Water Ways Technologies (WWT.V) is an Israeli agri-tech company which regularly features in my Friday Agriculture round ups. And for a good reason. The company has been making headlines, and the stock has been ripping. Recent moves has made Water Ways a favorite for traders and investors.

Water Ways is an agriculture technology company which provides water irrigation and agriculture solutions to agricultural producers in Israel and internationally. It designs, supplies, installs, and maintains irrigation systems for application in various agricultural and aquaculture operations. The company offers integrated solutions, including the precise irrigation and project implementation solutions for cannabis growers. It also sells irrigation equipment and components.

Readers of my Agriculture round up know why I am bullish the ag sector for the future. I suggest you read my base case established back in the Summer here, but I can summarize it:

- Jim Rogers and other Billionaires (Bill Gates being the largest Private Farmland owner)

- The Weather

- Supply Chain Issues

- Green/Clean Energy Transition

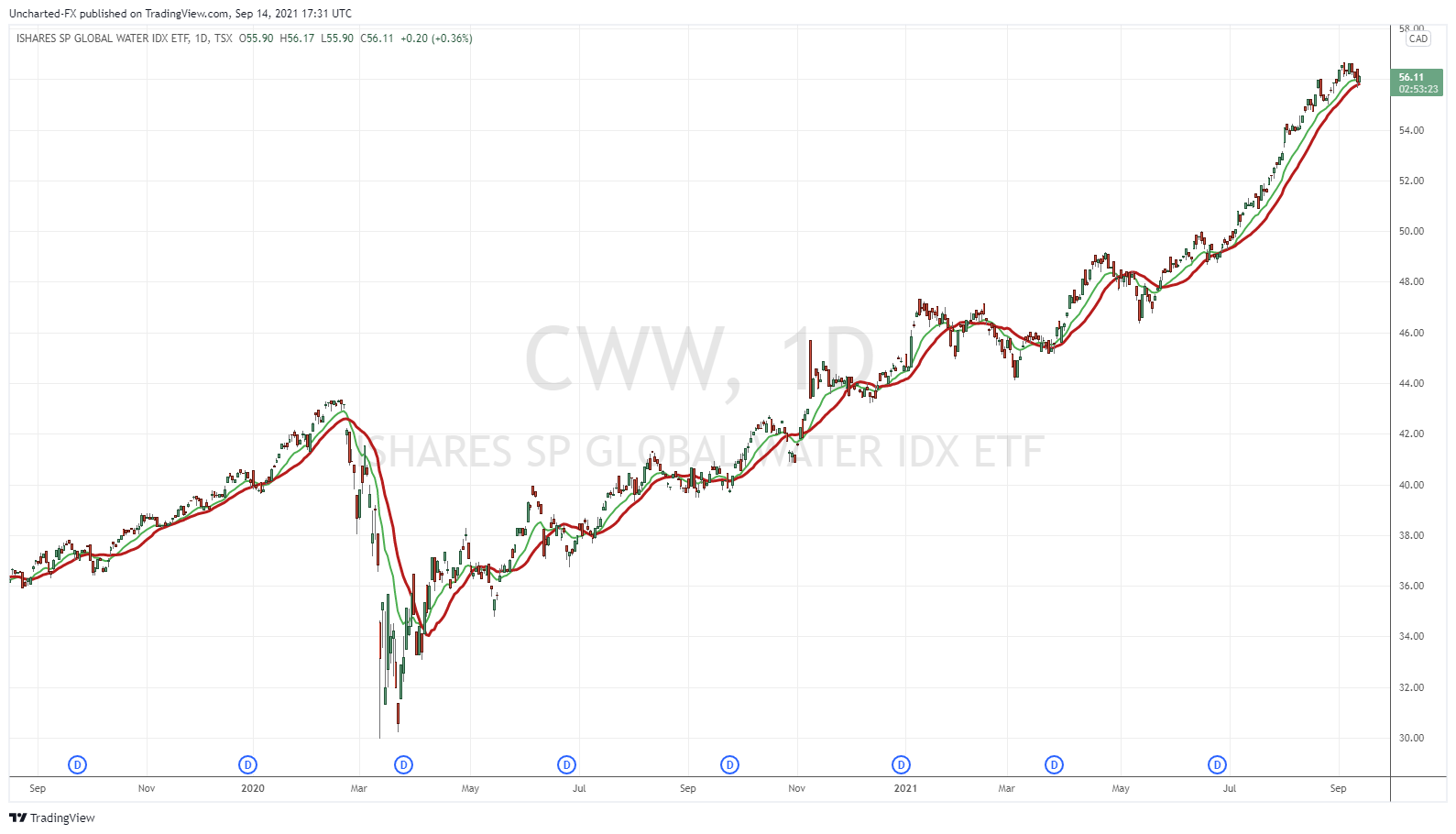

Water Ways is a play that combines increasing crop yield and water irrigation. For those wanting to gauge the interest in fresh water take a look at the iShares Global Water Index. Steadily rising:

Dr Michael Burry from the Big Short is the one who popularized investing in water. After a slew of Netflix documentaries covering the future water crisis, people are beginning to pay attention. Personally, I think ag and water goes hand in hand. So you get the best of both worlds here with Water Ways.

Just a disclaimer: I am invested heavily in water and agriculture plays. Some might say I am biased, but I think this is an undervalued sector as most people focus on things such as technology and cryptocurrency.

Recent news on Water Ways which came out on September 13th 2021 regards orders for smart irrigation components.

The orders are valued at C$1,300,000 and include the following:

- A C$375,000 order to deliver smart and drip irrigation components for Nurseries in Ethiopia.

- A C$975,000 order to deliver smart irrigation components to a Blueberries irrigation project in Peru.

For a deeper dive on this company and its financials, I recommend reading the other Equity Guru articles released today on Water Ways. My focus will be on the technicals, and what a treat for traders and investors.

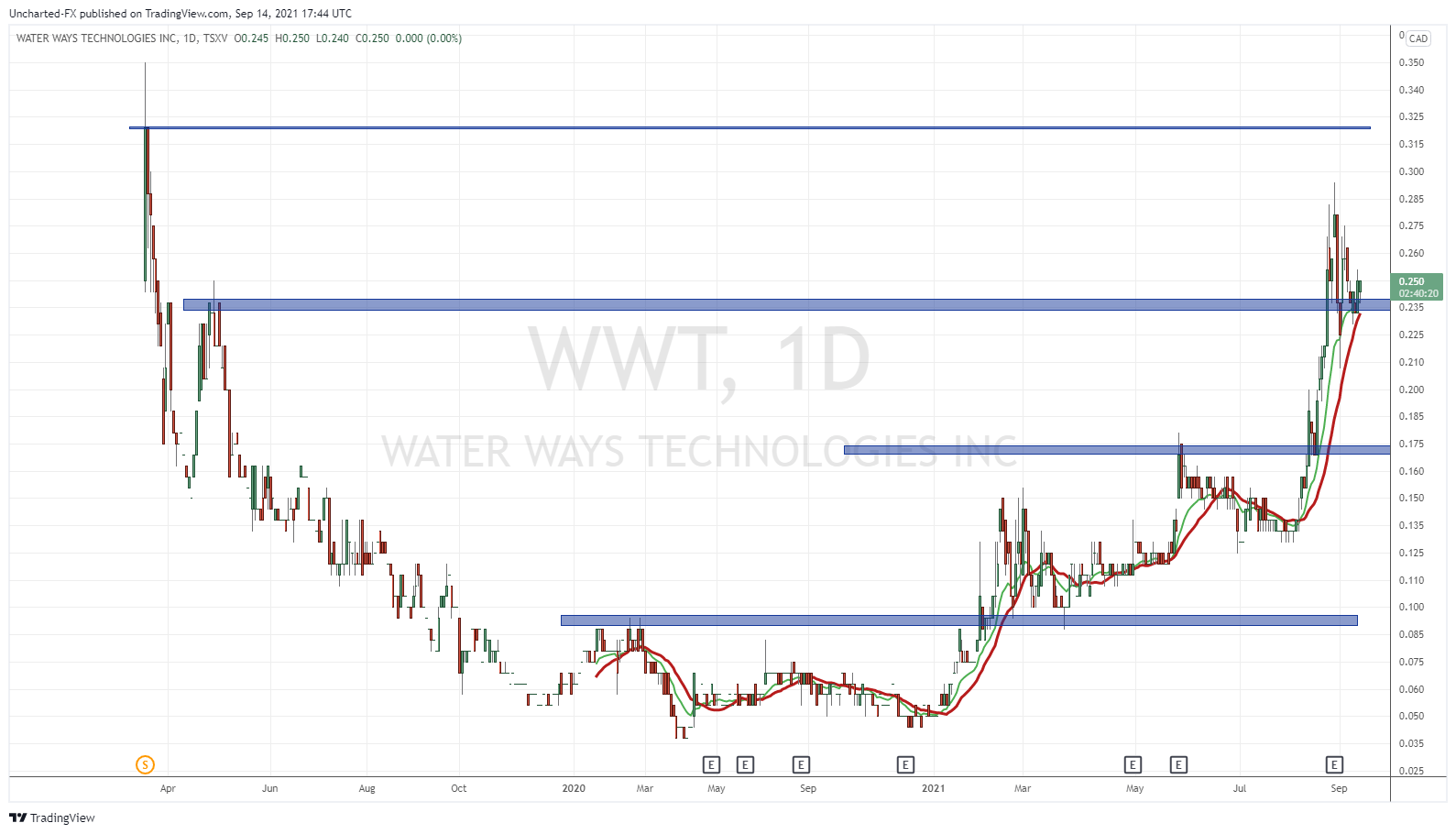

Water Ways is up 400% year to date! The company presently has a market cap of $34 million.

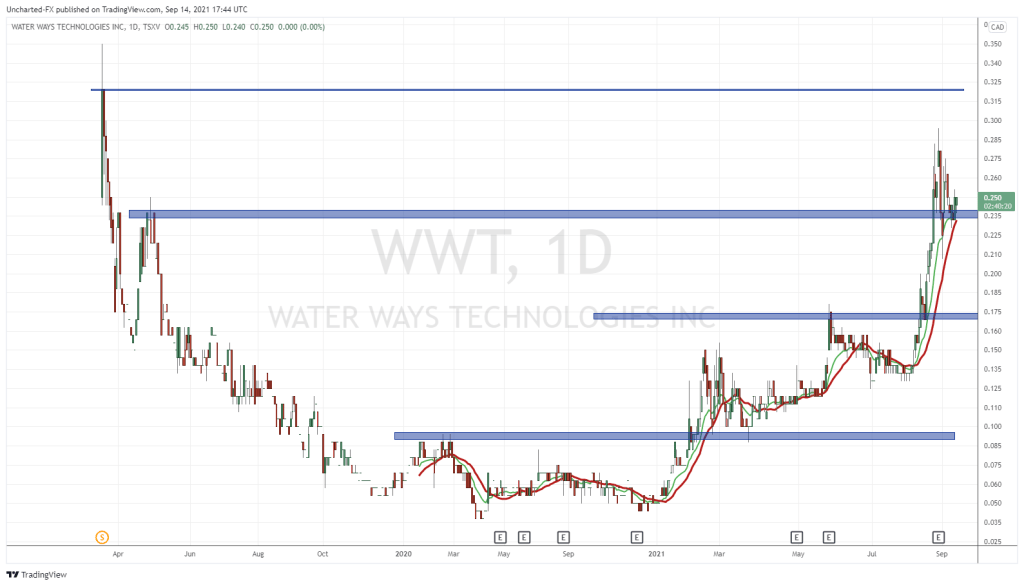

After the breakout above $0.10, we can see the trend shifted. This chart displays the fundamental foundations of my market structure method of trading and investing which I cover on my regular Market Moment, and in Equity Guru’s Discord Channel on a daily basis.

We had the downtrend, the range, and now the uptrend. The uptrend is still carrying momentum.

What I want to note before we go to current price action, is how Water Ways performed on pullbacks. The dips were bought. And we displayed typical support retest patterns. Dips were bought at support.

Note this happened when we pulled back to retest $0.10 after we broke above it. The same happened at $0.135, and $0.175. Now we are seeing if this repeats where we are currently at $0.235.

$0.235 was a major resistance zone we broke out of, and now are retesting it. We have been here for 12 trading days now. Initially when we pulled back, the dip was bought, but then price was hammered lower before buyers dipped in again. As I said, there is a large interest in this stock. For long term holders, this support area provides a good entry.

If this zone breaks, we will retest $0.175 again. If we hold, watch for a close above recent highs at $0.29 to take us to test previous record highs and make NEW record highs above $0.35.

Again this is a stock coming off of some major press releases recently. Contracts and revenues are coming in, and the agriculture sector is seeing investor money flows. Long term I am bullish given the macro back drop and the issue Water Ways is addressing with their proprietary technology.