AMPD Ventures Inc is a technology company, provides cloud and computing solutions to gaming and digital media companies in Canada and the United States. The company offers solutions for video games and eSports, computer graphics rendering, artificial intelligence, machine learning, mixed reality, and big data processing fields. It also provides AMPD Virtual Studio, a suite of private cloud-based solutions designed to create infrastructure-less studio; AMPD Virtual Workstation; AMPD Render solutions; AMPD Storage solutions; AMPD Metal, a bare metal server product; AMPD Cloud Plus; AMPD Flexible Edge; AMPD Virtual Production Services; AMPD Machine Learning Platform; AMPD CDN solutions; AMPD Game Hosting; and AMPD Studio.

This is one of Chris Parry’s favorite companies, and Equity Guru has been telling readers about this company ever since it was under $0.20. Investors who took our advice have doubled their money.

Recent news details an oversubscribed non-brokered private placement to invest in Metaverse initiatives. Here are some details from the press release:

The Private Placement was announced on October 26, 2021, with the Company initially expecting to issue up to 11,666,667 units at a price of CAD $0.30 per Unit for aggregate gross proceeds of up to CAD $3.5M. The Company announced an increase in the size of the Private Placement on November 1, 2021, increasing the number of Units to up to 16,666,777 Units for aggregate gross proceeds of CAD $5.0M.

The Private Placement closed on November 25, 2021, and the Company issued 23,139,663 Units at a price of CAD $0.30 per Unit, for aggregate gross proceeds of CAD $6,941,900.

“This positive response from existing and new AMPD investors demonstrates confidence in the company, recognition of the progress we have been making, and high levels of interest in our emerging Metaverse-related initiatives across AMPD’s core infrastructure business, as well as the anticipated acquisition of Departure Lounge Inc.,” said Anthony Brown, CEO at AMPD.

The Company intends to use CAD $2.5M of the proceeds from the Private Placement to fund the ongoing operations of Departure Lounge post Acquisition and has increased the planned allocation to general working capital to AMPD from the Private Placement from CAD $2.5M to CAD $4.4M, to accelerate the rollout of AMPD’s High-Performance Edge computing environments around the world.

The headline definitely got the stock moving, as anything and everything Metaverse is getting investor’s attention. From stocks to even NFT’s.

AMPD is no exception. The press release was released last week Friday post market. Investors and traders got to react to the news on Monday’s open. And react they did. The stock popped over 28% with a volume of 1,181,238 shares traded. But the key is it broke above a key resistance zone with a strong candle and big volume.

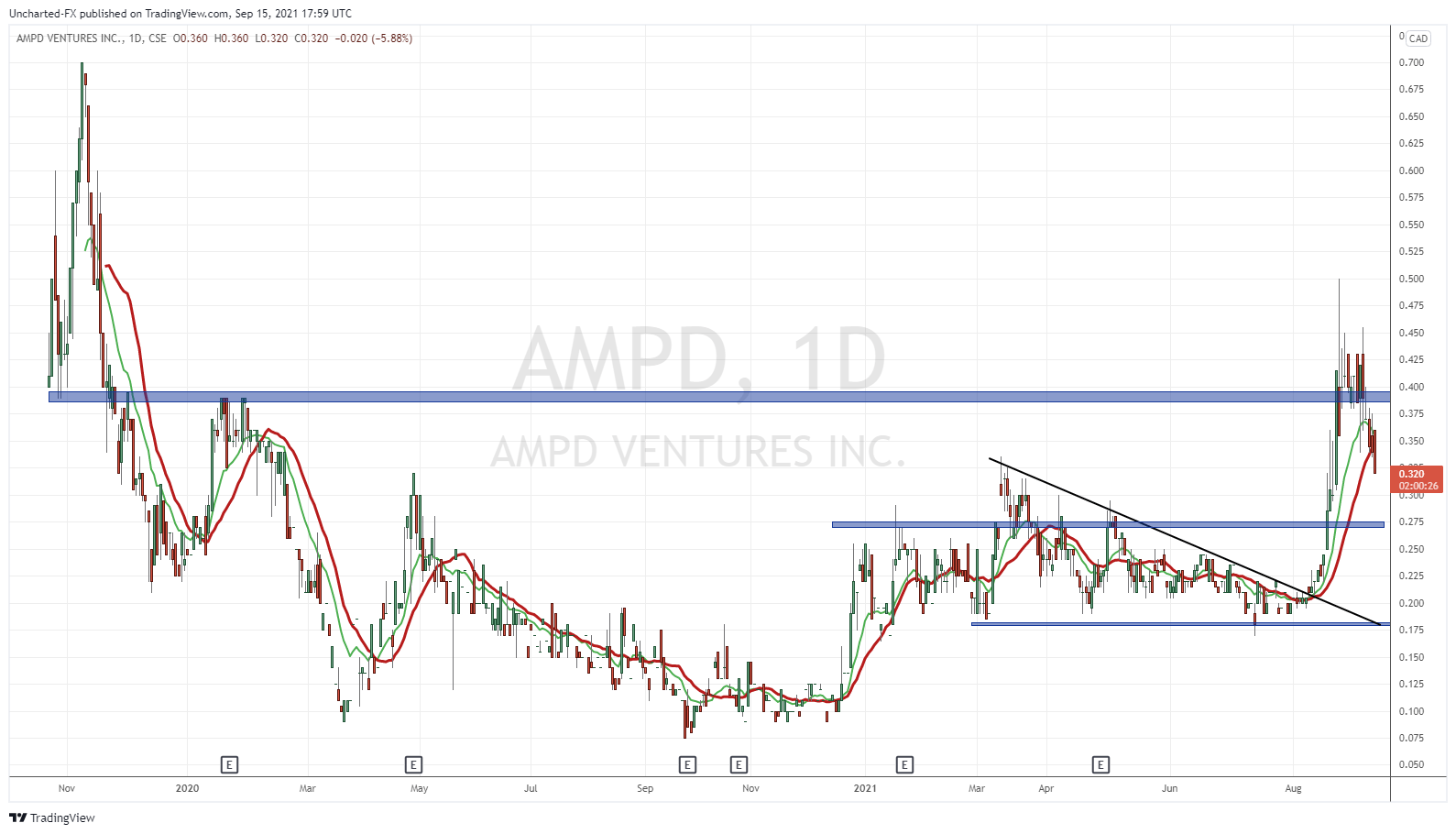

Before we look at the current chart, here is the chart I previously posted the last I wrote about AMPD:

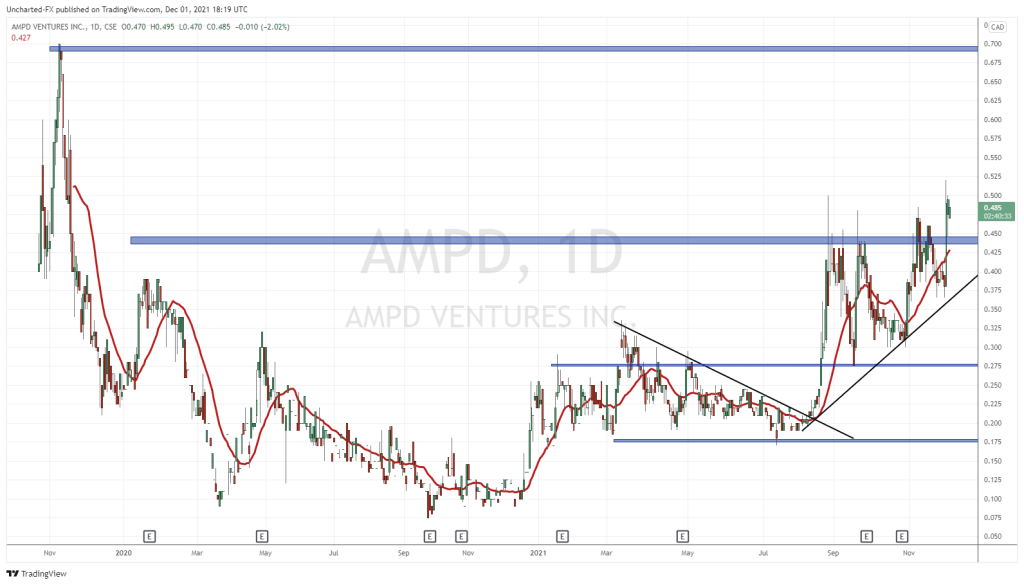

The breakout and the support and resistance levels at $0.275 and $0.40 were our key zones. Here is the present chart:

My support of $0.275 held, and the new resistance became the highs at $0.45. We did break above this resistance on November 5th 2021, but unfortunately, price did not hold above. The retest failed, and the stock price was pushed below. A false breakout. We attempted again. It did not, and to no avail.

The recent breakout was due to the Metaverse catalyst news. As I said, big volume and a strong candle. Let me zoom in to show you the retest a bit better:

Boom. That’s what we want to see on a retest. Buyers stepped in a day after to buy the dip at $0.45. What was once a resistance zone, now becomes new support. The stock is looking real bullish, and AMPD has the cash to initiate a catalyst.

Now here are some things to keep in mind going forward. First off the $0.50 zone. In the past few trading days, we just cannot climb above it. $0.50 is an important psychological resistance zone for stocks traded under $1.00. If we can get a nice close above $0.50, AMPD gets even more bullish. Secondly, the stock remains in an uptrend as long as the price is above $0.375. I have drawn an uptrend line to show you the strength of the trend.

Finally, and this is the great part for current shareholders: there really is no more resistance until we hit previous record highs at $0.70. Some may argue there is an interim resistance at $0.60, but I create my zones due to multiple touches. Being a whole number, perhaps it can provide some psychological resistance, but I think $0.50 is much more important in this regard.

The technicals look great, the company has funds, it has the Metaverse factor, and the company is moving forward with all their revenue generating businesses. The future looks bright for AMPD Ventures.