Falcon Gold (FG.V) is a Canadian junior focuses on acquiring, exploring and advancing projects in the America’s. If you fancy Gold, Silver and Copper, then this is a company for you.

Projects in the Canadian Provinces of British Columbia and Ontario, as well as Argentina in South America. Note the joint ventures and work with IAMGOLD, Montoro Resources and Marvel Discovery.

Speaking about Marvel Discovery, a company featured on Equity Guru in the past, we described it as a property mineral bank. The same can be said about Falcon Gold. And it makes sense. They are the vision of CEO of both companies, Mr. Karim Riyani.

In the mining sector, I like to look for management that acquires properties and increases claims when Gold and Silver prices are dropping. Good management plays the long game and cycles. This is what Mr.Rayani has done. Acquiring good property when prices are low and looking to flip them when Gold, Silver, and Copper prices rise.

As Chris Parry stated in our Investor Roundtable, Karim Rayani is also buying the stock. Great to know that management has skin in the game.

If you are bullish on commodities like I am, then these juniors are where the gains will be. Juniors move like the metal prices but on steroids.

Recent news has seen phase 2 of drilling at the high grade Spitfire-Sunny Boy project commence, and the announcement of a non-brokered private placement to raise $500,000 by issuing 3,846,154 Flow-Through Units:

Each unit priced at $0.13 per unit will consists of one flow-through common share and one-half of one common share purchase warrant; each whole warrant entitling the holder to subscribe for and purchase one non-flow-through common share at a price of $0.25 for a period of 24 months following the acceptance date. The shares and warrants are subject to a four-month hold.

Falcon Gold has a $10 Million market cap. The technicals are intriguing.

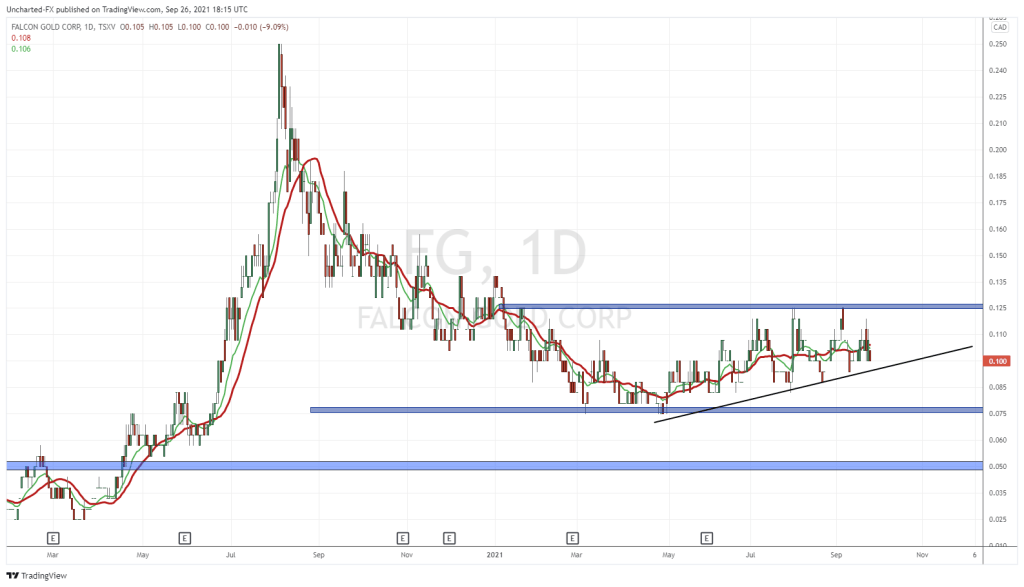

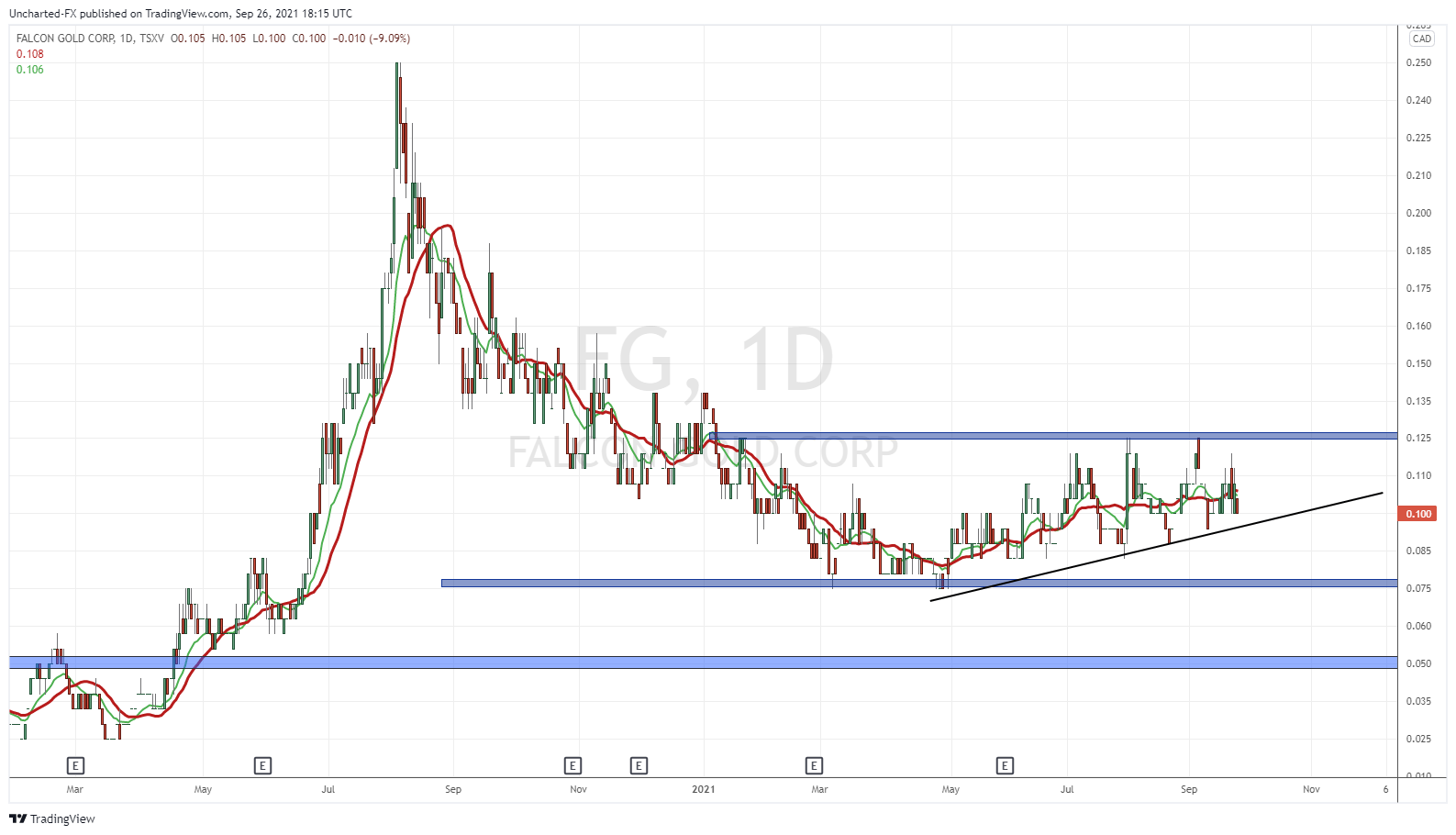

There is a saying: the trend is your friend. Do not trade against the trend. In the case of Falcon Gold, I have drawn a trendline connecting the bounces. We are ascending to the major resistance of $0.125. Recently we have tested it twice but no break. A break and close above $0.125 triggers the breakout.

From that breakout, we can move to test $0.185 and higher. I really like the market structure here.

If this trendline breaks, all is not over. I would look for support at the key $0.075 zone. A key support which should hold and perhaps sees Falcon Gold range from here to $0.125. If this support breaks, we then would watch for some sort of basing around $0.05.

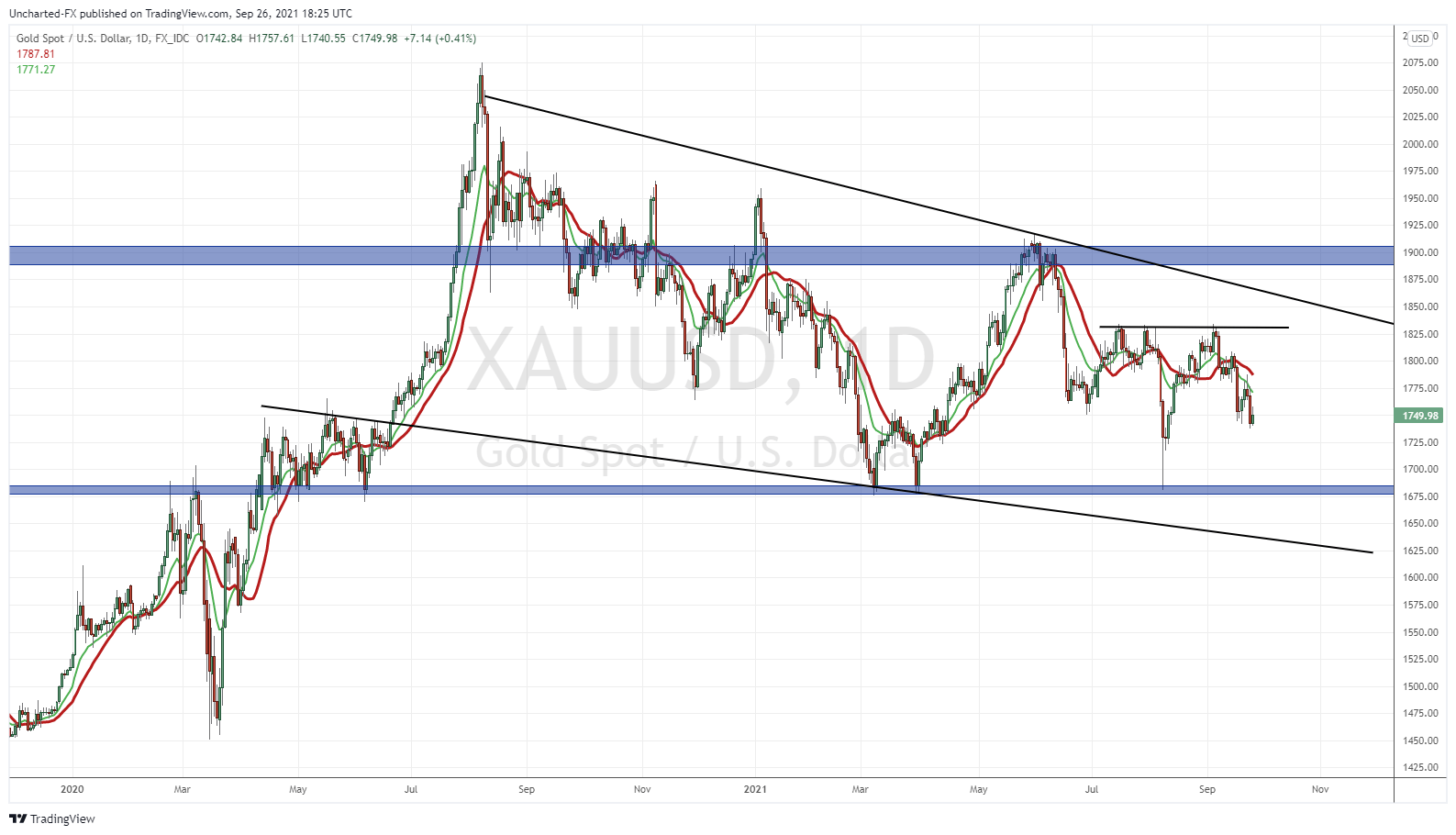

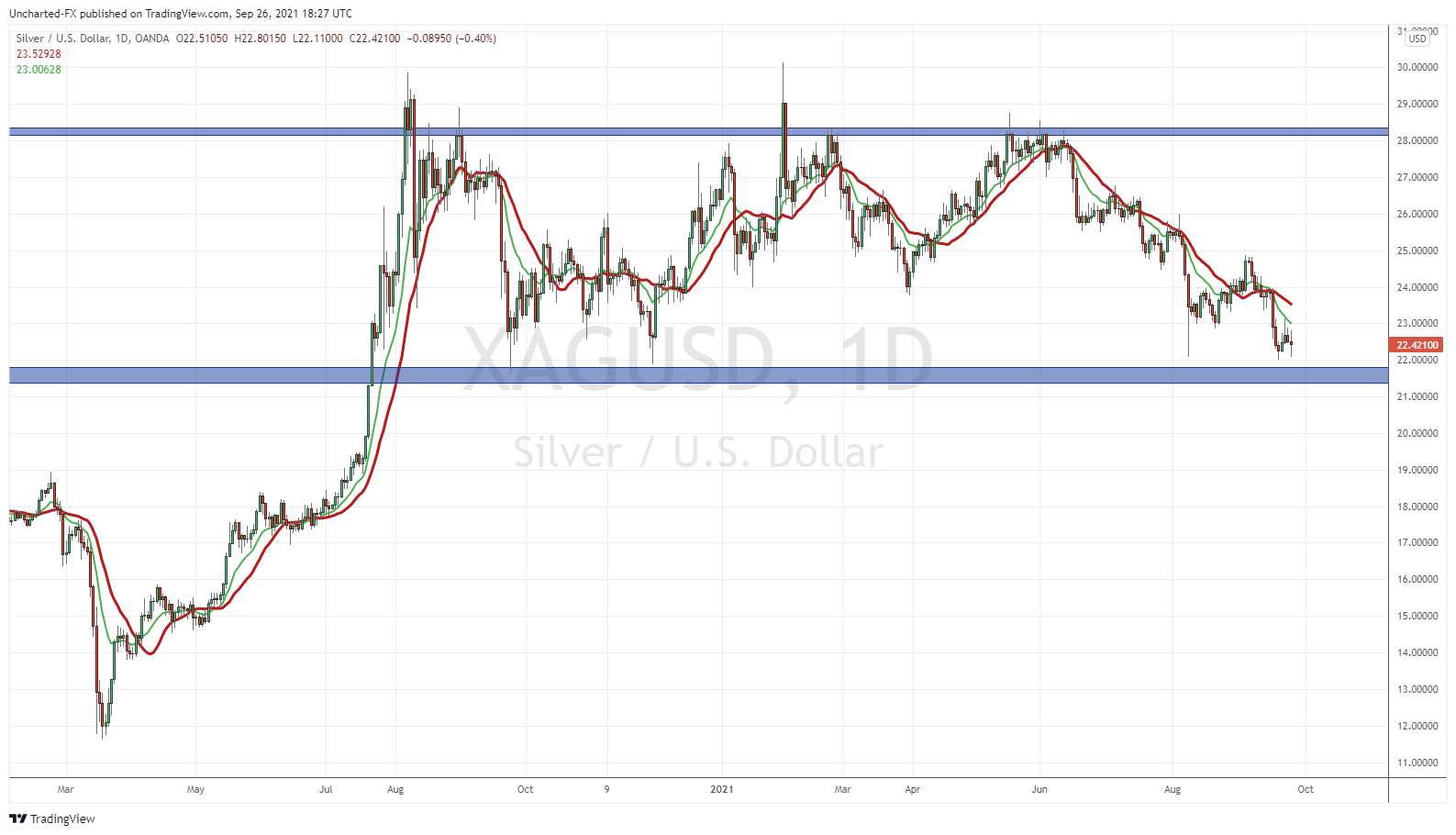

Perhaps the charts of Gold and Silver can give us a clue on where Falcon Gold goes next?

Don’t like the close below $1750 on Gold. $1725 is a key support zone if we drift downwards, but let’s watch to see if bulls can retake $1750 once again.

Silver is where things get spicy. A huge support test this week. If Silver bounces here, it would coincide with a bounce in Gold. Personally, I am watching for a long entry on the white metal. The wick is a first sign indicating buyers. I would like to see a larger green candle on Monday to confirm buyers are holding.