Wellfield Technologies (WFLD.V) is a company focused on decentralized finance (DeFi) by building open and accessible decentralized protocols and also blockchain based consumer products.

Back on February 23rd 2022, I covered the technicals and recent news on Wellfield. On the charts, the stock was heading back towards a major support zone… a level we will talk about in this article too. In terms of headlines, I covered news such as another appointment (Marshall M.Ball), expansion its engineering development capacity for the Seamless Brand (more info on Seamless below) with a new hub in Portugal, and subsidiary MoneyClip joining the Paytechs of Canada, an association comprised of leaders in Canadian Fintech.

The most recent news has to do with Wellfield signing a definitive agreement to acquire New Bit Ventures Coinmama. Coinmama was founded in 2013 and has achieved outstanding growth. Coinmama generated approximately US $130 million in annual sales for fiscal 2021, with more than 3.5 million registered users.

“We have followed Coinmama’s pioneering journey as an early blockchain business for some time and are confident that their nearly decade of success in the sector and proven regulatory and operations expertise will bring significant value to Wellfield. We expect this transaction to generate substantial synergies for the Company. Following the transaction, Wellfield will be positioned with all of the attributes required to achieve its mission to scale next generation financial applications powered by blockchain technology: robust decentralized protocols, verifiable and secure credentialing, established regulatory and banking infrastructure, and a scalable consumer facing DeFi application.” said Levy Cohen, CEO of Wellfield.

Coinmama will integrate Wellfield’s Seamless branded DeFi protocols into its current platform. This will enhance monetization of Coinmama’s more than 3.5 million registered users by expanding from a single offering, transaction-oriented model to a multi-product, recurring revenue business that leverages DeFi protocols and self-custody.

Wellfield’s MoneyClip branded DeFi app will integrate Coinmama’s regulatory, banking and operational infrastructure to expedite its expansion with significantly less capital investment.

Wellfield will acquire all of the issued and outstanding securities of Coinmama in exchange for total aggregate consideration of US$3,000,000 payable in cash and the issuance of 22,988,467 common shares in the capital of Wellfield.

The benefits for this transaction are:

- Enables rapid launch of DeFi products and services, at scale

- Opportunity to significantly enhance monetization of Coinmama’s user base

- Coinmama’s website generates millions of unique visitors per year, which presents a significant user conversion and expansion opportunity

- Established infrastructure to facilitate growth within Canada and efficient future expansion

- Adds experienced team to manage growth

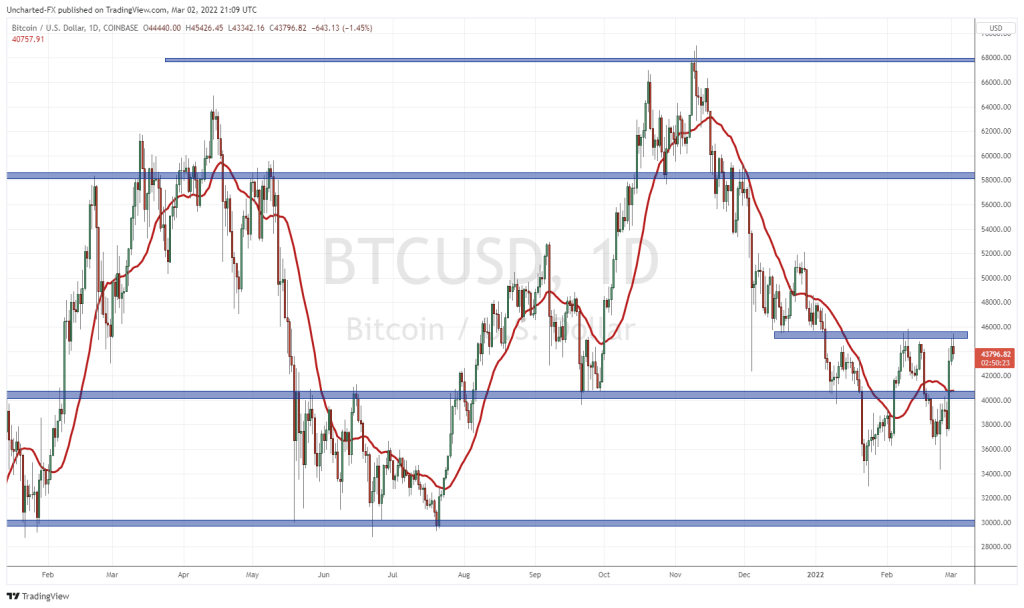

When it comes to the stock, I must say that it is volatile at times. Since December 2021, the stock has hit highs of $2.19 and lows of $1.10. There have been plenty of days where the stock has moved more than 5%. Just keep an eye on the volume. I would say it is pretty consistent, but there have been days recently with less than average daily volume.

Besides record highs and lows as support and resistance, I have drawn in two zones at $1.40 and at $1.70. We have seen the stock react at these levels a few times evident by candle wicks and bodies.

Price broke below 1.70 and has begun to range around $1.40. Note the small range between $1.40-$1.45 that the stock has been contained within for the past few days. I see this as $1.40 acting as a pretty strong support zone, and the chance for a reversal. The trigger would be the break above $1.45. If we fail, and close below $1.40, then we are looking for a move back to the major support zone down at $1.15, where the stock has bounced three times in its history.

The transaction for Coinmama is a pretty big deal bringing in a business with revenues of $130 million USD and also allows for the rapid launch of Wellfield’s Seamless for 2022. This year will be big for the company, and shareholders are expecting big things.

On a final note, decentralized finance is still in its early stages. I myself, am watching Jack Dorsey and Square (now renamed Block) for the big catalyst on defi, or citizen banking.