Valeo Pharma (VPH.C) is a specialty pharmaceutical company that sources, acquires, or in-licenses brand and generic products for sale in Canada. Valeo’s business objective is to become an anchor for the Canadian healthcare Corporations by focusing on the commercialization of ground-breaking products that increase patient lives and support healthcare suppliers.

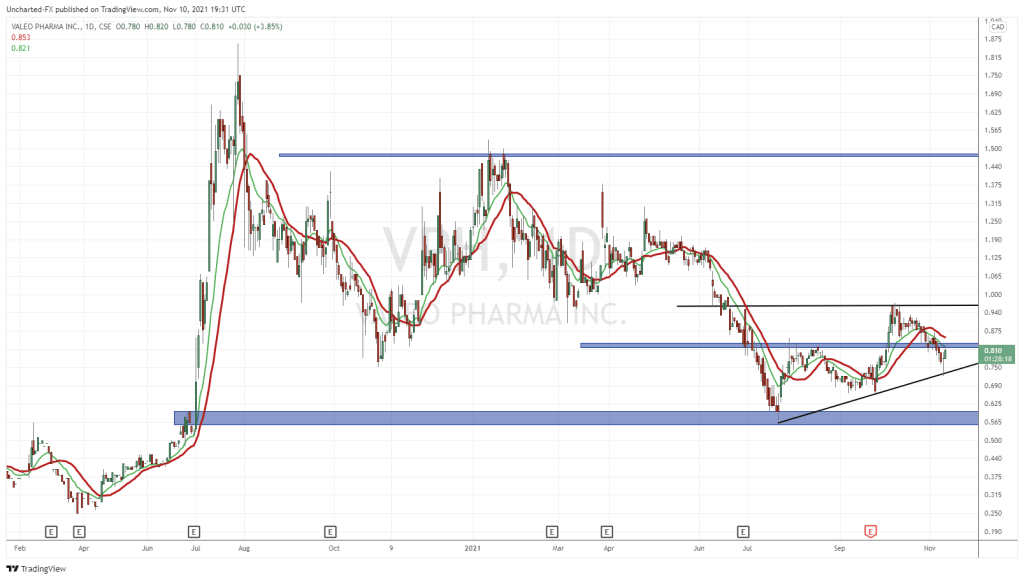

Year to date the common is down almost 34%, and over the last five years the stock is up 29% whilst the five-year compounded annual growth rate for revenues is 50% per annum. Sales over the last 12 months are at $12 million compared to the 2020 sales of $7 million.

Analysts are predicted that at the end of 2021 the total sales would be $17 million and for 2022 total sales would be $51 million. it’s no wonder there’s so much variability in the price of the common as the market tries to come to terms with the discrepancies between what’s happening in the underlying business and what most professionals feel the start should be trading at.

Although we don’t have the crystal ball that would tell us exactly what the future holds, we can do our best with the current financials to come up with a conclusion of where we think the business will be going. We can do this by screening the stock through six filters that focus on the profitability and earning potential of the firm, the financial strength and position of the company, and its ability to generate cash and returns for its investors and stakeholders.

The 6 Filters

5-year Revenue Growth (CAGR): +50%

Over the last five years, the sales went from $990,000 in 2016 to $7 million by the end of 2020 which is a compounded annual growth rate of 50% per annum like I stated above. As the business has grown over time the gross profit margins have been compressed starting just shy of 40% in 2016 and are now down to 18% at the end of 2020.

Valeo’s business model involves the acquiring of exclusive Canadian rights to regulatory approved or late-stage development products, either through acquisitions, long-term in-licensing or distribution agreements with pharmaceutical companies that do not have a presence in Canada and then providing all the services required to register, to reimburse and to commercialize these pharmaceutical products in Canada. As such cost of sales as a % revenues vary drastically from product to product. Branded products or products owned by Valeo will have lower COGS % than hospital-based products they commercialize for their strategic partners. Historically, the bulk of their product revenues were derived from M-Eslon which is a low-margin product for them.

5-year Operating Loss Increase (CAGR): 7%

As the business continues to scale the operating loss over the last five years has also increased at a 7% clip from 2016 to 2020. Most of this increase is because of corporate-level costs as the company does not use any of its resources is on research and development due to its business structure.

For the nine months ended July 31, 2021, VPH spent a total of $9 million on total operating expenses. As expected of a pharmaceutical company the sales desk and the marketing department took the largest chunk totaling $3.9 million. General and administrative expenses which include the IT and the legal department and human resources cost the firm $3.4 million to run.

This should not come as a surprise as the majority of the overhead of a pharmaceutical company comes from the legal department, the financial side, the sales desks including the marketing department. Since they don’t need a research department this reduces their total operating expenses and allows them to use those resources is for a greater sales team.

Quick Assets over Liabilities (“Current Ratio, Quick Ratio, Total Liabilities /Assets”)

At this point, I would be beating a dead horse but for those who read my articles from earlier this week you know by now, pharmaceutical companies have very little in assets. The analyst on Wall Street would say these companies are in capital-light and only need human resource is to function well with a little bit of capital for acquisitions of productive brands. as of their latest balance sheet, they had $8.9 million in cash and $7 million in non-convertible debentures.

They did however have $2 million in account receivables and $5 million in inventories compared to accounts payables of $4 million. On top of that, they had $1.5 million in convertible debentures and $1,000,000 in lease liabilities. This is where it gets interesting the company had $7 million in intangible assets mostly patents and other trademarks compared to their $500,000 in property planting equipment and $900,000 in right of use assets. The majority of what the business owns is in cash and intangible assets and a majority of what they owe is in the form of financial liabilities.

5-year Cash flow from (used) in Operations Growth (CAGR): (+22%)

This is where it got a little scary for me. The operating loss increased by 7% but the cash used in operations grew by 22%. this means the business is using more cash than it is bringing in and will need to dip into the public markets to raise cash for its operations.

Under normal business conditions, this is not a concern. As the market continues to chug along companies can raise capital at higher and higher valuations allowing them to bring in cheap currency to use for strategic acquisitions, capital expenditures to maintain or grow the business, pay off dividends or debt, or repurchase shares.

The problem comes when this is not possible anymore and stock market valuations are plummeting making it more difficult to raise cheap cash.

5-year Share Dilution (+) or Accretion (-): +12%

Continuing my thoughts from filter 4 on the ability of the businesses to raise cash. The current record indicates that VPH has relied somewhat on the issuance of common stock and convertible debt and man convertible debt. This in itself is not a problem as a conservative balance sheet with a mixture of equity financing and debt financing is usually profitable for a business if done properly. The risk is when the underlying business is not generating cash flow and the ability of the firm to cover its interest expenses and its cost of raising equity put a burden on the business model.

For now, with interest rates at a negative real return, there seem to be no issues with raising capital. But this is one filter that I would pay more attention to as I tried to figure out how much this marketable security should be.

5-year Return on Invested Capital (ROIC): -178%

And as we expected the business is not earning a return on invested capital because it is still producing negative cashflows. The average of the last five years was negative 178 percent, but it has improved since then and as of the last 12 months the ROIC was negative 23%. As the contribution of M-Eslon to their overall revenues decreases over time from the addition of new more profitable products, they expect their gross margin % will trend towards 50% of net revenues. If this guidance from the managers is true, the company might be in the right direction to break even and hopefully return a positive return and invested capital over time.

Having gone through the six filters it’s obvious that there is some uncertainty with the current business condition hence why the stock has dropped by 34% year to date. But it should be remembered the market can sometimes overreact and this volatility is what allows intelligent investors to capitalize on these opportunities and earn above-average returns over time if their conservative thesis comes true.