Medexus Pharmaceuticals (MDP.T) announced today that medac GmbH, the Company’s licensor for treosulfan, has received a Complete Response Letter (CRL) from the Food and Drug Administration (FDA) in response to its New Drug Application (NDA) for treosulfan.

Given the recent Health Canada approval, European Medicines Agency approval in 2019, as well as supporting data from more than 100 publications, we were all surprised by the FDA’s response. That being said, Medexus and medac look forward to continuing to work with the FDA to address their requests in a timely manner…,” commented Ken d’Entremont, CEO.

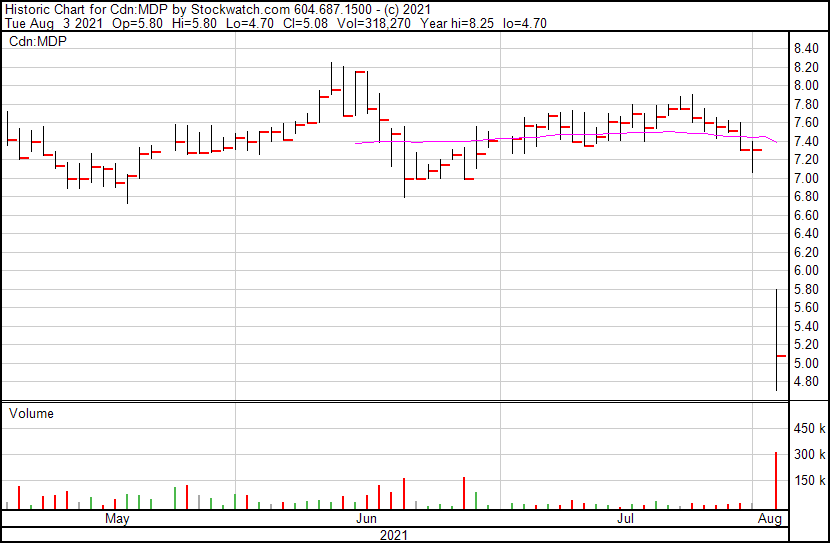

As you probably could have guessed, Medexus’ CRL does not bode well for Company. According to the CRL, the FDA has stated that it cannot approve Medexus’ NDA for treosulfan in its current form, causing the Company’s shares to plummet more than 30% following the news. With that being said, let me give you the rundown on treosulfan and what it is. Treosulfan is a medication intended to suppress bone marrow in preparation for a blood stem cell transplant. In combination with fludarabine, a chemotherapy medication used in the treatment of leukemia, treosulfan is used to provide conditioning treatment in adult and pediatric patients with acute myeloid leukemia (AML) and myelodysplastic syndromes (MDS).

With this in mind, the AML market is expected to reach a valuation of $18.3 billion by 2026, growing at a CAGR of 7.2% between 2021 and 2026. In 2019, the American Cancer Society (ACS) estimated that approximately 61,780 new causes of leukemia, and 22,840 deaths from leukemia would occur in the United States. Regarding AML, the ACS estimated that there would be around 21,450 new cases of AML, and approximately 10,920 deaths due to AML. Ultimately, this demonstrates the overwhelming prevalence of AML in the US, indicating a serious need for medications like treosulfan.

“…we remain optimistic for a future, albeit delayed, approval of treosulfan in the United States, complete with Orphan Drug Designation. The current standard of care is not suitable for numerous at-risk groups, due to the high toxicity effects, and treosulfan has demonstrated excellent survival data among those groups…,” continued Ken d’Entremont.

Both Medexus and medac were optimistic that a positive decision from the FDA in connection with a planned Prescription Drug User Fee Act (PUDFA) date on August 11, 2021, would allow for commercial launch of treosulfan in the US later this year. Unfortunately, as expressed in the CRL, the FDA has determined that it cannot approve the NDA of treosulfan in its present form. However, the FDA has provided recommendations specific to additional clinical/statistical data and analyses pertaining to the primary and secondary endpoints of the Company’s completed pivotal Phase III study.

So what’s the deal? Medexus’ isn’t the first company to have its NDA either rejected or unapproved by FDA. In fact, the FDA seems to be sending companies back to the drawing board left and right following its decision to approve Aduhelm, a medication intended for Alzheimer’s treatment, on June 7, 2021. Since then, the FDA has been under fire given the questionable evidence in support of Aduhelm, a drug developed by Biogen. Evidence generated in two clinical studies run by Biogen, left uncertain whether the drug actually helped improve the lives of people with Alzheimer’s. Moreover, the twin studies had originally failed, yet Biogen claimed success in one trial after reviewing additional data.

This is my own personal speculation, so please take what I am saying with a grain of salt. The bottom line is, Medexus has some work to do before the FDA can approve its NDA for treosulfan. Keep in mind, the Company’s revenues grew substantially to USD$79.7 million in 2021 compared to USD$55 million in 2020. Additionally, as of March 31, 2021, Medexus’ cash and cash equivalents were USD$18,704,000 compared to USD$5,233,000 year-over-year. With this in mind, despite taking a heavy blow from the FDA, Medexus has the potential to excel in the AML treatment market. The Company is now working closely with the FDA and, if successful, Medexus may be able to commercialize treosulfan in the US.

Medexus’ share price opened at $5.80, down from a previous close of $7.31. The Company’s shares are down -30.23% and are currently trading at $5.10 as of 12:01PM ET.

Medexus Pharmaceutical (MDP.T) readies for powerful year of growth in specialty pharma sector