Inflation is a hot topic right now. No pun intended. Here at Equity Guru, I have been sounding the alarm bells regarding inflation since the beginning of the year. Actually, since the Fed’s current monetary policy began. In this Market Moment, we will take a look at the current inflation data and pressures, the definition of inflation, and a reminder on the criteria for an inflationary versus deflationary environment. The last will be a powerful tool for investors and traders in the upcoming months and years.

Tapering is the talk on the street. The Fed said they had two criteria: one was inflation data, the other was employment data. Powell told us the Fed was focused on employment because well…inflation is transitory. Remember that narrative? Month after month inflationary pressures rose yet the Fed told us this would disappear. Doesn’t look like inflation is temporary now.

Supply chain disruptions are the cause of this inflation. Over in the UK, their energy crisis is largely stemming from the fact that there aren’t enough workers. There are even talks of a three day workweek to be the answer to the UK’s energy torment.

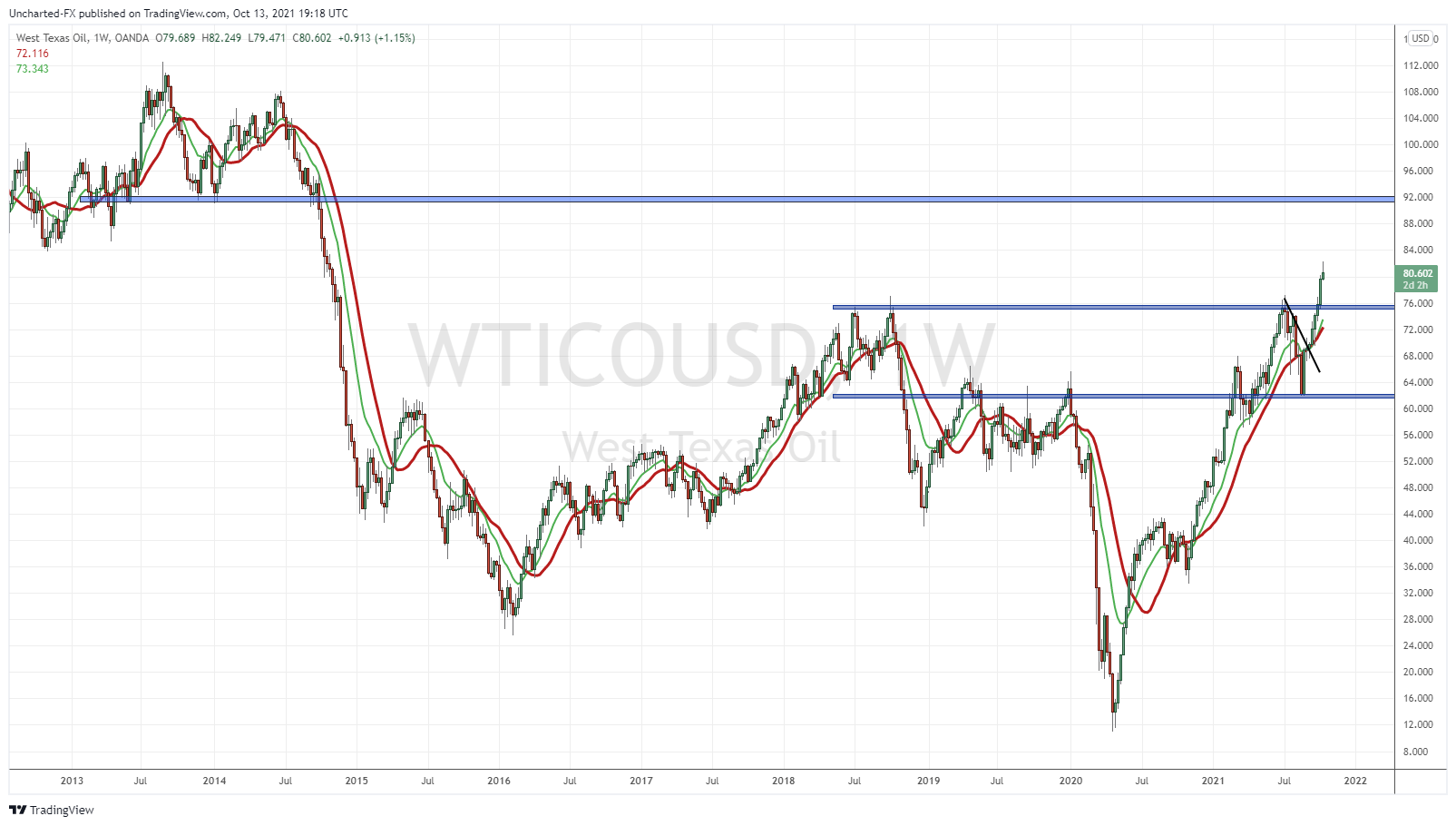

I have been detailing through the technicals that Oil prices are going to be heading higher. We aren’t done. Higher prices are coming. Higher fuel costs, as well as higher costs for heating homes will be pinching the middle class. Oh, and I forgot to mention rising food costs.

Today, US CPI data came out. This is what we got:

The consumer price index for all items rose 0.4% for the month, compared to the 0.3% Dow Jones estimate. On a year-over-year basis, prices increased 5.4% vs. the estimate for 5.3% and the highest since January 1991.

However, excluding volatile food and energy prices, the CPI increased 0.2% on the month and 4% year over year, against respective estimates for 0.3% and 4%.

Gasoline prices rose another 1.2% for the month, bringing the annual increase to 42.1%. Fuel oil shot up 3.9%, for a 42.6% year over year surge.

Food prices also showed notable gains for the month, with food at home rising 1.2%. Meat prices rose 3.3% just in September and increased 12.6% year over year.

Energy and food prices climbed, while used car prices, which had been a central story in the inflation picture this year, declined.

So the traditional monetary policy way to deal with inflation has been to hike interest rates. Something the Fed and the Markets don’t see until the second half of 2022. However, will rate hikes have to come sooner rather than later to control inflation? Even the IMF yesterday warned central banks to prepare to raise rates (tighten) to combat inflation. The million dollar question: can central banks even hike rates due to all the debt out there? Think about Japan, Switzerland and the European Union who have negative interest rates. And it has been this way for over a decade. Any rate hike could cause tons of problems. In fact the contrarians believe those central banks cannot hike rates. Is the US and the Fed in the same boat?

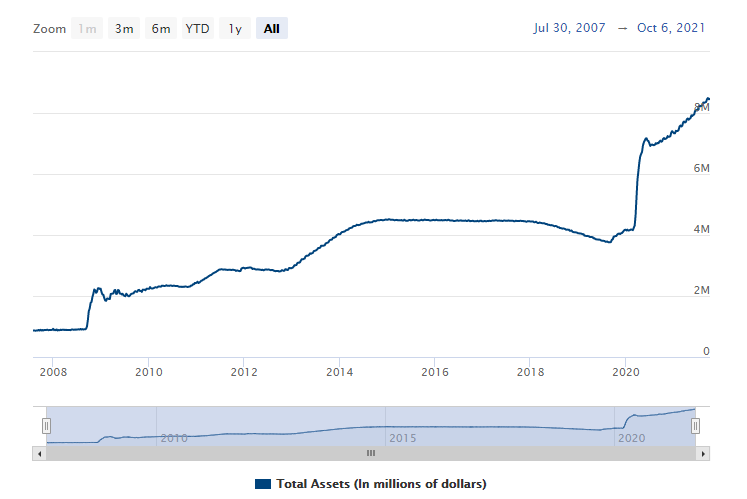

This is why tapering is a big deal. Even though we keep hearing about the Fed tapering, their actions are saying otherwise. The Fed’s balance sheet keeps on increasing every week:

So let’s talk about inflation. As someone who follows the classical economist inflation definition, I define inflation through currency. Inflation means your currency is getting weaker, so it takes more of a weak currency to buy something. Hence higher prices. Deflation is the opposite. Your currency is getting stronger, so it takes less of the stronger currency to buy something. Hence lower prices. It is all about purchasing power. This means from a classical perspective, supply and demand issues are not inflationary pressures. For example, a freak storm that wipes out wheat, or a war that disrupts Oil pipelines, both of which would cause wheat and oil prices to rise, are acts of nature or geopolitics. Not necessarily one to do with purchasing power and the currency. But central banks like to cite this nonetheless.

One of my favorite inflation examples is purchasing meat. Organic meat goes for a premium today. But in reality, it is just the same meat you would have bought back in the 70’s or 60’s before hormones and steroids were introduced into meat products. It is the same meat, but for a higher price today.

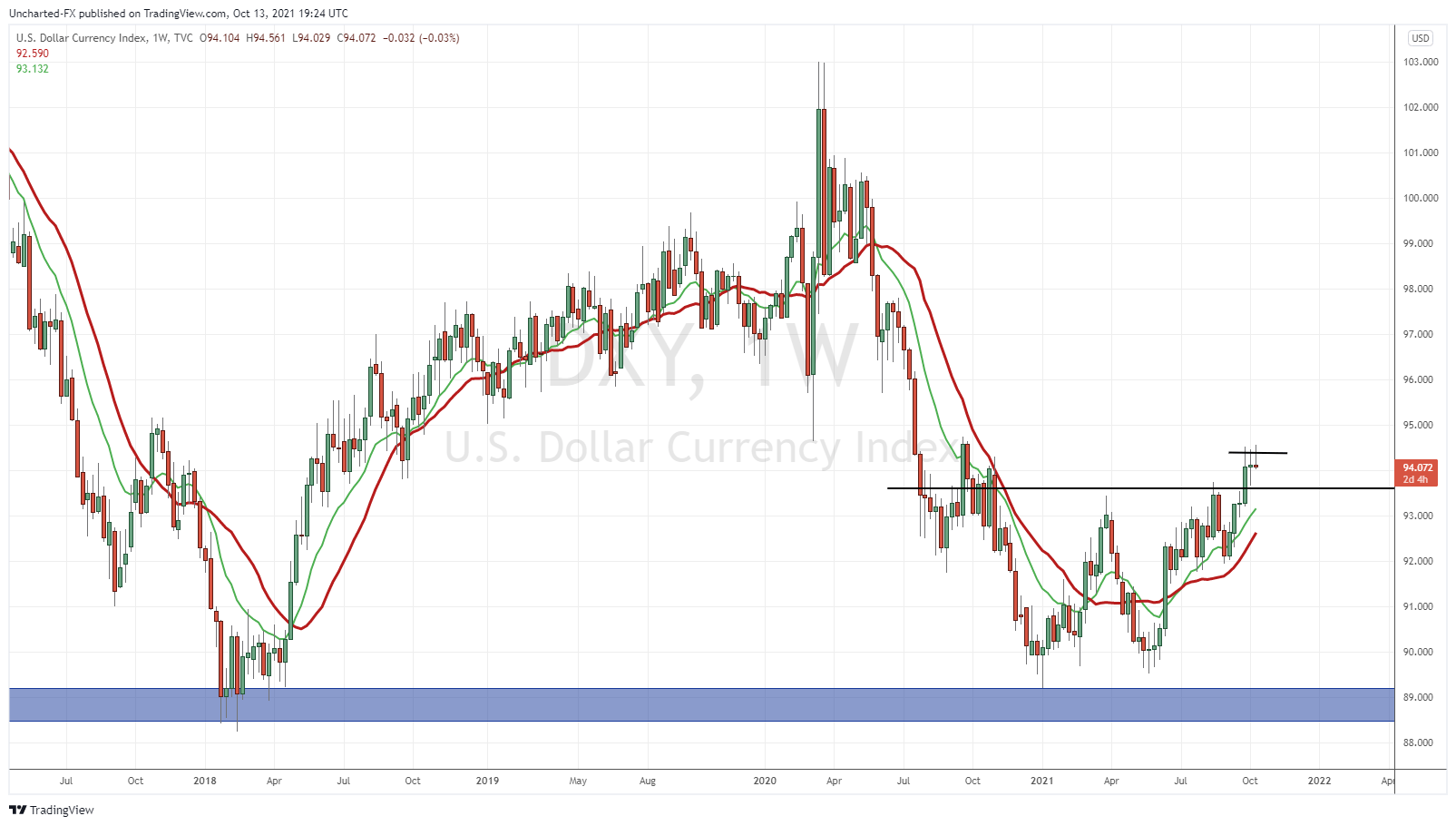

This is why I am watching the US Dollar like a hawk. A rise in the US Dollar means the decline of other currencies against the US Dollar. This would raise inflationary pressures on those countries. Which when added to the supply chain problem, will cause problems.

We should also mention the Fed money printing and money supply. We were in a situation, and some say still are, where we have people with more money competing for the same number of goods and services. Productivity was/is not going up. Just have people with more money competing for the same number of goods and services. This means prices have to move higher.

FOMC minutes have come out, and the Fed is saying that they could gradually begin tapering by mid November. The minutes indicated the central bank probably would start by cutting $10 billion a month in Treasurys and $5 billion a month in mortgage-backed securities. However, inflation remains a concern, and could linger longer ‘than they currently assumed’. If the Stock Markets are propped up on Fed monetary policy, then a taper would be bearish, and would cause a taper tantrum sell off. Perhaps this is why US Stock Markets remain subdued… and still remain below my Lower High bearish zone. More downside is possible unless we close above and take out these Lower Highs. You can find more info in yesterday’s Market Moment post.

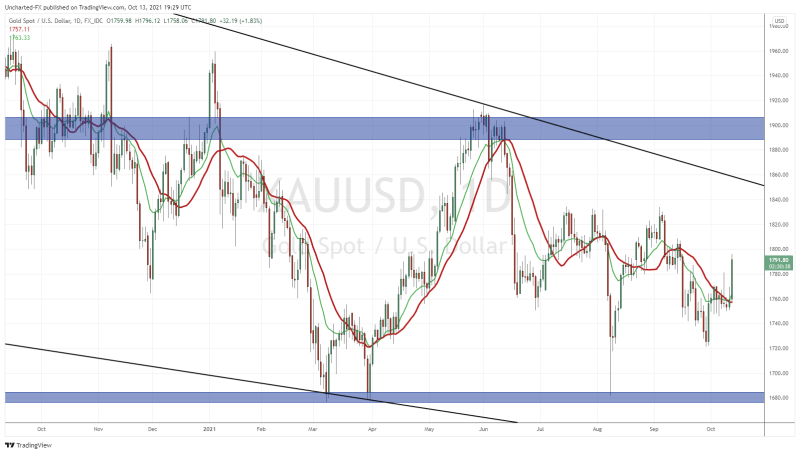

Gold and Silver are reacting as proper inflationary hedges today. Gold with a 2% green day after the CPI was released:

Now to end, I want to remind readers about our inflation vs deflation criteria. I mention this because the best case scenario seems to be Japan. Everything just looks like Japan in the 80’s, and they went through decades of deflation. Here are the criteria to look out for heading into the future:

Inflation Signals

- Rising Interest Rates (A Fall in Bond Prices).

- Rise in Foreign Currencies (Euro, Loonie etc) or another way to put it, a fall in the US Dollar.

- Rising Gold Prices

Deflation Signals are the opposite:

- Lower Interest Rates (A Rise in Bond Prices)

- A Fall in Foreign Currencies, or a Rise in the US Dollar.

- Falling in Gold Prices.