My cousin once had a brief conversation with Dolly Parton.

He subsequently announced that, “She was the least disappointing celebrity I’ve ever met.”

A lot of investors are starting to feel that Gold Mountain Mining (GMTN.V) is the least disappointing gold developer they’ve ever met.

In a sector that tends to over-promise and under-deliver – from the get-go – GMTN has done exactly what it said it would do.

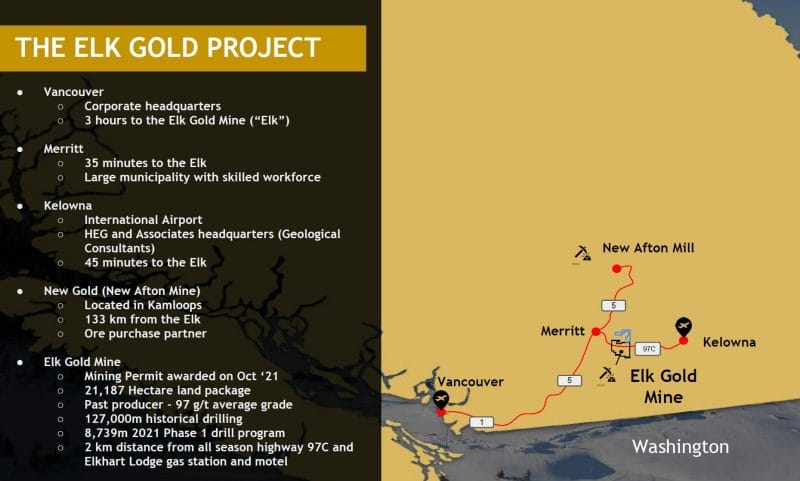

A $133 million gold developer located near Merritt, BC. GMTN is currently trading at $1.91 – down $1 from its June 2021 high, but up .50 from its July 2021 low.

“If you do go through the Gold Mountain investor deck, two things will become clear,” stated Equity Guru’s Chris Parry on December 17, 2020.

- It was written by guys who live, breathe, eat, and if it’s possible, engage in sexual relations with mining.

- They’re not farting about. This property isn’t a roulette spin, it’s blackjack.

“Of course, there’s always a chance they’ll miss with a drill bit or a local commune will claim land rights or a comet lands next door and dumps a million tons of gravel on top of everything,” continued Parry, “But the things that usually screw up a mining exploration deal – ignorance, corruption, or dumb luck – aren’t in evidence here at first glance.”

- The executive team have runs on the board.

- The bank balance is heavy.

- The data is deep and the targets many.

- There’s precious little that needs building.

- They’ve wasted no time doing the work to this point.

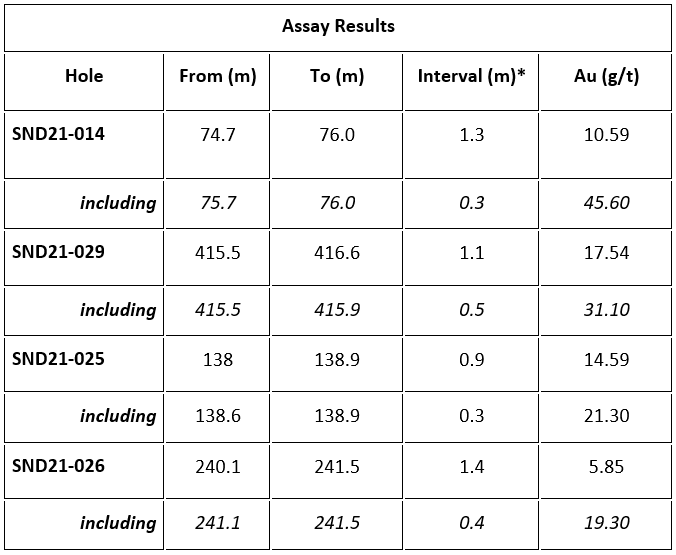

On November 16, 2021 GMTN announced assay results from its Phase 2 drill program at the Elk Gold Project located near Merritt, BC.

“The high-grade assay results continue to extend the Siwash North zone’s established mineralization down-dip and indicate clear vein continuity at depth near the project’s open pits,” stated GMTN.

Highlights:

- Drilling Highlights Include:

- 1.30m grading 10.59 g/t Au including 0.30m of 45.60 g/t Au

- 1.10m grading 17.54 g/t Au including 0.50m of 31.10 g/t Au

- 0.90m grading 14.59 g/t Au including 0.30m of 21.30 g/t Au

- 1.40m grading 5.85 g/t Au including 0.40m of 19.30 g/t Au

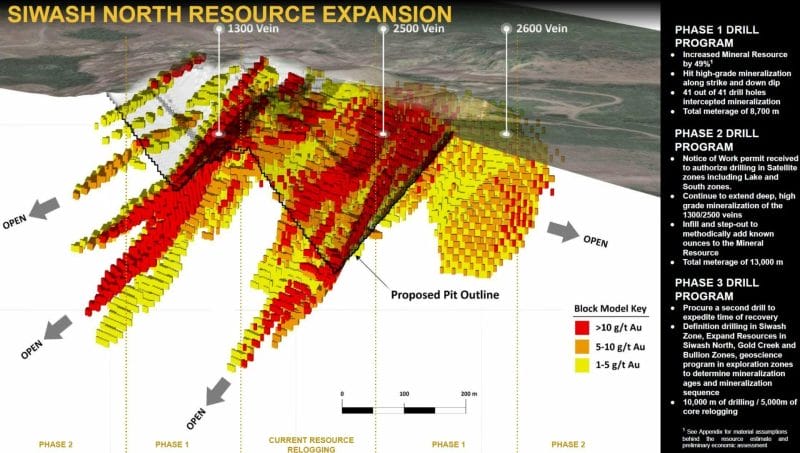

- Gold Mountain’s Phase 2 drill program continues to methodically extend the Elk’s shallow, open-pit amenable vein systems as well as its deeper, high-grade mineralization in the Siwash North Zone.

- Phase 2 encapsulated the exploration of the Lake, South and Elusive zones, 3 of the other 9 drill tested mineralized zones on the property.

- Based on the strong intercepts the Company struck early on in the program, Gold Mountain increased the total Phase 2 meterage by 30% from 10,000m to 13,000m.

“In Phase 1 we showed how impactful a well-planned and methodical drill program can be, as we increased our resource by 45% off an 8,700m program,” stated Kevin Smith, CEO and Director of Gold Mountain.

“Phase 2 continues this strategy of infilling and stepping out from the project’s well-established mineralization and we’re confident that assay results like these highlight intercepts will have a strong impact on our updated resource estimate due this fall,” continued Smith.

“Now that the mine is transitioning to commercial production, Gold Mountain’s focus is to scale our resource through proceeds of mining and uphold our commitment of getting the Elk past a million ounces,” concluded Smith.

Below is a table of selected core drill results.

On November 9, 2021 GMTN announced that is has mined its first significant mineralized material at its 100% owned Elk Gold project near Merritt, BC.

Highlights:

- The Company has exposed its 1100 vein system located on the footwall of historic pit 2.

- This area was mined by previous operators in 2012 at an average grade of 16.60 g/t.

- The Company will crush, weigh and assay the material prior to sending it to its Ore Purchase partners New Gold Inc.

- Year 1 of Gold Mountain’s mine plan contemplates mining some of the resource’s highest-grade material, resulting in an expected annual after-tax profit of $10,000,000.

From the “Why-doesn’t-everyone-do-this?” department, GMTN’s November 16, 2021 press release was augmented with a management video statement:

“As we reached the tail end of our Phase Two drill program, we’re seeing really strong results coming back from the lab,” stated Grant Carlson, Chief Operating Officer (COO) of Gold Mountain.

“We’ve been able to intercept grades as high as 45 grams a ton in the Elk shallow mineralization region,” confirmed CEO Kevin Smith, “Originally, we plan to drill a total of 10,000 meters in phase two, but based on the early success of the program, we decided to add an additional 3,000 meters of drilling”.

“Amongst a flurry of news events in H2 of 2021—while the Company was picking off one key milestone after another—management dropped a revised mine plan for the Elk project, one that sidelined any notion of building a mill on-site for production years 4 thru 11.,” reported Equity Guru’s Greg Nolan on November 8, 2021.

“The new mine plan involves broadening an ore purchase agreement that was already in place with New Gold, by scaling the volume of ore delivered to the New Afton mill from 70k to 350k tonnes per annum.

Aside from (dramatically) slashing the project CapEx, putting the kibosh on plans to build a mill on-site will drive down Elk’s all-in sustaining costs (AISC) from $735/ounce to $554/ounce,” added Nolan.

“We’re confident that these high-grade intercepts in close proximity to our open pits will have a positive impact on our updated resource estimate due this fall,” stated GMTN COO Grant Carlson on November 16, 2021.

“You’ll never do a whole lot,” said Dolly Parton, “Unless you’re brave enough to try”.

On January 14, 2021, GMTN was brave enough to announce a plan “to bring the Elk Gold Project into production as well as look to continue onto Phase 2 of our drill program”.

Zero disappointments – the company is doing exactly what it said it would do.

Full Disclosure: Gold Mountain is an Equity Guru marketing client.