One of the biggest promises that technology offers is that it’s going to provide solutions to existing problems. It does this regularly. It also introduces new problems that need innovative solutions to get past, and sometimes that requires new tech to provide a new solution to the new problem.

Here is a list of companies getting in on the ground floor of producing new and innovative solutions to old, or maybe emerging problems.

Netcoins adds another five coins to their holdings

Crypto’s got problems. You don’t have to look at the Bitcoin chart to see it. One of those largest and most pressing problems is the huge potential for regulation to disrupt the ecosystem. What Netcoins, and specifically, their parent company, Bigg Digital Assets (BIGG.C) does is it gets out in front of those regulations, so when they roll over and through the cryptocurrency and blockchain sector, anyone dealing with their exchange or their products won’t be too badly effected.

You can see in their latest developments that they’re playing by the rules and getting rewarded.

Earlier this week Netcoins launched five new coins on their platform—including SHIB, DOGE, MATIC, FTM and MANA. These coins are decent in-demand coins, and round up their holdings to seventeen coins. That’s a decent and respectful number of coin options for an exchange of this size.

The company also received approval for an update to their restricted dealer license, which they requested late last year, so they could expand on their offerings. These coins represent the response and are the first rollout, with more to come.

“We are thrilled to bring new coins to the Netcoins customer base to trade, HODL and sell. The addition of more coins will make our platform a better one-stop shop and drive assets under custody and increase trading revenues. On just the second day since launch, SHIB, DOGE, MATIC, FTM and MANA already accounted for 12 per cent of daily revenue. These coins are the first of a series to be launched on the platform, which will then make Netcoins more robust and competitive to enter the U.S. market. We look forward to providing more coin addition updates in the very near future,” said Mark Binns, Netcoins CEO.

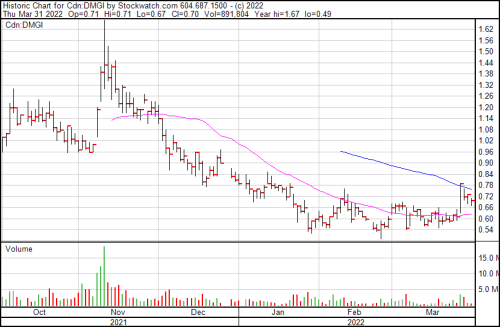

DMG Blockchain records best year yet and the markets are distracted

It seems that nowadays in order to get any traction in the cryptocurrency space you’ve either got to be into NFTs or the Metaverse, or both. That’s how a company like DMG Blockchain Solutions (DMGI.V) can have their best year yet and still have people bailing on the stock.

DMG is predominantly a Bitcoin miner. Most of their revenue sources come from mining Bitcoin in an environmentally safe and equitable way. They have a cozy little side-gig selling blockchain adjacent products giving companies and governments and anyone who can afford it certain tools to see and use the blockchain in curious ways, but they can’t beat the mining gig for solid revenues.

Speaking of which, the company pulled in $14.2 million in revenue in Q1, which is up 639% from Q1 of the previous quarter ending December 31, 2020. They got this because their miners finally arrived, which bumped up their hashrate and let them pull more Bitcoin down from the air. Gross margin and net income were $11.5 million and $5.9 million respectively, up 2,000% and 826% respectively compared with the year before.

Yep. No NFTs. No Metaverse. Just straight mining an already tested product, and nobody cares. Let’s not also forget that they’re the new solution for the old problem of Bitcoin mining’s impending environmental catastrophe in the making. They’re a signatory in the crypto climate accord and have devoted themselves 100% to mining with renewable energy.

Granted, it could be that nobody cares because nobody knows. One of the consequences of undervaluing marketing is that nobody knows you’re out there, so even if your numbers are jacked like DMG’s are, nobody’s going to see them because nobody’s writing about them.

Except maybe me. Except maybe here.

What can you do?

“A tremendous amount of work has gone in by the entire team to reach these results. For the first time the company is posting strong financial gains and we believe this will continue through many more quarters due to our large investment in new mining equipment. The whole team is focused on operational excellence for this new fleet of servers as well as working hard to launch several new software solutions throughout the year,” said Sheldon Bennett, chief executive officer.

Identillect and Abyde provide solutions for greater security

Here’s a terrifying stat to get us started. According to HIPAA Journal, 51 million healthcare records were exposed or compromised in 2021. The problem is one the heatlh care industry faces regularly, and the government has responded with increased penalties for non-compliance, which suggests the need for solutions for independent providers.

Old problem. New solution.

What Identillect Technologies (ID.V) does is provide e-mail encryption services to companies seeking to protect themselves and their clients from cyber attacks. They’ve teamed up with HIPAA compliance software provider Abyde to close the gap between security and compliance for both of their customers.

For those of us who aren’t in the medical field or don’t regularly watch medical shows, HIPAA refers to the Health Insurance Portability and Accountability Act of 1996 that deals with patient information and how it’s used. This tech ensures it can’t be stolen.

“Abyde is exactly the type of partner Identillect was designed for,” said Todd Sexton, Identillect chief executive officer. “Our Delivery Trust e-mail system confirms compliance with all HIPAA records management regulations while simultaneously being the simplest to adopt, with no disruptions for the office staff of irritation learning curves. Identillect continues to make strategic moves to advance our impact by increasing the level of security in the medical industry.”

Lexagene’s improvements to their system is an improvement in our quality of life

LexaGene (LXG.V) is a molecular diagnostics company involved in pathogen detection and genetic testing in veterinary diagnostics, food safety and open-access markets like clinical research, agricultural testing and biodefense. They help keep pets healthy, your food safe, your trials more effective, and our weapons stronger. All that’s required is a sample, which is loaded onto an instrument with a sample cartridge, a sample ID and then push the Go button.

Neat.

Now they’ve improved the cartridge.

“Some sample types are easily processed for PCR testing, such as nasal swab samples, whereas other sample types, contain inhibitors that interfere with PCR. To better handle more complex samples, we have recently embedded a new chemistry into our sample preparation cartridge that greatly improves the MiQLab System’s ability to process samples that contain a significant percentage of blood, which is a powerful inhibitor of PCR. We are excited about this advancement and believe the new sample preparation cartridge broadens our testing capabilities for companion animals,” said Dr. Jack Regan, LexaGene’s CEO and founder.

The MiQLab system was built to process liquid samples from animals and used to diagnose infections such as urinary tract infections and skin infections. The system, equipped with a MiQLab Bacterial and antimcrobial resistance testing (AMR) panel, screens samples for 10 common pathogens and 33 markers indicative of ARM testing. These tests target genes responsible for resistance to four classes of first line therapeutics.

Color Star Technology subsidiary brings the next stage of globalization

As peculiar as the metaverse is as a technology and a cultural artifact, we have to admit that it’s a fairly curious addition to the phenomenon of globalization. Globalization is, of course, the breakdown of borders to traffic flows of people, idea, money, etc. It’s caused a fair amount of pain in terms of lost jobs, but also added a fair amount of extra awesomeness in the form of greater understanding and exposure to cultures that aren’t our own.

Now Color Sky Entertainment, itself a subsidiary of Color Star Technology (CSCW.Q) formed an agreement with Xing’ao Family Office, a firm that works with wealth inheritance and family affairs solutions for ultra-high net work clients, like family trusts, funds, banks and strategy consulting and private jet travel, to join the metaverse and provide a series of weatlh management sectors with metaverse at the core.

“Color World is an interactive platform with the metaverse as its core highlight. We believe that the future economic environment must be a multi-economy that integrates the Internet and the entity industries. Therefore, metaverse emerges in time, and will become a new business market environment, which is illustrated by the many large enterprises that have already settled into our metaverse platform, established the metaverse headquarters, and issued NFT. Xing’ao’s presence will add fund management to the mix with anticipated upgrades over time, ultimately creating a full-service wealth management offering within the Color World platform. We believe that this cooperation between Color Star and Xing’ao will also provide a model for more wealth management companies to follow, which we also believe will attract additional wealth management companies to enter our platform,” said Lucas Capetian, CEO of Color Star.

Virtual fund management of real world assets located in a space that exists between servers. Xing’ao will establish a virtual office, and the company is anticipating this being the first in a series of moves that will include companies dealing with financial instruments and the like taking on virtual simulacra in the metaverse.

This is probably going to cause entirely new problems in terms of jurisdiction and monetary flows, but it does provide a curious solution to the problem of capital immobility. Put it on the metaverse.

CloudMD slashes overhead for a leaner mean machine

One of the reasons CloudMD (DOC.V) is a decent bet for any would-be investor is their product—the other is their team. Their product is telehealth, including provisions for mental health. You skip the long lines at the doctor’s office for a comfy spot on your couch and you get a little Facetime with their doctor via a screen as an intermediary.

This obviously isn’t great for everything you want to see a doctor for. Need to verify a hemorrhoid flareup? Might wanna see a doctor in person. But if you’ve got the sniffles and a conjunction of other symptoms that might suggest the garden variety flu? You definitely don’t want to head to a doctor’s office, especially during a pandemic.

The other half is their team, and specifically, their cost optimization team. Since the beginning of the year they’ve managed to slash $7.5 million in annualized run-rate operational expenses through integration, cost synergies and streamlining of operational functions. A lower run rate means lower overhead in other terms, and that means more revenue is saved, generated through efficiencies and ultimately, profit.

In this case, it exceeds the company’s expected number of $4 million in cost savings.

“We are pleased with our ability to accelerate the identification and elimination of $7.5-million of run-rate costs which we have already been taken out of the business since the beginning of the year. In addition, we have used this opportunity to re-evaluate the organizational structure and streamline our business operations to prioritize exemplary service for our customers. This will result in our customers realizing increased return on investment and return on employee satisfaction,” said John Plunkett, executive vice-president, transformation and strategic planning, at CloudMD.

CloudMD has demonstrated its ability to execute on its cost optimization strategy to drive sustainable profitability by:

- Integrating MindBeacon’s iCBT solution into CloudMD’s mental health support solutions, providing user engagement through assessment and treatment options for mild, moderate and chronic conditions;

- Streamlining and consolidating key operational functions across finance, IT, human resources, marketing and sales, and leveraging industry-leading talent to drive innovation and retention, and capitalize on human capital;

- Strengthening digital health solutions by creating a new product management team focused on innovation and continuing to meet the health needs of individuals.

New solutions to old problems. New solution being telehealth, and old problem being the necessity of coming into the doctor’s office when all you need is five minutes and some angular creativity with your camera-phone.

Good deal.

—Joseph Morton