On July 12, 2021 Globex Mining (GMX.T) agreed to sell its Tarmac Gold Property in Quebec to Wesdome Gold Mines (WDO.T) for a million dollars plus a 1% Gross Metal Royalty.

“With a total of 192 properties in the Globex project pipeline, 96 of which are prospective for precious metals, 60 for base and polymetallic metals, 36 for specialty metal metals (lithium, manganese, scandium, etc), there’s a lot of potential to incubate here,” wrote Equity Guru’s Greg Nolan on April 1, 2021.

“Management’s specialty is acquiring high-quality assets in well established mining-friendly jurisdictions, upgrading the asset by way of exploration and intellectual input, and monetizing said asset via options, outright sales, and royalties,” stated Nolan on September 12, 2020.

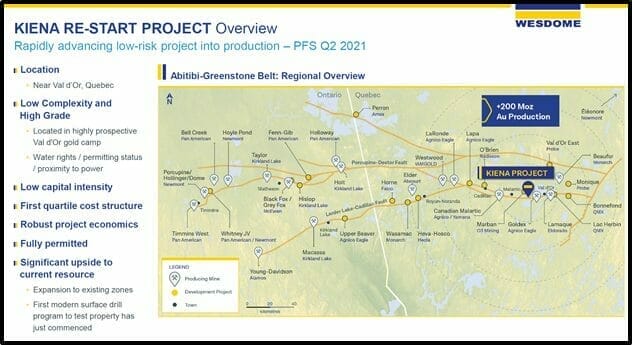

The Tarmac Gold Property consists of 6 claims covering 94 hectares located entirely within Wesdome’s Kiena Mine Complex and less than 2 kilometers northeast of the Kiena underground mine.

Globex drilled the Tarmac asset in 1996 returning gold intersections like TM-10 (14.22 g/t Au, 84.1 g/t Ag and 6.49% Cu over 1.2 m) and TM-24 (29.92 g/t Au and 22.4 g/t Ag over 2.24 m).

From Winsome’s P.O.V., this acquisition gives them the missing pieces to a jigsaw puzzle.

“The Property is surrounded on all sides by Wesdome claims,” confirms GMX, “thereby positioning the company to facilitate the potential exploration and advancement of these claims”.

What’s the upside for GMX?

A million bucks – that’s one thing.

The 1% Gross Metal Royalty could turn out to be a much bigger thing.

A Gross Metal Royalty “is based upon minerals recovered by a refinery or smelter from material originating from an optioned property. The percentage due is not subject to any costs what so ever”.

In other words, GMX would be paid from ounces-processed, not a profits or cash from sales. If GMX receives a suitcase full of gold bullion from Wesdome – and choses to hang onto it waiting for higher gold prices – it can do that.

What are the chances that the Kiena Mine Complex will become a producing asset?

Higher than you might think.

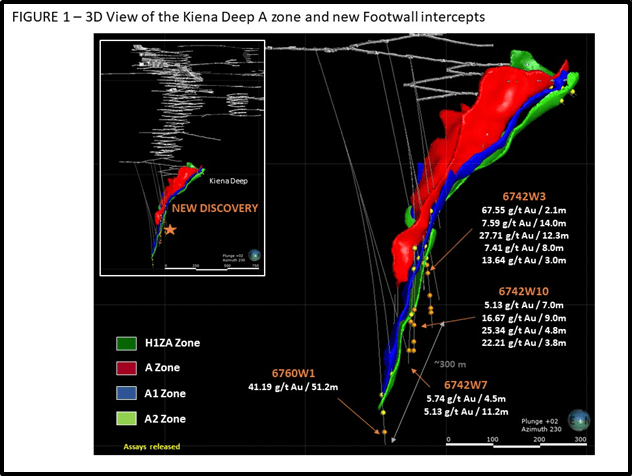

On May 19, 2021, Wesdome announced that it hit 41.2 grams/tonne gold over 51.1 metres Core Length, in the footwall of the Kiena Deep A Zone at the Kiena Mine Complex.

To paraphrase my favorite felon, Martha Stewart: “That’s a good thing.”

“Up to now, only 6 holes passed through the lithologies containing gold mineralization of the Footwall Zone,” stated WDO, “Given the limited drilling, it is difficult, at this time, to determine an exact number of new lenses forming the corridor of the Footwall Zone”.

“The orientation, dip and geometry of these new lenses are still not known with sufficient certainty to determine the true widths,” continued WDO, “The Footwall Zone corridor remains open laterally and down plunge”.

“The location of new gold intercepts in recent holes suggest that Footwall Zone extends over 300 m along plunge,” concluded WDO, “The deepest hole returned 41.2 g/t Au (uncapped) over 51.2 m core length.

Footwall Zone Drilling

Highlights of the recent drilling are listed below

- Hole 6760W1: 41.2 g/t Au over 51.2 m core length (25.7 g/t Au capped)

- Hole 6742W3: 27.7 g/t Au over 12.3 m core length (27.7 g/t Au capped)

- Hole 6742W10: 16.7 g/t Au over 9.0 m core length (14.9 g/t Au capped)

Highlights of the recent A Zone drilling are listed below

- Hole 6750: 122.1 g/t Au over 7.5 m core length (26.7 g/t Au capped, 4.7 m true width) A Zone

- Hole 6742W3: 96.1 g/t Au over 8.0 m core length (47.4 g/t Au capped, 7.1 m true width) A1 Zone

- Hole 6735: 24.5 g/t Au over 17.3 m core length (21.1 g/t Au capped, 7.0 m true width) A1 Zone

“This new discovery could have major positive impacts on the project, in particular on the next updated mineral resource estimate, the number of ounces per vertical meter, and on global economic characteristics of the project,” stated Mr. Duncan Middlemiss, President and CEO of Wesdome.

“Additionally, the recent A Zone high grade intercepts inside and outside of the current A Zone resource block model shows the potential to expand the current resource estimate,” added Middlemiss.

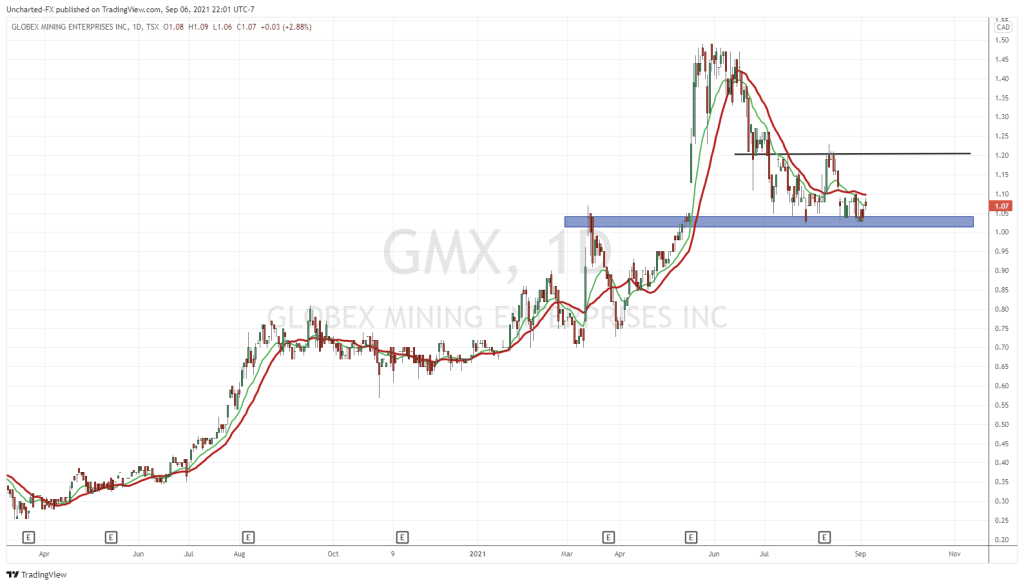

WDO’s share price spiked after publication of the May 19, 2021 drill results.

One week later, Wesdome announced positive results from the independent Pre-Feasibility Study (PFS) at its 100% owned Kiena Complex in Val d’Or, Quebec.

Highlights of the PFS are outlined below are based on a conservative gold price of us$1,600 ($200/ounce lower than it is now).

All figures are in Canadian dollars unless otherwise stated:

- After-tax NPV 5% of $367 million at US$1,600 per ounce gold, increasing to an after-tax NPV 5% of $491 million at US$1,900 per ounce gold using CAD/USD exchange rate of $1.32

- Internal Rate of Return of 98% and after-tax payback period of 2.7 years

- Average annual gold production of approximately 84,000 oz per year, with peak production over 115,000 oz in 2025; over 100,000 oz per year run rate expected in 2024

- LOM average cash costs of $502/oz (US$380/oz) and all-in sustaining costs (“AISC”) of $894/oz (US$676/oz)

- Life of mine capital of $230 million ($68 million spent in 2021) fully funded by existing liquidity and operating cash flows

- Average annual free cash flow (2022-2027) of $85.5 million at US$1,600 per ounce gold or $109.5 million at US$1,900 per ounce gold

Based on the results of the PFS, the Board of Directors of the Company has made a restart decision for the Kiena Complex, beginning immediately.

“When I first chatted with Jack Stoch, Globex Mining’s president and CEO, I must confess to being somewhat overwhelmed by the sheer number of properties in his project pipeline,” stated Equity Guru’s Greg Nolan on April 1, 2021.

“Stoch’s approach involves acquiring properties dirt cheap, advancing them using good science and intellectual input, and monetizing them via options, outright sales, and royalties. If you look at his deals, they very often include an upfront cash component and/or marketable securities,” added Nolan, “This is how Stoch keeps his treasury topped up and the share count low”.

WDO’s objective is to build an intermediate gold producer, producing 200,000+ ounces from two mines in Ontario and Quebec.

The Kiena Complex is a fully permitted former mine with a 930-metre shaft and 2,000 tonne-per-day mill, and a restart of operations was announced on May 26, 2021.

WDO has a current market cap of $1.7 billion.

It is a potential take-over target for a major gold company.

If that happens, Globex’s Tarmac Gross Metal Royalty may end up being bought out at a premium.

– Lukas Kane

Full Disclosure: Globex Mining is an Equity Guru marketing client.