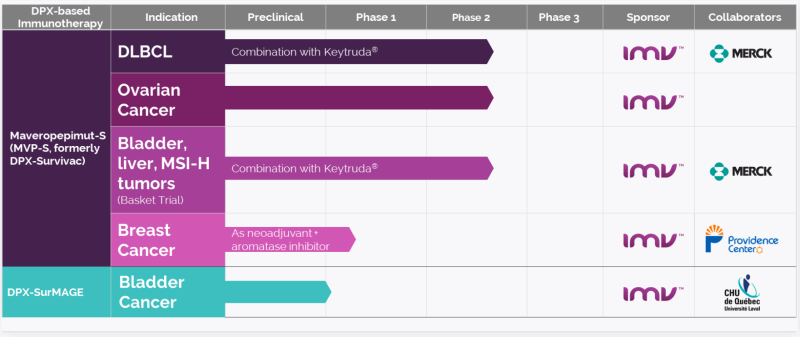

IMV Inc.

- $124.154M Market Capitalization

IMV Inc. (IMV.T) is a clinical-stage company focused on the development of immune-educating therapies based on the Company’s novel DPX platform for the treatment of solid and hematological cancers. Put simply, IMV’s DPX platform delivers instructions to the immune system to generate a specific, robust, and persistent immune response. In addition to the Company’s DPX platform, IMV has developed maveropepimut-S (MVP-S), its lead candidate.

IMV’s MVP-S delivers antigenic peptides from survivin, a recognized cancer antigen commonly overexpressed in advanced cancers. In terms of efficacy, MVP-S treatment has been well-tolerated and has demonstrated defined clinical benefit in multiple cancer indications as well as the activation of a targeted and sustained survivin-specific anti-tumor immune response. MVP-S is currently being evaluated in clinical trials for hematological and solid cancers.

Latest News

On April 8, 2022, IMV announced safety and efficacy data of the combinations of MVP-S, with pembrolizumab from a Phase 2 basket study of patients with advanced, metastatic bladder cancer. 17 subjects with advanced metastatic bladder cancer who, on average had received two prior lines of therapy, were enrolled in this study and were treated with this combination.

“We are very encouraged to see such positive clinical results, particularly in advanced, metastatic bladder cancer patients that had already been treated with immune checkpoint inhibitors. We are now meeting with top key opinion leaders in the field to design follow-on trials to deepen our understanding of this clinical benefit,” said Jeremy Graff, Ph.D., Chief Scientific Officer at IMV Inc.

With regards to IMV’s data, five out of 17 subjects showed responses, comprised of two confirmed complete responses and three additional partial responses. Furthermore, long-term clinical benefit was observed in several subjects as was an increase in detectable survivin-specific T-cells. Overall, treatment was well tolerated with the majority of adverse events reported being Grade 1 or Grade 2. In other words, the adverse events reported were mild and somewhat bothersome, but not dangerous.

IMV’s share price opened at $1.65 on April 21, 2022, up from a previous close of $1.63. The Company’s shares were down -7.36% and were trading at $1.51 at closing.