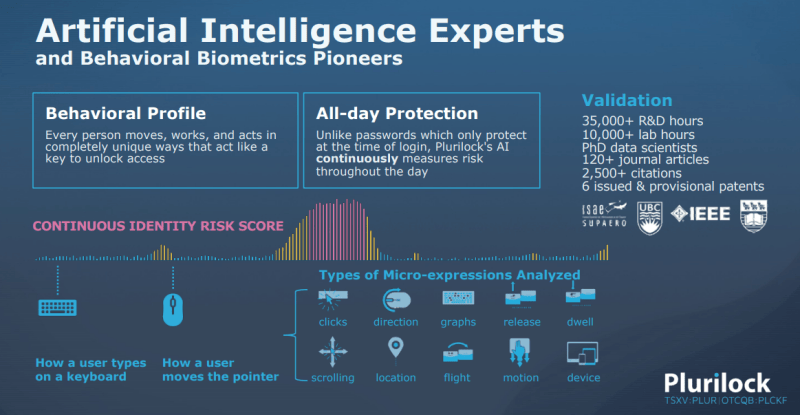

Plurilock Security (PLUR.V) is an identity-centric cybersecurity company that provides multi-factor authentication (MFA) solutions using behavioral-biometric, environmental, and contextual technologies. What does all that mean? Machine Learning that reduces or eliminates the need for passwords by measuring the pace, rhythm and cadence of a user’s keystrokes to confirm their identity. No more having to remember your first pet’s name for a password.

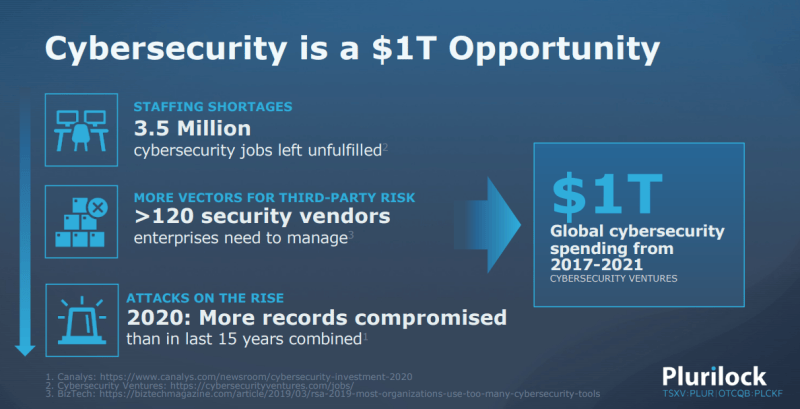

Let’s face it folks, Cybersecurity is a hot sector and trend for the future. Hacking and cyberwarfare will be a part of our lives going forward. We saw the Colonial pipeline incident, and then before that, a hack to take down some meat factories. This space will attract millions of investor’s money.

And it will attract millions of dollars from the government and institutions. The last time I covered Plurilock Security back on October 7th, I highlighted deals with NASA, the Department of Defense, the US Air Force, Department of the Navy, and even the Department of the Treasury. Well, here are some more headlines since the last coverage:

Management sets out and does what they say they are going to do. Consistent news flow is great for shareholders. More deals keep piling in, and a recent $4.6 Million bought deal financing has closed. Think more catalysts. I said this previously, but one day Plurilock will be able to branch out to more corporate contracts and eventually a consumer contract as opposed to just government deals. But government deals go a long way to establish trust and confidence for when Plurilock decides to go down the regular consumer route.

A lot of positives for this company, and I still believe they remain under the radar.

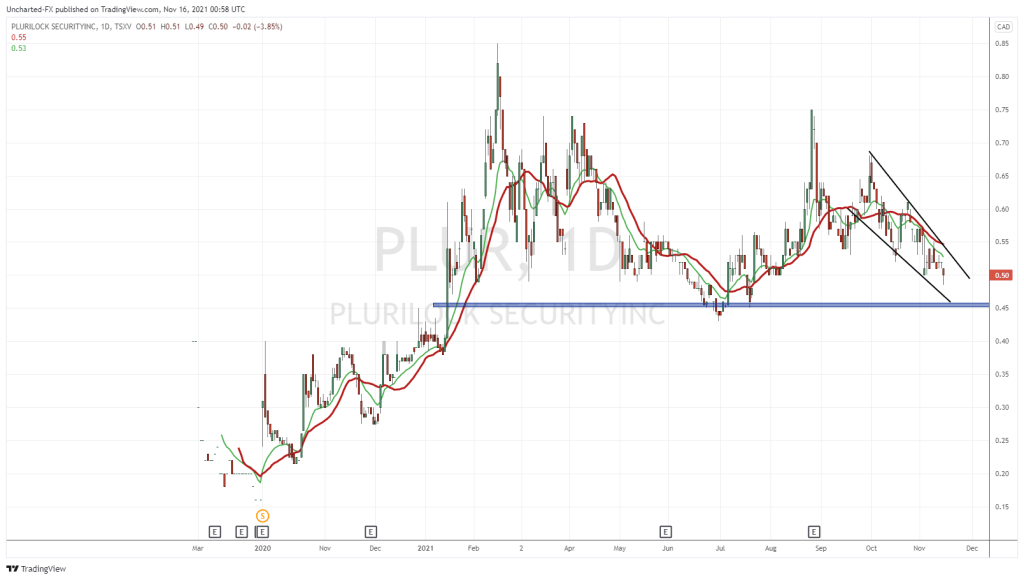

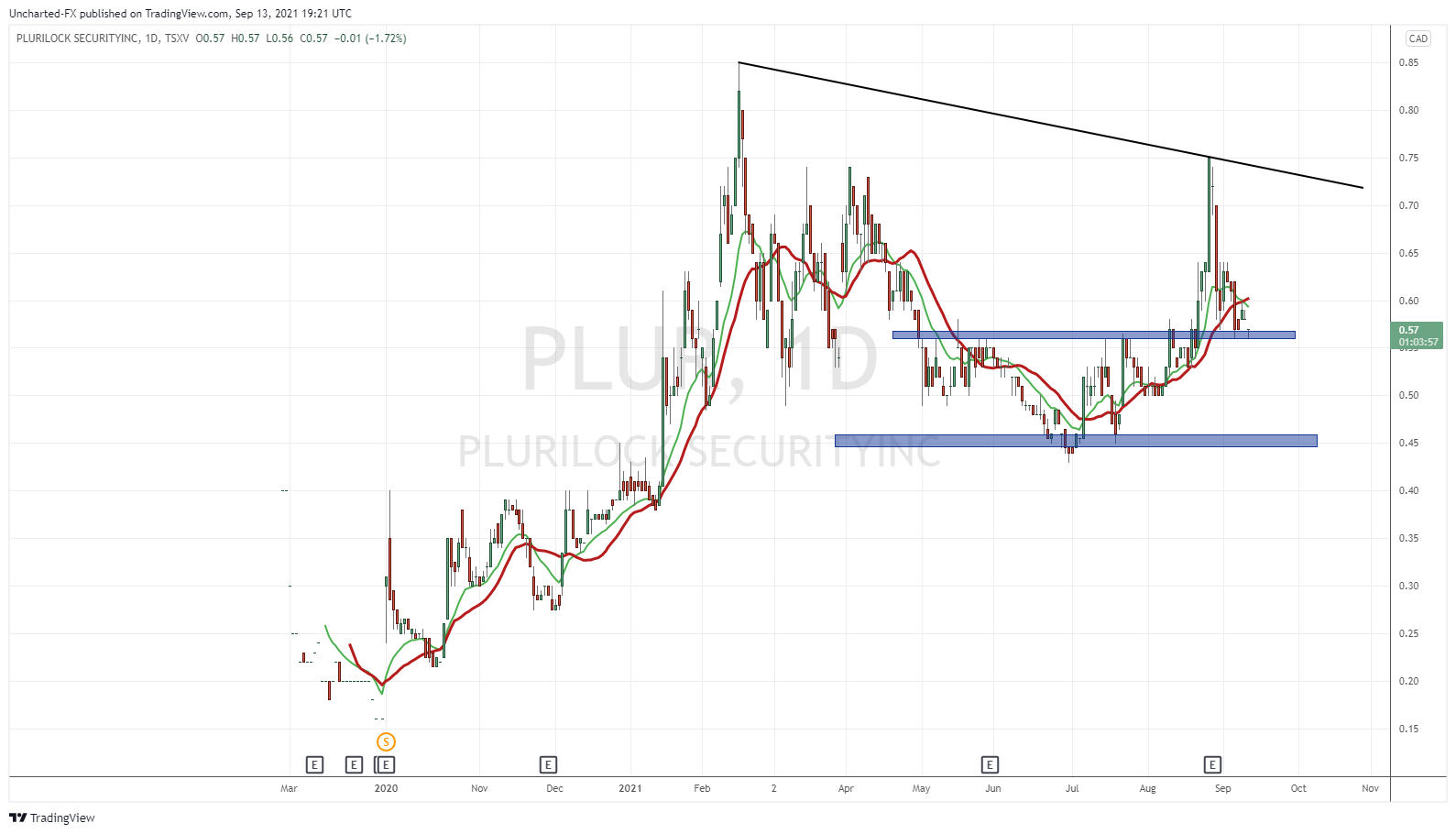

The chart of Plurilock unfortunately did not hold above the support mentioned in the last coverage. Here is a reminder:

This is what we are working with now:

A few things catching my technical eyes. Firstly, this $0.50 zone. A huge psychological number for stocks traded under $1.00. Yesterday saw trading volume hit 364,129 shares traded at $0.50. On November 3rd 2021, we also tested $0.50. Volume seen was 433,392 shares traded. So yea…this $0.50 zone is pretty big. I will be watching the next few days to see if we can build some support here. Yesterday was an initial good sign.

The line in the sand would be $0.45. So why don’t we mark this support zone between $0.45-$0.50. We must find some type of support here. A break below $0.45…and things wouldn’t look too great. We would then be looking at an extended downtrend.

If we see signs of basing at support, then this is a good sign for an entry. Alternatively, you can be like me, and wait for a proper breakout trigger to indicate momentum to the upside. Notice the trendlines I have drawn. This is known as a wedge pattern.

A falling wedge to be exact. Which is a BULLISH technical pattern. Since we are heading towards a major support zone, this area would provide the best platform for a major bounce. A bounce that would be strong enough to cause a breakout of the wedge pattern. A break and close above the wedge would be our bullish entry signal.