The Cannabis space has been garnering a lot of attention. Maybe not from the mainstream financial media, but definitely from the retail crowd. I cannot even begin to tell you all how many people have contacted me the last few weeks regarding cannabis stocks. What piqued my interest was the fact these people were trading tech stocks such as Tesla, Palantir etc just a few months ago.

I approach things from a technical and cyclicality view. In my opinion, cannabis and other sectors look very cheap compared to everything else. You will see what gets me groovy when we take a look at the charts. Spoiler: meeting a lot of my reversal criteria.

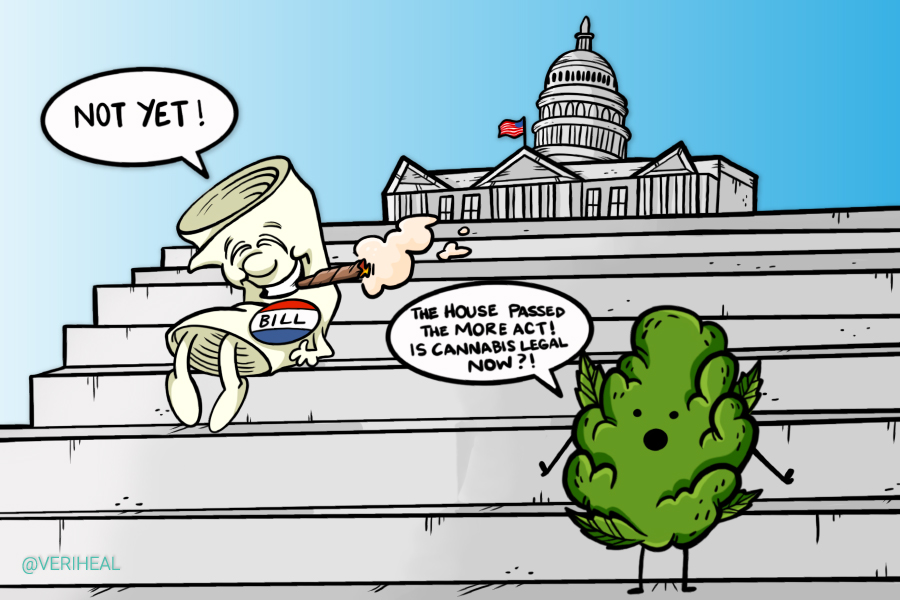

Others are saying that US deregulation is definitely coming so cannabis stocks are great pick ups for long term investments. Sure. The problem is that we have heard this government bill story a few times in the past. Nothing happened, but there is hope that this time things will go through.

The US House passed legalization on April 1st 2022 that would legalize marijuana nationwide, eliminating criminal penalties for anyone who manufactures, distributes or possesses the substance. Lawmakers approved the bill in a 220-204 vote. I am of course talking about the Marijuana Opportunity Reinvestment and Expungement Act. A mouthful so we will just call it the MORE Act.

All eyes now on the Senate. The MORE Act did pass the house last year, but did not move forward in the Senate. For cannabis bulls, let’s hope this revised bill will appease. However let’s be real. The prospects for passing the bill in the Senate appears to be low. The Democrats would need all of their members and 10 Republicans to overcome a 60 vote hurdle needed to advance the MORE Act to a final vote.

“This landmark legislation is one of the most important criminal justice reform bills in recent history,” House Speaker Nancy Pelosi, D-Calif., said in remarks on the floor Thursday about the measure.

Thirty-seven states and Washington, D.C. have enacted laws legalizing medical marijuana, with 18 states and D.C. legalizing marijuana for recreational purposes, according to the National Conference of State Legislatures. California became the first state to legalize medical marijuana in 1996. Is it time for the Federal government to follow suit?

Keeping this in mind, let’s take a look at the technicals of ETFs and 4 cannabis plays.

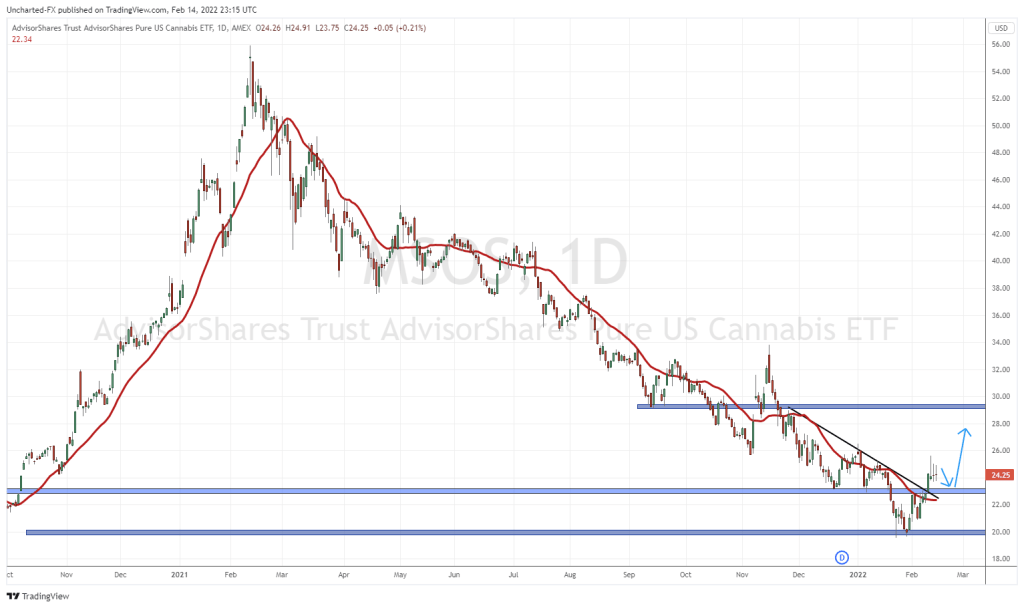

The US Cannabis ETF is showing some potential. But as always, we must wait for the breakout confirmations. MSOS shows a good reason why.

First, let’s go back to early March 2022. MSOS broke below major support at $20. It didn’t look too good for the cannabis bulls. But then, MORE Act headlines started coming out. We managed to close back above $20 after rejecting it earlier on the retest. Regaining this level was very significant. This zone has been acting as resistance and now as support. A major flip zone. We have been bouncing at this support, but with recent stock market weakness, MSOS has broken below this $20 support.

So what would get me bullish? A break above $21 AND a close above the long downtrend line I have drawn out. Both of these points converge together at just above $21. If we get a daily candle close above, then we can safely say the downtrend has been broken, and we look forward to a new uptrend. But we NEED that close. As of now, price has broken down below support, and could potentially continue the downtrend unless we can reclaim the $20 zone.

Perhaps the biggest surprise to some is that the Canadian cannabis space looks even better. Above is the ETF HMMJ. It is meeting my bottoming criteria. We have had a long downtrend, we are in a range, and a new uptrend might be around the corner. We could also be forming a reversal pattern known as the inverse head and shoulders pattern. Things look promising.

But we do not have a trigger just yet. To turn bullish, we need a daily candle close above $6.00. This would confirm a breakout and the right shoulder in the aforementioned inverse head and shoulders pattern. From a market structure perspective, I prefer the Canadian ETF more than the US ETF even though the fundamental catalyst comes from the American side of things.

Let’s take a look at individual Canadian companies. We will look at 2 Cannabis product retailers, a private equity firm investing in US Legal Cannabis, and finally a producer. Something for everyone.

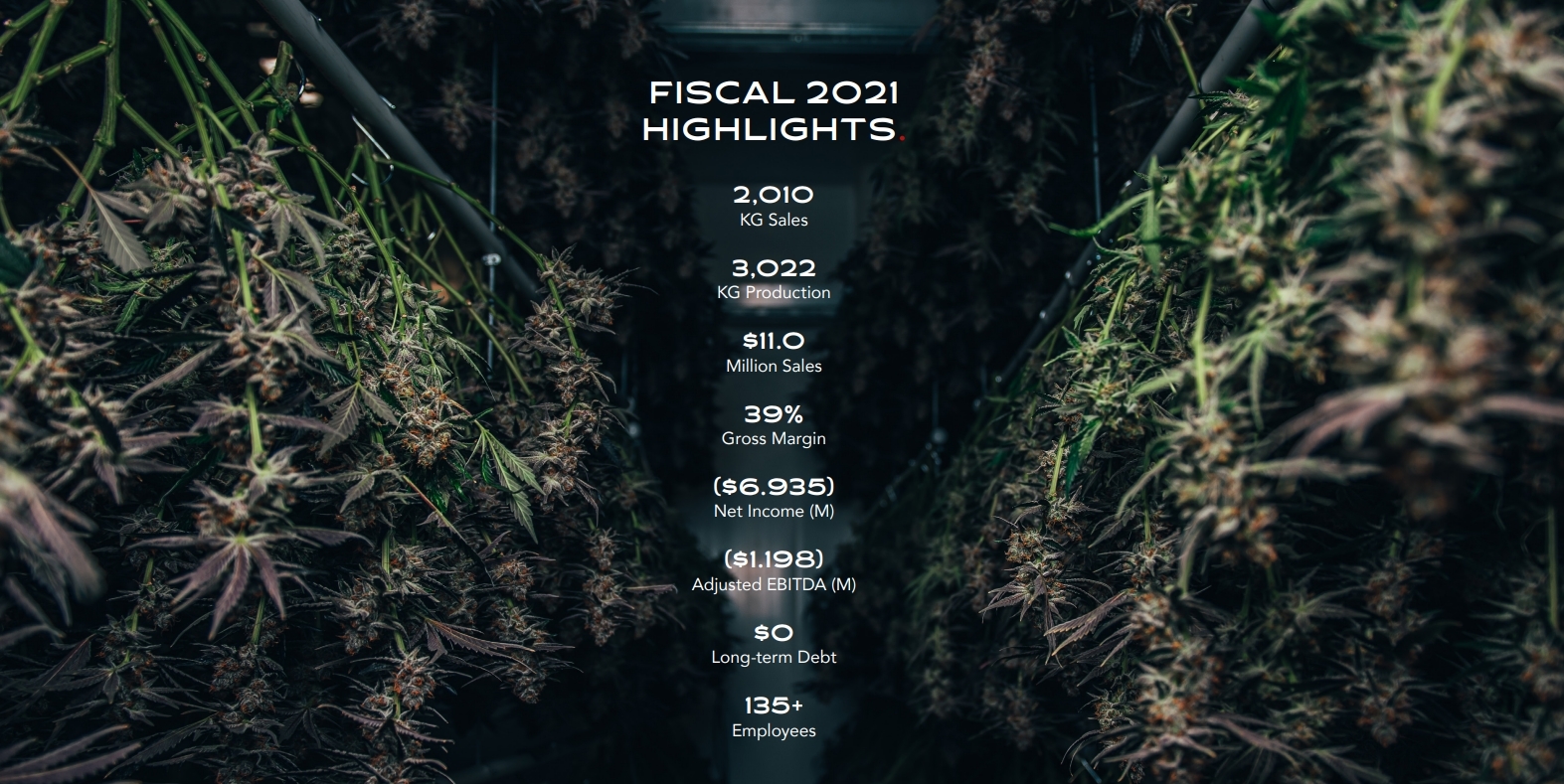

Avant Brands (AVNT.TO)

Market Cap ~ $57 million

Avant Brands Inc. cultivates, produces, and markets premium cannabis products in Canada. The company offers medical and recreational cannabis products under the BLK MKT, Tenzo, GreenTec, cognoscente, Treehugger, and Pristine brands. It distributes cannabis through medical and recreational sales channels, as well as an e-commerce website.

Q1 2022 earnings are set to be released on Wednesday April 13th 2022. A catalyst for the stock price is just a week away.

Okay, we do have something to work with here. You will be seeing a lot of structure similarities on the cannabis charts.

A long downtrend and then basing at $0.225. It is now about breaking above the range at $0.32. The probabilities for this have increased given the triangle breakout that I have drawn out. I want to see a higher low, or simply put, a pullback in price before buyers step in and take us above $0.32. I would be patient and wait for the earnings that are going to be released next week.

Harborside (HBOR.CN)

Market Cap ~ $ 27 million

Harborside Inc. engages in the cultivation, manufacture, distribution, wholesale, and retail of cannabis and cannabis products for the adult-use and medical markets in California. It owns and operates three retail dispensaries under the Harborside brand located in Oakland, San Jose, and San Leandro, California; and a dispensary under the Terpene Station brand name located in Eugene, Oregon, as well as manages and operates a dispensary under the Harborside brand under a management services agreement located in Desert Hot Springs, California. The company also operates approximately 47 acres of cultivation/production facility located in Salinas, California.

“This is an important milestone,” said Ed Schmults, Chief Executive Officer of Harborside. “By combining the businesses of Harborside, Sublime, Urbn Leaf and Loudpack, we established a true leader in California’s cannabis industry with a strong platform for growth. The Loudpack team, led by CEO Marc Ravner, has built a tremendous business that is highly complementary to the rest of our operations. We welcome them aboard and look forward to building a stronger company together as StateHouse.”

Okay. We have something to work with here. This is one chart that is more advanced in its reversal stage but is finding trouble for advancement. Harborside printed a double bottom reversal pattern in early 2022. And this double bottom was triggered! What this means is technically, we are in a new uptrend. We just await the first higher low swing which is finding some trouble to print. We need a close above $0.815 to trigger the continuation, with the uptrend remaining intact as long as price remains above $0.60.

So far buyers are defending $0.60. Look at that hammer candle with a large wick printed on April 7th 2022. Harborside continues to range and we just await the break out in either direction. Obviously the upside is most preferred. Traders could enter with a tight stop loss just below $0.06.

SOL Global Investments (SOL.CN)

Market Cap ~ $82 million

SOL Global Investments is a diversified private equity firm targeting best-in-class companies that operate in ultra-high growth industries. Their current portfolio is built on thematic trends that ensure they are always at the front of the grid. Major holdings include investments in the Legal U.S. Cannabis Industry, e-Sports, Electric Mobility, Health and Wellness, and many more.

Investments in Cannabis include Verano and Pure Kana.

SOL recently released audited financials for the year ended November 2021 on March 31st 2022. Highlights include:

- For the year-ended November 30, 2021, the Company recorded a positive net income of $159 million vs. year-ended November 30, 2020, income of $98 million. This represents a favourable change of $61 million.

- Total gain from investments totaled $307 million for the year-ended November 30, 2021, compared to a gain of $139.0 million for the year-ended November 30, 2020. This represents a favourable change of $168 million between periods.

- The Net Asset Value (“NAV“) per share is equal to $6.29 at November 30, 2021 vs. $3.51 at November 30, 2020. SOL Global achieved realized liquidity events for several of its largest investments, primarily in the cannabis sector, resulting in the Company’s best performance to date. The market confirmed the value of the Company’s holdings and further demonstrated the strength of its private markets investment strategy.

- Throughout the year, the Company divested a large percentage of cannabis assets while valuations were favourable and re-diversified from cannabis by investing in new thematic trends in line with its diversified growth strategy.

SOL broke below major support at $3.12 and it has been downhill ever since. We saw some signs of selling exhaustion. A range did develop, but unfortunately, we have broken down below support.

Last month, we broke below $1.50 which was the failure of upholding the range. We briefly reclaimed $1.50 but then have given it all back. We actually broke below recent lows at $1.37. What’s the next support? $1.00 is the next big psychological support zone.

TerrAscend (TER.CN)

Market Cap ~ $ 2 billion

A big boy. TerrAscend Corp. cultivates, processes, and sells medical and adult use cannabis in Canada and the United States. It produces and distributes hemp-derived wellness products to retail locations; and manufactures cannabis infused artisan edibles. The company also operates three retail dispensaries under the Apothecarium brand name in California and Pennsylvania. In addition, it owns various synergistic under Gage Cannabis, Ilera Healthcare, Kind Tree, Prism, State Flower, Valhalla Confections, and Arise Bioscience Inc. brands.

These are the plays I prefer. I would invest in the producers of cannabis. It also plays in with the agriculture space as indoor farming could be adopted to grow vegetables.

The TerrAscend chart looks similar to that of Avant Brands structurally. Major support at $6.00 has held after a downtrend indicating the selling pressure has exhausted. We just need a strong breakout. Almost happened on April 4th 2022 but we closed below the $7.50 resistance zone. The triangle has broken which gives more confluence for the bulls. But the major trigger will be the green daily close above $7.50.

On the fundamental front, we have the MORE Act news, but the Senate situation is very likely to halt progress. From a technical and cyclical perspective, cannabis stocks look cheap compared to everything else. Nothing moves in a downtrend forever, but in order to confirm an uptrend, we need to see our triggers being met. For now, they have not, but cannabis stocks show great potential.