*Updated April 08, 2022

Kermode Resources (KLM.V), a Victoria, British Columbia-based junior explorer, floated listlessly on the boards for years as the former CEO promoted just enough to collect a paycheque. Peter Bell joined the company’s board of directors in January 2020 and watched with growing disbelief as a reckless leadership regime continued to drain shareholder value while fumbling mission critical activities. Activist investor and mining industry icon, Peter Clausi, joined the company’s board in August 2021, and immediately helped Bell clean house, installing Bell as president and CEO of the floundering junior.

One can only imagine the insanity Bell and Clausi were attempting to correct at Kermode when you consider the company’s ticker was the initials of the previous CEO’s wife. Trading at just above a cent a share, their work was cut out for them. Over the next six months, Bell eagerly braved the waters, building back the trust of shareholders and creating a workable portfolio of properties, all while working under the crushing constraints of a micro-cap junior.

So far, Kermode has one flagship property known as Vidette Gold Camp and three other projects under LOIs in Nevada, Newfoundland, and Australia.

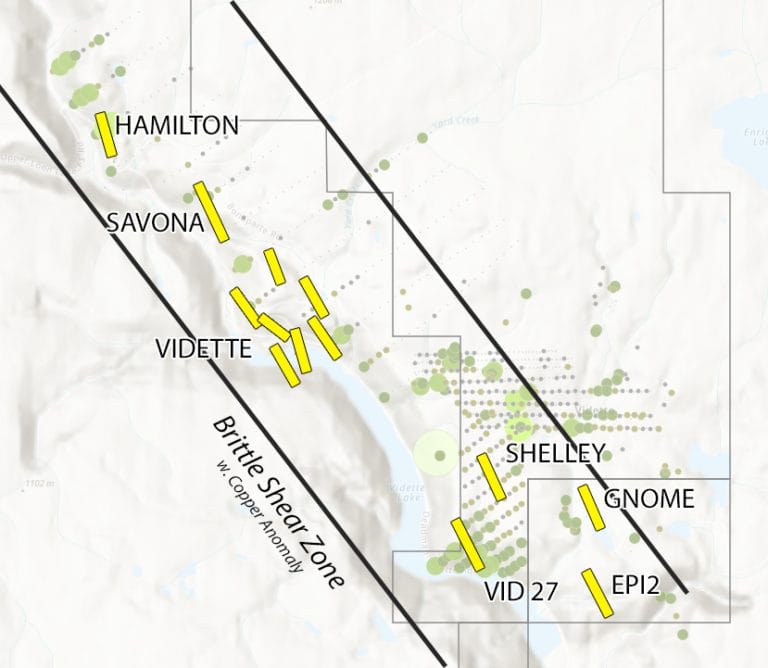

Vidette Gold Camp covers roughly 44 square kilometres about one hour outside of Kamloops, British Columbia. The property is close to established infrastructure in a prime mining jurisdiction. Historical exploration has revealed showings of 4.8 g/t Au at VID 27 and 18.40 g/t Au as well as 63.80% Cu at Arrowstone. In 2020, exploration revealed quartz veins and newly discovered porphyry at X4.

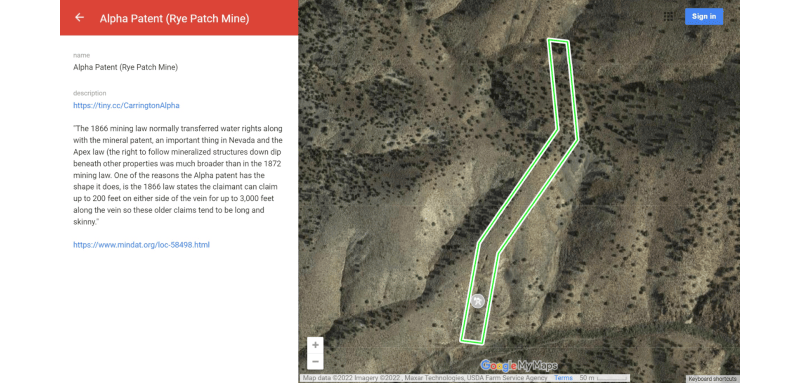

The junior explorer’s first LOI project, Rye Patch Silver Mine, is in Pershing County, Nevada, on the prolific West Humboldt Range where four major mines produced approximately 4.8 million ounces of gold and 140 million ounces of silver in past production and proven reserves. Roughly 30 miles north of Lovelock, Nevada, the Rye Patch Mine was discovered in 1864 and produced $634,388 USD in silver and gold from 1871 through 1881. Kermode recently released exploration results from one of its LOI properties, Rye Patch Silver Mine, with assays returning up to 2,605 g/t Ag and 13.2% Sb.

Kermode continues to negotiate with the Rye Patch project vendor and will update investors as news becomes available.

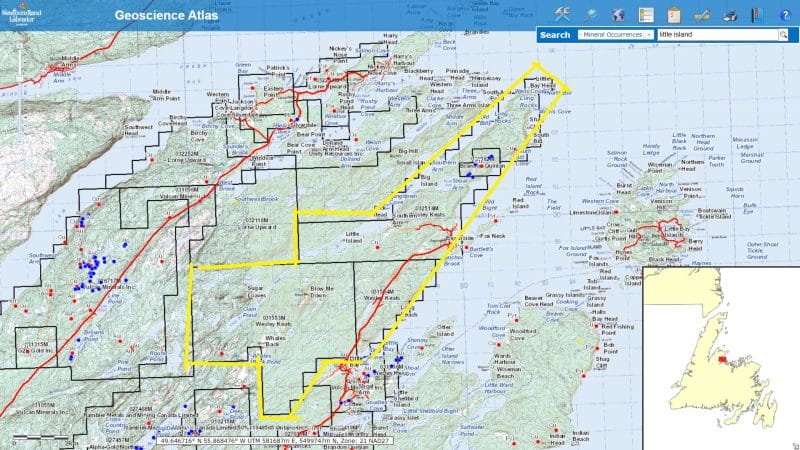

Little Bay Copper project lies in the Notre Dame Bay region of Newfoundland covering approximately 5,000 hectares. Little Bay is adjacent to three historical mines: Little Bay Mine, which produced 2.9 million tonnes ranging between 0.89% and 1.96% Cu and 6,300 ounces Au; Little Deer Mine, which has an indicated resource of 2,029 tonnes of 2.33% Cu; and the Whalesback Mine, which had an indicated resource of 854 tonnes of 2.13% Cu.

Kermode announced an update to its LOI deal at Little Bay Copper on April 05, 2022. In the release, the junior noted it had changed the terms to acquire the project and under the new deal, it was committed to $4.25 million CAD in exploration work over the next four years. During that time, it would also pay a total of $262,000 in cash and hand over 33.0 million shares.

Also, as part of the deal, Planet X Exploration has first right of refusal for all exploration work contracted by Kermode over the life of the option deal.

The company’s last LOI prospect is Seahorse Saddle project located at the Rawlinna station, 370 kilometres east of Kalgoorlie, Australia. The 1,217 square kilometre project is adjacent to holdings of the BHP Nickel West Seahorse Project. Recent geophysical work at the project carried out by Geological Survey of Western Australia shows the potential for massive sulphide mineralization under cover.

There isn’t a lot under the company’s hood in terms of exploration at the aforementioned properties, but that isn’t necessarily a bad thing for traders. Again, you’re looking at a stock that’s currently at $0.02 CAD per share. You could become a market maker with a modest investment. The risk/reward ratio here is pretty sweet. Sure, things could go incredibly south and drop to zero, but even the smallest news showing progress could push the stock north of $0.04. That’s a two-bagger right there.

Management is important for any mining operation success, but it is especially so in cases such as Kermode. At this point, that’s the most material thing you can hang your investment hat on with this junior explorer. Peter Clausi is well-known in Canadian mining circles as a stand-up fellow. He is revered for taking out the shysters and bringing shareholders a sense of security in a sector that breeds charlatans. Peter Bell is young, but he isn’t naïve and as I watched him being interviewed by our own Chris Parry in the latest Gauntlet video series, I saw a man with a passionate purpose and steeled resolve.

There hasn’t been a rollback to date, but if the company needs to do a raise at $0.05 to kickstart its exploration efforts at Vidette and Rye Patch, we could see a 2-1 squeeze, but that won’t be much of a bleed compared to the potential upside of a positive program at either property.

The junior announced at the beginning of April that it had handed out 1.0 million stock options to certain consultants to the company exercisable at $0.05 per share for a period of five years from the date of grant. Kermode also announced that 1.0 million stock options that had been issued to former corporate secretary, John Fahmy, had expired.

Kermode continues to trade at $0.02 per share for a low market cap of $2.18 million. Lots of growth potential here and the ability to become a market maker for mineral investors accustomed to the risk involved in turning a once dead company into a mining performer. You must admit, this is one great story of intrigue and good vs stupidity.

That said, you should speak to an investment professional after conducting a reasonable amount of due diligence before you make any portfolio decisions. After that pick your winning junior explorer and free yourself to make this a better world. Good luck to all!

Peter Bell also joined Jody Vance for a first glance at the company and its prospects in this video.

If you’re looking for an in-depth technical breakdown of the sector and Kermode, check out Vishal’s piece.

We have opinions and if you’re in the mood for them, our latest Investor Roundtable video dips into Kermode and it’s potential.

–Gaalen Engen