Poking Around in a Glory Hole

- $2.183M Market Capitalization

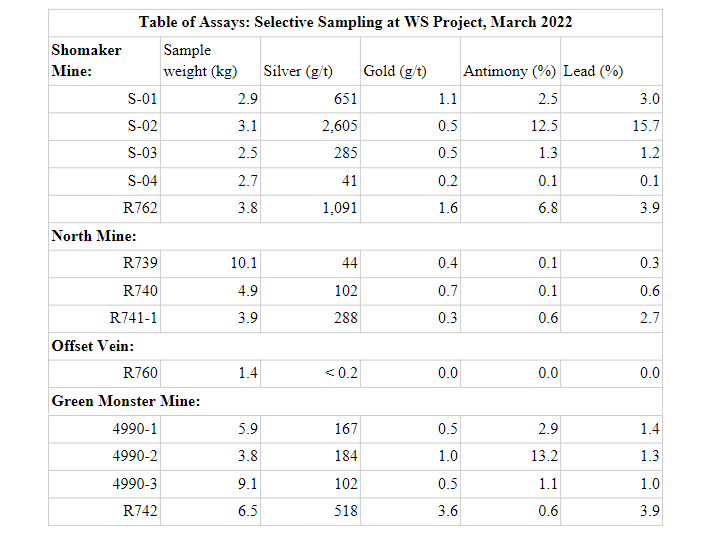

Kermode Resources Ltd. (KLM.V) reported on March 14, 2022, initial results from geochemical sampling as due diligence under the Letter of Intent (LOI) for the Eye Patch Project, which resides in Nevada, USA. Highlights include assays up to 2,605 grams per tonne silver (g/t Ag) and 13.2% Sb antimony from sample S-02, which was 3.1 kilograms (kg) taken from the wall of the Shomaker mine.

“In addition to the follow-up sampling at the face of the Shomaker mine and in the road at the Green Monster mine, I would like to undertake initial mineralogical and metallurgical testing of the high-grade material from the old mine to better understand what the old-timers may have been doing to recover the antimony,” commented Peter Bell, President & CEO of Kermode.

I’ll admit, I am no Greg Nolan. When it comes to mining, I need to learn to walk before I can run…except I never learned how to walk to begin with. However, I am going to do my best to make a mining piece as palatable as possible, more so for my own sanity than for yours. Sorry. So bear with me as I try and blend in with the mining kids. Buckle up!

For starters, it’s worth noting that Kermode signed an LOI to lease the Rye Patch Mine silver mine from Gold Range Company LLC (GRC) on December 3, 2021. Rye see what you did there Gold Range. The project comprises two land positions that are approximately 45 km apart. This includes:

ALPHA: a single patented claim of fewer than five acres of private land. Alpha has Apex mining rights covering the Rye Patch mine operated in the 1870s. For context, the law of apex refers to the principle that the title to a given tract of mineral land, with defined mining rights, goes to the individual who locates the surface covering the outcrop or apex. In other words, finders keepers, losers weepers.

WS: ten claims in a package covering the Green Monster silver mine active intermittently from 1936 to 1967. Investigations by Kermode into historical records indicate mineralization in the WS area was first discovered around 1906, with limited mining occurring from 1918 through about 1967. However, the production appears to have focused exclusively on antimony, with little to no attention or even mention of silver or gold potential.

“We are working at the Alpha patent to repair timbering in part of the underground mine at the Rye Patch Mine. These repairs will improve access for an initial underground selective sampling program as our immediate priority for the Rye Patch project. Let’s find out if we can get better numbers from the Alpha patent than the WS as reported here,” continued Peter Bell.

According to the non-binding LOI, GRC has granted Kermode a sole and exclusive due diligence period. During this period, Kermode has the exclusive right to conduct such due diligence as it may deem necessary or advisable. This includes, but is not limited to, researching the title of the project, GRC’s leasehold interest, mapping, and sampling the surface and underground workings.

Expansion of WS Land Position

As previously mentioned, the WS project’s gold and silver potential were entirely glossed over by the old-timers. That being said, Kermode is positioned to capitalize on this negligence. In fact, Kermode has worked with the project vendor to expand the WS claim block.

To date, the Company has staked more than 200 hectares of highly prospective ground covering potential structural extensions of mineralization at the Green Monster, Shomaker, and North mines. In doing so, this has tripled the size of Kermode’s WS land position to approximately 285 hectares.

To sweeten the pot, the new land position includes the historic Gold Plate Mine. While the details of the mine are unknown, reconnaissance prospecting at the site has identified a new area where recent erosion by surface water has revealed visible copper oxide minerals in a calcite vein at the surface. Following this discovery, sampling is planned to investigate this copper exposure.

Positive Results

With this in mind, the aforementioned Shomaker mine is situated along what appears to be the same vein structure as the Green Moster Mine and other unnamed workings. To provide some background, the Green Monster Mine is found at the crest of the hill, approximately 100 meters up-slope from the Shomaker Mine.

The vein appears to outcrop for 100 to 500 meters and has a dip slope, which means that it is dipping at roughly the same angle as the surface slope. This is important because it presents favorable exposure and potential for significant metal endowment near the surface. That being said, sample R762 was collected from the side of a glory hole at the top of Shomaker decline.

While the “glory hole” I am thinking of resides in a truck stop bathroom, the mining industry’s equivalent isn’t too far off the mark. In terms of mining, glory hole is a term used to describe several different types of excavations that commonly occur during the process of creating an open pit, drilling a mine shaft, or creating a mine. A defining charactertistic of a glory hole includes an impressively large hole.

In terms of numbers, sample R762 assayed 1,091 g/t Ag silver, 1.6 g/t Au gold, 6.8% Sb antimony, and 3.9% Pb lead from 3.8 kg of material. Furthermore, both S-02 and R762 had low levels of As Arsenic and Hg mercury. That being said, initial indications of high-grade mineralization demonstrated low concentrations of potential deleterious elements.

For context, deleterious elements are materials or building techniques, in this case, materials, that are dangerous to health, environmentally unfriendly, tend to fail in practice, or are susceptible to change over the lifetime of the material. Both arsenic (As) and mercury (Hg) are classified as deleterious elements.

So, what does a mining novice like myself make of these results? Well, there’s a reason why Kermode is talking about samples S-02 and R762. Both samples, despite being of comparable weight to other samples, showed significantly greater g/t of silver, gold, and antimony. In addition to samples S-02 and R762, sample R742 taken at Green Monster Mine also demonstrated encouraging results.

Similar to samples S-02 and R762 taken from Shomaker Mine, sample R742 taken from Green Monster Mine assayed 3.6 g/t Au gold and 518 g/t Ag silver in a sample weighing 6.5 kg. The closest comparable sample in size includes sample 4990-1, which assayed 167 g/t Ag silver and 0.5 g/t Au gold in a sample weighing 5.9 kg.

Sample R742 was taken from a mineralized outcrop in a roadbed recently exposed by winter storms. This sample also contained fragments of brecciated quartz in an extremely dense iron oxide host rock. Looking at the results, Shomaker Mine and Green Monster Mine do appear to be positioned across the same vein structure.

Negative Results

Offset Vein:

Moving on, sample R760 was collected from an outcrop across the ravine from the Shomaker Mine, as seen in the graphic above. It was initially thought that this outcrop may indicate a footwall structure directly related to the mine, seeing as it contained the right kind of rocks with common to abundant levels of quartz in hydromorphic gossan.

Keep in mind, gossans are formed by the oxidation of sulfide minerals in an ore deposit. As such, they may be interpreted as indicators of subsurface ore deposits. However, other than a mild case of blue balls, sample R76o did not produce any significant results. The sample itself demonstrated a low concentration of all metals.

At the surface, it appears the vein where sample R760 was collected runs parallel to the ravine and meets the structure where sample R742 was collected, the same sample that assayed 3.6 g/t Au gold. However, the fact that sample R760 did not contain anomalous gold suggests that the offset vein was unrelated to the deposits at Shomaker Mine and Green Monster Mine.

North Mine:

Of the three samples taken at the North Mine, all were inferior to what was seen elsewhere at the WS project. In terms of numbers, assays returned 44, 102, and 208 g/t Ag silver and 0.4, 0.7, and 0.3 g/t Au gold, respectively, at the surface and inside the underground mine. However, samples at the North Mine did contain significantly higher arsenic, with values ranging from 2-5%.

The North Mine is approximately 750 meters north of the Green Monster Mine and Shomaker Mine. Keep in mind, geological structures generally dip northerly at the North Mine. On the contrary, all observed structures in the vicinity of Green Monster Mine and Shomaker Mine dip southernly.

From my limited understanding, this would indicate that there’s money to be made in the south, not so much in the north. At this time, it is currently unclear if there is any higher grade material or other indications of a significant metal endowment at the North Mine.

Thoughts from a Novice

While Kermode’s North Mine appears lackluster, both the Shomaker and Green Monster mine samples have produced encouraging results. In particular, samples demonstrated significant amounts of gold and silver, two of the world’s most precious metals. The bottom line is, any finite resource is or will become precious in time. Just look at oil. Aside from looking pretty, gold and silver are also incredibly versatile.

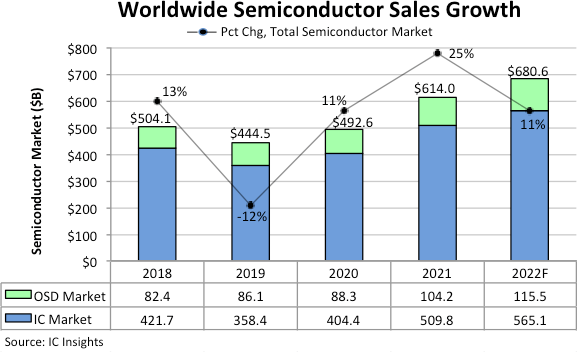

When it comes to electronics, gold and silver are in high demand. For example, gold is a must-have in the semiconductor market, where sales are expected to reach a record high of $680.6 billion in 2022. It is worth noting that more than 13,000 Chinese enterprises registered as semiconductor companies in the first nine months of 2020, representing an increase of nearly 9,000 compared to 2019.

Bearing this in mind, gold could test new highs of $2,100 per ounce in 2022, according to analysts. Similarly, the Silver Insitute predicts that global demand for silver could rise by 8% from 2021 to a record high of 1.112 billion ounces in 2022. This growth can be attributed to a variety of factors, including the ongoing Ukraine-Russia conflict.

In response to Russia’s invasion of Ukraine, safe-haven investments, or secure investments, have notably increased, including investments into precious metals like gold and silver. For example, silver fell to $22.39 at the end of January 2022 before climbing to $24.71 an ounce following Russia’s large-scale invasion.

However, sentiment around gold and silver could wildly change depending on the US Federal Reserve, which is expected to raise interest rates several times this year in response to inflation, Ukraine, and, of course, that bastard COVID-19. If you’d like to know more about the current state of inflation, check out Vishal Toora’s article here!

Full Disclosure: Kermode Resources Ltd. (KLM.V) is a marketing client of Equity Guru.

Oh boy! Now do “antimony”? Love the word play. Thanks for the bullish coverage.

https://tiny.cc/KermodeWS

Map here may help give some perspective. FYI.

Thank you for providing this! I was having trouble converting a barcode into a usable link.

Ya, real novice.

You did not even mention location of the company property, Canada, USA, where?

Google map with pins???

Really? You not get a map from the company with more detail.

Past exploration? You provided not detail, mining, has the property been ever drilled

by the truth bit???

Lot my interest in this article and just passed.

Admittedly, I should have provided the location, which has since been added! It slipped my mind since mining is definitely not my area of expertise. After all, this was intended to be a press release opposed to a deep dive into Kermode Resources. If you’d like to read some legitimate mining pieces that look into past digs, I suggest you check out our articles from Greg Nolan or Chris Parry himself. Either way, sorry for disappointing you, Dave.