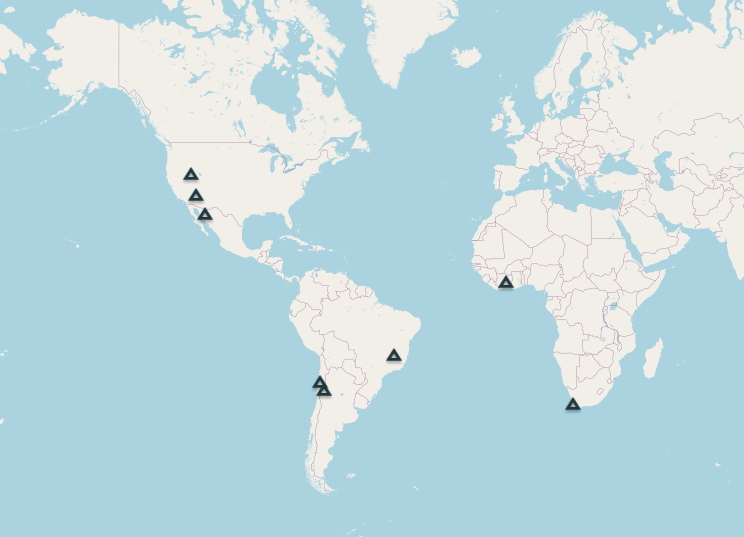

Nomad Royalty (NSR.TO) is a gold and silver royalty company that purchases rights to a percentage of the metals produced from a mine, for the life of the mine. Nomad owns a portfolio of 16 royalty and stream assets, of which 8 are currently producing mines. The company will grow by acquiring more producing and near term producing gold and silver streams and royalties.

Here are Nomad’s 8 producing mines as of now:

Recently, the stock gapped down on news released on January 11th 2022. Nomad Royalty announced a CAD $40 million bought deal financing. Here are the details:

“underwriters have agreed to buy on bought deal basis 4,400,000 common shares, at a price of C$9.10 per Common Share for gross proceeds of approximately C$40 million. The Company has granted the Underwriters an option, exercisable at the offering price for a period of 30 days following the closing of the Offering, to purchase up to an additional 15% of the Offering to cover over-allotments, if any. The offering is expected to close on or about January 20, 2022 and is subject to Nomad receiving all necessary regulatory approvals.”

The net proceeds of the offering will be used to support the Company’s recently announced acquisitions of streams on the Greenstone Gold project and the Platreef palladium-rhodium-platinum-nickel-copper-gold project, and for general corporate purposes.

The stock took a hit, which we will discuss below, but the company now has cash to initiate catalysts and get the stock popping once again. When we look at the chart, I will discuss the hurdles.

It may not come as a surprise to my readers, but I am a big fan of gold and silver. Always have been even before the pandemic. It is the best way to bet against the debt. If you think I am just a gold doom and gloom bull, read what Ray Dalio has been saying. He is recommending gold because he believes it will be the best currency out there. He is also expecting a currency war, and questions the limits of what central bank monetary policy can do.

With this macro background, I think gold and silver will have great months and years ahead. Generally I am bullish on most commodities.

What will be occurring in the next few months here will be crucial for metals, and the world in general. Lots of talk about the Fed hiking. It seemed that Powell downplayed the number of rate hikes at his testimony. However, later last week, Brainard and Harker came out more bullish saying they still expect 3-4 rate hikes this year to curb inflation.

Gold does not tend to do well in a high rate environment. With all this talk of rate hikes, take a look at the 10 year yield:

Very bullish, and it looks like rates will be heading higher. This is definitely impacting the equity markets. One would expect gold to get hammered by rising yields, but instead, the yellow metal is holding up well. This is a good sign. It means some money is already pricing in the confidence crisis.

Longer term, I am watching for a breakout on the weekly chart of Gold. Once we get a confirmed close above this trendline, new record highs are next. Remain bullish above $1750. The long term still looks positive.

If we go down to the daily chart, things still look constructive. If you are a member of our Discord channel, and told members that gold confirmed a breakout above $1785. We have pulled back to retest the breakout, and have seen buyers step in and carry the price higher. What we want to see though is the daily close above recent highs of $1830. That would give us the strength to perhaps push and breakout above the major trendline on the weekly chart.

Silver looks even better. A major support at $21 has held. This zone has been held 5 times going back to 2021. We played the rejection, and I am looking to add more contracts on a breakout above $23.30. It seems we are setting up for a nice double bottom pattern. Let’s wait for the confirmation.

Metals are looking good right now, but the Fed and rate hikes will be a crucial theme. If the markets believe the Fed is going to raise rates multiple times, the US Dollar will get a nice bid, which would put pressure on the metals. I would really hate to see Silver breakdown below $21. Yikes.

On the other hand, inflation is still coming in strong. Inflation came in at 7%, the highest since 1982. We just keep breaking records. The Fed though has convinced markets that this is due to supply chains, and will disappear sometime in mid 2022. I, and many others, suspect the Fed is using supply chains to cover up the real culprit: Fed easy money policy and money printing. We have a situation where there is more money competing for the same number of goods and services. Productivity needs to increase to balance out.

If you follow markets closely, in the past few weeks, Fed chairs have come out saying they need to hike rates to curb inflation. However, they don’t mention how raising rates will resolve supply chain issues if that is the culprit. It sure doesn’t seem like it is to calm a surging US economy with NFP and retail sales coming in worse than expected. Now pundits are talking about if the Fed can even hike in a weak economy! They know a lot of this has to do with cheap money and the hunt for yield. The big question is how many times can the Fed even raise rates without breaking the government and consumers who are loaded with debt. This is why I hold non-fiat assets. I prefer commodities and hard assets. Gold and silver being my favorite.

If gold and silver continue to rip higher, I expect the precious metal stocks to follow. I think juniors, explorers, and miners will all do well. But my favorite way to invest in precious metals is by buying physical and buying the royalty and streamers. There are a handful of big boys in this space: Franco-Nevada, Wheaton, Royal Gold, Osisko, Sandstorm, and I would include Nomad in the mix too, although the growth prospects for a Nomad and Sandstorm are much more attractive.

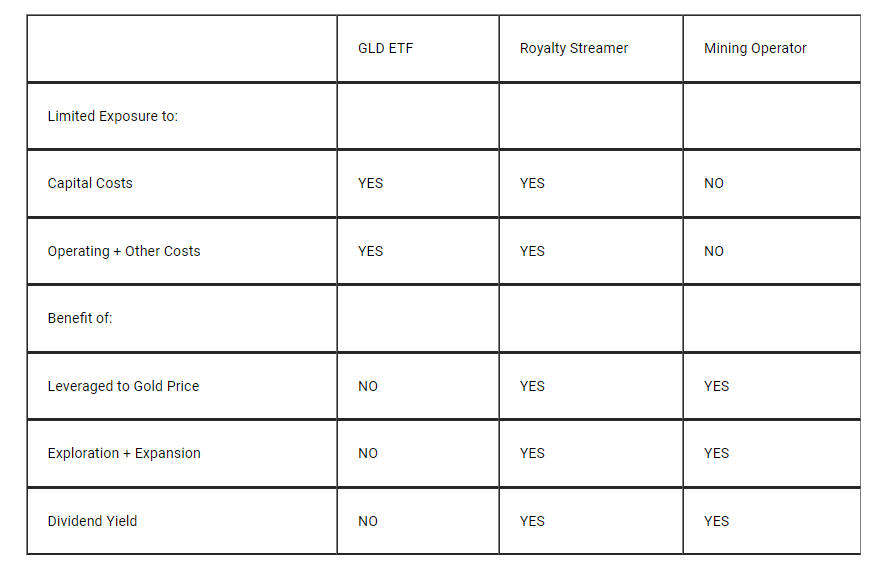

I have covered why I love royalty and streamers in this article. To quickly summarize, the overhead costs are low. These companies can be run by less than 20 people. Mining is expensive with tons of costs, and you can’t really stop even when metal prices are falling. Here is a chart proving the superiority of investing in royalties and streamers compared to GLD and a mining operator.

Royalty and streamers can do well when metal prices are falling too. They still get the royalty, and good management will look for deals when prices are down. I really think this is one of the best business models created.

For more info, take a look at this educational video:

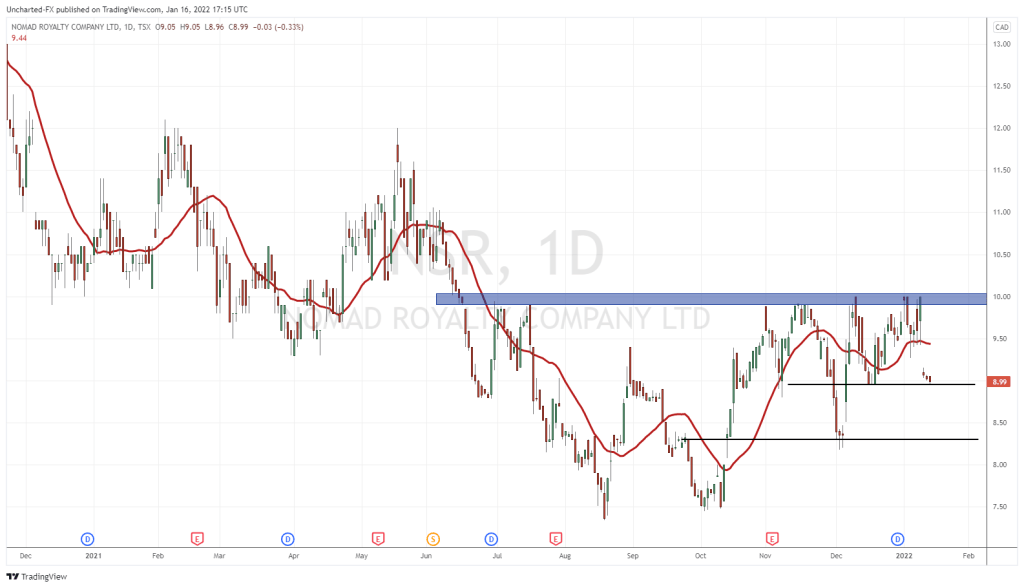

Now onto the chart of Nomad Royalty. The stock looked really exciting near $10. A breakout would trigger a reversal pattern. It does look like a cup and handle, but some would say it looks like a broader inverse head and shoulders. What matters is the market structure went from a downtrend to a range, and a new uptrend was looking likely.

Another important lesson on why it pays to be patient. The trigger was the break and close above the $10 resistance zone. The stock did not confirm this, and fell on major news afterwards. Pay attention to these support and resistance zones. They work really well.

As you can see, Nomad Royalty dropped on the $9.10 financing. The stock could see another drop on dilution if the underwriters exercise the option to purchase up to an additional 15%. The price closed right at support on Friday. A break and close below this support, would set us for a drop down to $8.30. Let’s see how this support holds today on Monday.

There is also a large gap between $9.15-$9.50. This will act as resistance, and Nomad must close back above this gap to begin to price in a new uptrend. To be honest, I have a feeling this gap will be closed quickly depending on the gold and silver price action. Even though Nomad diluted shares, they do have a lot of cash to work with to get catalysts going when gold and silver prices are looking ready to breakout. A strategic raise frontrunning breakouts. If so, I expect money to run into the royalty and streamers, including Nomad Royalty.

Everything looks great for the precious metals. The only caveat is the US Dollar, but even rising yields are not putting the pressure expected on gold. Let’s follow that in the upcoming weeks. Let’s watch Nomad at this support, and see if it can fill the gap. I do think you want to be in this company or any royalty and streamers for the long term, and not just as a trade. The breakout above $10.00 is still the trigger for the uptrend, but these prices present a great opportunity for an entry. I still remain a bull.

Pingback: Nomad Royalty (NSR.TO) Raises $40 Million as Gold Tests Recent Highs – DailyBubble News