Even during my university days, I would find myself grasping my chest, wheezing after a short 15-minute walk to campus. In terms of fitness, I would consider myself to be above average. With this in mind, I found it startling that I was struggling to do something as trivial as walking to class. Drenched in sweat and gasping for air, it still wasn’t enough to convince me to drive back home and see my family doctor. To this day, unless I breathe deeply before climbing a set of stairs, I will be short of breath once I reach the top.

To make matters worse, I sound like a sad kettle whenever I inhale to catch my breath. Does this mean I have asthma, I don’t know, but statistically speaking, there is a high chance I might.

Asthma refers to a chronic inflammatory disease that causes the airways in the lungs to narrow and swell, making it difficult to breathe. It is one of the most common long-term diseases of children, however, adults can have asthma too. Some of the symptoms associated with asthma include wheezing, breathlessness, chest tightness, and coughing at night or early in the morning. That being said, asthma affects more than 3.8 million Canadians, including 850,000 children under the age of 14. It is the third most common chronic disease, with 300 Canadians being diagnosed daily and 250 Canadians dying from asthma attacks every year.

Valeo Pharma Inc.

- $63.03M Market Capitalization

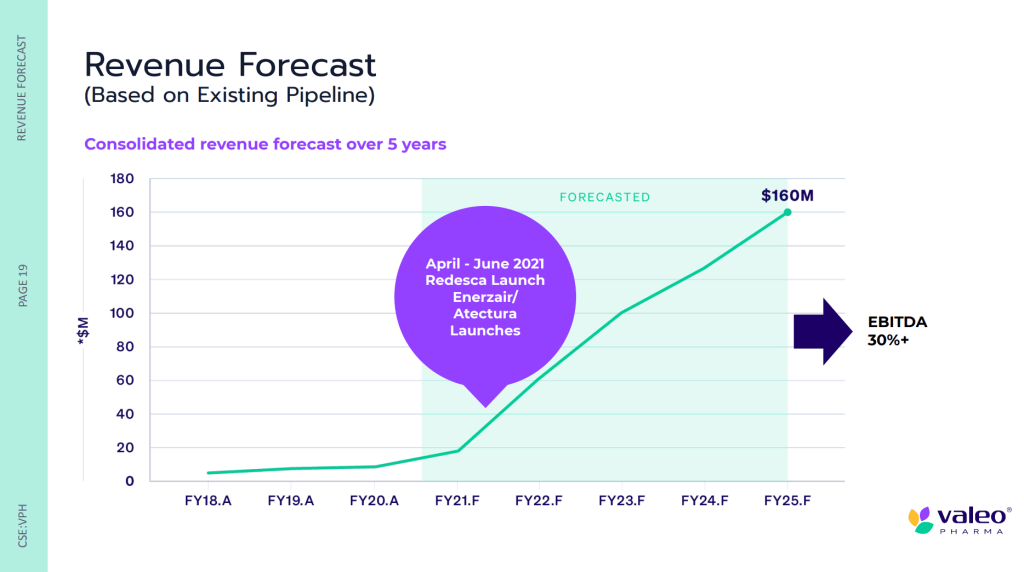

Valeo Pharma Inc. (VPH.C) is a pharmaceutical company dedicated to the commercialization of innovative prescription products in Canada with a focus on respirology, neurodegenerative diseases, oncology, and other specialty products. The Company is committed to expanding Canadian healthcare through the licensing and acquisition of commercial-stage, innovative and proprietary drugs. Following its initial listing on the Canadian Securities Exchange (CSE) on February 20, 2019, Valeo was able to raise more than $37 million in funds. With regards to respirology, also referred to as pulmonology, Valeo is recognized for its two asthma treatments, Enerzair® Breezhaler® (“Enerzair”) andAtectura® Breezhaler® (“Atectura”).

Atectura is indicated as a once-daily maintenance treatment of asthma in adults and adolescents 12 years of age and older with reversible obstructive airway disease. This is where things get a little technical, so bear with me. First, let’s clear up a couple of terms, including ICS and LABA. ICS refers to Inhaled Corticosteroid, commonly referred to as an inhaled steroid, which works to reduce the inflammation in the airways of the lungs. Similarly, LABA refers to Long-Acting Beta Agonist, a bronchodilator that works by relaxing the muscles around the airways.

The combination of these two medications, https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistered through an inhaler, is intended to prevent an individual from having an asthma attack. That being said, ICS are first-line therapy for all patients with persistent asthma, controlling asthma symptoms and preventing exacerbation. With this in mind, Atectura should be prescribed for patients not adequately controlled on a long-term asthma control medication, such as ICS, or whose disease severity warrants treatment with both a LABA and an ICS. Combining the properties of both ICS and LABA in a precise once-daily formulation, Valeo’s Atectura maintenance treatment is delivered via a dose-confirming Breezhaler® device.

Similar to Atectura, Enerzair is indicated as a maintenance treatment of asthma in adult patients not adequately controlled with a combination of a LABA and a medium or high dose of an ICS who have experienced one or more asthma exacerbations in the previous 12 months. Unlike Atectura, Enerzair combines the various properties of LABA and ICS medications with a LAMA, a long-acting muscarinic antagonist, which is intended to be taken in combination with LABA and ICS inhalers.

Put simply, LAMAs are historically considered less effective than LABAs, however, recent studies have generated substantial evidence in support of LAMAs as add-ons to either ICS monotherapy or LABA combinations. Like Atectura, Enerzair is a precise once-daily formulation, https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistered via the Company’s Breezhaler® device. Commercialization for both Atectura and Enerzair began on June 22, 2021, following product shipments across Canada and the initial deployment of the Company’s national respiratory sales force.

Aside from Atectura and Enerzair, Valeo has a whole portfolio of products, all of which have been launched and are approved by Health Canada. Some of these products include the Company’s Redesca® biosimilar for deep vein thrombosis and pulmonary embolism, Hesperco® anti-oxidant for immune system support, Onstryv® for second-line treatment of Parkinson’s Disease, and Yondelis® for second-line treatment in soft tissue sarcoma (STS).

Keep in mind, Redesca® has more than 8 years of proven in-market safety internationally and more than 150 patient days treated in Europe alone. Similarly, Onstryv® has been marked since Q3 2019 and is expected to reach peak sales within 3-5 years. As for Hesperco®, in addition to being available online as well as through Amazon Canada, the Company expects Hesperco will be available at most Canadian retailers in 2021, with a United States (US) launch planned for 2021. With this in mind, having launched several products across Canada for multiple indications, Valeo has pulled some impressive numbers out of its hat.

Financials

According to Valeo’s Q3 2021 Financial Results, the Company reported quarterly revenues of $5.7 million, up 280% compared to $1.5 million year-over-year. Compared to the previous quarter (Q2 2021), this represents a 114% increase, up from $2.6 million. Moreover, Valeo achieved improved quarterly gross margins of $2.2 million, up an outstanding 1602% compared to $0.1 million year-over-year. In total, Valeo reported record year-to-date (YTD) revenues of $10.2 million, up 94% compared to $5.3 million. However, the Company also reported an increased net loss of $6.6 million compared to $3.3 million in the same period.

According to Valeo, the Company’s net loss was impacted by material non-recurrent expenses such as hiring fees, which totaled $0.8 million YTD. As of Q3 2021, Valeo had a cash balance of $9.0 million compared to $2.8 million at year-ended (YE) 2020, representing a 217% increase. The Company’s cash reserves also increased substantially as a result of a $10.3 million bought deal offering closed in June. Overall, as of July 31, 2021, Valeo had working capital of roughly $4.6 million. In the same period, the Company’s total outstanding shares equaled 78,787,674, resulting in a market capitalization of approximately $73.272 million.

Recent News

Most recently, on November 3, 2021, Valeo announced that it has entered into a Product Listing Agreement (PLA) with the Alberta Minister of Health, for the listing and public reimbursement of Enerzair Breezhaler and Antectura Breezhaler, on the Alberta Drug Benefit list effective November 1, 2021.

Additionally, on October 5, 2021, Valeo announced that it has completed its negotiations and entered into a Letter of Intent (LOI) with the pan-Canadian Pharmaceutical Alliance (pCPA) regarding Enerzair and Atectura, the Company’s two asthma therapies. For context, the pCPA conducts joint provincial, territorial, and federal negotiations for brand name and generic drugs in Canada. In doing so, this is intended to achieve greater value for publicly funded drug programs and patients through the use of the combined negotiating power of participating jurisdictions. Some of pCPA’s key responsibilities include increasing patient access to clinically effective and cost-effective drug treatment options and achieving consistent and lower drug costs for participating jurisdictions.

“The successful conclusion of our negotiations with pCPA regarding Enerzair and Atectura is a key milestone for our respiratory commercial program. We now look forward to working diligently with all participating jurisdictions to secure coverage from publicly funded drug plans across Canada. In addition, private payer health plan coverage currently stands in excess of 85% of privately insured lives in Canada“, said Frederic Fasano, Valeo’s President and Chief Operating Officer.

Valeo previously entered into an LOI with the pCPA on April 6, 2021, regarding Redesca®. Following the successful completion of its negotiations, the Company was permitted to exchange with provincial, territories, and federal instances to ensure coverage under publicly funded drug plans in Canada, thereby making the Company’s treatments more accessible for Canadians. Looking forward, the Company has completed its new corporate structure with full commercial activities ongoing for Redesca®, Enerzair, and Atectura. All three products have been transformative assets for Valeo, enabling the Company to achieve record results in Q3 2021.

Valeo is a perfect example of just how profitable a pharmaceutical company can be once its products get off the ground. However, by licensing and acquiring Canadian rights to commercial-stage proprietary drugs, Valeo has the unique advantage of bypassing the risks associated with drug development and clinical activities. Additionally, the Company’s fully integrated capabilities, ranging from business development & licensing to medical affairs, Valeo is able to manage its growing product portfolio through all stages of commercialization.

Referring back to Valeo’s presence in the asthma treatment market, it is worth noting that direct costs associated with asthma are estimated at $2.1 billion per year. This number is expected to grow to roughly $4.2 billion by 2030. With this in mind, there is a growing market for Valeos’s two innovative asthma treatments, Enerzair and Atectura. With significant insider ownership of 62%, it is clear to see that Valeo is supported by a stalwart management team, led by the Company’s Founder and CEO, Steve Saviuk.

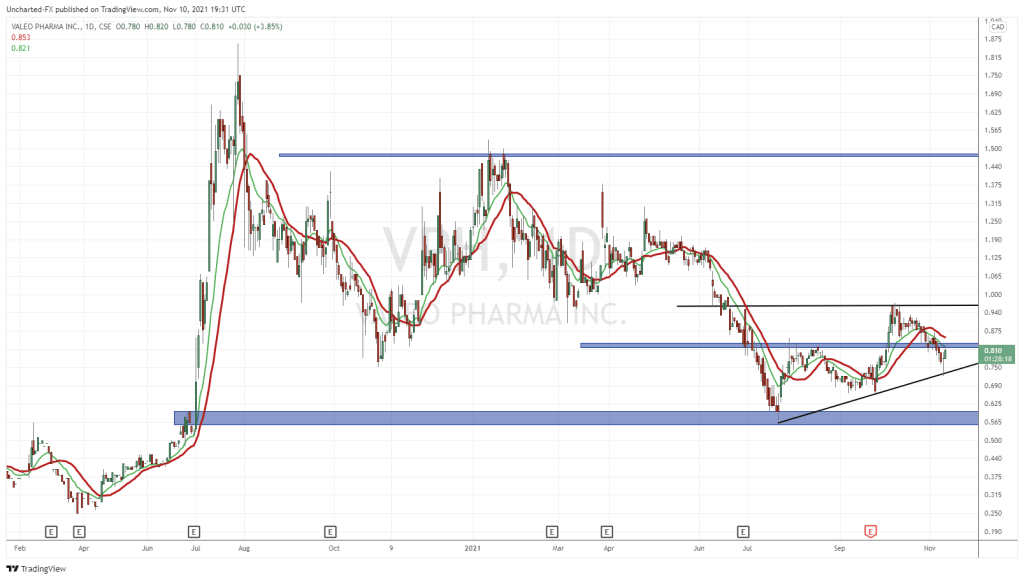

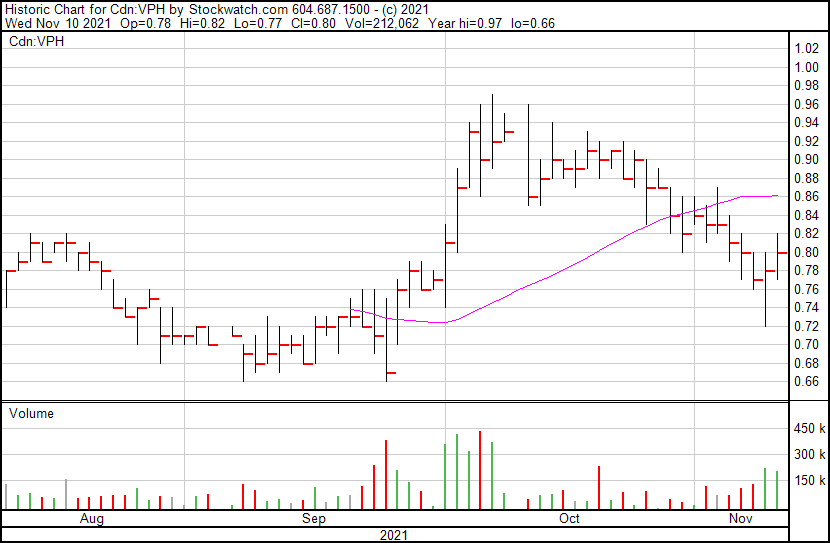

Valeo’s share price opened at $0.78 and closed at $0.80 on November 10, 2021.