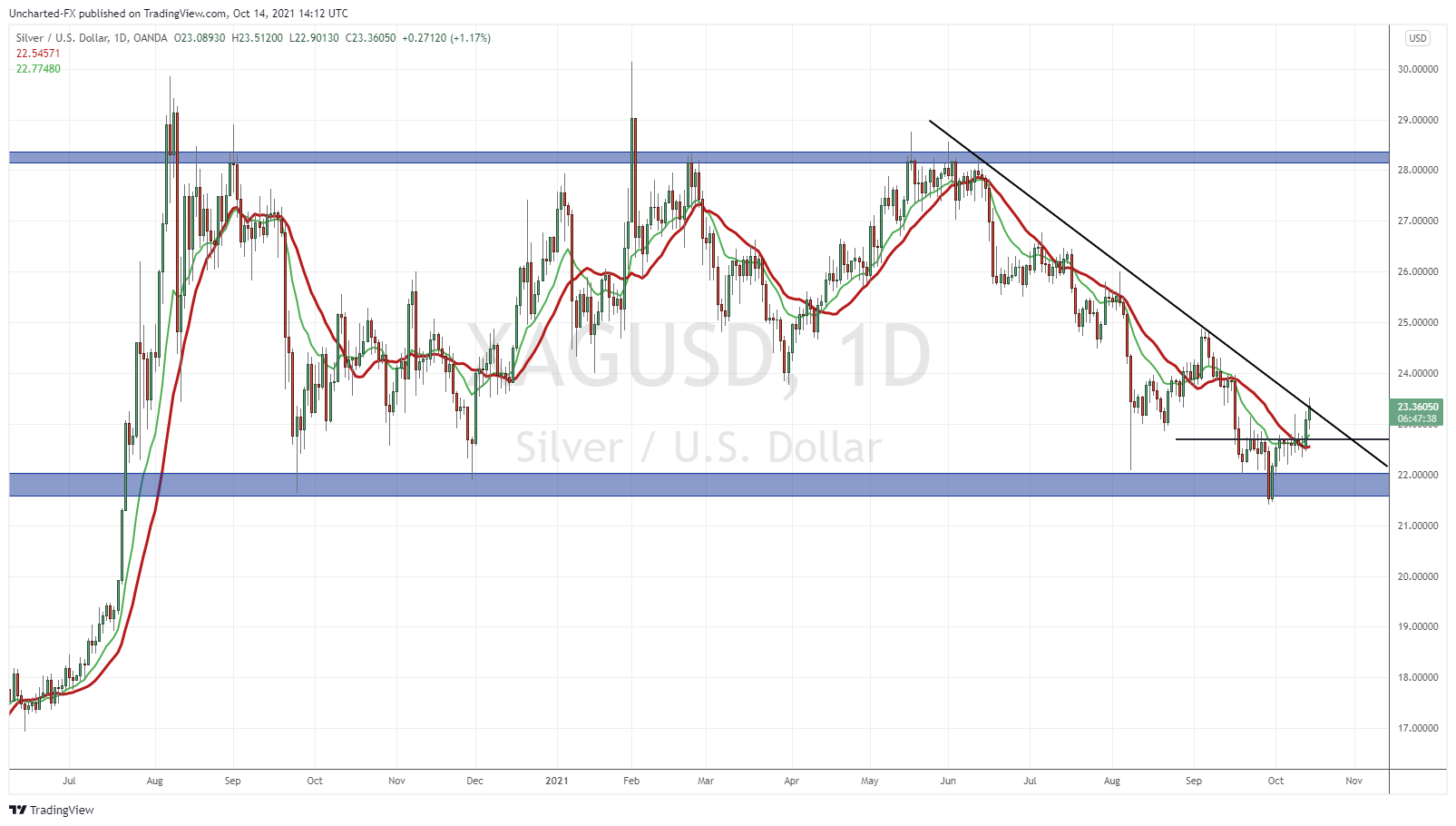

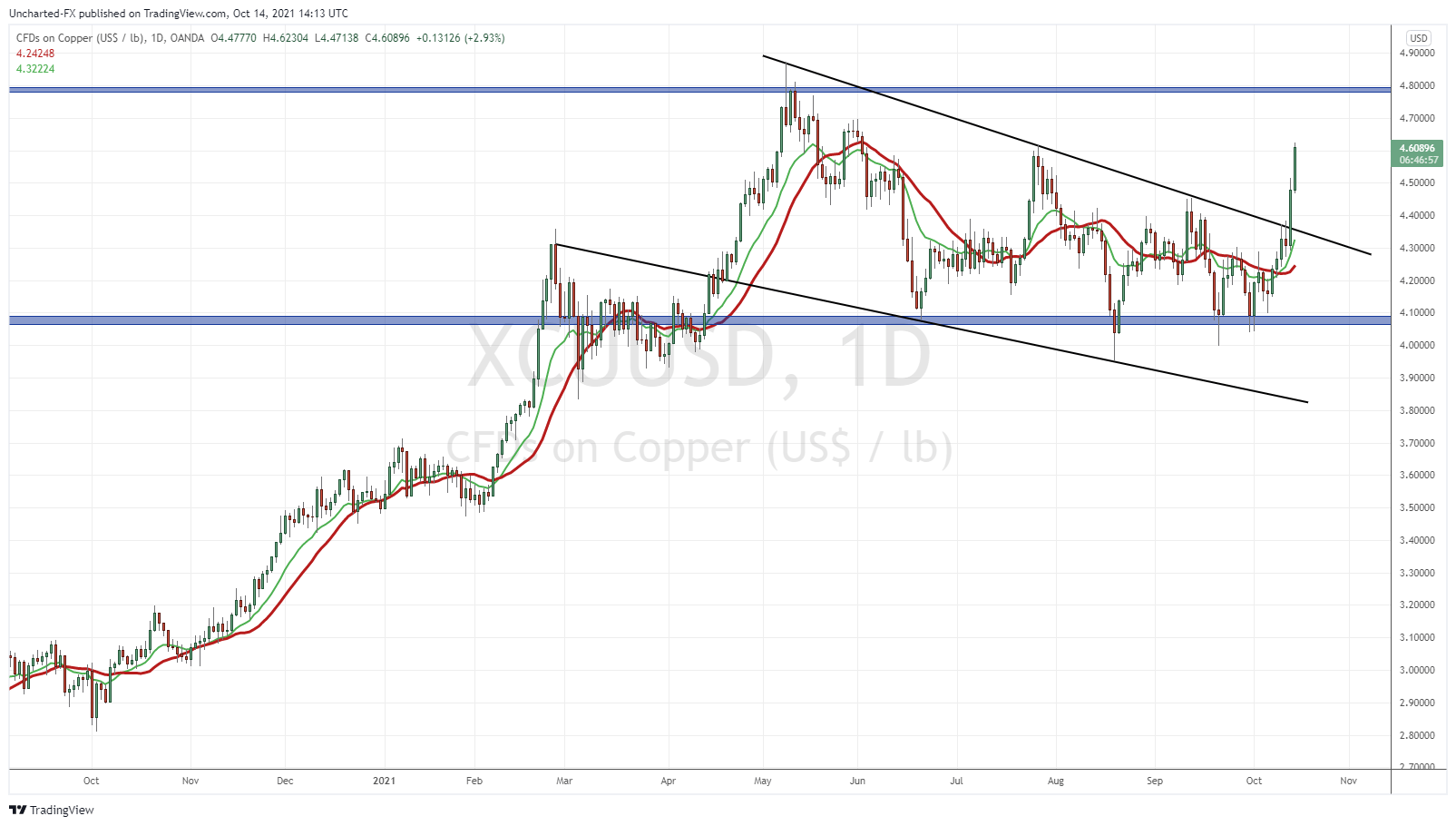

Yesterday saw a pair of stock market moving data dumps. First off, we had the CPI which told us that inflation is still coming in hot. Used car prices, which has been leading inflation data for months, finally came down. But bad news for the ordinary middle class as food and energy rose. Gold, Silver, and Copper popped hard on this data.

One of the anticipated high risk data event was the FOMC minutes. These are the notes from the Fed committee from the LAST Fed rate decision. It provides us an opportunity to gauge what individual members are thinking and therefore determine when policy will change. If you follow markets and macro news then you know all about tapering. For months, the Fed has kept us on edge by hinting at tapering only to push the goal posts further down the road. A tapering timeline from Powell’s mouth is what the market is watching for in the next two Fed meetings.

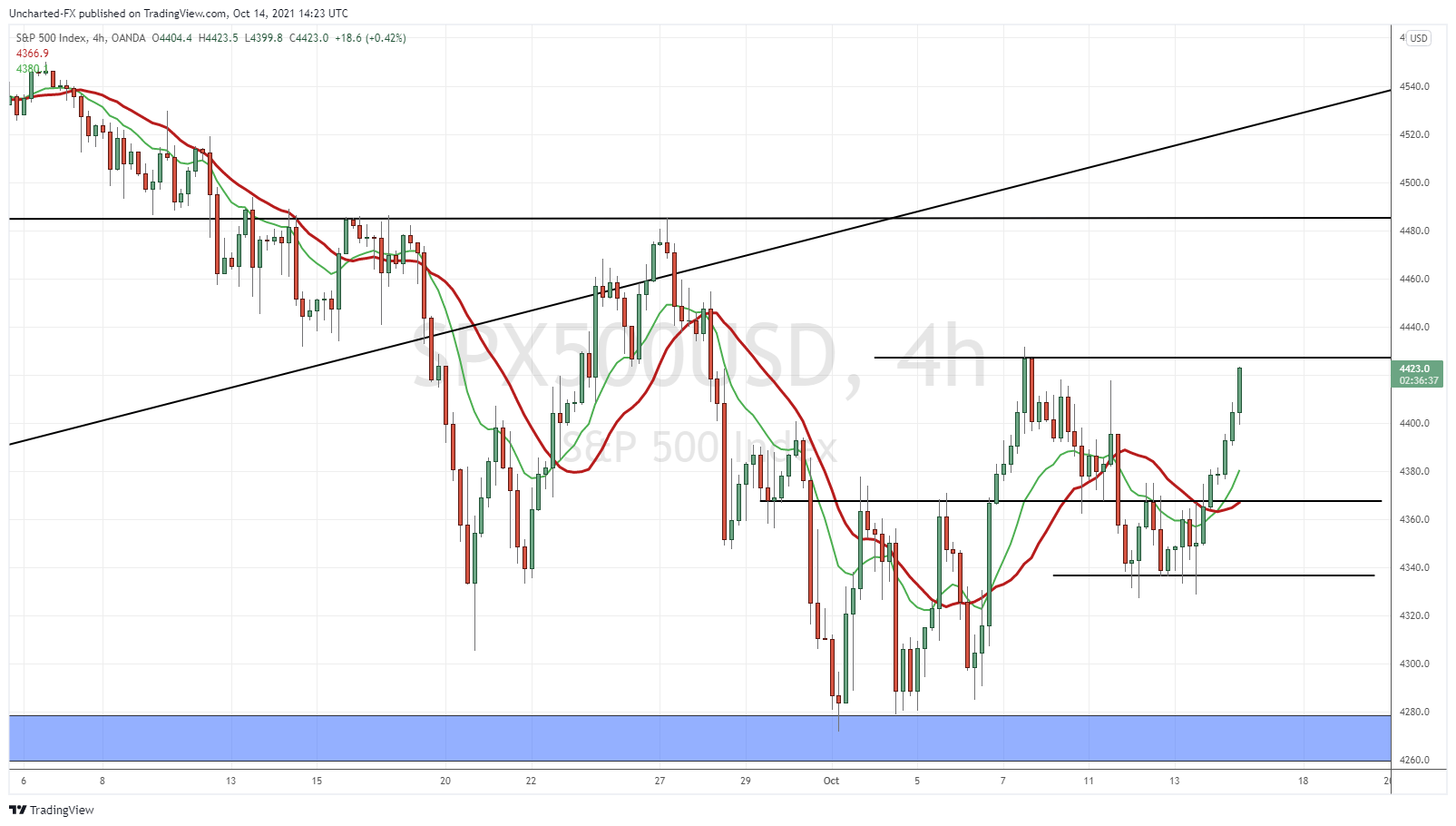

However, FOMC minutes may have given us a preview. The Fed ‘could’ begin the gradual tapering process mid-November. Here is how the stock markets reacted after the news and into today:

A breakout above our range and a rip into the US session. This comes as a surprise especially to those who thought a taper process would cause a taper tantrum market sell off. But just wait, let’s dig into the FOMC statement just a little bit more.

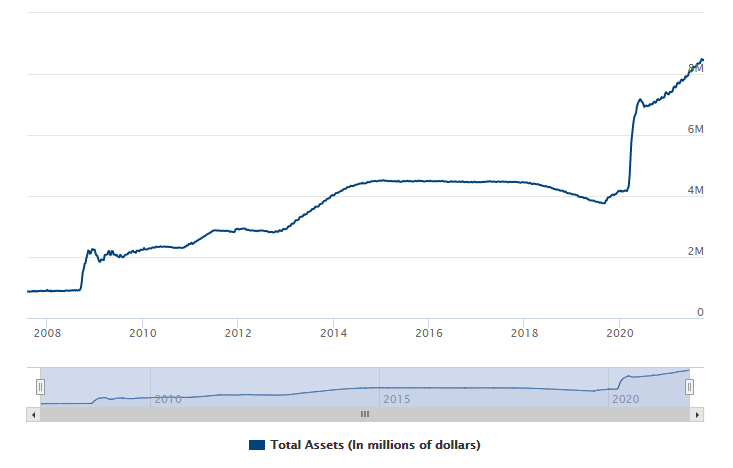

In a process known as tapering, the Fed would reduce the $120 billion a month in bond buys slowly. The minutes indicated the central bank probably would start by cutting $10 billion a month in Treasurys and $5 billion a month in mortgage-backed securities. The Fed is currently buying at least $80 billion in Treasurys and $40 billion in MBS.

The target date to end the purchases should there be no disruptions would be mid-2022.

One argument for this reaction is that the taper is a token taper. I mean in the scope of things, Out of the $120 billion spent a month to buy treasurys and mortgage backed securities, the Fed is reducing that by $15 billion down to $105 billion per month.

The other argument is that the market doesn’t buy the Fed taper talk. The market is pricing in no SIGNIFICANT change in Fed policy. Stock markets are reacting as if no taper is coming. To be honest, from now until November it could be any sort of bad news such as Covid numbers, employment data, or say something outside the US like China, which could force the Fed to rethink tapering.

Oh and there is this too:

While the Fed tells us taper taper, their actions indicate the opposite. We still see the Fed’s balance sheet increase weekly. Look at what entities do rather than say. In fact, this lesson can be applied to everything in life.

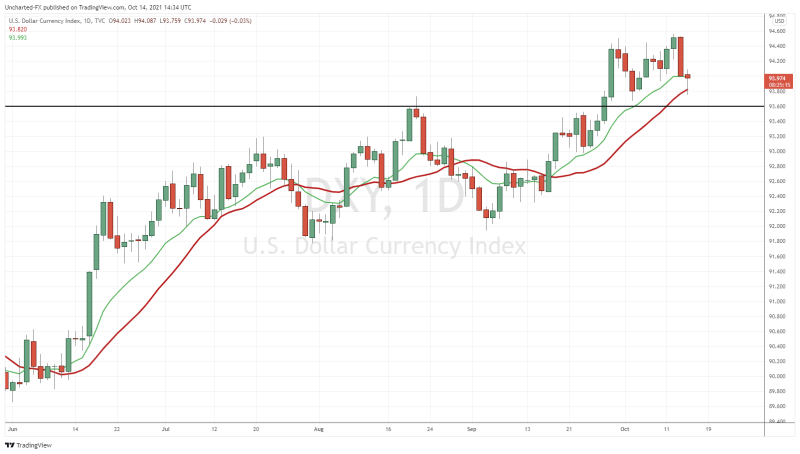

But the two charts which told us the markets are not buying the Fed’s tapering talk, either meaning the token taper is insignificant, or no taper at all, are the charts of the US Dollar and the 10 Year Yield.

Above is a zoomed in daily chart of the US Dollar Index, or the DXY. We had a breakout confirmed on Tuesday, only to see a fake out sell off on Wednesday. The Dollar dumped on FOMC minutes. It should have done the opposite on a taper. No yes, I understand some of you may be thinking this was a buy the rumor sell the news incident. Perhaps. But we will know for sure in the next few days. If the Dollar breaks below the major support at 93.60, then we can say the market is not pricing in a taper or a token taper.

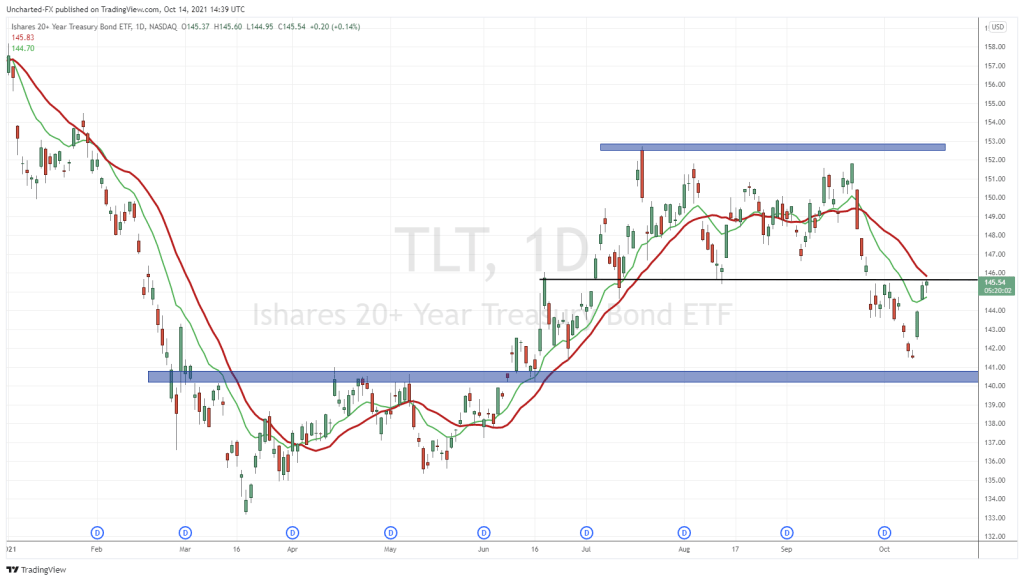

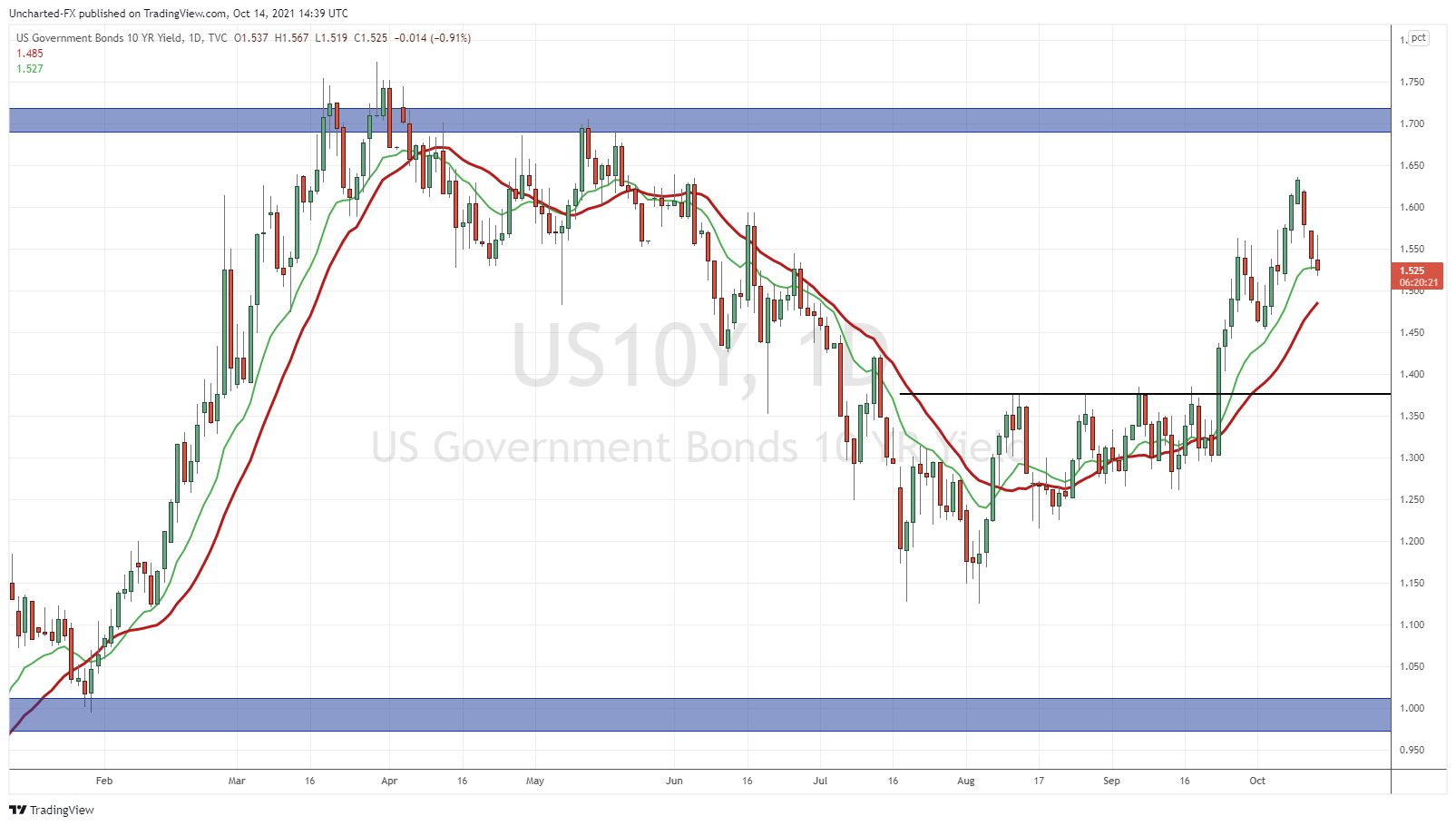

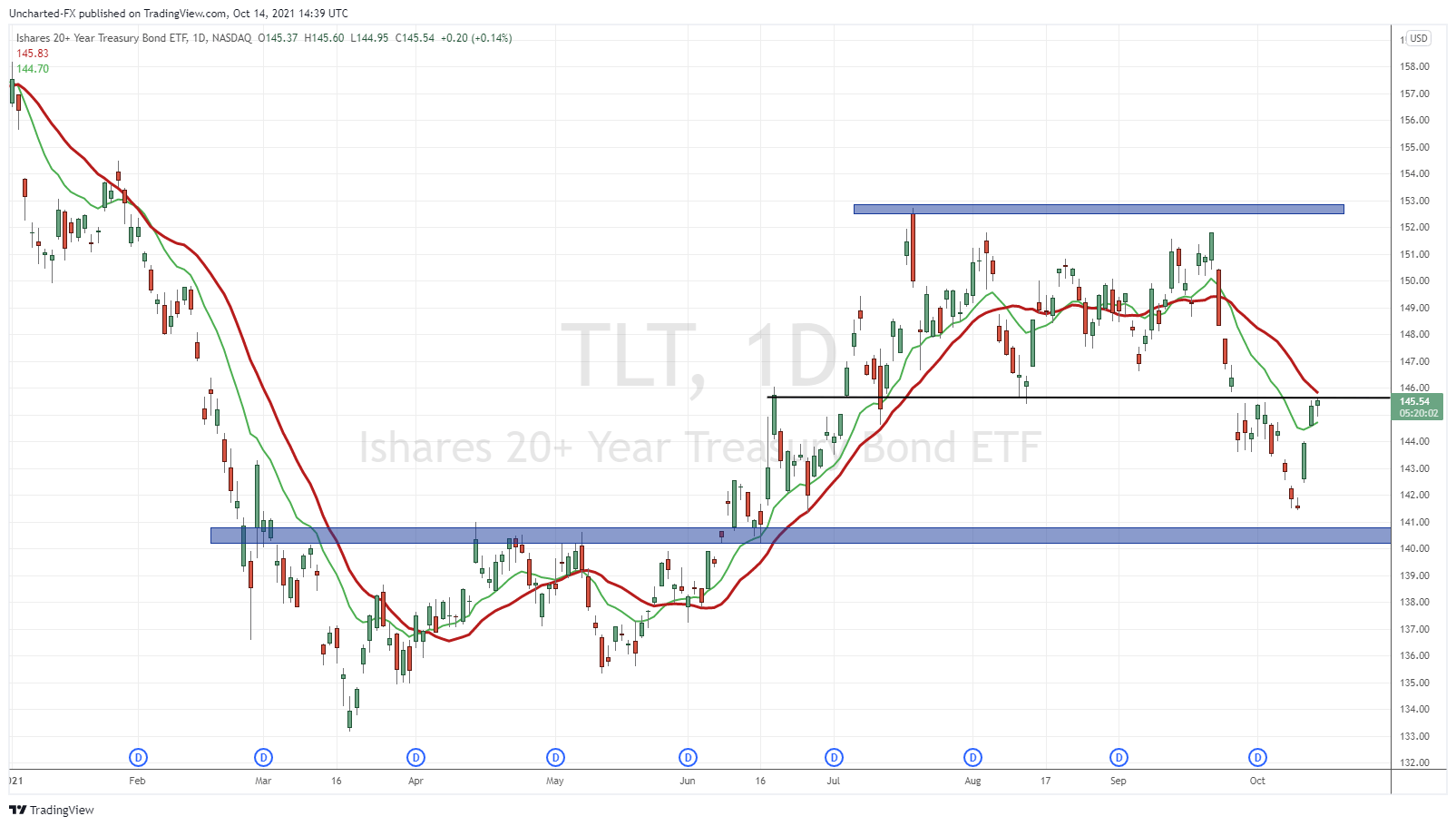

Above are the daily charts of the US 10 year yield and TLT. Remember the inverse correlation: when bonds go up, yields go down. When bonds go down, yields go up.

So let me ask you this. You have been buying bonds because the Fed has been buying bonds. I mean you cannot lose buying what the central bank is buying. Ask the Japanese and the Bank of Japan as the Nikkei regains levels not seen for 30 years.

Now you hear the Fed will begin to sell some bonds off. What would you do? Many would say, and have been saying, that bonds have been selling off due to the market pricing in a taper. It makes sense. But what we saw is the opposite. Bonds climbed higher and yields dropped. The bond market either finds this token taper insignificant, or is pricing in no change to Fed policy.

Let’s watch to see how both the US Dollar and the 10 year yield react going forward. If you are a part of Equity Guru’s Discord channel, you will see updates from me on a daily basis. I will be honest, when I saw the FOMC minutes, and then saw the reaction in Stock Markets, the Bond Markets and the US Dollar, the first thing to come to mind was the markets are not buying it! We still have about 30 days until the mid of November. A lot can happen from now until then to change the Fed’s mind.