The following content augments and updates an Equity Guru article published by yours truly on November 2nd, 2021—Gold Mountain (GMTN.V) is BC’s next gold producer.

Gold Mountain (GMTN.V) – (GMTNF.OTC) – (5XFA.FSE)

- 69.82 million shares outstanding

- $131.26M market cap based on its recent $1.88 close

- > $10M in the treasury

After a seamless push along the development and permitting curve, Gold Mountain (GMTN.V) and its wholly-owned 21,187-hectare Elk Gold Project are now fully permitted. The first load of ore will soon take an easy ride down the highway to the New Afton mill.

The November 1st headline…

Gold Mountain Receives Its Mining Permit from The Ministry of Mines

There was a slight delay in getting signatures put to paper on this final document, but during the procedural ‘down time’, it was pedal to the metal for this crew. Management has been busy driving all aspects of development that were in its control—heavy equipment mobilization, drilling-blasting, haul road rehab, stripping waste rock, bringing everything up to code… lining everything up at the starting post for the inevitable wave of the solid green flag.

There was never any doubt. The delivery of this final permit was always deemed ‘inevitable’ by this top-shelf crew.

Quoting Gold Mountain CEO, Kevin Smith, in a recent interview:

“A lot of people thought we were crazy with all the capital outlays we did prior to having certainty on the permit, but management had a lot of conviction in our proposed mine plan and ability to get the permitting across the line. We set extremely aggressive targets for ourselves and knew the only way to achieve all of them on time, we would have to push the pace from the moment the Construction and Development Authorizations were received in April. Big thanks to our mining contractor Nhwelmen-Lake LP for all their hard work on building out the site and getting the project to the stage it is at right now.”

Highlights from this November 1st press release:

- After 18 months of regulatory and permitting advancements, Gold Mountain has received its Mining Permit from EMLI;

- The Company will immediately begin mining the 1100 and 1300 vein systems in historical pit 2;

- Mineralized material will be delivered to the Company’s Ore Purchase Partner, New Gold Inc;

- The Company anticipates achieving commercial production in November;

- Year 1 of Gold Mountain’s mine plan contemplates mining the highest grade mineralization, resulting in an expected annual after-tax profit of $10,000,000.

Quoting CEO Smith from the text of this watershed news event:

“It is extremely rare for a junior mining company to evolve from exploration and into production. For Gold Mountain to achieve this after being public for only 10 months is a testament to Management’s focus and commitment. We would like to thank our shareholders for believing in the project and continuing to support us while we transition into BC’s next gold producer.”

In what often takes the better part of a decade, this crew accomplished in 18 months.

This landmark permit from the EMLI is also a signal that the province of British Columbia is open for business. But you need to employ Gold Mountain’s model—you need to work with the local communities, as partners, in a spirit of fairness and cooperation.

While the Provincial review and the corresponding Mine Review Committee process have come to a close, Gold Mountain is aware and acknowledges each respective Indigenous Nation’s decision-making process will continue independently from the Province of British Columbia.

Over the past 18 months, the Company has made a concerted effort to build strong relationships with communities that are affected by the development of the Elk Gold Project. Gold Mountain looks forward to continued collaboration with all Indigenous Nations that have interests in the Elk Gold mine. The Company also wishes to communicate that there is no time limit on direct engagement and consultation between the Company and each respective Indigenous Nation.

Elk’s Ounce-Count

The Elk Project’s ounce-count currently stands at 651,000 oz at 6.1 g/t Au Measured & Indicated and 159,000 oz at 4.8 g/t Au Inferred. The last time we checked in, the Company’s exploration contractor, HEG Explorations Services Inc, was in the midst of an aggressive Phase-2 drill campaign. In targeting the 1300, 2500, and 2600 veins along the Siwash North zone, recent results continue to demonstrate good (vein) continuity downdip, at depth:

- 1.0 meter grading 17.3g/t Au including 0.73 meters of 24.4g/t Au;

- 1.3 meters grading 13.9g/t Au including 0.30 meters of 60.4g/t Au;

- 1.12 meters grading 6.4g/t Au including 0.30 meters of 24.0g/t Au.

This resource appears destined to grow.

Continuing my recent Q&A with CEO Smith (with additional observations sprinkled about)…

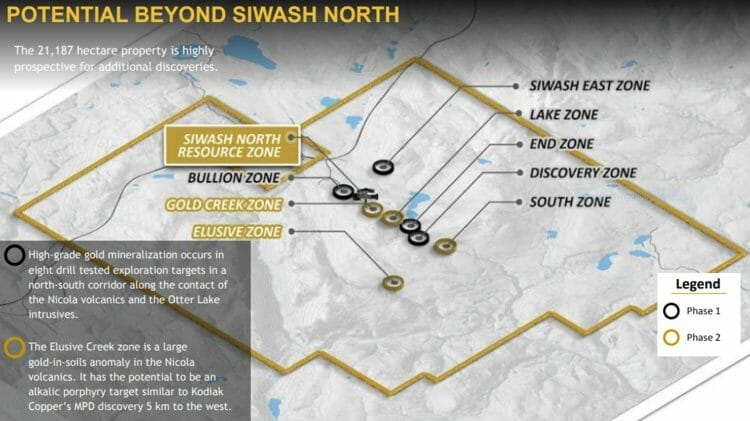

Nolan: Can you give us some insight into the resource expansion and exploration upside in the vicinity of your Siwash North resource base?

CEO Smith: We continue to have a lot of success with the drills and our historic core relogging program. We’ve hired the team at HEG to manage our exploration program and they are led by John Ryan, who is the former head of exploration at Teck HVC. HEG has done an incredible job rebuilding the Geologic model from the ground up and shown just how much growth potential there is from not only the Siwash North Zone, where all our current resources lie, but also in other areas on the property where we are looking to delineate new resources in our upcoming resource update.

Exploration is advancing across the property. Multiple zones—the Gold Creek Zone, the Lake Zone, the South Zone—are getting a proper probe with the drill bit. These highly prospective satellite zones could add additional tonnage and extend the mine life well beyond the 11 years outlined in a May 27th, 2021 (updated) PEA.

Nolan: Can you comment on the regional exploration potential of this 21,187-hectare property i.e. the Elusive Zone where you’ve encountered a large gold-in-soils anomaly?

CEO Smith: Our Phase 2 drill program is nearing completion, we completed a bunch of infilling and step out drilling in Siwash North. We’ve also started infilling some spatial data gaps in the Lake and South Zones, so that we can start building our geologic model and delineating maiden resources. Originally this was set to be a 10,000m program, but with all the positive core that we have been pulling up, we have pushed a few holes deeper and added a few holes that will help us get a better handle on the geologic model. The Program should land somewhere in and around 13,000m. The Elk also has a Zone called Gold Creek that we are working on delineating maiden resources just from all the high quality drill data that came with the project, but never seemed to be followed up on. Right now the drill is in the Elusive Zone and we have 5 holes planned there with a goal of linking up with that Copper/Gold Porphyry which would be a complete game-changer for the project. As soon as Phase 2 is completed, we will jump right into Phase 3 which we anticipate to be is another 10,000m. The team at Helm Diamond Drilling is having some monster shifts and hitting pretty incredible meterage with just a single rig at the moment. We look forward to adding a second drill as soon as cash flow from mining kicks off.

“Game-changer” is an apt characterization. Porphyry deposits in this region hold world-class potential.

Regarding this regional potential—the prospect for a copper/gold porphyry discovery specifically—Smith went on to add:

“This project has a great deal of prospectivity outside of the area we plan to put into production. The Elk came with 127,000 meters of historic drilling that not only highlighted the opportunity in the Siwash North Zone, but also 7 other Zones that are drill tested and showing similar grades and structure. All the historic and current drilling on the property has been done in the Otter Lake Intrusives just inside the eastern side of the fault line that runs down the center of the property. To the west we have the Nicola Volcanics and we have some maiden drill holes planned for an area of our property called the Elusive Zone. We are targeting a more bulk tonnage style target here and given it being home to the second-highest gold-in-soils anomaly on the property we are encouraged by the potential for a copper/gold Porphyry. We had a team of 20 Geo’s doing a grid sampling in the entire Southwest portion of our claims this summer, with a goal of flushing out where the best targets are for these first holes. With the Kodiak MPD discovery only 3.5km away from that area of our project and being in the same geology, we are pretty excited about what we might find. There are also a couple of areas that we identified through our analysis of historic data that seem to have copper porphyry potential. In particular and there is an area that is showing polymetallic potential with some exciting historic grades, so we definitely have no shortage of ground to expand upon.”

Kodiak Copper‘s MPD Copper-Gold Porphyry project CEO Smith referenced above is detailed here.

Nolan: What are you targeting as a realistic goal for your next resource update? Could we see one million ounces?

CEO Smith: We told the market we wanted to deliver 1,000,000 ounces in Q4 and that is still very much our goal. It is a super-ambitious target given the property only had a 375,000-ounce resource when we took it over in May 2019, but we feel very confident that the HEG team and our drill crew from Helm Diamond Drilling are going to help us deliver that important milestone to our shareholders. Both teams are executing at an extremely high level and we are fortunate to have them working with us on developing the Elk.”

This resource update, due in the coming weeks, could represent a potent price catalyst for this stock.

Amongst a flurry of news events in H2 of 2021—while the Company was picking off one key milestone after another—management dropped a revised mine plan for the Elk project, one that sidelined any notion of building a mill on-site for production years 4 thru 11. The new mine plan involves broadening an ore purchase agreement that was already in place with New Gold, by scaling the volume of ore delivered to the New Afton mill from 70k to 350k tonnes per annum.

Aside from (dramatically) slashing the project CapEx, putting the kibosh on plans to build a mill on-site will drive down Elk’s all-in sustaining costs (AISC) from $735/ounce to $554/ounce.

Nolan: You recently decided to opt-out of building a mill on-site for production years 4 thru 11. Can you elaborate on the benefits of this revised mine plan?

CEO Smith: This really came down to economics. We hired JDS Energy & Mines, who are the best in the business, to not only complete a PFS on the Elk, but also design our underground mine plan. One of the key pieces that came out of their extensive trade-off studies was that the economics on building a mill do not really pencil until you get up to around 100,000-120,000 ounces of annual production. Eliminating that CapEx had a dramatic effect on our Economics and the high-grade ore we will produce can easily absorb the short highway haul to New Gold’s Mill in Kamloops. You can really see the effect of these changes and moving to an underground/open pit hybrid mine plan, based on the bump in the latest PEA we released in June. Another big factor for this change in strategy is when you avoid building a mill and tailings storage facility on site, the permitting and environmental impacts also drop off significantly which we anticipate will help streamline the permitting and community consultations required for expansion.”

With inflationary pressures mounting by the day, the timing of this decision couldn’t have been better. Economic studies generated one year ago will almost certainly need to be revised, particularly where the CapEx is concerned.

As fiat currencies across the board lose their purchasing power, a bloated CapEx can kill a project.

Summarizing Elk’s economics:

- An (after-tax) NPV5% of C$231M

- AISC = $554 per oz

- CapEx = an (extremely) modest $9M

- A 1 year (after tax) payback period

- The first 3 years of production will see roughly 19k ounces per annum

- Beginning year 4, management expects to produce 100k ounces per annum

- Life of Mine = 11 years

- (price inputs = $1,600 Au)

A kinder slope on the permitting curve, an appreciably reduced CapEx, and all-in sustaining costs at the lower end of the range for a gold producer = greatly reduced project risk.

What’s not to like here?

(Key assumptions behind the Company’s Year 1 production profile and anticipated cash flow are outlined in the Company’s recently updated PEA).

Nolan: Are you looking to make additional acquisitions in the future, and if so, will you be targeting advanced-stage assets similar to Elk?

CEO Smith: Right now the team is laser-focused on getting the Elk into steady-state cash flow and the resource up over a million ounces. In saying that, we are constantly reviewing similar brownfield opportunities with near-term production potential and blue sky exploration opportunities that we can add to Gold Mountain’s portfolio. There are a few candidates that could fit the bill, but nothing will materialize until we have executed on our near-term deliverables to shareholders at the Elk.”

Nolan: What are your longer-term goals as a producer? Do you see Gold Mountain evolving into a mid-tier company?

CEO Smith: A lot of people ask us if we plan to just package up the Elk and sell it. We are building and developing this project like we plan to be here for the next 20-30 years, but if the right opportunity came along that made sense for Gold Mountain shareholders we will give it some consideration. Ultimately, this is a young management team with a lot of ambitions to do something special with Gold Mountain. The Elk project’s cash flow is an excellent foundation, but larger-scale production is definitely on our minds and we intend to continue expanding our footprint within British Columbia. With all the COVID-19 travel uncertainty, being located in British Columbia has been a huge advantage for our team and we look to continue developing projects in our home Province. Going elsewhere is of course not totally out of the question, but it would really have to be a special opportunity in order for us to change what we feel has been a winning recipe up until this point.”

That concludes the Q&A. My thanks to CEO Smith for taking time out of his busy schedule to indulge my curiosities.

The Next Steps for the Company

With mine construction nearly complete and waste rock mining taking place near Pit 2, the Company is in a strong position to achieve revenue in Q4 ‘21. Gold Mountain will now turn its focus to the following operating milestones:

- Continue to engage directly with surrounding Indigenous communities to adhere to each Nation’s independent review process;

- Begin mining operations, targeting the Elk’s high-grade 1100 and 1300 vein systems;

- Deliver material to New Gold’s New Afton mine in Kamloops, located 133km away from the Elk Gold Project;

- Begin revenue generation and receive payment from its first mineralized material delivery.

A November 5th press release

Gold Mountain Receives Conditional Approval to List on the Toronto Stock Exchange

Uplisting to the TSX is yet another major milestone for the Company. Increased exposure, greater liquidity, not to mention a welcome mat for institutional investors looking for exposure to a burgeoning new producer in the space, are the upshot of a Big Board listing.

TSX Conditional Approval

The Company received conditional approval to list on the TSX after only ten months of trade on the Venture Exchange.

During this period, the Company transitioned from an exploration and development junior mining company, to a near term gold producer with strong and established partnerships in South Central British Columbia. The Company’s sound economics, broad shareholder base and imminent revenue generation lead Management to begin the process of up listing to the TSX.

Final approval of the Gold Mountain up-listing to the TSX is subject to the Company meeting certain customary conditions. Gold Mountain will officially announce when the trading of its common shares is expected to commence on the TSX. Upon completion of the final listing requirements, the Company’s common shares will be delisted from the TSXV.

CEO Smith:

“This should send a clear message on management’s intention to continue rapidly developing the Company.”

Deal Ready

The Preliminary Shelf Prospectus

Though management’s central focus is to generate optimum cash flow for each tonne of ore hauled off to the mill, you gotta know that this crew will be scouring the landscape in pursuit of new opportunities to drive shareholder value.

Fast-tracking exploration—creating synergies and delineating new resources organically—is where the immediate opportunity lies. But taking down a new acquisition, should the right one cross their radar, will likely require a significant cash outlay.

An additional $50M would put the Company in an enviable ‘deal ready’ position to facilitate such a move.

The Shelf Prospectus, upon a receipt for the final base shelf prospectus, would allow Gold Mountain to make offerings up to C$50,000,000 of common shares, warrants, subscription receipts, units, debt securities, share purchase contracts, or any combination thereof, from time to time over a 25-month period. The specific terms of any future offering of securities (if any) will be set forth in a shelf prospectus supplement. Gold Mountain has filed this base shelf prospectus for future financial flexibility and has no immediate intentions to undertake an offering. As reported in its quarterly financial statements ending July 31, 2021, Gold Mountain had a cash position of $14,931,106.

CEO Smith:

“As we transition into commercial production and continue expanding the Elk’s resources, the timing is right for our company to up list onto the Toronto Stock Exchange. Up listing to the TSX will mark a significant milestone for Gold Mountain and should send a message that management’s focus is corporate development on all fronts, with a goal of becoming a prominent name in Canadian mining. By listing on the TSX, we seek to further enhance the Company’s exposure and accessibility to institutional investors, as well as increase the liquidity of our market. We have also filed a Preliminary Base Shelf Prospectus with each province in Canada. While the company does not have any immediate requirement for additional funds, we wanted to put ourselves in a position to be deal ready over the next 25 months, should we elect to accelerate our exploration plans at the Elk or the right M&A opportunity presents itself. With a healthy treasury, the M199 mining permit in hand, and our Phase II exploration program nearing completion, the Company is positioned for a strong finish to our first year of trading, and look to carry that momentum into 2022.”

Final thoughts

This is the first gold mining permit issued in BC in nearly a decade.

This seamless transition from exploration/development to production could kick the shareholder-value-creation process into a whole new gear. As a cash-flowing Junior, this liquidity will be deployed to scale growth, without diluting its shareholder base.

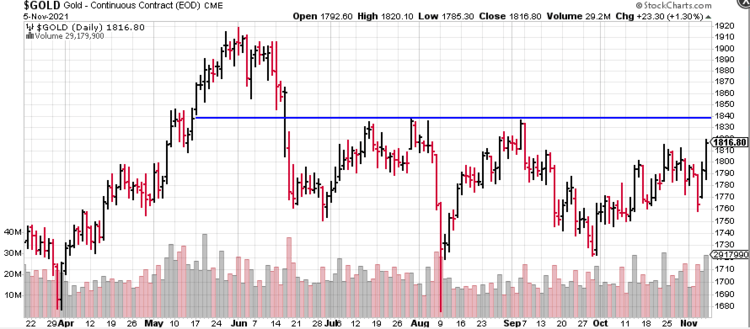

Positive trajectory on the price chart over the past three months may be a prologue of what’s to come, especially if gold pushes and settles north of its current chop at $1,800.

Recent trade in the precious metal—it’s currently changing hands overseas at $1,800 as I update this piece—positions it for a test of the $1,840 level.

With a plethora of compelling fundamentals underpinning the metal, that test appears inevitable…

In the short term, expect strong newsflow out of Gold Mountain on multiple fronts.

With a clear path to cash flow, a pending resource update, and stacks of assays yet to drop from an ongoing 13k meter Phase-2 drill program, there’s no shortage of near-term catalysts here (the Company plans an immediate launch into a 10,000 meter Phase-3 campaign on the heels of Phase-2 drilling).

We stand to watch.

END

—Greg Nolan

Full disclosure: Gold Mountain is an Equity Guru marketing client.