Before we begin today’s Agriculture roundup, I thought I would share a story with you. Last week we spoke about supply chains, well I experienced it first hand. Went to my local mall to buy some food. One sushi place had no fish and half of their menu was unavailable. When I asked whether they would be good to go tomorrow, they replied they don’t know when they would be getting a new shipment. I then went to a big fresh juice chain store. They were out of vanilla flavored protein. They had to substitute it with a chocolate whey protein. Just fyi: an acai berry protein shake isn’t the best with chocolate protein.

Was I just shopping at the wrong time? Perhaps. But it seems like the supply chain issues we have been hearing about is slowly making its way to the West Coast.

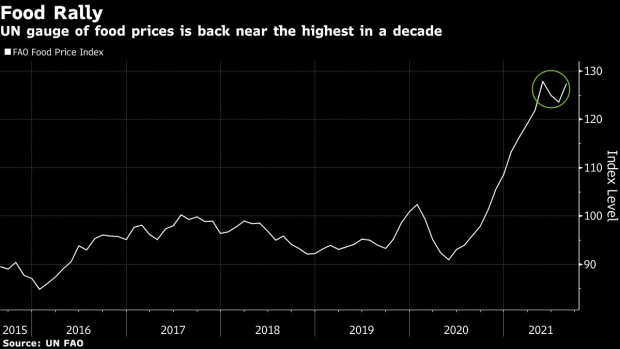

The big news is that Global food prices have jumped and hit decade highs on harvest woes. This is reviving concerns on inflationary pressures. Not a surprise for my readers, this is what we are expecting, and why we remain bullish Agriculture.

In other news, we have more climate change news. Just watching the flooding in New York and New Jersey. Seeing some unbelievable footage from Manhattan. President Joe Biden said today that “extreme storms of climate crisis are here”. Two of the reasons why I am overly bullish on Agriculture are coming true. For those wondering, here is why I am going all in on Agriculture.

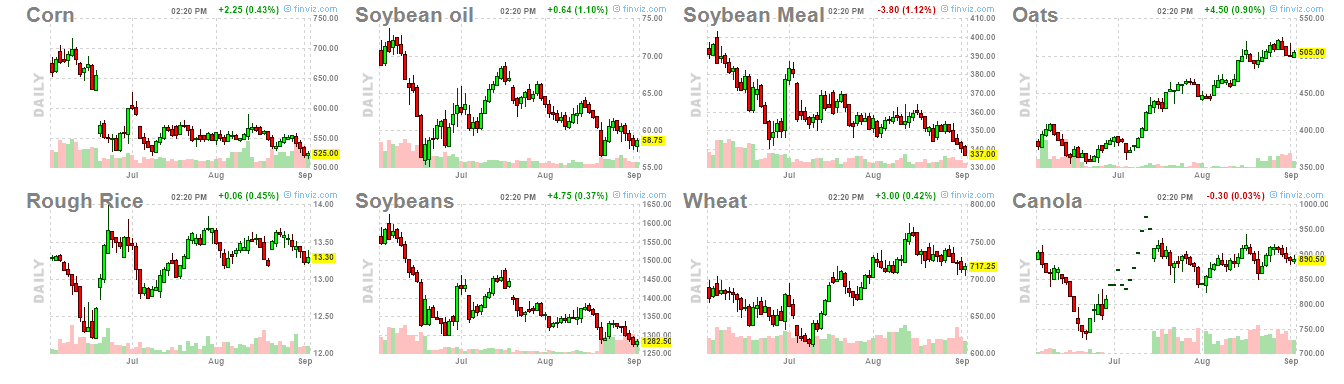

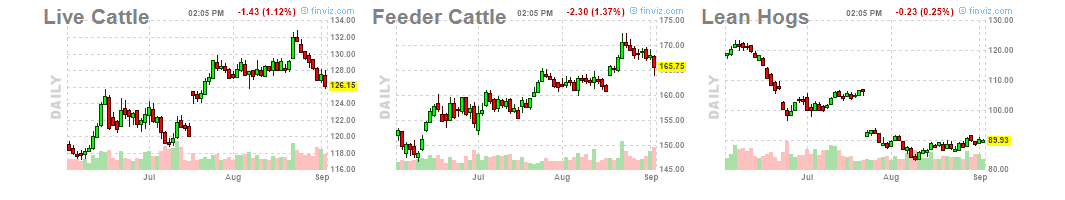

In terms of Agricultural commodities, this is how the charts look:

I’m a bit worried about Corn, Soybean Oil, Soybeans and Wheat. They are near major support zones and look like they want to break down. Soybean Meal is already breaking down. We should expect further drops on these grains based on the technicals.

In terms of meats, Lean Hogs are tempting to go long. The basing pattern remains intact, and it is the type of set up which brings me success in my trades.

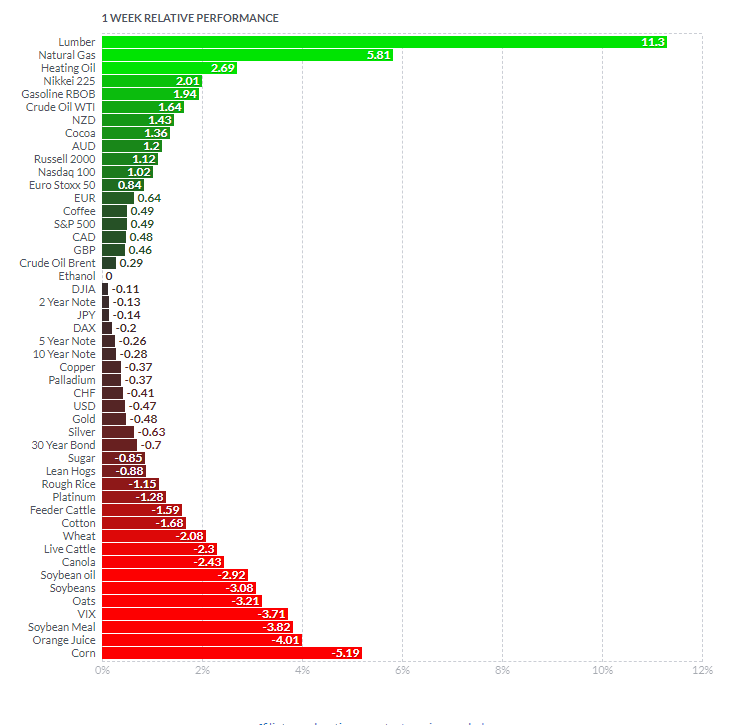

Here is how Agriculture performed against other assets for this week:

Cocoa and corn being the winners on the green side, while many ag commodities were the worst performers this week. Just the VIX performed worse.

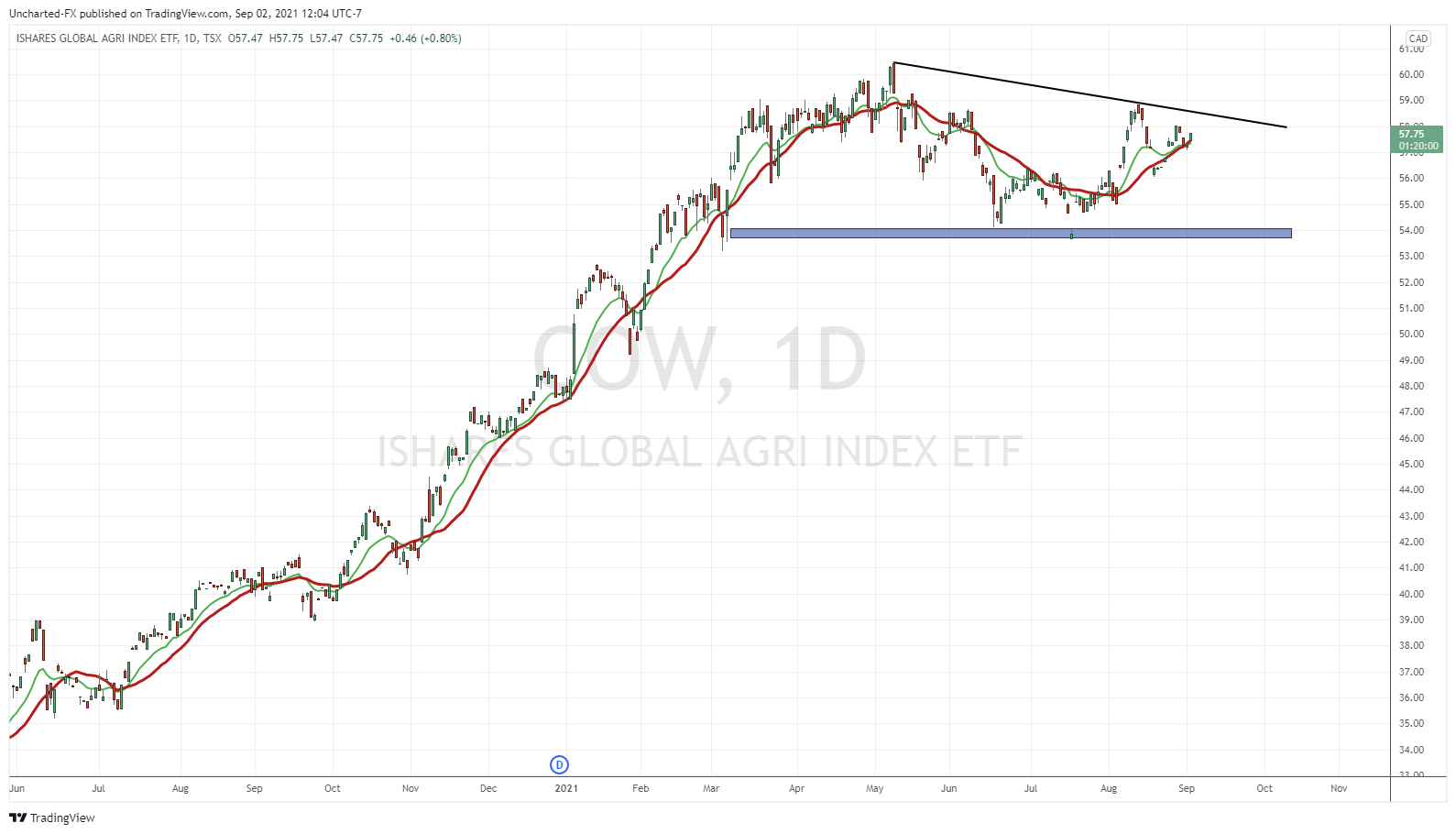

The COW ETF really didn’t do much this week. Still constrained below our trendline and ranged between $57-$58 all this week.

In terms of major headlines and stock movements from our list:

| NTR | OGO | BEE | ARGO | IZ |

| LEV | BUI | GROW | FDGE | VIV |

| AFN | NPK | WWT | FARM | MARY |

| IFOS | TGH | ERTH | AGFY | LITE |

| GRF | CSC | GRO | VFF | SPRT |

| CUB | CSX | PACR | AJX | AFI |

| MGRO | EAC | KRN | TBIX | DE |

CubicFarms (CUB)

It was a busy week for CubicFarms!

Big news first, as of September 1st 2021, the stock will commence trading on the Toronto Stock Exchange (TSX). An uplisting from the TSX Venture. This move will attract more institutional eyes.

On the 1st of September, CubicFarms announced a new project to deliver commercial scale FreshHub with 96 CubicFarm System modules. This is the company’s largest project to date.

From the press release:

This next generation high-density system, called FreshHub, is the next level of indoor growing aiming to significantly localize food production. Leveraging the significant land and water efficiencies of the award-winning CubicFarm System technology, the new stacked configuration of this FreshHub will include a remarkable 96 modules occupying one acre of land. New features of this FreshHub include a new efficient agricultural building design that reduces capital costs, new farm infrastructure, workflow design, automation components, and proprietary software.

Another headline had to do with Microsoft. CubicFarms has selected Microsoft’s technology to launch the next generation of indoor farming technologies for fresh food and fresh livestock feed. The company will be working with Microsoft and using Microsoft Azure IoT, collecting and analyzing system and CEA data from on the edge to AI in the cloud using easily scalable microservice architecture built into Azure.

Here is what Dave Dineson, the CEO of CubicFarms had to say:

“We’re excited to announce the next generation of our indoor growing system using Microsoft’s IoT services,” said Dave Dinesen, Chief Executive Officer, CubicFarms. “CubicFarms worked closely with our long-time Farmer Partners, like Swiss Leaf Farms in Alberta, to innovate and improve our indoor growing technologies for commercial scale farms. AI in the Cloud and on the Edge services help drive automation and scalability for our new and existing Farmer Partners, and for our business.”

And then finally, CubicFarms released Q2 earnings. Here are some highlights:

- Revenue for the six months ended June 30, 2021, was $4,262,815, from systems sales and revenue from other services and consumables, slightly higher than the amount recorded in the same period of the previous calendar year.

- The Company currently has a total of 176 modules under contract and deposit. The amount of system sales orders that are pending manufacturing and installation is approximately USD$23.3 million.

- The Company increased its workforce from 52 to 116 full-time employees and contractors as of June 30, 2021, compared to the same period ending June 30, 2020.

- Revenue for the three months ended June 30, 2021, was $356,005. Revenue in the three and six months ended June 30, 2021, includes HydroGreen equipment, customer seeds and other consumables, and CubicFarm Gardens consulting services sold in the period.

- Working capital increased from $15,244,610 as of December 31, 2020, to $30,133,283, as of June 30, 2021, an increase of 98%.

- Net loss for the three months ended June 30, 2021, was $6,472,041, a 177% increase from the same period ending June 30, 2020. For the six months ended June 30, 2021, the net loss was $10,149,129, a 74% increase from the same period of the previous calendar year.

- Research and development (R&D) expenses of $1,320,935 were incurred in the three months ended June 30, 2021, an increase of 115% from the same period of the previous calendar year.

- General https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses increased 43% to $3,279,358 for the three months ended June 30, 2021, reflecting the continued expansion of the Company’s business and necessary staffing additions.

A very big week for CubicFarms and I look forward to what comes next with this company. My full breakdown on the company came out with my large ag piece in the Summer. Read it here.

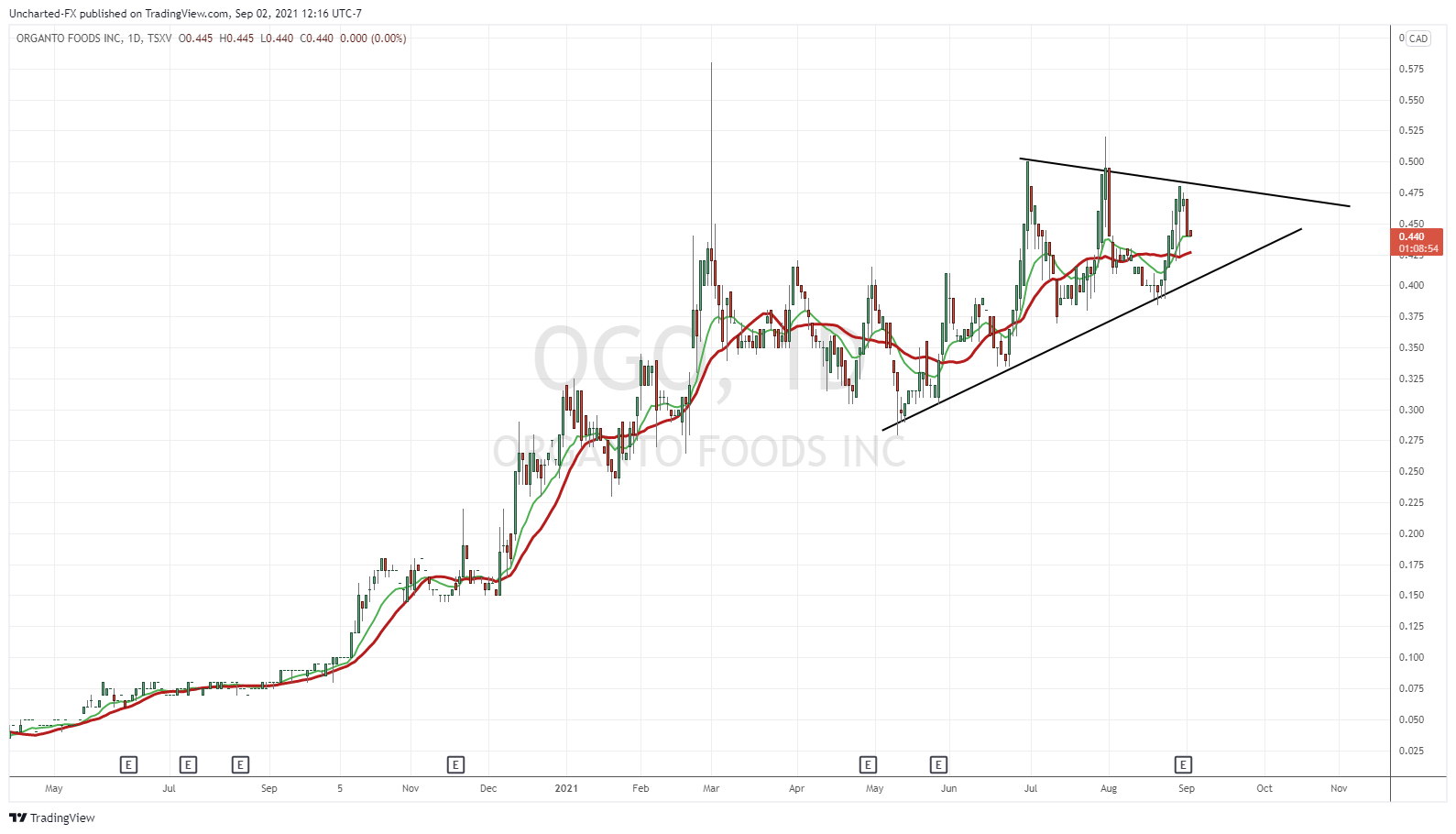

Organto Foods (OGO.V)

Organto Foods added organic fresh cut fruits to their product portfolio this week. This includes red apples, grapes, mago, pineapple, blueberries, and raspberries with further products expected to be added on market demand. These products will be sourced from growers in Europe and Latin America and be available on a year-round basis.

On Monday, Organto also announced record Q2 financial results. Here are some highlights:

- Record second quarter revenues of $5,372,162 versus revenues of $2,163,955 in the prior year, an increase of approximately 148% versus the same quarter in the prior year. Second quarter revenues represent the largest quarterly revenues in the history of Organto and the eighth consecutive quarter of record revenue growth versus the same quarter in the prior year. While volumes continued to expand as expected, revenues in the quarter were impacted by a combination of lower avocado selling prices versus expectations due to increased supply from an earlier than anticipated start to the Peruvian export season, and logistics challenges resulting from the timing and availability of containers required to deliver supplies to Europe.

- Record gross profit of $648,987 or 12.1% of revenues versus $232,504 or 10.7% of revenues in the prior year, an increase of approximately 179%. The gross profit in the second quarter of 2021 represents the largest quarterly gross profit in the Company’s history and an increase of 250 basis points versus the previous quarter, driven by a higher mix of value-added private label and branded products.

- Cash overhead costs for the quarter were 26.3 % of revenues versus 26.8% in the prior year. These costs include expenditures of approximately $436,900 related to retail branded product development and on-line digital transformation activities, acquisition related costs and costs related to the successful filing of the Company’s base shelf prospectus, all of which are expected to generate positive future benefits. Excluding these investments, cash overhead costs reduced to 18.2% of revenues in the second quarter.

We had a nice few green days this week. However, major technical levels still remain the same from last week. We have a nice uptrend that is holding. We can even draw a triangle here. Price is contained between these levels, and we shall await a breakout. Just looking at those wicks above, we are seeing some major resistance come in at $0.50.

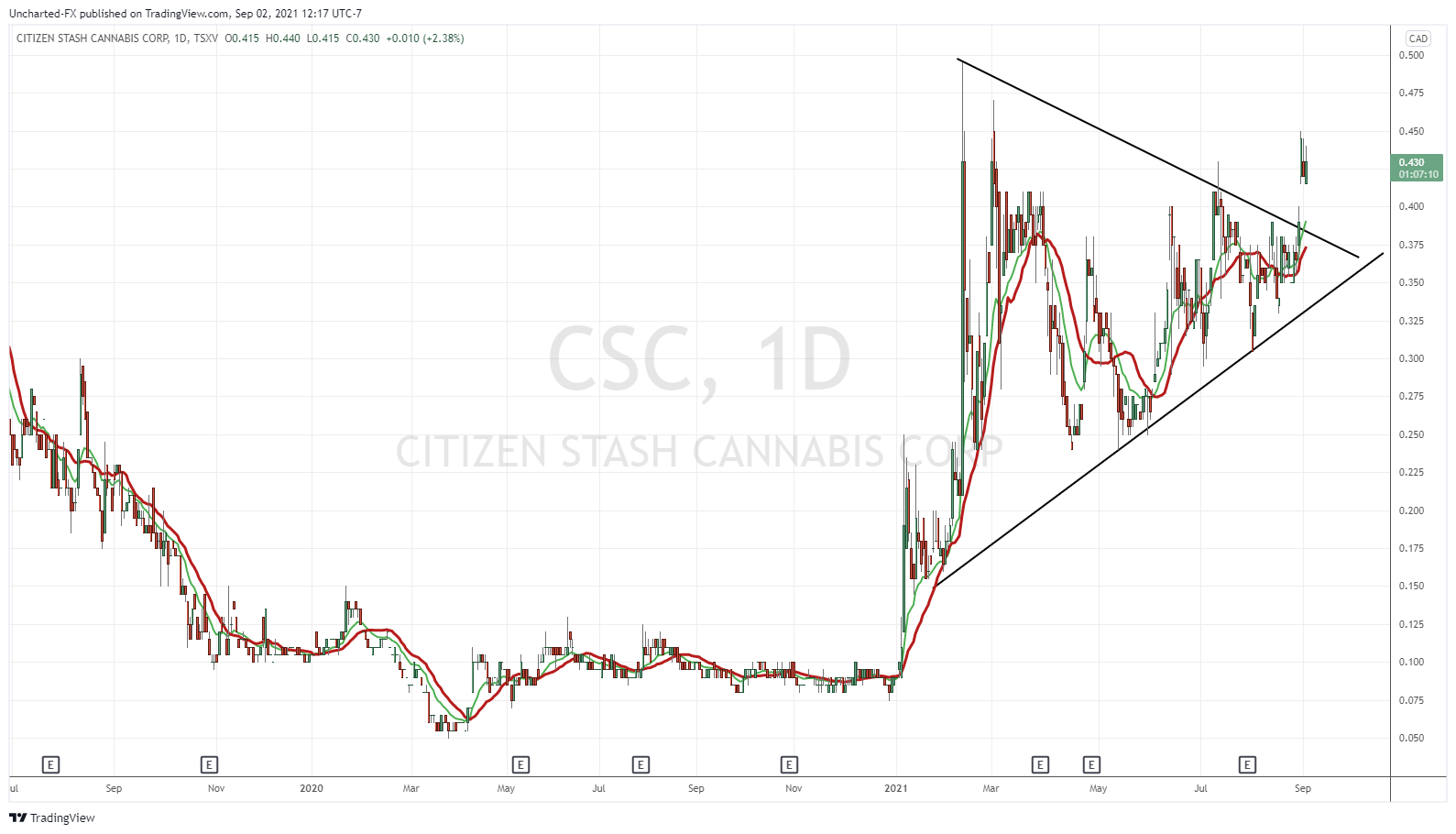

Citizen Stash (CSC.V)

Citizen Stash is being acquired by the Valens company for about $43 million. The share price of Citizen Cannabis popped 11.8% on the announcement. Under terms of the deal, Citizen Stash shareholders will receive 0.1620 of a Valens common share for each Citizen Stash common share.

The chart is a triangle breakout. Not one to talk about technically now since prices should hover in this area on the buy out.

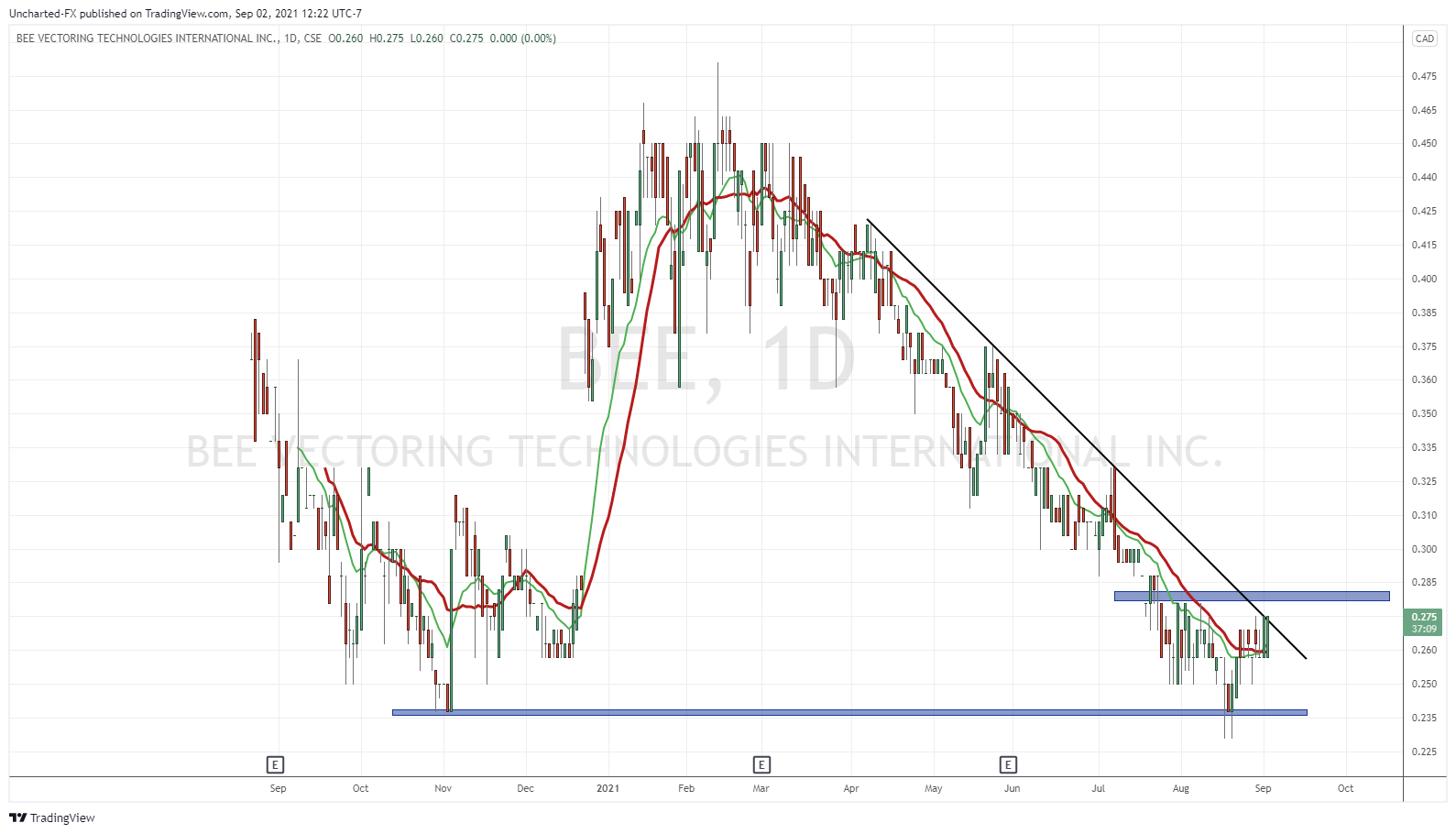

Bee Vectoring (BEE.CN)

Not much news but I want to remind readers about the chart which we looked at last week.

Such a nice basing pattern. At previous lows which is acting as support. We have a trend line and a resistance which can break with a nice strong close above $0.285. All this needs is a catalyst. Picking up shares here seems reasonable, but I would want the breakout as detailed for better probability. If we don’t BEE can still drop lower.

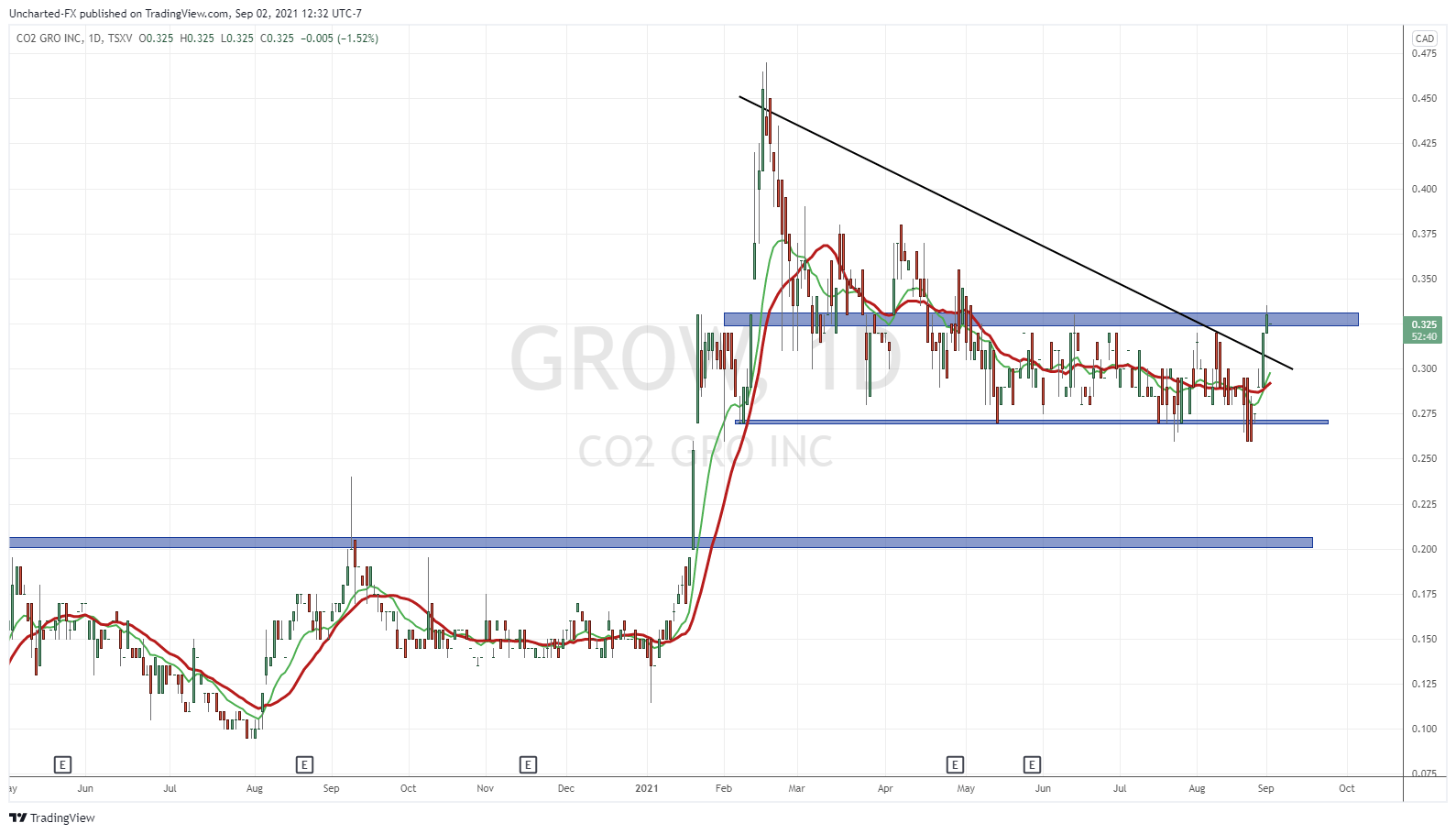

CO2 Gro Inc (GROW.V)

This is one we covered in the last Agriculture round up. We will get to the chart in a moment, but we have some news out this week!

CO2 Gro released Q2 2021 earnings. Here are some highlights:

- During the second quarter of 2021, the Company reported revenues of $91,660 versus $16,597 in the first quarter of 2021. As well, as at June 30, 2021, the Company had signed purchase orders (the “Orders“) of $50,625 not yet meeting the Company’s revenue recognition criteria of which, $21,828 was for Order pre-payments, reported as deferred revenue. As sales installations for the Orders are completed and commercial feasibility CO2 Delivery Solutions™ systems are installed and in operation the applicable revenue will be recognized.

- Sold five CO2 Delivery Solutions™ commercial installations in Q2; one to a Canadian Cannabis LP achieved without a commercial feasibility, one to an existing customer to be installed in a second Canadian Cannabis facility they operate, one to Golden Peaks Cannabis LC at the 9 month mark of a one year commercial feasibility, one in BC and one to a US distributor. Golden Peaks Canadian Cannabis LC is an organic craft micro cultivator wholesaler one of whose customers is Crystal Cure a Canadian Cannabis LP.

- In Q2 four new commercial feasibilities were achieved, one at a medical Cannabis cultivator in Israel and three with tomato growers, one in Alberta and two in the UK in conjunction with Rika Biotech, a GROW Marketing partner. Three of the grower facilities total 1,731,000 square feet of greenhouse space while the fourth customer required its name and facility details to be withheld for competitive reasons.

- Signed a non-exclusive MOU with Rancho Nexo to market and sell CO2 Delivery Solutions™ technology to the approximately 6 billion square feet protected ag market in Mexico.

- Participated in Canada’s Trade Commissioner to Mexico CTA Accelerator Program through mid-April that introduced GROW to Mexican protected agriculture growers, associations and potential marketing partners.

- Canada’s Trade Commissioners offices in the Netherlands (the Hague), Belgium (Brussels) and Spain (Madrid) selected CO2 GRO to present at the Collaborations in Sustainable Technologies in Agriculture virtual conference in May 2021.

In other news, CO2 Gro announced commercial feasibility of a CO2 Delivery Solutions system with a major EU based greenhouse vegetable grower that wishes to remain unnamed. This is CO2’s largest potential customer to date. Good news.

You got to love the stock. We held the support on the range, and it appears we will make a breakout soon. Watch today’s candle close. We might get a breakout by the end of this week. The trend line is also broken. Personally, what I would like to see is either a strong green breakout candle, or prices to move down slightly before creating a higher low. Both with heavy volume. This would indicate strong buyers. Very nice chart. Keep this company on your radar.

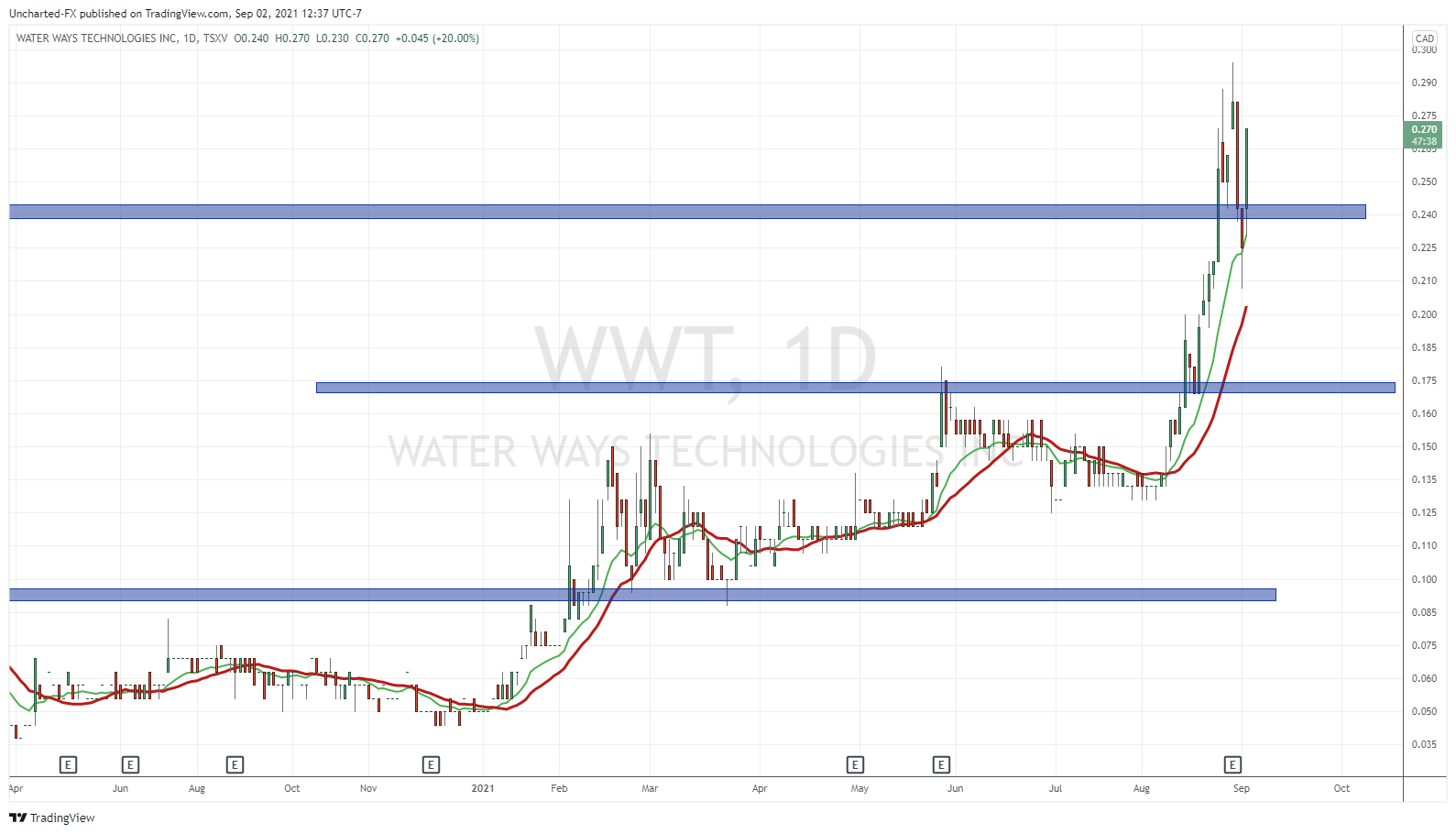

Water Ways Technologies (WWT.V)

What a beast move on Water Ways. This is one we have been watching over on my Twitter and Equity Guru’s Discord channel. We called the technicals to the T. And we are hoping for a retest repeat.

Big news was H1 2021 earnings. Here are highlights:

- Record sales for the three months period ended June 30, 2021, totaling CAD$6,643,000 compared to CAD$3,724,000 for the three months period ended June 30, 2020, for total revenue growth of 78%.

- Record sales for the six months period ended June 30, 2021, totaling CAD$12,112,000 compared to CAD$6,976,000 for the six months period ended June 30, 2020, for total revenue growth of 73%.

- EBITDA for the six months period ended June 30, 2020 reached CAD$832,000 compared to a loss of CAD$112,000 for the six months period ended June 30, 2020.

- Non-GAAP EBITDA for the six months period ended June 30, 2020, reached CAD$1,137,000.

- Project revenue stream increased substantially to CAD$6,398,000 compared to CAD$1,930,000 for the six months period ended June 30, 2021 and 2020, respectively, for total project revenue growth of 231%.

- Sales of Heartnut Grove WWT Inc., the Company’s wholly owned Canadian subsidiary, increased substantially and reached CAD$3,744,000 for the six months period ended June 30, 2021, compared to CAD$2,975,000 for six months period ended June 30, 2020.

- The Company installed and delivered the largest contract in its history, in Uzbekistan, resulting in revenue of over CAD$4,054,000.

- The Company completed an oversubscribed private placement of CAD$4,444,742 in August 2021.

The stock fell after earnings, but I think the run up was pricing in good earnings anyways. We then pulled back to retest previous resistance now turned support, and my moving averages. When I said I hope it is a repeat, I am referring to price action at $0.175. We broke out and then pulled back to retest before taking off. Buyers have stepped in on the retest of $0.24. Very bullish. The next major resistance zone comes in at $0.32. With this type of momentum, I think we hit that sometime soon. Very strong price action on this one and a big congratulations to the team and those who invested/traded this stock.

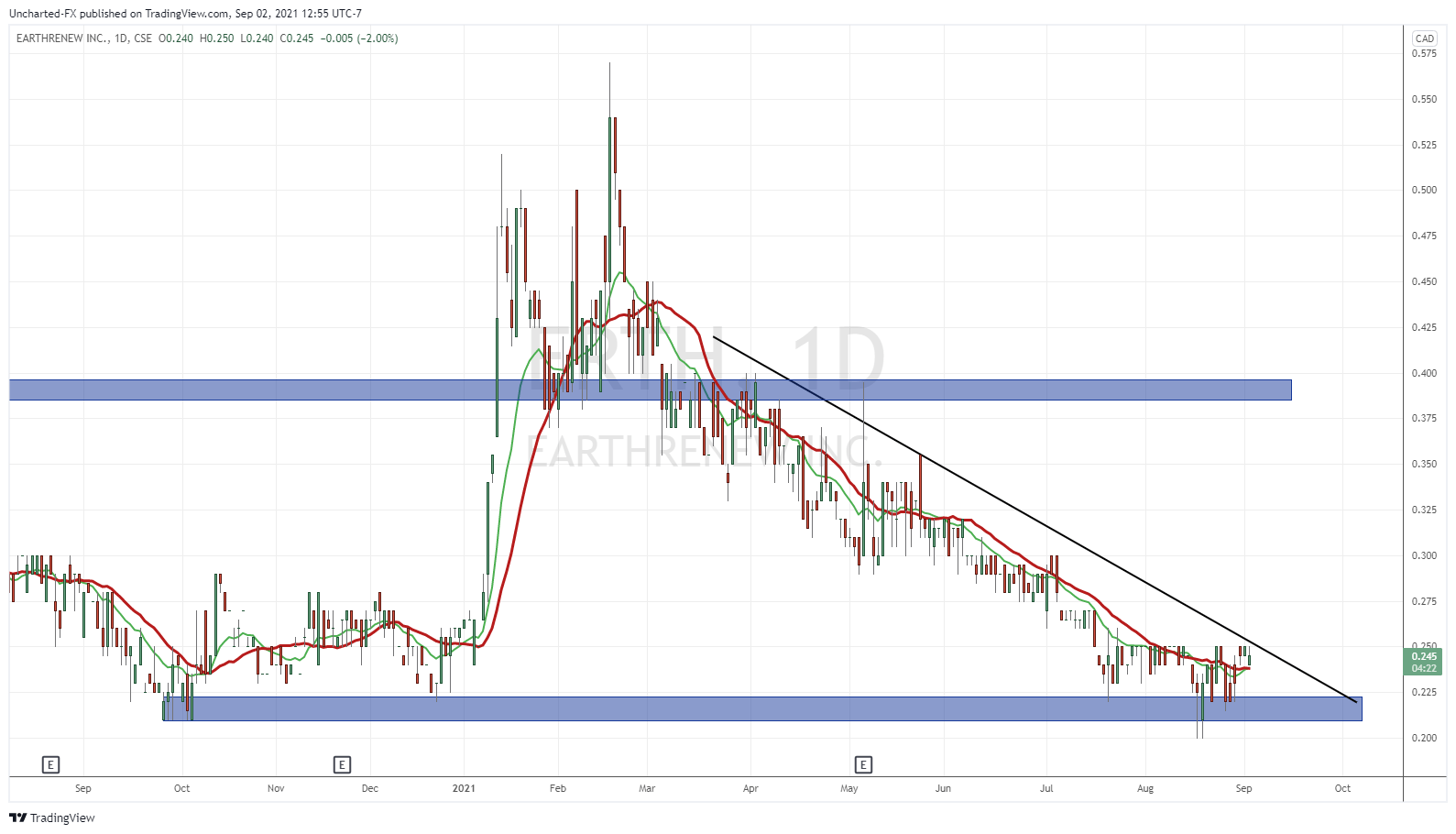

EarthRenew (ERTH.CN)

I have to throw EarthRenew here because the stock is looking prime. The long downtrend seems to be over with the stock basing at a major support. We need that catalyst and volume to break out above the trendline. Technical wise the set up is great.

EarthRenew is driven to support a farm system that puts healthy soils and grower profitability back on the table. Using circular economic principles of upcycling waste materials into high value agronomic inputs, they are building an innovative platform of soil health products that offer growers an alternative to conventional fertilizers which leave the soil devoid of the nutrients and bacteria essential to plant life.

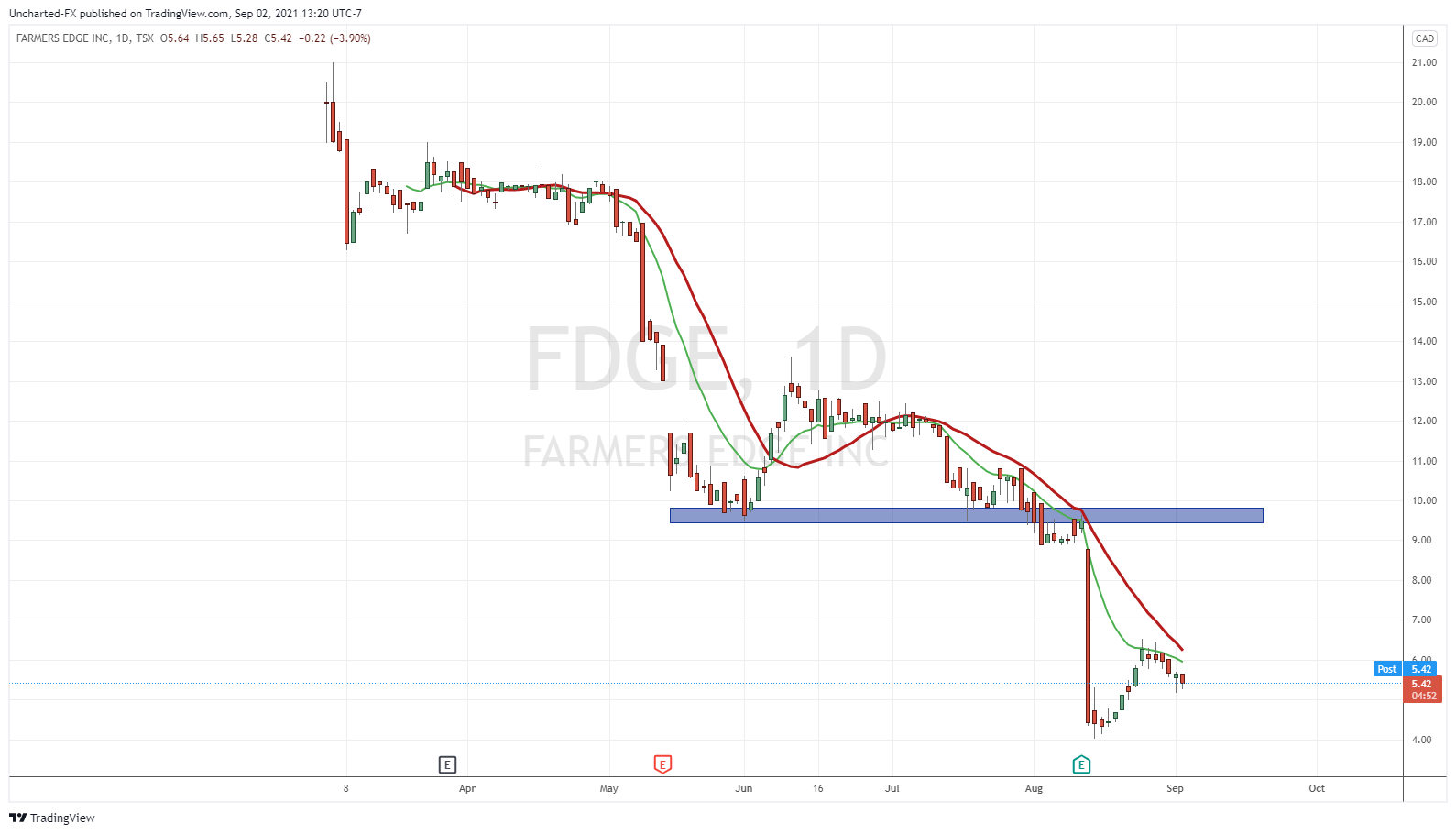

Farmers Edge (FDGE.TO)

Farmers Edge has been a recurring chart here on my Round Up. A lot of people want to buy this dip. In news this week, Farmer’s Edge and Merit Functional Foods have launched a pilot program aimed at improving the production, quality, traceability, and marketing opportunities of Canadian protein crops.

I highlighted our resistance zone at the $10.00 zone. We want to see that break before turning bullish. As a long term investor, if you pick some here, you are in good company with Prem Watsa and Fairfax. Ideally, we would like to see a basing pattern here…maybe even a double bottom.

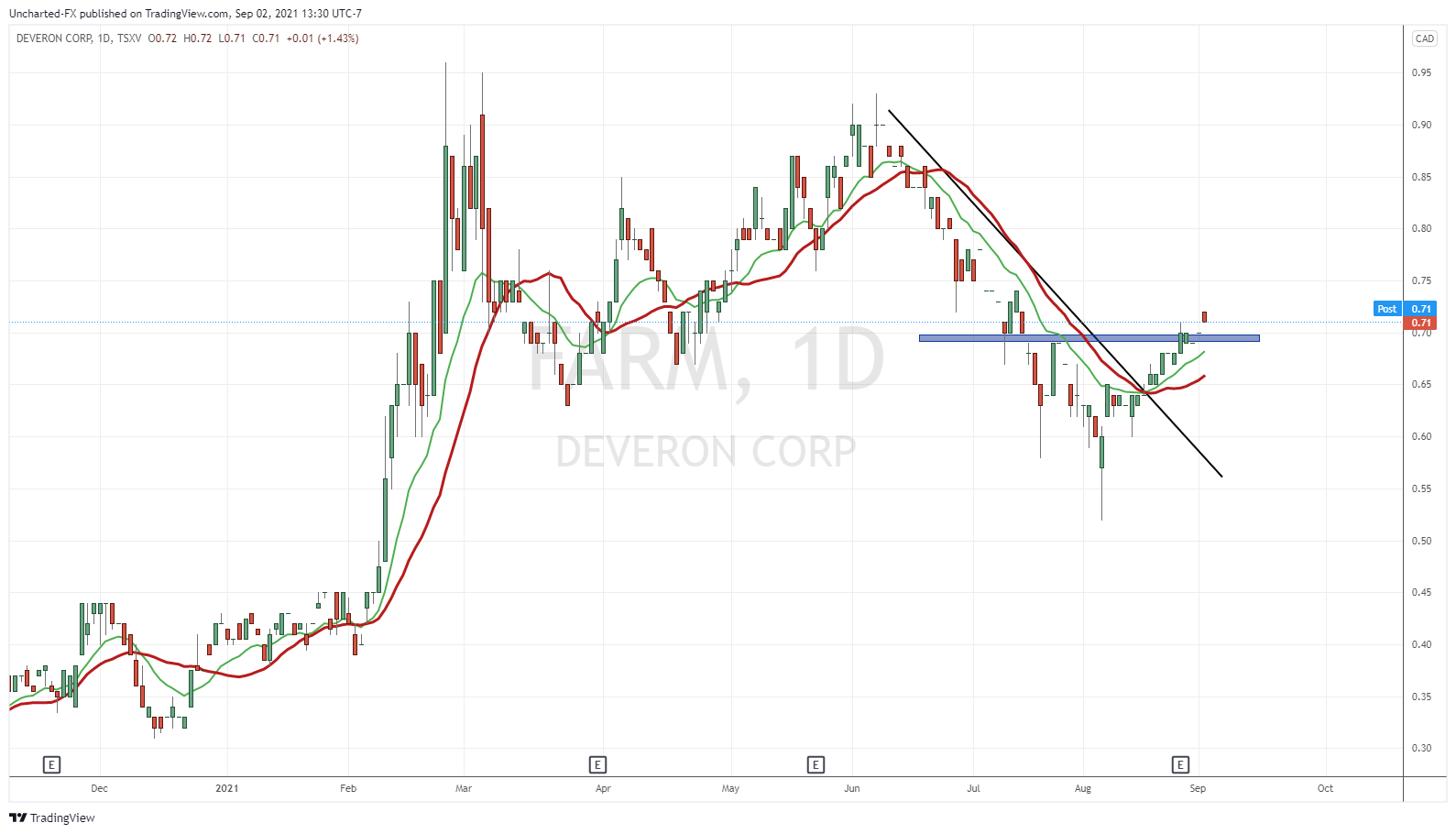

Deveron Corp. (FARM.V)

Lot of news from Deveron this week!

We had Record Revenue reported for Q2 2021 with a 63% YoY Revenue Growth. Here are some highlights:

- Revenue grew 63% year over year to $1,832,078 in Q2 2021, from $1,123,867 in Q2 2020

- The Company’s data insight solutions sales grew 71% year over year to $1,069,926 from $624,255 in Q2 2021

Deveron also acquired the assets of Stealth AG Inc, a digital agronomy company with offices in Minnesota and Iowa. The terms of the deal can be seen here.

We have a close above our resistance zone we have been watching for the past two weeks. $0.70 now turns from resistance to support or price floor. We remain above, and we stay bullish. The company did raise money, and saw an upsize to the Private Placement financing. Now it is about management using the cash to grow the company and provide catalysts. The acquisition of Stealth is a step in that direction.

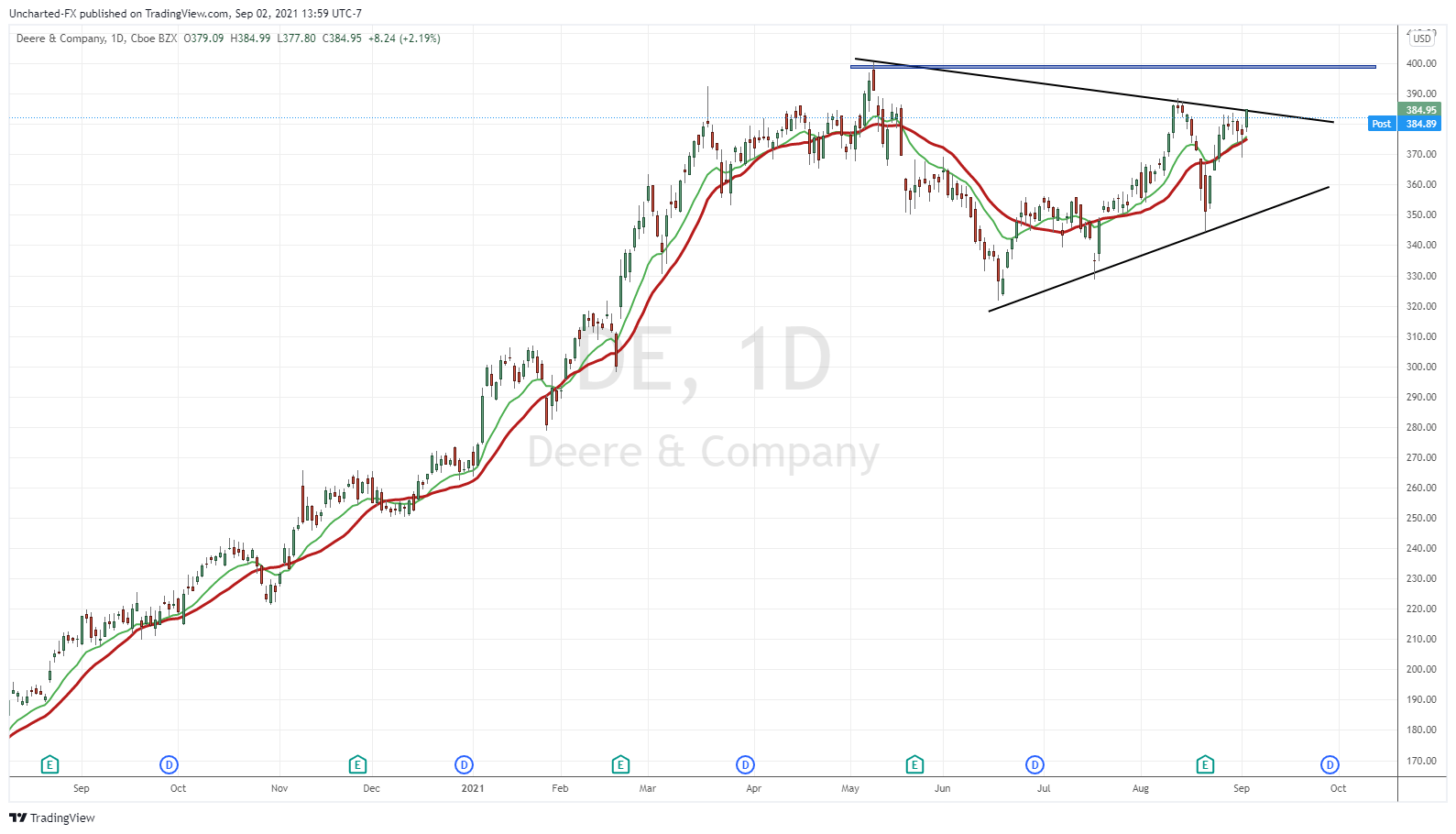

Deere (DE)

Let’s end off with Deere. Chart wise. After stellar earnings and an increase in dividends last week, more investors are looking at the stock as a solid value play. The chart remains in a triangle, and is at the upper limit of the triangle. If we get a close above, we then look to test the all time highs around $400…and if markets remain propped due to Powell and the Fed…we likely print record highs.