On December 22nd 2021, I covered the technicals on Wellfield Technologies (WFLD.V), a company focused on decentralized finance (DeFi) by building open and accessible decentralized protocols and also blockchain based consumer products.

In that post, I discussed the printing of all time record lows (again, the stop just IPO’d recently), and how a recovery and close above $1.25 would be crucial. This price zone would act as new support. The technicals would be supportive, but a catalyst would be required to get the stock moving.

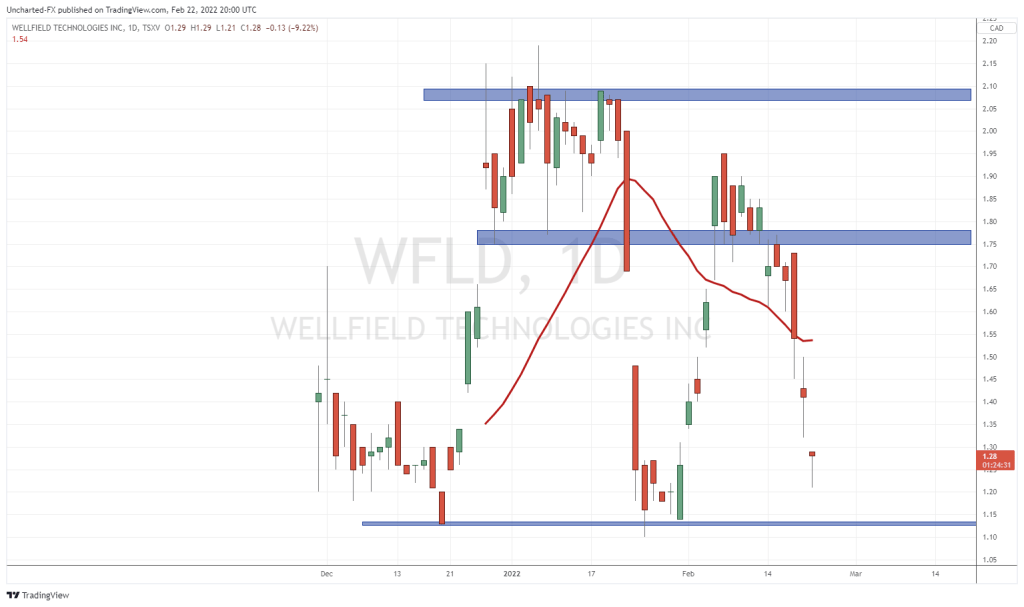

Here is how the chart looked on that post:

Let’s just say…Wellfield got the catalyst. During the holiday period, the stock market sees less liquidity, and therefore, stocks and other assets can make very volatile moves. I tend to see companies put out bad news because they know not many prying eyes will be on the market and on their charts. However, sometimes we get news that is positive and causes a nice rally. For Wellfield, it wasn’t just a nice rally, but a SPECTACULAR rally.

Since the record lows printed on December 20th 2021, the stock popped early 90% to print new all time record highs at $2.15 before retracing. Crazy. From printing record lows to record highs within a span of seven days.

Before we get to the chart, let’s cover the major press release. Wellfield Technologies announced the appointment of globally recognized computer science expert Amir Shpilka as Member of Advisory Board. Our very own Crypto asset (can I still call him our Master of Coin?) Joseph Morton covered this news and what it means. Here are some excerpts from his piece, which can be fully read here.

Here’s what Shpilka brings to the table:

Amir Shpilka is a globally recognized professor and researcher in the field of theoretical computer science. His main research focus is on computational complexity theory, algebraic complexity, and coding theory.Currently, Prof. Shpilka is a faculty member at the Blavatnik School of Computer Science, at Tel Aviv University, where he previously served as the head of the Computer Science Department.

Professor Shpilka has been a significant contributor to Wellfield’s blockchain technology, almost since inception, and he now joins the Advisory Board as the Company begins to commercialize its IP.

Shpilka has been involved in Seamless Logic Software, a wholly owned subsidiary of Wellfield, almost since its inception. He brings a PhD from computer science and mathematics from Hebrew University in Jerusalem to the table, and before he moved to Tel Aviv University, he served as a professor of computer science at the Technion-Israel Institute of Technology, and supervised students that went onto teach at schools like Princeton, University of Illinois at Urbana Champagne.

On the release of the Shpilka news, the stock closed up 19.25% for the day, and saw volume of 706,776 shares traded. The most shares traded on Wellfield ever. Major record broken for the stock: the largest gain per day, new record highs, and the most volume traded.

Since then, we have had more news such as another appointment (Marshall M.Ball), expansion its engineering development capacity for the Seamless Brand (more info on Seamless below) with a new hub in Portugal, and subsidiary MoneyClip joining the Paytechs of Canada, an association comprised of leaders in Canadian Fintech.

After a spectacular rip, the stock has given back most of those gains:

I have an interim resistance zone at $1.75, but the big resistance remains the $2.10 level. Now, prices are heading towards our major support zone around $1.15. The fall here is caused by other issues in my opinion. Broader stock markets are falling given the geopolitical situation over in Eastern Europe.

The crypto’s are still acting like risk on assets just like stocks. Smaller cap stocks tend to get hit the most if markets continue to fall. I would be watching for an overall bounce in markets, and watch how Wellfield acts at support. A huge engulfing candle like one printed on January 31st 2022, would be a good sign of buyers defending.

Longer term, I like the DeFi space. Some of you know from my 2022 Cryptocurrency Outlook, I am excited about this space, and expect Square Inc, now Block Inc, to make big moves which will only be positive for DeFi and DeFi stocks in general. I own some tokens, and I still think that is the best way to play DeFi. However, if the risk isn’t your thing, then you can pick up shares in WellField and others to play the sector.

2022 will be a big year for Wellfield Technologies with the anticipated release of Seamless. A lot to look forward to if you are a long term investor.