Let’s be honest. 2021 wasn’t a great year for cannabis. We kicked off the year with some excitement and hope that the new Democrat administration would federally legalize cannabis. Things looked like they were progressing in Spring with Chuck Schumer but cannabis was put to the side due to other pressing government matters. Of which there were a lot…and 2022 will probably see more.

The ongoing legalization of Cannabis will still be the hot topic in 2022. To end the year, we had renewed hope with Republican Nancy Mace. But nothing came to fruition. Then at the beginning of December 2021, marijuana banking reform was tucked into Congress’s annual military spending bill… but failed.

Here is a great summary from Forbes heading into 2022:

After years of inaction, this Democratic Party-controlled Congress seemed the likeliest in decades to pass some significant reform of federal marijuana policy, which has been virtually unchanged since former President Richard M. Nixon signed the Controlled Substances Act more than 50 years ago.

While Majority Leader Chuck Schumer and other top Democrats have sponsored outright federal legalization, the best chance for a win in Washington seemed to be what’s known as the Secure And Fair Enforcement Banking Act.

Currently, most major banks refuse to work with cannabis businesses, which are all illegal under federal law. This means state legal dispensaries and other businesses that deal with marijuana are in turn are forced to pay state and federal taxes (as well as all of their other bills) in cash.

The SAFE Banking Act promised to make this situation easier by prohibiting federal banking regulators from punishing financial institutions that work with “legitimate cannabis-related” businesses.

2021 ended with no notable reform in the cannabis industry. Here is hoping 2022 will be different. Will 2022 be the year that the US finally legalizes marijuana federally? Or will it be another letdown for cannabis investors? I’m not someone that really has high hopes for the government (specifically career politicians who have been in office for decades and done nothing) doing what they say they will do, but for what it is worth, Chuck Schumer is back in the fold spearheading cannabis legalization. Judging by his Twitter, he seems a bit more focused on student debt, but he did tweet this out in December:

Personally, I would be focused more on the US side of things rather than Canadian. A catalyst at this point seems more likely down South of the border. Also, I would be focused more on the actual growers of cannabis. Edibles and retail don’t really interest me because of the competition, but of course there are some gems out there. Funnily enough, I like the growers because it also incorporates elements of farming and agriculture. Sort of my thing. Check out my weekly Agriculture sector roundups. But companies like Agrify (AGFY) and others that focus on vertical integrated and indoor farming solutions are developing fully integrated, data-driven, evidence-based cultivation solutions for Cannabis, Hemp & Other High-Value Crops.

Cannabis in a money flow perspective also catches my fancy. The stock markets are rising because there is nowhere to go for yield. As long as the Fed easy money policy continues, stock markets will continue to be moving higher. Add the inflation element too. The reason why inflation is rising is because of the Fed. Money is not going to productive things, and we are now in a situation where there are people with more money competing for the same number of goods and services. To beat rising inflation, money will flow into stock markets. Dips will be bought, but here is where cannabis and other sectors may benefit: Cannabis looks cheap in comparison to everything else.

If markets continue to rise, money will start looking for cheaper things betting on everything to ‘catch up’. In other words, money will start looking for bargains. Again, I suggest keeping tabs on US cannabis growers. This may seem too simple for readers, but I really don’t think this market cares about fundamentals such as forward guidance and p/e ratios. It is all about chasing yield.

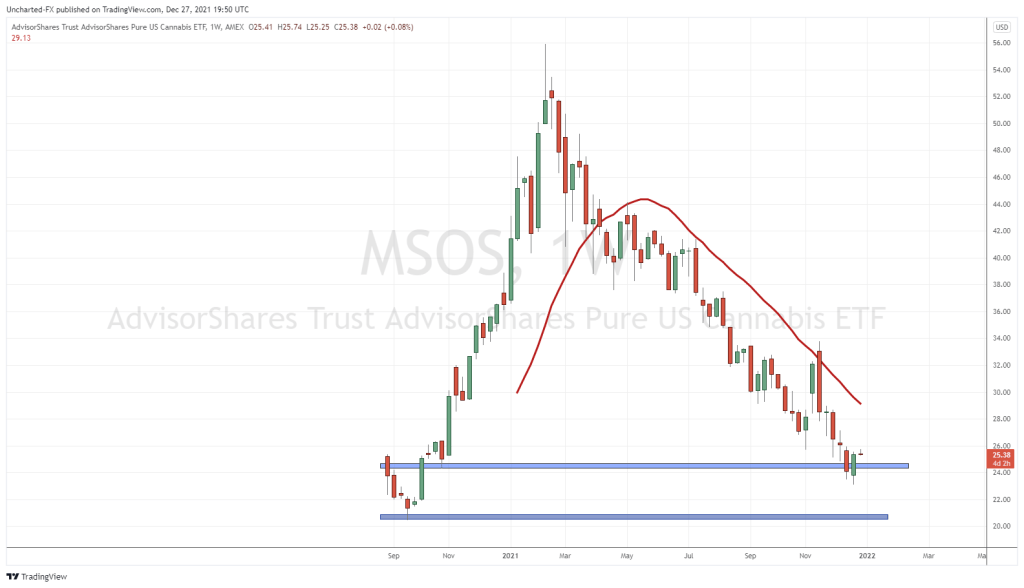

If you don’t want to pick out individual cannabis stocks, I suggest the ETF MSOS, or the Pure US Cannabis ETF. The name tells you what this ETF is all about.

“MSOS is the first and only actively managed U.S.-listed ETF with dedicated cannabis exposure focusing exclusively on U.S. companies, including multi-state operators. The portfolio manager allocates across an investable universe of U.S. companies spanning a variety of cannabis-related businesses.”

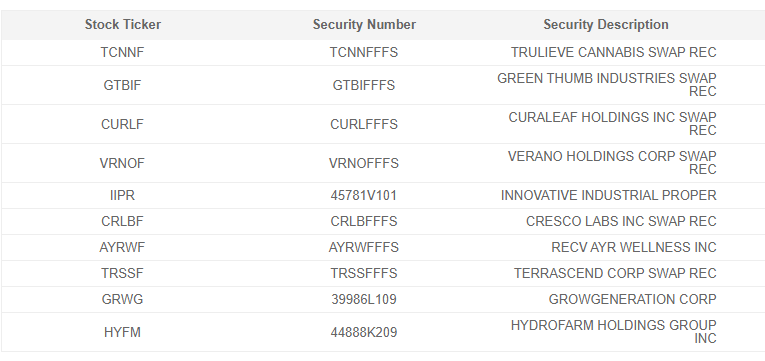

Here are the holdings, and these are exactly the companies I would be watching individually if you prefer. Companies like Trulieve, Green Thumb, Ayr Wellness, and Curaleaf are on my list.

On the technicals, I have a weekly chart for you guys. As you can see, 2021 was a rough year. But recently, we have hit a major support zone on the weekly chart at the $24.00 zone. Not going to lie, but technically, this is exciting. The price action is significant because last week, we got a red weekly candle close below this support zone. A breakdown. Very bearish. But on the retest, we got a close back above $24. A fake out, or a false break down. Bullish.

Look back at the weekly candle in November 0f 2020. Cannabis bulls would love to create the same 128% move from this support. I wouldn’t be itching to pull the buy trigger this week, I would prefer to wait until the first few weeks of January. We could either range here, or pullback lower to retest $24. If we can get a weekly close above $27.00 (would trigger a pattern on the daily chart), it would be a long trigger with investors placing a stop loss below $24. Just ride.

If you are investing in the US cannabis stocks, I suggest keeping tabs on the Russell 2000 index, or the small cap index. In Market Moment posts, I have mentioned how US cannabis follows the trajectory of the Russell 2000. They are listed on the OTC so it makes sense. Technically they are ‘small caps’. With the Russell 2000 bouncing from a major support, MSOS has a high probability of following. If the Russell for some reason breaks below 2120…then it would initiate a new downtrend and bear market, which suffice to say, wouldn’t bode well for MSOS. New record lows would be a sure thing.

To end off, let’s quickly look at the weekly charts of the aforementioned companies (Ayr Wellness, Green Thumb, Trulieve and Curaleaf). I will be showing the US market charts, but they all can be traded on the Canadian exchange. The charts look similar, just in Canadian dollars of course.

Most of the charts will look like MSOS. A downtrend, with signs of bottoming at support. Curaleaf here got some bids at $8.00. What I want to see is a confirmed weekly close ABOVE the downtrend line I have drawn.

Ayr Wellness has printed record lows on the US listing. The Canadian listing can give us hints of where support can come in. Ayr is finding support and bouncing in Canada, which means the US listing may have bottomed at $12. The next few weeks will be big. If we can get a weekly close above the moving average here, that would be big. I would also love to see a weekly candle close above $16. That would trigger a lovely inverse head and shoulders pattern on the weekly chart. And who doesn’t love inverse head and shoulders patterns?

The last two charts here are somewhat different. Green Thumb has held relatively well, rather than a straight decline. The drop was a bit more choppy and held above the $18 support zone from November. I like this level for a bounce. We are seeing some nice price action here so far, but a nice strong weekly close above my moving average and this down trend line will get this stock going. This could be triggered by the end of this week, giving us an entry opportunity in the first week of the New Year!

Last but not least, Trulieve. Everything I have been saying about a breakout candidate has been met here on Trulieve. A bounce from support, a weekly close above my moving average, and a weekly close above a down trend line. There could be some interim resistance at $28, which could create a pullback down to our breakout for a re-entry opportunity. Then, a weekly close above $30 sets us up for a new major uptrend.

The Cannabis charts are setting up nicely at the end of 2021, and are hinting towards a significant 2022. Will government decisions influence cannabis? Or will money flow into the space regardless because of how cheap they are in comparison? Time will tell.