So folks, I was actually going to focus on avocados, and the avocado shortage supply. But something else happened on Wednesday night, which had me changing plans. A Russian attack on Ukraine.

A lot of traders were talking about Gold and Oil. I love both, and have been bullish on both. But not enough traders/investors/pundits/analysts are talking about the agricultural ramifications. Being an Agriculture guy, my eyes were on agricultural futures. I also recently wrote a piece about the large implications on this sector if a Russian attack happened, back on January 28th 2022. Readers were prepared.

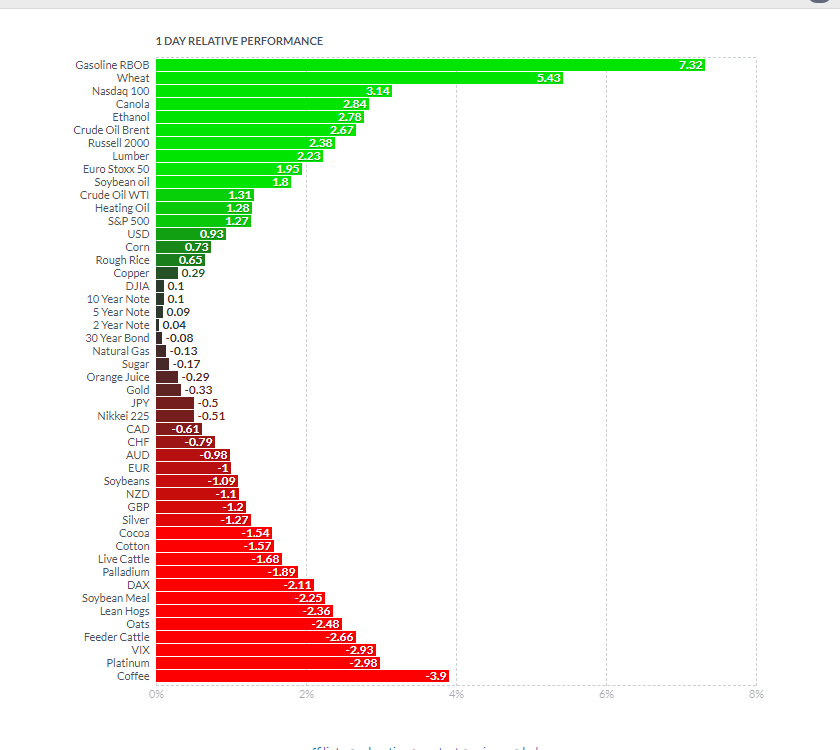

The stock markets had time to digest all of this news. Some crazy price action including Oil closing lower from its highs and technically, did not confirm a breakout. More shockingly, Gold began on a tear, but then closed RED. Yes, that’s right. Gold and Silver closed red!

Wheat was the real winner! Wheat FTW! (For The Win!). The agricultural commodity was one of the top performing assets yesterday as markets began to price in the events in Ukraine.

Oh and yes folks, higher ag commodity prices does mean more expensive food prices and grocery bills. That food inflation will continue, and likely worsen.

Both Wheat and Soybeans hit nine year highs on the news. Wheat and Corn futures actually hit their daily trading limits. Russia and Ukraine account for 29% of global wheat exports, 19% world corn supplies, and 80% of world sunflower oil exports. Traders are worried that a full scale military engagement could impact crop movement and trade.

Analysts at Rabobank forecast a 30% jump in wheat prices and a 20% rise in corn prices. International sanctions against Moscow would be bad for grains, vegetable oils and fertilizers.

“If sanctions were still in place by July, when harvesting of the next crop begins, it would cut deeply into global grain availability. Demand rationing would be forced via higher prices: wheat would then double, and corn rise 30%.”

But hey, if Western nations don’t want Russian agriculture (and energy for that matter) China is a buyer. Russia and China announced a wheat and barley deal when Putin attended the Beijing Winter Olympics ceremony on February 8th 2022.

Global Agricultural commodities trader Bunge said it closed company offices in Ukraine and suspended operations at two oilseed crushing facilities in Nikolaev and Dnipro. The company employs more than 1,000 people in Ukraine and operates grain elevators and an export terminal.

The stock itself broke above a major resistance zone of $92 and continues higher in an uptrend. Massive day yesterday. A lot of the large ag companies had moves like this. We hold the uptrend, and would not be surprised if we confirm a nice breakout today.

Before we look at the charts of Wheat, Soybeans and Corn, let me share with you some graphics I posted in my article detailing how Russia-Ukraine tensions could impact Agriculture.

If you remember back to your history/social studies days, we were taught that Ukraine is the breadbasket of Europe. We were also taught how the Soviets were blessed with so much farmland, yet had to import food to feed its people.

Ukraine has more than 41.5 million hectares (or 102.5 million acres) of agricultural land that cover 70% of the country.

According to the International Trade Administration, in 2020 Ukraine’s agricultural sector generated 9.3% of GDP. Crop farming accounted for 73% of Ukraine’s agricultural output, with the main crops being sunflower, corn, soybeans, wheat and barley. Here are some global stats for comparison:

- 1st in global sunflower production (For 2021/22 Ukraine sunflower seed production is estimated at a record 17.5 MMT)

- 6th in global corn production. (For 2021/22 Ukraine corn production is estimated at a record 42 MMT)

- 6th in global barley production

- 7th in global rapeseed production

- 9th in global soybean production

- 9th in global wheat production

Agweb also put up this map showing where the crops are produced in Ukraine. Focus is of course in the Eastern Donbass side which is heavily populated with Russians. This is the area where we have seen Russian mercenaries fighting Ukrainians… and now Russia acknowledging as independent states. As you can see from the map above, cereals and sunflower will be impacted the most.

Let’s start with wheat futures. Look at that rally. But of course, it’s all about the technicals for us. I like the range we were forming between 740 and 820. Some would say it’s a head and shoulders pattern, but I only use that as a reversal pattern, meaning they need to be at bottoms or the very top for the inverted variety. Instead, I just say this is a nice and clean breakout. With very good follow through. 820 remains a good support zone.

Zooming out to the weekly chart, and going to a line chart (because the candles wouldn’t look great), you can see that prices indeed are hitting levels not seen since 2012. If wheat continues to climb here and confirms a weekly candle close above this resistance, the next zone would be all time highs around 1200.

We can keep tabs on Corn on the weekly chart. Some of you may remember me writing about the major Corn breakout way back in January of 2021. Our targets were met within the first half of 2021. For those into market structure, we still have not really formed a higher low on the weekly chart. We haven’t even pulled back to retest the breakout zone, but I think the way we are trading right now, we probably won’t. It is more likely we take out recent highs at 731. Looking real good and the trader in me would play that breakout.

Soybeans was actually a set up that we took with the beautiful reversal pattern printed mid December 2021. We have also hit our major price target at 1630. I was expecting a pullback but geopolitics had other plans. We now have close above recent highs.

On the weekly chart, prices are hitting levels not seen since 2012. The next zone would be record highs. I think we will test that in the upcoming months or weeks. Another factor could be China. A lot of eyes are on Russia but China may get some ideas now with Taiwan seeing the US response to Russia. A double pronged attack by Russia in Ukraine, and China in Taiwan would force the US to deal with both nations. Militarily if it requires. If the US does not, allied nations would see the US is not going to back its allies. US hegemony would take quite the hit.

Soybeans tend to move on any Chinese headlines, so agriculture has this added fundamental.

In summary, markets are worried about energy prices, but the Oil close hints the market is already overcoming invasion fears (or pricing in no rate hikes). Agriculture needs your attention, especially with food inflation. I still think other fundamentals are there for a rise in agricultural commodities such as the climate issue and the North American Potash issue which will hit come Spring of this year. Just around the corner.