I’m trying hard to ignore last Friday’s market shocks—the extreme volatility and downward price chart trajectory triggered by a new variant of the coronavirus. To prevent this piece from going all Madison Cooper, I’m cutting right to the chase.

A list of ExploreCos with sub-$20M market caps (M thru V)

Once again, this is NOT a complete list by any measure.

Mas Gold (MAS.V)

- 140 million shares outstanding

- $14.7M market cap based on its recent $0.105 close

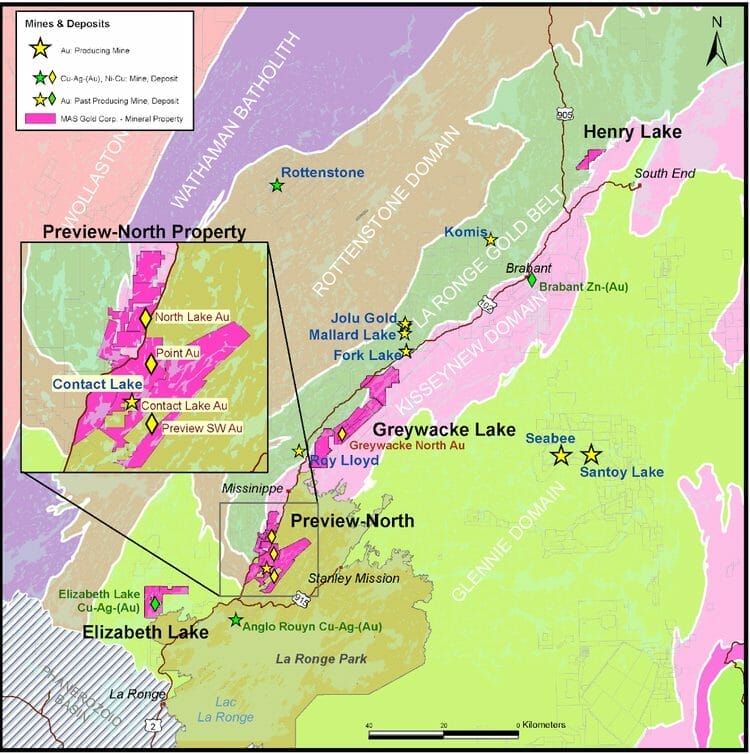

Like SKRR Exploration (featured further down the page), Mas Gold is focused on Saskatchewan’s vastly underexplored Trans-Hudson Corridor, along the La Ronge Gold Belt.

Mas’ 2021 exploration efforts along the La Ronge Belt were geared to:

- Increase the gold resource size and definition confidence of the current resource estimates for the Greywacke North and North Lake deposits.

- Define a resource at the Point deposit.

- Continue chemical and physical characterization of gold-mineralized materials from the North Lake, Greywacke & Point deposits to confirm compatibility for process comingling.

- Systematically drill test the Greywacke South and Central zones, as well as the Lyons zone at North Lake.

- Establish a long-term, working-level relationship with the Lac La Ronge Indian Band, the Metis Local, and the greater community of La Ronge.

- Undertake required assessment work at Elizabeth Lake and Henry Lake Properties.

- Identify regional “opportunities”.

The resource at the Greywacke North Deposit currently stands at 81,500 ounces @ 9.92 g/t Au Indicated and 14,100 ounces @ 7.42 g/t Au Inferred.

A 2,913 meter 2021 winter drill program at Greywacke North tagged the following intervals:

Greywacke North deposit

- 7.36 g/t over 9.9 meters (this hole infills a data void within the center of the Greywacke North deposit);

- 3.79 g/t over 5.53 meters;

- 1.39 g/t Au over 10.12 meters (including 2.19 g/t Au over 3.12 meters).

Greywacke South Zone

- 3.8 g/t over 8.16 meters (including 5.7 g/t over 2 meters) and 10.87 g/t over 1 meter – a hole that successfully tested the extension down dip;

- 2.34 g/t Au over 1.5 meters (designed to test for mineralization within the Greywacke Central zone).

The resource at the North Lake Deposit (Preview North Project) currently stands at 417,000 ounces at 0.92 g/t Au Inferred.

2021 North Lake Deposit drilling highlights:

- 0.927 g/t gold over 122.5 meters;

- 1.093 g/t gold over 30.7 meters;

- 1.249 g/t gold over 117.2 meters;

- 0.741 g/t gold over a 85.4 meters;

- 1.080 g/t gold over a 119.0 meters.

There appears to be very good mineralized continuity in these broader intervals.

On September 13th the Company announced a new acquisition—a 100% interest in the past-producing Contact Lake Gold Mine.

And this just in…

MAS Gold Provides Final North Lake Drill Results

The highlight interval from this November 29th press release was in Hole NL21-068: 1.38 g/t gold over a 103 meter interval.

An extensive 5,500 meter North Lake winter-of-2022 drill program is on deck.

Minnova Corp (MCI.V)

- 43.58 million shares outstanding

- $6.75M market cap based on its recent $0.155 close

Minnova hasn’t generated much in the way of newsflow over the past year, but a recent (modest) PP suggests the Company is about to find a gear.

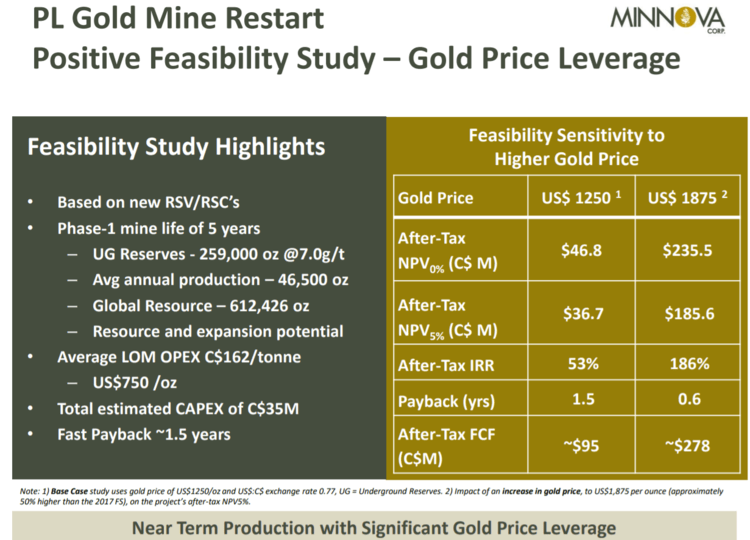

The Company’s flagship asset is the past-producing PL Gold Mine Project in the prolific Flin Flon–Snow Lake Greenstone Belt of Central Manitoba.

The current global resource at the PL Project stands at 700k-plus high-grade ounces.

The project boasts some compelling economics with a very modest CapEx:

I first featured this Company in August of 2020 in a piece titled A new addition to the Highballer shortlist – Minnova Corp (MCI.V)… Since then, save for the odd flurry of drill hole assays, there has been minimal movement here. Higher Au prices should motivate management to push this one further along the curve.

Company website (STILL a work in progress)

Norra Metals (NORA.V)

- 87.3 million shares outstanding

- $3.49M market cap based on its recent sub-nickel close

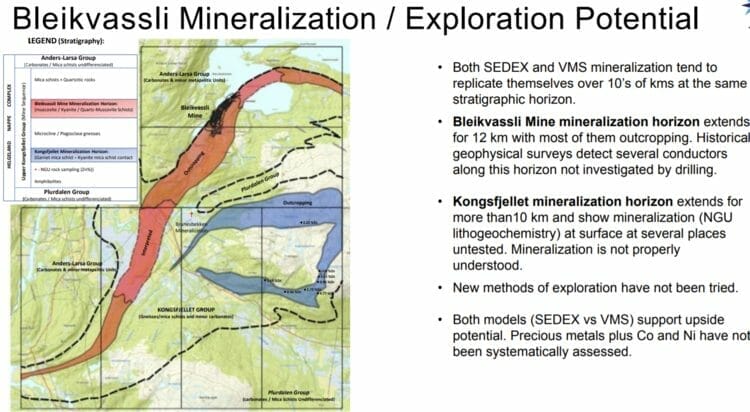

Norra Metals’ 6,000-hectare flagship Bleikvassli Project is located in the Hemnes Municipality of the Nordland Fylke Province of Norway.

The property hosts a past-producing SEDEX-style (sediment-hosted) massive sulphide Pb-Zn deposit with minor Cu, Au, and Ag credits. The mine began operations in 1957 producing 5.0 million tonnes of material grading 4.0% Zn, 2% Pb, 0.15% Cu, and 25g/t Ag. The mine, which closed in 1997 due to low metal prices, ditched a (historic) resource of 720,000 tonnes grading 5.17% Zn, 2.72% Pb, 0.27% Cu, 45g/t Ag, 0.2g/t Au (according to the Norwegian Geological Survey).

The Company’s 20,300-hectare Meråker Project is located in the Meråker municipality of Trøndelag County, Norway.

Norra’s Pyramid Project is a greenfield copper-gold porphyry project located along the Quesnel Terrane of British Columbia. I believe Pyramid is available for option.

Norra has been dormant for the better part of a year. The following headline represents the only news item I can find in 2021, and it dates back to early February.

Norra Metals Adds Senior Geologist to Technical Team

A quote from this February 2nd press release kinda piques my curiosity:

“We are pleased to have Mr. Caessa join the Norra technical team,” said Mike Devji, President and CEO of Norra Metals Corp. “Mr. Caessa is well-known in the exploration community, not only for his technical expertise, but through his past affiliation with Lundin Mining and EuroZinc as a project geologist. He will be developing and leading the field programs during the upcoming exploration at both Bleikvassli and Meråker properties.”

There’s been no real news this year, but they have a highly regarded geologist on board, and the Company’s deck appears to be up to date.

If/when the Company decides to get active on one of its Norwegian properties, the stock has room to move off these lowly levels.

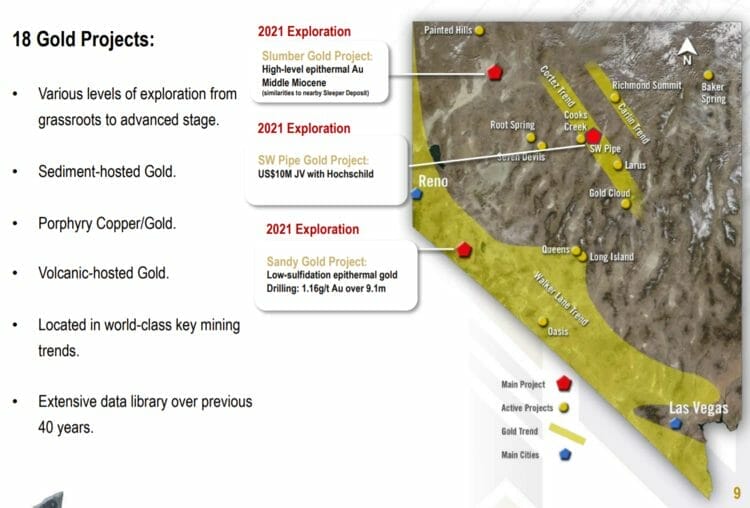

NV Gold (NVX.V)

- 79.58 million shares outstanding

- $10.35M market cap based on its recent $0.13 close

I’ve featured NVX in numerous roundups as a prospector generator with an extensive portfolio of Nevada-based projects over the past few years. The stock occasionally claims higher ground on the price chart but is never able to hold the altitude.

On the Company’s home page, you get the following communiqué…

This highly competent management team is confident they’re holding a world-class discovery somewhere along their project pipeline, somewhere in these subsurface layers. Be bold and mighty forces will come to your aid?

This crew’s in-house technical knowledge and a decades-in-the-making geological database of research and exploration could serve as a formidable foundation from which to build the lofty ounce count envisaged above.

An April 26th press release put a spotlight on their SW Pipe Project and triggered a flurry of speculative trading activity:

SW Pipe is located in a very upscale neighborhood—along the Cortez Gold Belt roughly six kilometers southwest of the Pipeline Gold Mine operated by Nevada Gold Mines (a JV between Barrick and Newmont).

NV Gold has been active on several fronts in 2021.

On October 7th, the Company updated shareholders on plans for five of its Nevada projects:

- The upcoming Slumber Gold Project drill program is designed to determine the extent of additional near-surface oxide-mineralization at its north-central Nevada project (see Figure 1). The 6 to 8 hole drill program should be underway by now.

- The Discovery Bay Project is located approximately 15 kilometers southeast of the Cove-McCoy gold deposits in Lander County, Nevada controlled by I-80 Gold (see Figure 1). This North-South structural zone, also known as the “Rabbit Suture”, hosts other significant gold deposits such as Turquoise Ridge, Twin Creeks as well as the Fortitude, Phoenix and Lone Tree Mines. Drilling of a four-hole recon program is expected to commence in November.

- The Pickhandle Gold Project is located at the structural intersection of the Rabbit Suture (Hwy 305) and the Crescent Valley Fault Zone (see Figure 1). Pickhandle is located 25 kilometers south of the Discovery Bay Project. The 3-4-hole drilling program is anticipated to begin in December.

- The recently announced IP/Resistivity program at the Sandy Gold Project has added a highly compelling target that will likely be drilled in Q1 2022. See news release on 9/28/2021.

- At the SW Pipe Project, a 2D Seismic survey was recently completed by the optionee to determine depth to Carlin-type host lithologies and structural drill targets (see Figure 2). Drilling at SW Pipe is scheduled for mid-2022 depending on core rig availability.

An October 25th press release announced the commencement of a 1,500 meter RC drill program at the Slumber Gold Project.

Omineca Mining and Metals (OMM.V)

- 129.99 million shares outstanding

- $20.8M market cap based on its recent $0.16 close

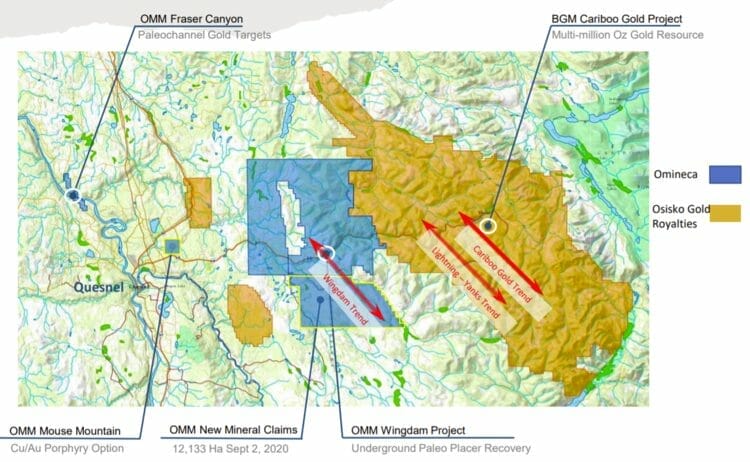

What initially drew my interest in this one is its land package in a region that played host to one of the more spectacular (placer) gold rushes in BCs history—Lightning Creek, Cariboo Mining District, south-central BC.

“In the first day, Mike, he (Ned Campbell) takes out 900 troy ounces“. That one day haul was the equivalent of 75 troy pounds of gold nuggets.

A common theme with many of these prolific placer creeks: “Where did all of that nuggety gold come from?” Omineca may be onto one of the more significant hard rock sources.

The Company has a ‘dual-track program’ underway—an underground bulk sample program and a diamond drill campaign designed to home in on one or more of the (potential) bedrock sources.

The flagship Wingdam Project includes hard-rock tenures totaling 50,000-plus hectares and more than 15 linear kilometers of placer claims along the Lightning Creek valley.

Earlier this summer, the Company began a Phase-2 drill campaign to pin down the aforementioned hard rock sources.

The company is preparing to resume bulk sample operations at Wingdam. The first bulk sampling campaign conducted in 2012 recovered 173.4 oz of placer gold from a single 2.4-meter wide crosscut.

According to an August 20th press release:

“The mining method will involve a series of crosscuts and drifts running the length of the underground paleochannel starting downstream from the first crosscut bulk sample completed in 2012. Stage 1 will take the series of crosscuts and drifts downstream for the first 300 meters. The Company has mapped through sampling, historic drilling, and 3D seismic, 2.4 kilometers of potentially placer gold bearing paleochannel both upstream and downstream of the successful 2012 crosscut. Omineca has an additional 14 kilometers of claims along the Lightning Creek valley which will be explored for the potential continuation of the gold-bearing paleochannel through drilling and 3D seismic programs. The 2012 bulk sample was extracted from a 2.4m x 2.4m x 23m crosscut and yielded 173.4 troy ounces (5.4 kilograms) of placer gold using freeze mining technology to stabilize the ground.”

Ophir Gold (OPHR.V)

- 57.92 million shares outstanding

- $7.82M market cap based on its recent $0.135 close

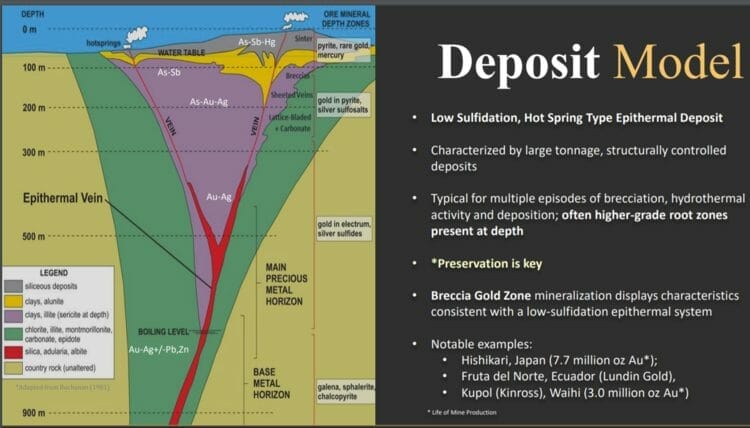

Ophir’s flagship is its Breccia Gold Property, a past-producer located in Lemhi County, Idaho. The Company stands to earn a 100% interest in the project from Canagold (formerly Canarc Resource) and DG Resource Management Ltd.

Exploration and development activity on the property dates back to the 1930’s—several thousand tons of mineralized quartz veined material was extracted from multiple adits. In the 1980s, a 4,621-ton bulk sample yielded an average grade of 0.335 oz/t Au.

The property has since been re-assembled by the Company, and now covers both the Meadows Fault Zone and the lesser explored, parallel Musgrove Mine Trend. Recent exploration carried out in 2018, 2019 & 2020 has included the re-mapping, sampling and a magnetic survey of the Meadows Fault Zone. The results are suggestive of a significant low-sulfidation, epithermal gold system with a very low level of erosion and strong potential for significant gold mineralization at depth.

Recent surface produced 57.6 g/t Au and 19.6 g/t Ag in outcrop, and 69 g/t Au and 27.5 g/t Ag in float.

Back in early June, Ophir launched a maiden 3,200-meter drill campaign at Breccia.

On September 20th, the Company updated drilling progress and announced the commencement of a Controlled Source Audio-frequency Magnetotelluric Survey (CSAMT) survey over the property.

Tough drilling conditions and and an active forest fire season initially hindered the pace of drilling.

“A total of approximately 1,295.7 meters over seven drill holes have been completed to date – BG21-001, 002, 003, 003a, 004, 005, and 006. Core length depths range from 69.2 meters (DDH BG21-003, lost due to hole conditions) and 296.3 meters (DDH BG21-006), with all holes oriented to intercept and cross at depth the breccia unit that defines the Meadows Fault Zone. The Company is pleased to report that the breccia unit has been successfully intersected in each hole and is characterized by variable widths of heavy iron-manganese oxide and clay alteration, quartz veining, and silicification, with the unit similar in appearance to that observed at surface. Occurrences of bladed quartz have also been encountered in several drill holes.

Significant clay alteration and occurrences of bladed quartz in drill core are characteristics consistent with the uppermost regions of a low-sulphidation epithermal system. In addition, quartz veining and silicification are observed to increase with depth of the breccia zone intercepted in drill core.”

Additional prospecting on the property led to the discovery of a new breccia outcrop occurrence located roughly 800 meters north-northwest of the drill area, and several hundred meters west of an extensive gold-in-soil anomaly associated with the Meadow’s Fault Zone.

“A total of 16 samples were collected from a series of large breccia outcrops, extending for least 200 m in a generally east-west direction. The discovery indicates a potential splay off the Meadow’s Fault Zone and further highlights the surface exploration potential of the Property, and most specifically the north end of the Meadow’s Fault Zone. Analytical results are expected to be reported shortly.”

Assays from the 2021 drill campaign are pending.

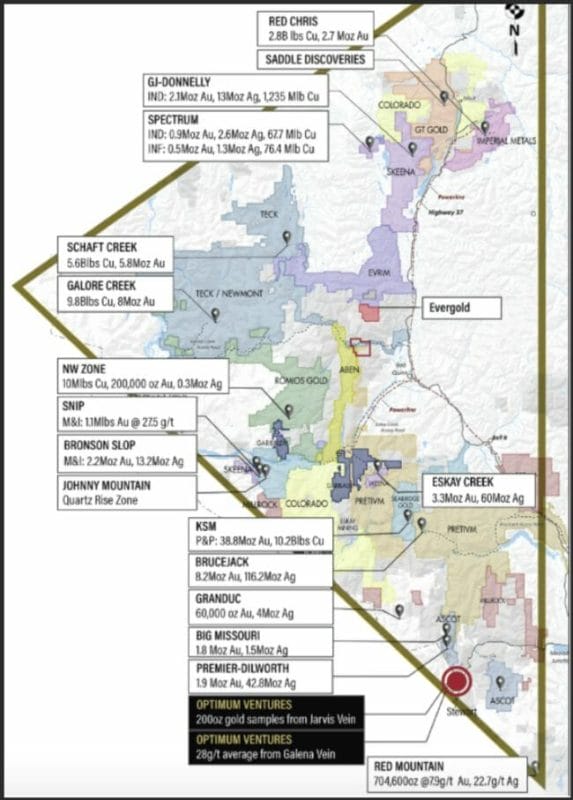

Optimum Ventures (OPV.V)

- 34.62M shares outstanding

- $17.31M market cap based on its recent $0.50 close

Optimum is a newly positioned player in British Columbia’s prolific Golden Triangle.

After putting signatures to paper with Teuton Resources for the highly prospective Harry Property—a deal that allows Optimum to earn up to an 80% interest in the 1,333-hectare project—the Company now has a strategic foothold in a region that offers extraordinary discovery potential.

According to an October 15, 2021 43-101 report: “The bulk of the Harry property lies within a 3 km wide and at least 15 km long prospective corridor which hosts a number of gold-silver deposits as well as numerous prospects. Deposits within this corridor include Premier, Big Missouri, Silver Coin, Martha Ellen and Mt Dilworth.”

The Milestone showing—a 2.0-meter wide quartz breccia vein containing pyrite, minor galena and local dendrites of native gold—produced a grab sample that ran 1,553 g/t gold. A chip sample taken across the vein returned 269.5 g/t gold over 2.0 meters (see Teuton Resources press release dated December 9, 2020).

The S-1 showing on the property returned up to 1.34 g/t gold and 32 g/t silver in grab samples.

This 43-101 technical report went on to state:

“In addition to these two mineral occurrences, the area also contains numerous quartz+/-carbonate veins with some of them mineralized with pyrite, galena, sphalerite chalcopyrite and tetrahedrite. Only a few of these veins were sampled as smooth rock surfaces made it impossible to sample them.”

During the 2020 exploration program the author identified a large intrusive body of Premier Porphyry in the area of Milestone and S-1 showings which is in contact with a large prominent quartz-sericite- pyrite alteration zone at least 400 metres in size. The presence of Premier Porphyry is very encouraging since this rock was the source of mineralization in the historic Premier Mine.

The Harry property has excellent potential for the discovery of high-grade gold-silver mineralization as well as large-scale low-grade gold-silver zones similar to those located within the mineralized corridor described above.”

The Technical report outlines a recommended Phase 1 exploration program on the Harry intended to generate drilling targets which subsequently will be drill tested consisting of rock sampling, geological mapping, geophysical surveys drilling and core cutting at an estimated cost of $500,000. The Company intends to complete Phase 1 of the recommended work program in beginning in the second quarter of 2022.

These are early days for Optimum.

The crew behind this one is top-shelf in every respect.

Expect strong newsflow from an aggressive 2022 exploration campaign.

Corp Presentation (coming soon)

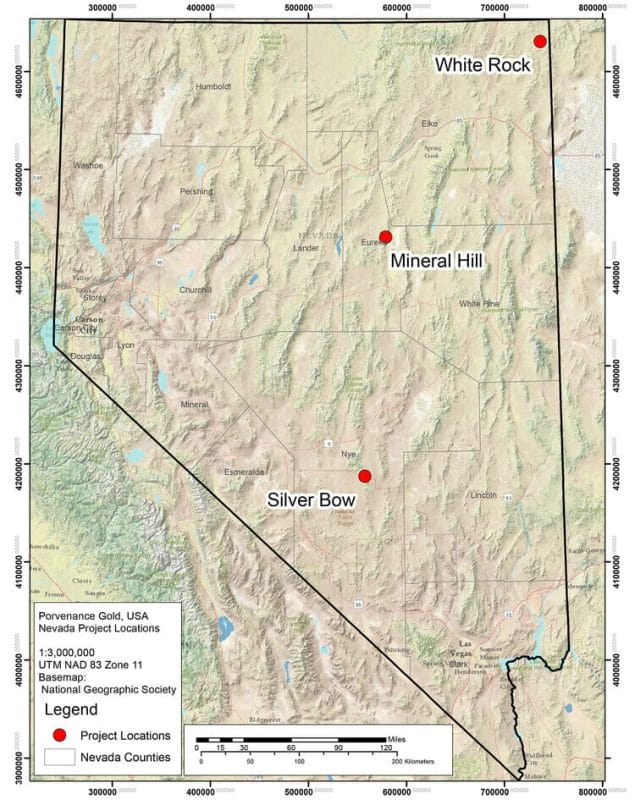

Provenance Gold (PAU.C)

- 60.98 million shares outstanding

- $10.06M market cap based on its recent $0.165 close

Provenance’s flagship 2088-hectare White Rock Property is located in the northeastern corner of Elko County, Nevada.

The property is host to an extensive gold system extending across an open-ended area measuring > 3.2 kilometers by 1.6 kilometers.

On July 13th, the Company launched a 5,000-meter drill program designed to confirm and expand historical drilling that tagged thick intervals of continuous gold mineralization across the 3.2 km by 1.6 km setting. This program also included a mapping and sampling campaign targeting the project’s regional potential.

Results from this summer campaign were reported on August 5th, August 18th, and September 16th. On November 4th, the Company reported “a newly recognized open-ended gold mineralization feeder structure that extends across the core mineralized area of 3.2 km in length and 1.3 km in width.”

Drill hole 45 intersected the feeder structure at 17 meters (55 feet) and was still in it at 104 meters (340 feet), where the hole had to be terminated because of ground conditions. Between 17 and 84 meters (55 and 275 feet), the hole averaged 0.015 oz/t gold (0.52 g/t) within which 21 to 52 meters (70 to 170 feet) averaged 0.026 oz/t gold (0.88 g/t) and between 37 and 49 meters (120 and 160 feet) the hole averaged 0.032 oz/t (1.11 g/t). The hole bottomed in mineralization at 340 feet, with indications it was entering another zone of stronger mineralization.

Another property in the Company’s project pipeline—the past-producing Silver Hill Property—was first mined in 1868 at a reported grade of 140 ounces (4,350 grams) of silver per ton. Mining continued until 1939 with reported grades of up to 25 ounces (780 grams) per ton.

According to a July 8th press release:

“The Company’s recent sample of the historic on-site mill tailings assayed 216 g/t silver (6.9 oz/t). The Company’s five assays of the lower loose rock piles discarded from historic mining assayed from 6.1 g/t to 301 g/t silver (0.196 oz/t to 9.7 oz/t), with an average of 180 g/t silver (5.8 oz/t). The Company’s two assays of the talus slope on the hillside assayed 278 g/t silver (8.94 oz/t) and 20.2 g/t silver (0.65 oz/t). The Company’s chip samples of wall rock from the historic mining assayed an average of 430 g/t silver (13.8 oz/t). By comparison, Coeur’s active Rochester mine in Nevada averages approximately 20 g/t silver (0.6 oz/t).”

Corp Presentation (no conventional deck – only project pages)

Raindrop Ventures (RAYN.C)

- 40.54 million shares outstanding

- $17.43M market cap based on its recent $0.43 close

Raindrop IPO’d in January of 2020.

The Company’s website is a little lean—no pitch deck, limited info re their flagship asset. Usually I’d give it a pass for that very reason, but the management team behind this one buoys my interest. Aside from a productive tenure with Ivanhoe Mines, the Company’s CEO, Daniel Kunz, is also the CEO of Prime Mining (PRYM.V), one of the better success stories in the junior arena over the past two years.

The Company’s 350-hectare Clover Mountain Property is projected to lie within the Jarbidge Trend, host to the Delamar, Florida Mountain, and War Eagle projects operated by Integra Resources in Idaho. Jarbidge also plays host to the Jerritt Canyon Gold Mine in Nevada, where over 8 million ounces of gold have been produced since 1981.

Classified as a low sulfidation, gold-bearing hydrothermal system, Clover Mtn is marked by rock chip samples grading 1.99 g/t gold, 19.95 g/t silver, 1.25% copper, and 1.54% zinc, and soil values ranging from 0.02 g/t to 0.78 g/t and silver values ranging from 0.02 g/t to 1.19 g/t.

Since its IPO nearly two years back, the Company has been busy sizing up potential acquisitions.

On March 3rd of this year, the Company acquired a portfolio of exploration projects from Liberty Gold.

This exploration portfolio is located along the prolific Great Basin of Nevada and Utah:

- Anchor (100% interest) – Carlin type gold property, with undrilled gold targets;

- Stateline (100% interest) – low sulphidation gold /silver property with highlight gold values of 1.46 to 4.55 g/t gold from 1.5 meters drill intersections along a 305 meter long vein (true widths unknown);

- Sandy (100% interest) – sediment hosted gold property with a 2,740 by 735 meter jasperoid zone;

- Brik (49% interest) – low sulphidation gold property with highlight drill intersections of 2.41 g/t gold over 16.7 meters, including 14.95 g/t gold over 1.5 meters, and 0.99 g/t gold over 18.3 meters, from surface in hole PB-24;

- Easter (49% interest) – low sulphidation epithermal vein-breccia-stockwork gold-silver deposit with a 2010 historic resource; and

- Viper (49% interest) – low sulphidation epithermal gold property with highlight drill intersections of 1.09 g/t gold over 33.5 meters (true width unknown).

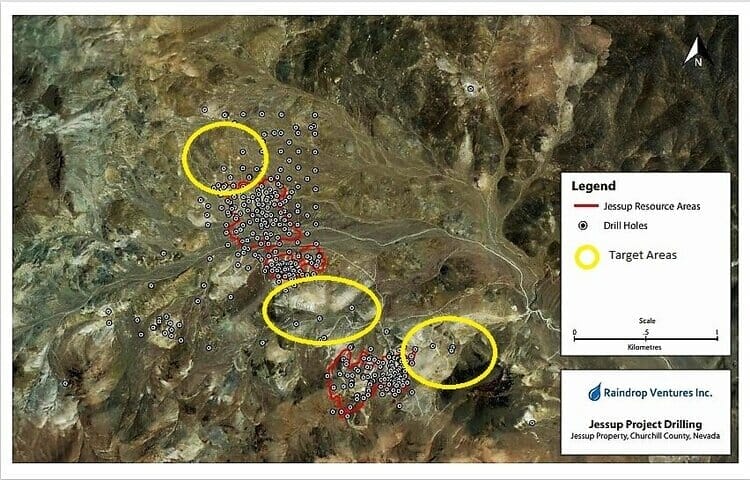

On July 12th, Raindrop signaled its intent to acquire the Jessup Au-Ag Project in Churchill County, Nevada from a private owner.

Project highlights:

- 2018 Resource Development Associates pit-constrained, heap leach model Measured and Indicated resource of 17,041,500 tonnes containing 275,000 oz gold at 0.501 g/t and 3,934,000 oz silver at 7.2 g/t. The inferred resource is 1,709,100 tonnes with 25,000 oz Au at 0.455 g/t and 195,000 oz Ag at 3.5 g/t;

- 349 historic drill holes (map below) that include numerous high-grade intercepts exceeding 5 g/t Au;

- 91% of the resource is oxide with leach test recoveries between 75% to 89% for Au and 14% to 40% for Ag;

- the resource currently comprises four mineral occurrence areas that remain open in multiple directions and geophysical studies show several target areas for new discoveries.

A strategic four-hole core drilling program was completed in June 2021. Assays are pending.

On September 8th, the Company dropped the following headline:

Ridgeline Minerals (RDG.V)

- 55.68 million shares outstanding

- $18.37M market cap based on its recent $0.33 close

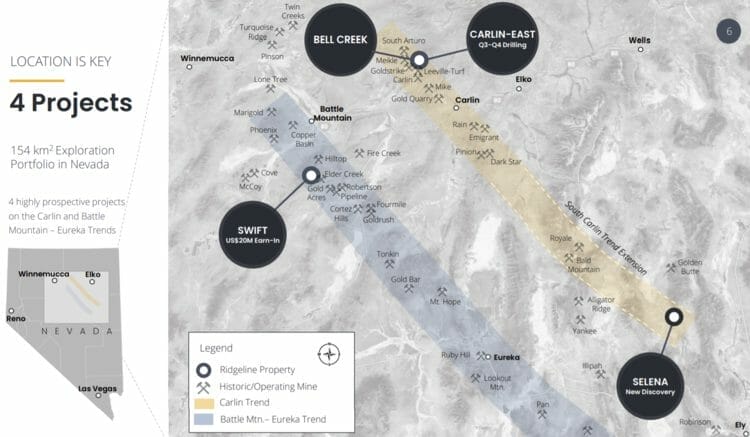

Ridgeline is a Nevada-focused ExploreCo with four highly prospective projects along the Carlin and Battle Mountain–Eureka Trends.

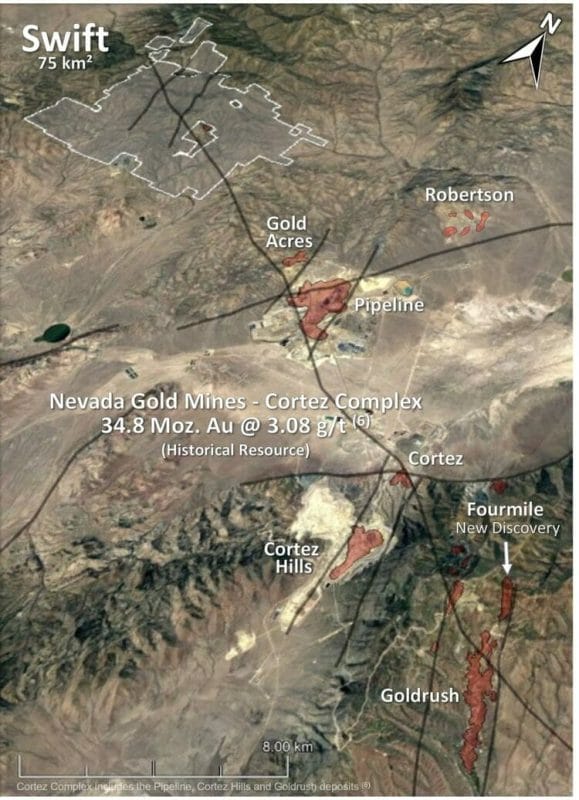

All four projects are potential company makers, but the Swift Project—the subject of a recent deal with Nevada Gold Mines—is the standout in my mind.

The transaction highlights as per this November 22nd press release (note that Ridgeline is potentially carried to production in this deal—a rare proviso for a Junior this day n age):

Reimbursement of Prior Expenditures: Within 15 days of signing the definitive agreement, NGM will reimburse a total of $372,763 to Ridgeline in consideration for recent overhead and work expenditures at Swift. Done.

Initial Earn-In Option: NGM will assume operatorship of the project and can earn up to a 60% interest in the project by incurring a minimum of $20 million in qualifying work expenditures over five years, including:

- $4 million in guaranteed work expenditures before December 31, 2023 (we should see a lot of meters drilled via this aggressive 2-year spending commitment);

- $16 million in work expenditures and preparation of a technical report in compliance with the requirements of National Instrument 43-101 before December 31, 2026;

- NGM and Ridgeline will each elect two representatives to a Swift technical steering committee, which will meet quarterly to review budgets and exploration progress (you don’t often see this level of accountability from a senior partner).

Second Earn-In Option: NGM will retain a one-time option to earn an additional 10% interest in the project by sole-funding an additional $10 million in work expenditures before December 31, 2029.

Development Funding Option: Within 90 days of a joint venture decision to proceed with development and construction of a mine and/or related processing facilities on Swift, NGM will have a one-time option to elect to provide, or arrange for third-party, financing of Ridgeline’s portion of debt financing required for the development in consideration, in either case, for an additional 5% interest in the project for a total of 75% (or 65% if the second option was not exercised).

A Carlin-type gold setting, these 7,425-hectares are located in Lander County, Nevada, within the prolific Cortez district of the Battle Mountain–Eureka Trend.

Numerous multi-million ounce past and currently producing gold mines—Pipeline, Cortez Hills, Fourmile, Goldrush—are located downtrend of Swift along the Cortez Structural Corridor.

As per current guidance, the Cortes Complex is forecasted to produce between 800,000 and 1,2000,000 ounces annually from 2021 to 2025. These may be the highest margin ounces in Barrick’s and Newmont’s reserve base.

Another Swift project map is necessary to pound home just how upscale this neighborhood is (note the map’s scale – bottom left).

At the Carlin-East Project—~3.5 kilometers north of the North Leeville discovery (23.3 meters @ 32.6 g/t Au and 32.9 meters @ 16.9 g/t Au)—the Company completed a 2,272 meter Phase-2 drill campaign in mid-October. Assays are pending.

At the Selena Project, the Company has a Carbonate Replacement (CRD) style deposit in its crosshairs. Highlights from a recently completed Phase-4 drill campaign—a combination of infill and stepouts—include:

- SE21-025: 44.2 meters grading 123.2 g/t Ag, 0.1 g/t Au, 1.5% Pb and 0.6% Zn starting at 232 meters true vertical depth (TVD);

- SE21-024: 10.7 meters grading 194.0 g/t Ag, 0.3 g/t Au, 2.0% Pb and 1.7% Zn starting at 191 meters TVD.

On October 27th, the Company updated all four of its projects via the following headline:

RIDGELINE MINERALS PROVIDES NEVADA EXPLORATION UPDATE

“Be right, sit tight” might be the best advice I can offer re Ridgeline. This one has ‘endgame’ written all over it.

Riley Gold (RLYG.V)

- 32.18 million shares outstanding

- $10.94M market cap based on its recent $0.34 close

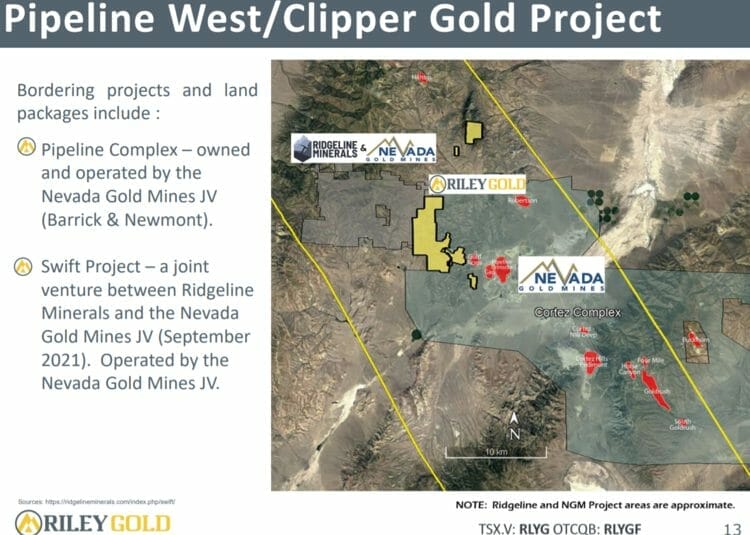

Riley Gold has two Nevada projects in its crosshairs: the Tokop Gold Project located within the Walker Lane Trend, and the 24.7 square kilometer Pipeline West/Clipper Project located in the Battle Mountain Eureka Trend.

The 100% owned Tokop Project is located in Esmeralda County, roughly 80 kilometers south of Tonopah. The nearby Tonopah, Goldfield, and Bullfrog districts accounted for historical production of more than 8.3 million ounces of gold and 143.5 million ounces of silver.

In late June 2021, the Company released assays from the first three holes designed to target near-surface quartz veins, shears, and mineralized fault zones at Tokop.

Highlights :

- TKR-21C: 9.32 g/t gold over 2.6 meters from 46.2 meters;

- including 17.1 g/t gold over 1.4 meters plus an additional 235 g/t silver;

- TKR-22C: 1.67 g/t gold over 5.1 meters from 31.9 meters;

- including 0.4 meters of 3.73 g/t gold plus an additional 82.2 g/t silver;

- including 0.8 meters of 4.02 g/t gold;

- TKR-23C: 2.62 g/t gold over 5.94 meters from 102.3 meters;

- 4.98 g/t gold over 2.92 meters plus an additional 97.3 g/t silver over 1.40 meters.

If you refer to the Ridgeline segment above, specifically the map showing the location of Ridgelines Swift Project within the prolific Cortez district of the Battle Mountain–Eureka Trend, Riley’s West/Clipper Project may pique your curiosity.

Regarding the landmark deal Ridgeline inked with Nevada Gold Mines on September 22nd, Todd Hilditch, Riley’s CEO:

“We commend both Ridgeline and NGM on this earn-in agreement of the highly prospective Swift project within a region well known by NGM due to their past and current production and their currently reported gold reserves and resources of approximately 35.2 million ounces of gold within the Cortez Complexi. The Battle Mountain-Eureka Trend, and particularly this portion of the trend, has been blessed with favourable geology and very large gold deposits like few places on earth. Having a major gold producer continuing to explore regionally, and working with junior explorers too, is a proven model for success. We are now essentially surrounded by NGM and look forward to beginning our own exploration program at Pipeline West.”

Exploration at Pipeline West will be targeting lower plate carbonates at depths greater than 250 meters (deeper than tested in previous campaigns).

A campaign of mapping, soil sampling, and geophysics—magnetics and gravity—will come into play to light-up targets for a proper probe with the drill bit.

Rockridge Resources (ROCK.V)

- 72.98 million shares outstanding

- $7.66M market cap based on its recent $0.105 close

We’ve given Rockridge a fair amount of attention over the past year or so.

The Company’s flagship Knife Lake Project is a VMS play located in Saskatchewan, near the Flin Flon Lake mining camp. The Flin Flon camp has produced in excess of 170 million tons of sulphide ore from 31 VMS deposits worth more than $25 billion.

The current resource at Knife Lake stands at 3.8 MT @ 1.02% Cu Eq Indicated, and 7.9 MT @ 0.67% Cu Eq Inferred.

Based on general observations regarding the deposit’s mineralogy, mineral textures, and metal ratios, the current resource is interpreted as “a remobilized portion of a presumably much larger (primary) VMS deposit.”

Results released on June 17th from a 2021 Phase-1 drill campaign included a highlight (infill) interval of 1.95% Cu, 0.11 g/t Au, 7.41 g/t Ag, 0.53% Zn and 0.02% Co (2.34% CuEq) over 14.02 meters beginning at 24.62 meters.

On July 14th, the Company released additional assays from its Phase-1 program including 0.73% Cu, 0.06 g/t Au, 2.98 g/t Ag, 0.15% Zn and 0.01% Co (0.88% CuEq) over 21.11 meters starting at 27.39 meters.

We covered the Phase-1 drill campaign in a piece titled Rockridge Resources (ROCK.V) tags additional copper at Knife Lake – plans phase-2 drilling this summer

On September 8th, the Company announced having commenced a round of geophysics at Knife Lake—a helicopter-borne electromagnetic (EM) and horizontal magnetic gradiometer geophysical survey.

On October 14th, the Company dropped the following headline:

Rockridge Completes its VTEM Geophysical Program at the Knife Lake Copper Project

Jonathan Wiesblatt, CEO:

“Modern exploration tools such as airborne electromagnetic and horizontal geophysical surveys have been and will continue to be an important part of ROCK’s exploration strategy at Knife Lake. We have been using these and exploration techniques to identify new and prospective target areas in and around the existing Knife Lake deposit. The deposit was first discovered many decades ago but the project overall has yet to be the beneficiary of a thorough and complete, modern-day exploration campaign at its regional target areas. The current and upcoming exploration work will help us to commence another diamond-drilling program to follow up on historical results and test new targets.”

In this October 14th press release, the Company stated that additional fieldwork is planned to (further) prioritize targets for a diamond drill campaign.

Considering that VMS deposits rarely occur in isolation—where there’s one deposit (or lens), there are often others—Knife Lakes regional discovery potential appears wide open.

SKRR Exploration (SKRR.V)

- 46.86 million shares outstanding

- $4.69M market cap based on its recent $0.10 close

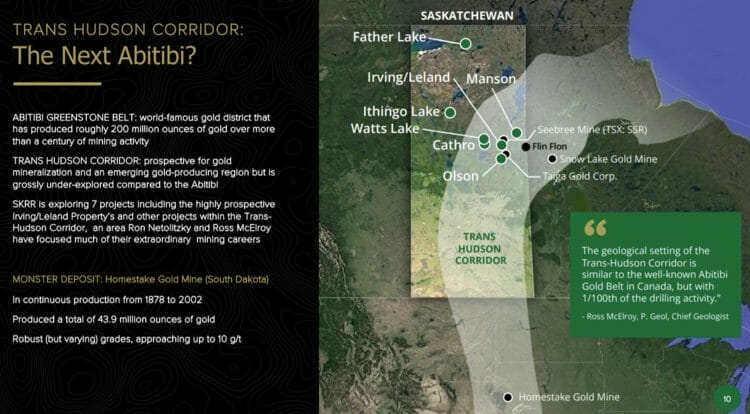

Expertly helmed SKRR is targeting Saskatchewan’s Trans-Hudson Corridor (THC) for its considerable discovery potential. The Company characterizes the THC as “an under-explored and emerging gold-producing region that could become Canada’s next big gold district.”

Containing the La Ronge Gold Belt and part of the same geologic formation as the famed Homestake Gold Mine, the Trans Hudson Corridor has the potential to be the next great gold district, with two multi-million ounce discoveries to date (Seabee, MacLellan).

At last count, the Company had seven properties in its project pipeline.

On October 20th, the Company reported progress at its Manson Bay Project where a 1,700 meter, nine-hole NQ core drill program was expanded to 12 holes based on positive visual cues.

The primary focus of this campaign was to test the historic Manson Bay Gold Zone where historic drilling outlined a gold-rich zone highlighted by a (historic) 10.03 meter hit grading 15.39 g/t Au (this included a higher-grade interval of 23.13 g/t Au over 6.40 meters).

Assays are pending for these 12 holes.

On November 5th, the Company announced a new acquisition in the THC:

SKRR management is currently cultivating their (discovery) options.

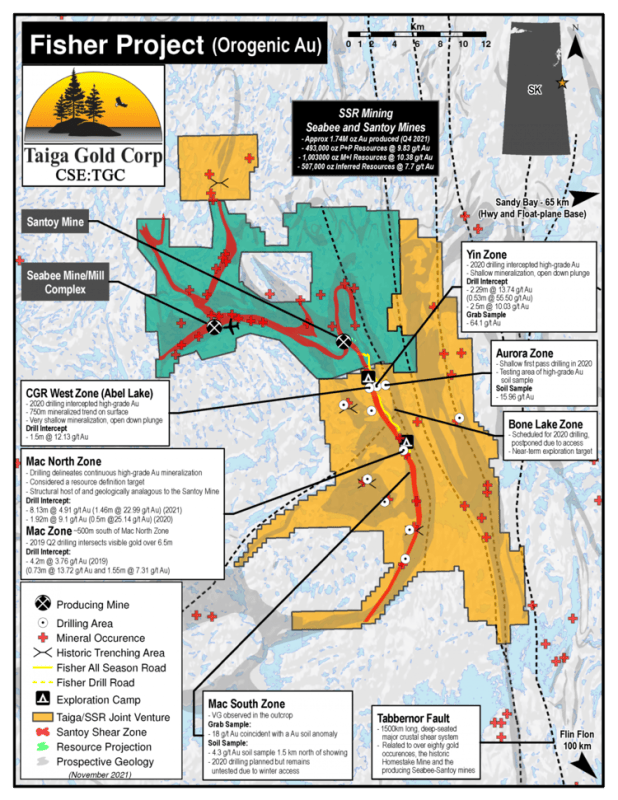

Taiga Gold (TGC.C)

- 95.33 million shares outstanding

- $17.64M market cap based on its recent $0.185 close

Taiga, a spinout from Eagle Plains Resources (recently featured here), is another company with a suite of properties strategically located along Saskatchewan’s Trans-Hudson Corridor (THC).

Taiga’s flagship Fisher Property boasts four separate high-grade gold discoveries to date.

The property lies adjacent to SSR Mining’s Seabee Gold Operation and roughly 1.5 kilometers from the Santoy Mine, where SSR is currently producing from a high-grade (underground) reserve base.

“The Fisher property is bisected by the Santoy Shear Zone along its entire length, approx. 25km, and the nearby Santoy Mine is currently producing high-grade gold from this structure.”

The Santoy Shear Structure is characterized by SSR Mining as the “Seabee Growth Pipeline”—80% of this highly prospective structure runs through the Fisher Property.

Drilling in Q1 of 2021 tagged the highest gold values reported to date.

Highlights as per a July 13th press release:

- Widespread high-grade mineralization confirmed by drilling at Mac North Zone over a down-plunge area of 180m x 650m- open in all directions

- All four holes completed reported significant gold mineralization (>1 g/t Au), with visible gold reported in two holes

- DDH FIS 21-065 returned 4.91 g/t Au over 8.13 meters from 341.80 meters to 349.93 meters;

- Including 7.25 g/t Au over 5.13 meters from 344.8 meters to 349.93 meters;

- Including 22.99 g/t Au over 1.46 meters from 348.47 meters to 349.93 meters;

- DDH FIS 21-064 returned 3.76 g/t Au over 3.63 meters from 134.25 meters to 137.88 meters;

- Including 7.2 g/t Au over 0.88 meters from 137.00 meters to 137.88 meters;

- DDH FIS 21-062 returned 3.51 g/t Au over 2.83 meters from 260.95 meters to 263.78 meters.

The Fisher Project is a 80/20 joint-venture between SSR Mining and Taiga Gold.

In order to square away its (second) option on the property, SSR Mining recently cut Taiga a $3M cheque.

“It is anticipated that this JV will continue to undertake significant exploration including drilling with the intent of locating gold deposits for development into potential reserves.”

SSR has roughly eight years of mine-life left at Seabee. I believe that it’s only a matter of time before SSR Mining takes out Taiga with a fat takeover offer. Of course, SSR is likely the only real suitor for the project—they may elect to take their sweet time.

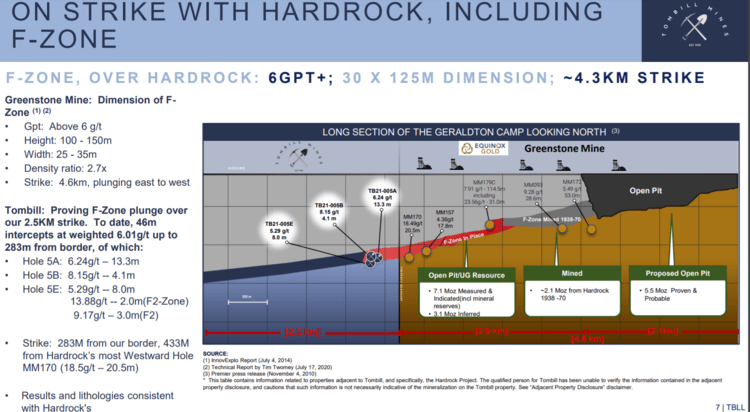

Tombill Mines (TBLL.V)

- 153.76 million shares outstanding

- $16.91M market cap based on its recent $$0.11 close

Tombill is exploring a number of exploration and past-producing gold properties in the Geraldton Gold Camp of Ontario.

The Company’s Tombill Main Group and Tombill Original Mine properties are located in the heart of the re-activated Geraldton Gold Camp.

The Tombill Main Group lies adjacent to the world-class Hardrock deposit (7.1 million ounces M&I). Hardrock—a JV between Equinox (60%) and Orion (40%)—is teed up to begin producing in 2024.

The dominant geological structure that runs through Hardrock—the F Zone—runs through the Tombill Main Group property.

A September 20th headline:

Summary of Phase-1 drilling to date:

- Hole TB21-005E, a wedge hole drilled from mother hole TB21-005, returned 5.29 g/t gold over 8.0 meters from the targeted F-Zone. A second interval of 13.88 gpt gold over 2.0 meters was encountered somewhat deeper in a new mineralized structure deemed the F2-Zone;

- Hole TB21-005B, another wedge hole drilled from hole TB21-005, returned 8.15 gpt gold over 4.1 meters from the F-Zone;

- As previously reported in our news release dated June 17, 2021, hole TB21-005A, the first wedge hole drilled from TB21-005, returned 6.23 gpt gold over 13.3 meters confirming Hardrock’s robust F-Zone extends onto Tombill’s flagship property;

- The spacing between the F-Zone intercepts in holes TB21-005A and TB21-005E is 21 meters, these intercepts are situated approximately 250 meters west of the eastern property boundary with the neighbouring Hardrock mine.

F-Zone remains open down-plunge to the west and will soon be tested by hole TB21-006, a 150 meter step-out to the west of TB21-005.

On November 15th, the Company reported additional results from Phase-1, the highlight interval being 1.65 g/t Au over 11.5 meters near Talmora—a past-producing mine, and Tombill’s first near-surface target.

If Tombill succeeds in defining a significant Au resource on its side of the fence, it becomes an obvious takeover target for the likes of Equinox, or Orion.

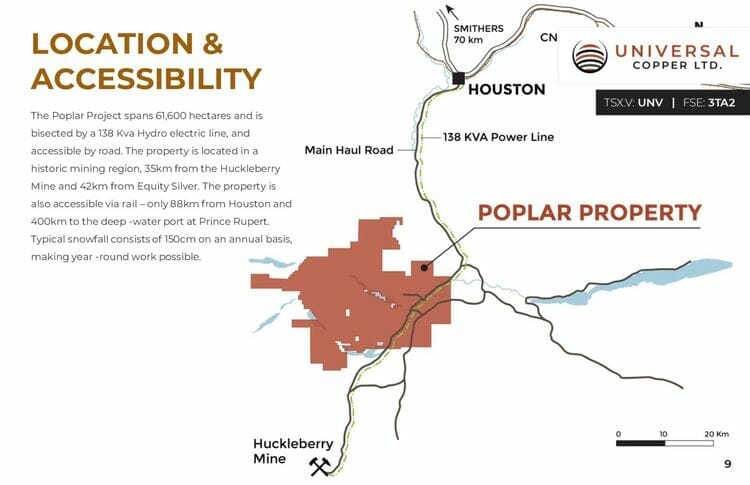

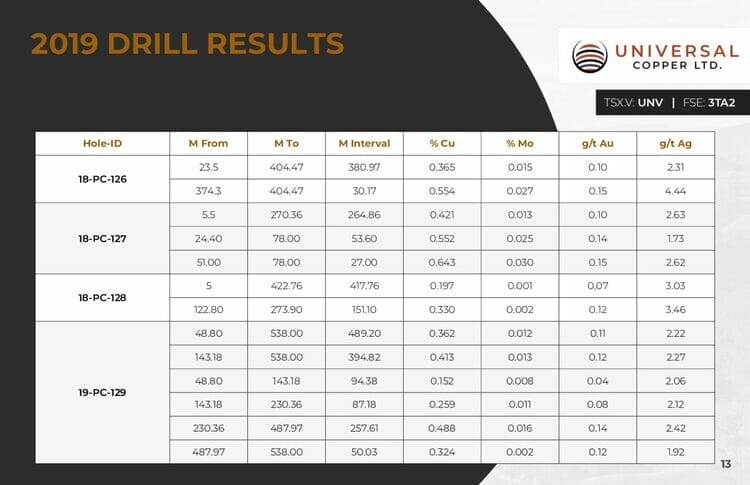

Universal Copper (UNV.V)

- 62.19 million shares outstanding

- $5.6M market cap based on its recent $0.09 close

Universal Cu’s flagship Poplar Project is located in a historic mining region roughly 35 kilometers from the Huckleberry Mine and 42 kilometers from Equity Silver.

Using a 0.20% Cu cutoff, this 61,600-hectare property hosts an Indicated resource of 152.3 million tonnes grading 0.32% copper, 0.009%molybdenum, 0.09 g/t gold, and 2.58 g/t silver plus an Inferred resource of 139.3 million tonnes grading 0.29% copper, 0.005% molybdenum, 0.07 g/t gold and 4.95 g/t silver.

On September 28th, the Company launched a 3,000-meter drill campaign designed to expand the limits of the higher-grade mineralization within the current resource block and test the deposit at depth. The Company’s previous two campaigns succeeded in adding 21.3 million tonnes (at 0.32% copper) to the Indicated component of the resource base.

After announcing the completion of its 2021 Phase-1 drill campaign on November 9th, the Company summarized progress on the property to date via the following headline:

Universal Copper Continues To Advance The Poplar

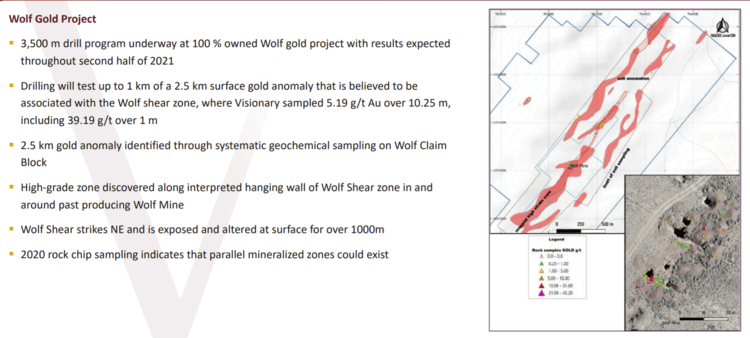

Visionary Gold (VIZ.V)

- 71.95 million shares outstanding

- $8.99M market cap based on its recent $0.125 close

Visionary Gold is focused on the discovery and development potential of the past-producing Lewiston Gold District of Fremont County, Wyoming—a region yet to be subjected to modern exploration methodologies

The Company controls a ~50 square kilometer land package in the region with numerous drill-ready targets.

The Wolf Gold Project is the Company’s flagship.

On August 4th, the Company mobilized a drill rig to the Wolf Project. This maiden 3,500-meter campaign is designed to test up to 1 kilometer of a 2.5-kilometer-long surface gold anomaly—an anomaly believed to be associated with the Wolf Shear Zone where the Company recently (channel) sampled 5.19 g/t Au over 10.25 meters (including 39.19 g/t over 1 meter).

On November 19th, the Company updated progress at the Wolf Project:

Wes Adams, CEO:

“Strong gold values in soil and rock chip samples complimented by associated geophysical anomalies continue to highlight potential for a large gold bearing system at the Wolf, as we await results from the initial drill program. Like many of our peers, we have experienced significant delays this year in returning assay results, but we haven’t stopped collecting data and the results that we have received continue to be encouraging. We will release the results from the entire drill program as soon as we have results from all holes, and we will continue to release results from regional exploration efforts as they become available.”

END

—Greg Nolan

Full disclosure: Of the companies featured in this piece, only SKRR Exploration is an Equity Guru marketing client.