It hasn’t been fun being invested in the Cannabis space recently. A lot of eyes have been on the US side of things. The catalyst being Federal deregulation. I am referring to the States Reform Act championed by Republican congresswoman Nancy Mace. Here is what would be included:

-Cannabis would be federally descheduled and treated in a manner similar to alcohol.

-A 3.75 percent excise tax would be imposed on cannabis sales. Revenue would support grant programs for community reentry, law enforcement and Small Business Administration (SBA) aid for newly licensed businesses.

-The Treasury Department’s Alcohol and Tobacco Tax and Trade Bureau (TTB) would be the chief regulator for marijuana with respect to interstate commerce.

-The Food and Drug Administration (FDA) would be limited in its regulatory authority, with the intent being that it would have no more control over cannabis than it does for alcohol except when it comes to medical cannabis. The agency could prescribe serving sizes, certify designated state medical cannabis products and approve and regulate pharmaceuticals derived from marijuana, but could not ban the use of cannabis or its derivates in non-drug applications, like in designated state medical cannabis products, dietary supplements, foods, beverages, non-drug topicals or cosmetics.

-Raw cannabis would be considered an agricultural commodity regulated by the U.S. Department of Agriculture (USDA).

-The legislation would grandfather existing state-licensed cannabis operators into the federal scheme to ensure continued patient access and incentivize participation in the legal market.

-As federal agencies work to promulgate rules, there would be safe harbor provisions to protect patients and marijuana businesses acting in compliance with existing state laws.

-People with certain federal cannabis convictions that were non-violent would be eligible for expungements.

-To prevent youth use, there would be a mandatory 21 age limit for recreational cannabis, and the bill also prescribes certain restrictions on things like advertising.

-SBA would need to treat marijuana businesses the same as other regulated markets, like it does for alcohol companies, for example.

-The measure also stipulates that veterans can’t face discrimination in federal hiring due to cannabis use, and doctors with the U.S. Department of Veterans Affairs (VA) would be specifically authorized to issue recommendations for medical cannabis for veterans.

-Federal agencies could continue to drug test for marijuana.

-The Bureau of Labor Statistics (BLS) would be required to issue a report to Congress on the marijuana industry.

Unfortunately, nothing has come out of it. It seems Congress has more pressing matters. Same story like before, when Chuck Schumer was leading the Democratic push for Cannabis Federal Deregulation in Spring of this year. Nothing happened. For those betting on a catalyst to come from the government side…you might be disappointed.

In my opinion, this is where technicals can come in handy, but the key question is buying at the right time. Let’s be honest, the beatdown on Cannabis means that this sector looks cheap compared to everything else. A good time for picking up bargains. Just my take: I would prefer to hold the companies that actually grow Cannabis.

In previous Market Moment articles, I have written about the Russell 2000. A very important index that tends to be a leading indicator to determine where US Stock Markets are moving. This index is also important for US Cannabis. I have found that the OTC listed Cannabis companies in the US, move with the Russell. When the Russell broke out, it was when Cannabis stocks were having their nice pops and breakouts…which turned to be false breakouts, just like the Russell closing back below breakout support.

If the Russell can begin to climb back across 2340, watch the reaction and movement on US Cannabis stocks!

Just like the US Cannabis ETF, MSOS, the Canadian Cannabis ETF, HMMJ, is not looking too bullish. We had a huge support at $7.35 that needed to hold. The hope was there would be a bounce from there. Just another reason why waiting for breakouts is important in trading.

Instead, we broke down below support. To turn back bullish, we must climb and close back above $7.35. Otherwise, it looks like another lower high swing is incoming, which would take us down to $6.00. Which means another leg lower for most Canadian listed Cannabis stocks.

But here are some positive things to look for:

Above are some Canadian listed charts, but they can also be traded in the US. I have shown above the charts of Verano (VRNO), Tilray (TLRY), and Aurora Cannabis (ACB). A lot of them are indicating some basing or are at major support zones. Basing and ranges are great, but the breakout is what matters to confirm a new trend. Verano is holding up well given the clobbering Cannabis has been taking. It looks the best out of the bunch. Just watch to see if it can hold even with HMMJ dumping, or if we can climb across $16.30.

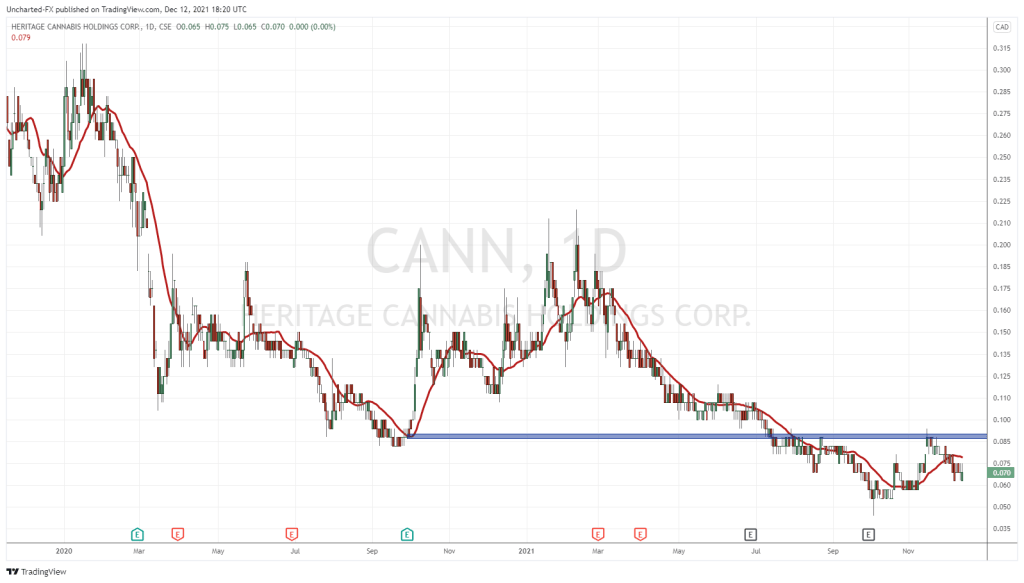

Speaking about bottom picker plays, let’s take a look at Heritage Cannabis (CANN.C).

Heritage Cannabis is a leading cannabis company offering innovative products to both the medical and recreational legal cannabis markets in Canada and the U.S., operating under two licensed manufacturing facilities in Canada. The company has an extensive portfolio of high-quality cannabis products under the brands Purefarma, Pura Vida, RAD, Premium 5, feelgood., CB4 suite of medical products in Canada, and ArthroCBD in the US.

Just two months ago, Heritage Cannabis announced record sales in Q4 and the continued drive towards a positive cash flow. The most recent news release details a commercial agreement with Canopy Growth for the supply of bulk concentrates, including live resin. Future purchase and shipments are to follow.

“I am honoured that Heritage is being recognized by Canopy and was selected as the pre-eminent commercial partner to supply their bulk concentrates,” said David Schwede, CEO of Heritage. “We are excited to launch this relationship as it demonstrates our depth and breadth of experience in cannabis extraction and provides a high gross margin revenue stream to our well-established platform – one that we will continue to grow through a number of additional commercial relationships we are pursuing.”

Chart wise, Heritage Cannabis may attract the eyes of bottom pickers. The stock printed all-time record lows on October 4th 2021, hitting a price of $0.045, before bouncing 100% to hit $0.085 on November 15th 2021. Also the day the Canopy Growth agreement news came out.

No momentum on the stock afterwards, and we continued to sell off after trying to break above $0.085 for six full trading days. Our key levels now become $0.045 support to the downside, and $0.085 resistance to the upside. A breakout or breakdown indicates the next move.

In summary, I would be watching the Russell action, and the action on the ETF HMMJ. If those get a decent bounce, it might be time to start acquiring cheap Cannabis stocks. If not, then the pain isn’t over just yet. A big week for Cannabis, and Stocks overall with the Federal Reserve Interest Rate Decision on Wednesday December 15th.