Tech stocks have been feeling the pressure with rising yields. As I am writing this, the Nasdaq is once again trying to climb back over a major support zone. A breakdown here would mean a new downtrend in the Nasdaq. For more info on what I am watching as a trader, take a look at yesterday’s Market Moment article titled “3 Charts That Stock Market Traders Must Watch This Week“. That 10 year yield is one to watch, especially for tech investors.

A lot of talk about the FAANG stocks: Facebook (now Meta), Amazon, Apple, Netflix and Alphabet. During this volatile period for the stock market, most of the FAANG stocks have held up well considering the Nasdaq drop. All of them except Netflix…and to some extent Amazon. But the latter has not fallen as much as Netflix. Wonder if it has something to do with the ‘pandemic’ stocks such as PTON and ZM and others which are also selling off.

Netflix fell hard and is now testing a support zone. On the day the stock tested this support, news came out that Netflix will be raising subscription fees in the US and Canada. The stock liked the news, and closed above support with a nice green candle. I will talk about that more in the chart breakdown below.

So is this good news? The way to value Netflix has flip flopped between rising subscription rates versus revenues. We know the company brings in big revenue, but investors have always been glued to those growth data regarding increasing or decreasing subscription rates. It is pretty obvious that raising subscription fees will be positive for revenues. The only negative thing would be subscribers canceling subscriptions because it’s too expensive. I guess in this day and age you have alternatives like Disney Plus, Amazon Prime and many others. But it comes down to the content, and I think Netflix still has the best of the bunch. People are excited about the upcoming Ozarks final season. Stranger Things is still upcoming, and I bet people will get hyped when Squid Games Season 2 gets a release date.

In the US, the monthly cost for the basic plan rose $1 to $9.99, the standard plan jumped from $13.99 to $15.49, and the premium plan rose from $17.99 to $19.99. Canadians were spared an increase in the basic plan, which remains $9.99 CAD, but Canadians will fork up an extra for the standard plan and the premium package. Netflix said the price for its standard plan, which includes high-definition video and two simultaneous streams, will rise $1.50 to $16.49 per month, while the premium package, with Ultra HD access and four streams, is going up $2 to $20.99.

Netflix reports Q4 earnings this week on January 20th 2022. Wall Street analysts are expecting the company to miss its subscriber growth forecast, but with the raise in subscription fees, analysts are now saying the company should just shelve the subscriber growth metric entirely.

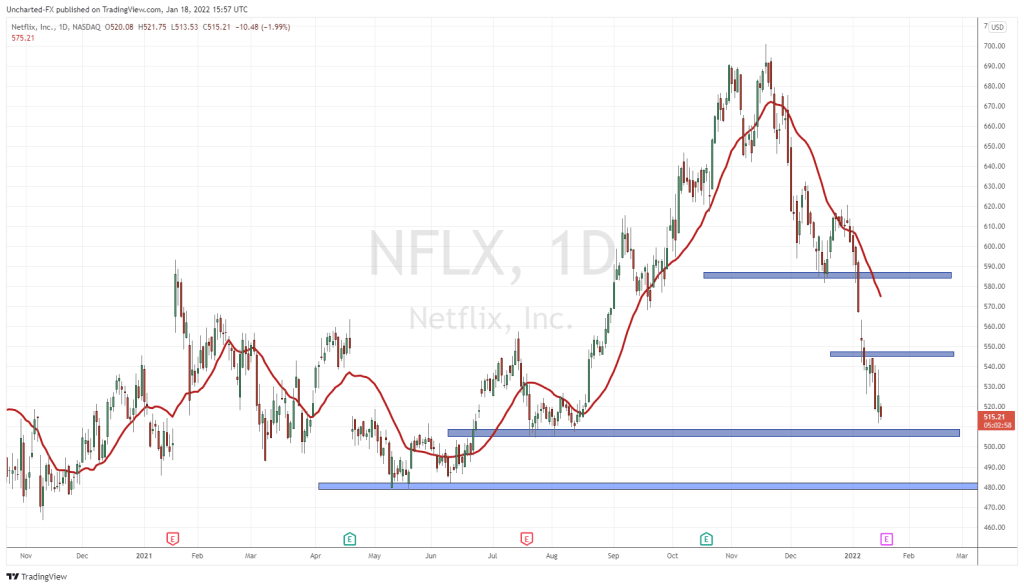

Before we look at the daily chart, I just want to give you all a broad perspective. Let’s start with the weekly chart. I just want you to focus on one zone, and that is the $475 zone. This is our major weekly support. I tend to favor this as major support, but once we zoom into the daily chart, you will see that the $500 zone is acting as interim support.

Now let’s break down the daily chart. Let’s start at the very top. I didn’t draw the support, but we confirmed a reversal with a breakdown below $640. A double top pattern after an uptrend with multiple higher low swings. Our Discord members were notified of this breakdown.

Now Netflix has had multiple lower high swings. To me, the chance of a bottoming and a reversal has increased, but of course we need confirmation. I keep my eyes on major support zones, as these are the areas where price could reverse. We definitely have one here just above $500 at around $504.

January 14ths candle saw some reaction near our support zone but that is not enough to say a reversal is in the works. What I want to see is a range. Evidence that the selling has exhausted and buyers are once again entering this market. The final confirmation will be a breakout above $550, since that is the lower high we are currently working with. As long as we remain below this, the downtrend is still intact.

If this support breaks, then we target my major support zone at $475. This drop could come from an earnings miss, or even from the Nasdaq and US Stock Markets breaking down. My advice for trading this is to wait for the earnings to come out on January 20th. Earnings are market moving, but you just never know how the stock will react on the release. It is 50/50. It would be more prudent to wait for earnings to come out and then see the market reaction. If it is a breakdown, we continue to wait for basing. If we get a ripper, perhaps the stock will have ranged here at this support, and we then set our eyes for a breakout above $550. Patience pays.