We have been calling for higher agricultural commodities for months here on Equity Guru’s Agriculture Sector roundup. Though our fundamentals did not account for war and invasion, the technicals were telling us higher prices were coming. This goes back to the whole debate between fundamentals and technicals. I, of course, am more of a technical chartist. In my experience following world markets since 2014, I have seen that the fundamentals lag the technicals. Whether it is big money and imperfect information getting in before things happen isn’t really my focus. I just trade what I see rather than what I want to see.

We spoke about the weekly breakouts in early 2021. That was when a new long term uptrend began. Once again, we had many reasons why this could happen but we don’t have a crystal ball. We just trade the charts. We have known higher food prices are coming…and are still coming.

In early 2022, we saw hints of the Russia-Ukraine situation escalating. Some of my Market Moment and Discord members might remember me saying watch that EURCHF. Last year in October, we were seeing European money running into Swiss bank accounts. Nothing else was happening to the Euro or the Swiss Franc at the time. Looking back, this might have been our major sign. Something else mind boggling is the Moscow stock market…take a look at the MOEX weekly chart. The market broke down around the same time EURCHF was dropping…when global indices in Asia, Europe and North America were moving higher.

In January of 2022, I wrote a piece speaking about how Russia-Ukraine tensions would impact Agriculture. Things that you are probably reading about now on the mainstream media and financial media. The important part of that piece was that Wheat, Soybeans, and Corn were all breaking out. Very nice technical setups for the latter two.

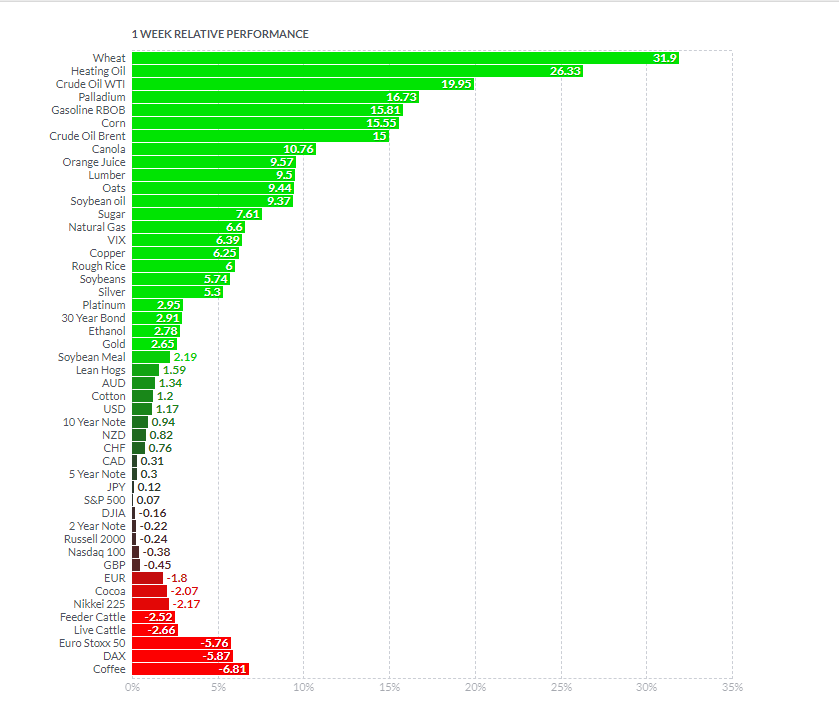

Last week’s Agriculture Sector Roundup headline was “Wheat Prices Rocket as Russia Attacks Ukraine!“. Wheat was one of the largest winners for trading last week. And guess what… wheat is number 1 this week (at time of writing from Monday to Thursday of this week).

Last week, both Wheat and Soybeans hit nine year highs on the news. Wheat and Corn futures actually hit their daily trading limits. Russia and Ukraine account for 29% of global wheat exports, 19% world corn supplies, and 80% of world sunflower oil exports.

Russia exports a lot of wheat. So does Ukraine. We have heard all about food inflation. Well guess what? Expect higher food prices as we are getting a double whammy from rising agricultural commodities, and from higher oil prices. Higher oil prices means higher transportation costs, and those extra costs, will be passed onto the consumer. It makes central bank rate decisions a bit more interesting because higher rates would hurt indebted consumers. Being pinched by rising inflation and rising rates could be enough to cause a recession itself. But this is a topic for my Market Moment.

Let’s get back to agriculture. As you can see from the weekly performance, wheat prices have continued to perform this week. We have now made 14 year highs! And, wheat prices have hit limit up on multiple days. Wow.

Prices are so crazy that I need to zoom out to the weekly chart of Wheat futures (ZW1!) to show you what has happened. We have not seen levels like this since March 2008 (14 years). Previous record highs are next. In terms of pullback, yes, we can move back to the 920 zone before continuing higher. Very strong price action and dips are being bought.

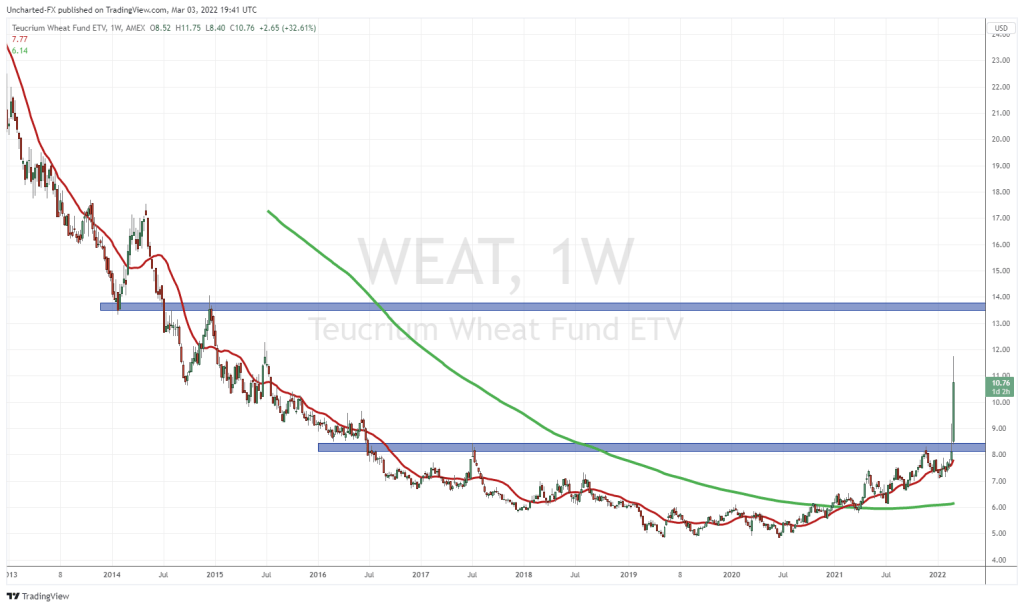

If you cannot trade futures and CFDs, then you want to take a look at the ETF WEAT:

What a beautiful chart. Again, the actual trigger for the reversal occurred last year. We love this type of set up: a long downtrend, with a range or a reversal pattern breakout indicating a new uptrend. A very big weekly breakout above $8.00 is being set up. It all depends on today’s (Friday March 4th) close. It is likely we remain above $8.00, meaning a weekly breakout is confirmed. I would be looking for pullbacks and buy opportunities. The best would be a retest at $8.00, but judging by the dip buys, we might not be able to test those lows.

Russia-Ukraine headlines are a factor, but I think other catalysts such as a Potash/fertilizer shortage and climate change will keep agricultural commodities buoyed. Agriculture will be a great sector to invest in. You all know this, hence why you read my Agriculture sector roundups!

Because I have been focused a lot on geopolitical headlines for the past few weeks, I haven’t been able to update readers on companies. Let’s look at some Agriculture companies with nice set ups and recent news.

CubicFarm Systems (CUB.TO)

CubicFarm Systems is a popular company among my readers. No major news for 16 days, but the chart looks great for a potential trade if money heads to Agriculture stocks.

We have been watching this support zone near $1.00 for the past few months. We still are holding within our ranges. $1.00 support and $1.25 resistance. I am looking for a breakout. The structure looks like a double bottom, which will only be triggered once breaking out above $1.25.

MustGrow Biologics (MGRO.CN)

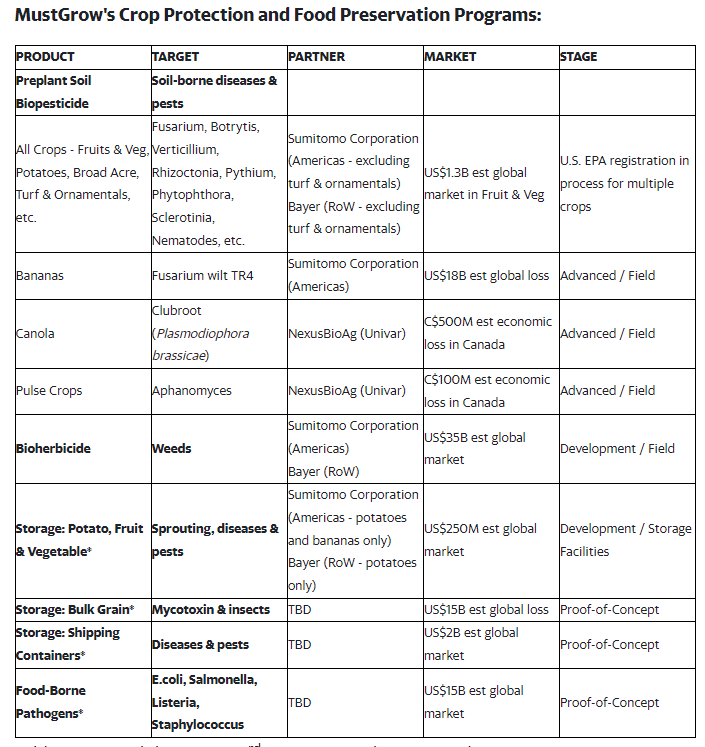

MustGrow has provided an update of its organic mustard plant-derived crop protection technology pipeline. The company also hosted a live investor webcast yesterday discussing recently announced partnerships with Bayer and Sumitomo corporation and upcoming catalysts.

Just like CubicFarms, MustGrow is also maintaining a range. The $3.00 zone is major support, and buyers still hold it. Look at the bid on February 24th. We still require the breakout, the $4.25 zone is what you need to watch. Fundamentally, I REALLY like the company with partnerships with Bayer and Sumitomo. It shows that their technology, which harnesses the mustard seed’s natural defense mechanism, is garnering the attention of big corporations.

Verde Agritech (NPK.TO)

Verde Agritech is on fire! I usually show the daily chart but this time, I need to show you guys the weekly chart.

New record all time highs as we took out $6.20. In terms of resistance, we are in new territory but I would look at the $10.00 zone. With a potential potash shortage looming, Verde is definitely seeing a large influx of money. Recent headlines detail an increase of potash production capacity in 2022. It has started working to double the capacity of its second production facility which is currently under construction (Plant 2). Plant 2 is on track to start production in Q3 2022, and the enlarged production capacity is expected to be in operation early Q4 2022.

By Q4 2022, with Plant 2’s expansion, Verde expects to have raised its overall production capacity to 3,000,000 tpy, becoming Brazil’s largest potash producer.

The company is also increasing production to offset supply issues due to Russia-Ukraine.

“Given the latest sanctions applied to Belarus and Russia, we are acutely aware of the collateral impact on Brazil’s agriculture in the case of a potash supply disruption,” Verde President and Chief Executive Cristiano Veloso said. “We are equally worried about a global food shortage, which might be unavoidable if there is a breakdown in fertilizer supply.”

Bee Vectoring (BEE.CN)

A very quick one here on Bee Vectoring (BEE.CN). We really like the chart setup here.

The setup is obvious. In many Agriculture Sector Roundups in the past, I have highlighted this $0.235 support zone. We have always bounced here. This is the 6th test here since August of last year. It would be nice to see some support and range set up here before we climb higher and take out the $0.275 zone.

Farmers Edge (FDGE.TO)

Maybe not the most popular company right now, but a reversal could be in the cards. We are watching for a $4.00 break. This is definitely a major resistance. Two weeks of trading saw the price attempt to break above, but to no avail just yet. If we can get a daily close above $4.00, then we have something going. Remember, Fairfax and Prem Watsa did buy shares and are owner’s of the stock.

TrustBIX (TBIX.V)

TrustBIX announced a long-awaited signing of a definitive agreement to acquire Insight Global Technology. The company has entered into a definitive agreement to acquire Insight Global Technology Inc. (“Insight”), an early stage company providing solutions to track, protect and identify the movement of high-value moveable equipment used in agriculture and other industries.

Hubert Lau, CEO of TrustBIX, said, “I am very excited about the acquisition of Insight, which is a major milestone for TrustBIX. We are confident that the acquisition will help us expand our BIX platform, enhance our value in supply chains, and enable us to better serve our clients with a more diversified set of products and services. We believe Insight will assist us to drive growth and shareholder value in the months and years ahead.”

Under the terms of the definitive agreement, TrustBIX will acquire 100% of the issued and outstanding shares of Insight for up to 30,000,000 common shares of TrustBIX priced at $0.18 per share, scheduled to be paid out to Insight shareholders across specific milestones in four tranches.

The structure here looks great. Not a breakout just yet, but I like the long down trend and the range. A daily close above $0.215 is the major trigger for us. That would initiate a new uptrend with higher lows and higher highs!