China is spooking the stock markets. It seems like a long time since I have said this. Remember the pre-pandemic days when the stock markets moved on anything US-China related? We had a “very good” deal, and then even a phase 1 deal. Literally just for cameras and both sides to save face, while China just agreed to purchase more soy.

Well China is back, and the US-China trade war might be going down a whole new path. A financial war (although many, me included, have said we have been in a financial war for China way before the trade war). But let’s start at the beginning.

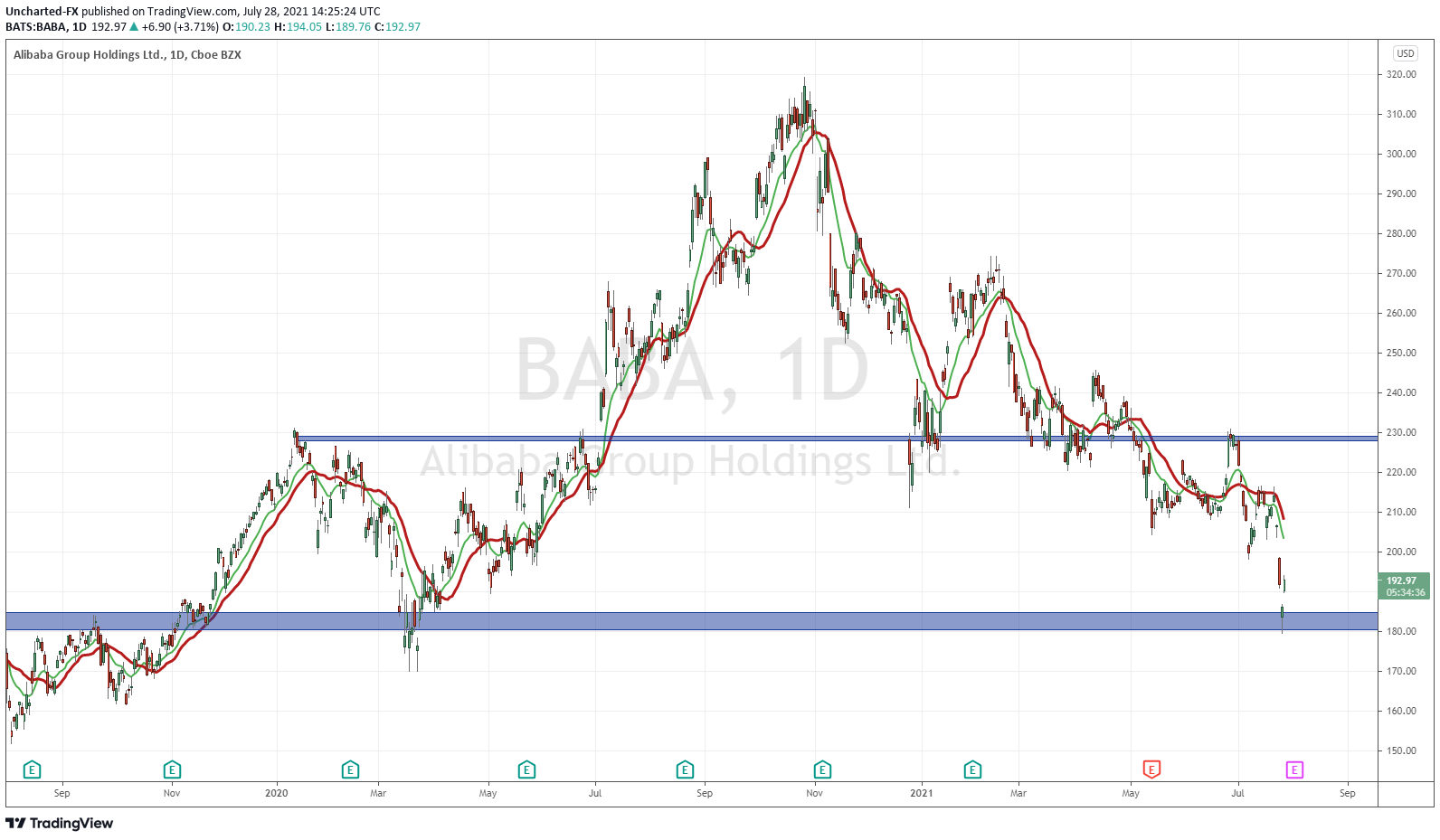

The Chinese Communist Party (CCP) has been cracking down on big tech. It began a few months back with Ali Baba (BABA) and slapping a $2.8 Billion antitrust fine. Jack Ma even disappeared for a bit, but then re-appeared. There are a lot of rumors about that. Use your imagination. The CCP’s actions even gained some praise from Warren Buffett’s Berkshire Hathaway partner Charlie Munger, saying the US can learn from Communist China when dealing with Billionaires. The actions on BABA was a sign of what was coming down the pipeline.

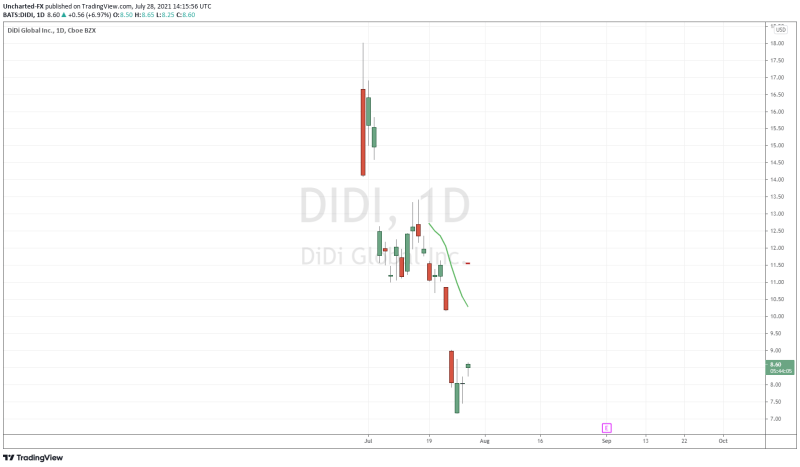

And then Didi. The Chinese Uber which recently IPO’d on US markets. This is what happened.

DIDIsaster as some have called it.

Now bear with me on some stock market lessons. Chinese companies love the US capital markets. Many of them IPO’d and listed on US exchanges in order to raise a bunch of money. US investors gobbled them up. I remember my first trades back in 2012. Chinese stocks were the hot thing. Some of the PE ratios were outstanding. I remember investing in these companies at bargain prices believing nobody was seeing these numbers.

Then it turned out the numbers were all fake. China does not adhere to GAAP principles. They have their own way of accounting. I highly recommend the documentary “The China Hustle”. It may still be on Netflix, but I will put a Youtube link under this paragraph. Watch it before it gets removed. It details how a hedge fund realized all these valuations of Chinese companies were fake. They went to China to look at these paper companies valued in the millions but whose factory was literally taking in one delivery truck per month, and was in crappy condition. But Chinese accounting made it seem otherwise. Wall Street likely knew, but they were making a quick buck getting these companies on US exchanges. In the end, it was the US middle class investors who lost out by believing these unbelievable valuations and putting their life savings in them.

Basically you need to understand that US capital markets are open. We allow Chinese companies to come and list and raise money. US companies cannot do the same in China. In fact, the average investor cannot invest or trade domestic Chinese stocks. This is a big talking point in the trade war between the US and China. China has a closed current account. Money can flow in, but cannot flow out. US corporations like Tesla, Apple et al, that do business in China have difficulties taking the cash out and bringing it back to the US. Hence the US government cannot tax those profits, meaning that tax revenue cannot be used by the US government to help the middle class and the poor with spending on education and healthcare and all that good stuff. Most of that money stays in China, so US corporations have two choices: either just hold US Dollars that do nothing, or use the profits to try and increase business in China. They tend to do the latter, which means helping build up China’s infrastructure. This is largely what the trade war is about.

China is not likely to allow money to move freely across their borders not because they want to prevent corporations from removing money, but Chinese citizens. When they experimented relaxing capital controls in 2012, we saw the Chinese people taking their money out of China. As far away as possible from the CCP. It can be said with pretty good confidence that relaxing capital controls would cause a huge exodus of money. Money still trickles out. You all have heard about how Chinese citizens get their money out in excess of the official $50,000 China allows on a yearly basis. It tends to include buying assets in foreign countries.

Back to the DIDIsaster. Why has China all of a sudden clamped down hard on tech companies? Access to US capital markets are the “goose that lays the golden egg”. Why would Beijing kill this? This is precisely what has markets nervous. Even seasoned Wall Street traders are now taken by surprise. The paranoia is running rampant.

It did not end with DIDI. Just last week, China cracked down on Education Technology. Some are calling these crack downs the beginning of a new financial war with the US. Education technology is quite popular as many westerners did go to China to set up English teaching businesses.

One of my favorite analysts on China is Hedge Fund manager Kyle Bass. I have been listening to his thoughts on China and Hong Kong for years. He has called all of this. His take on Beijing killing the golden goose that is the access to US capital markets is a bit worrying:

“One of the biggest questions plaguing American investors since China rug-pulled the Didi listing is why would Beijing kill the “goose that lays the golden eggs” that is access to American capital markets. Bass explained that right now, maintaining stability and order at home are much greater priorities since China still has nearly 1 billion people living in poverty, according to Bass.”

“I believe it’s bigger than just China…given the global financial crisis in ’08 and the virus crisis of the last couple of years we’ve seen central banks expand their money aggressively…what’s happening is…the difference between the asset prices moving up, the middle class can’t reach up because asset prices are moving too quickly…this is fundamentally core to what China is struggling with. They have 400MM people in the middle class, but they still have nearly 1 billion people in abject poverty. All of this is rooted in the amount of central bank expansion globally…and now what you’re seeing them doing is the government now has total control…it all started with Ant Financial and now it’s moving into tech into education…I talk to some of my friends who are asset managers and they are finally starting to pull out of Hong Kong…this is just the beginning.”

“No one believes China’s numbers are real…people do believe they will continue to print fake numbers and it will look like growth…on the audits themselves, there are no audits. To this day, there is no audit that’s reliable on a Chinese firm,” Bass said.

So the shocking thing is the domestic issue in China that Bass thinks is occurring. There are many who believe China’s debt issue is worse than that of the US. That one day, China will have their 2008 credit crunch. Which will impact the world. Perhaps, but it really is tough to gauge given the limited information, or maybe even false data, that we have access too.

What caught my attention is Bass saying Hedge Fund managers are pulling out of Hong Kong and China. We have even seen Cathie Wood sell off ARK’s Chinese holdings such as Tencent, KE Holdings, and JD.com. Bass says that US traders were blinded by the promise of access to Chinese domestic markets. That one day, China would relax their capital controls and allow access to Chinese markets just as the US allows for pretty much everyone in the world. But it hasn’t/isn’t happening. They seem to be listening to Bass now. The CCP seems to be tightening control even more.

Technical Tactics

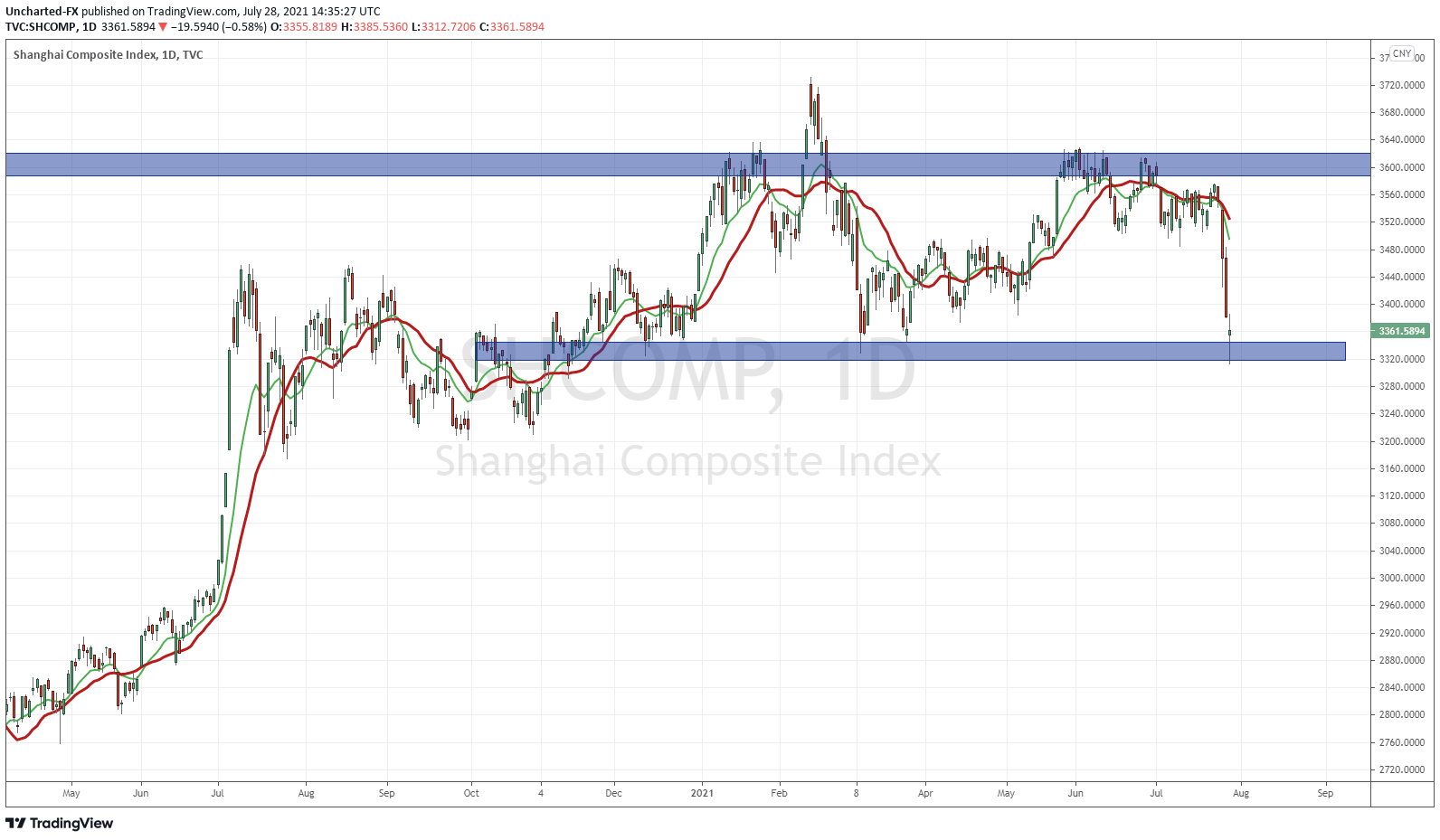

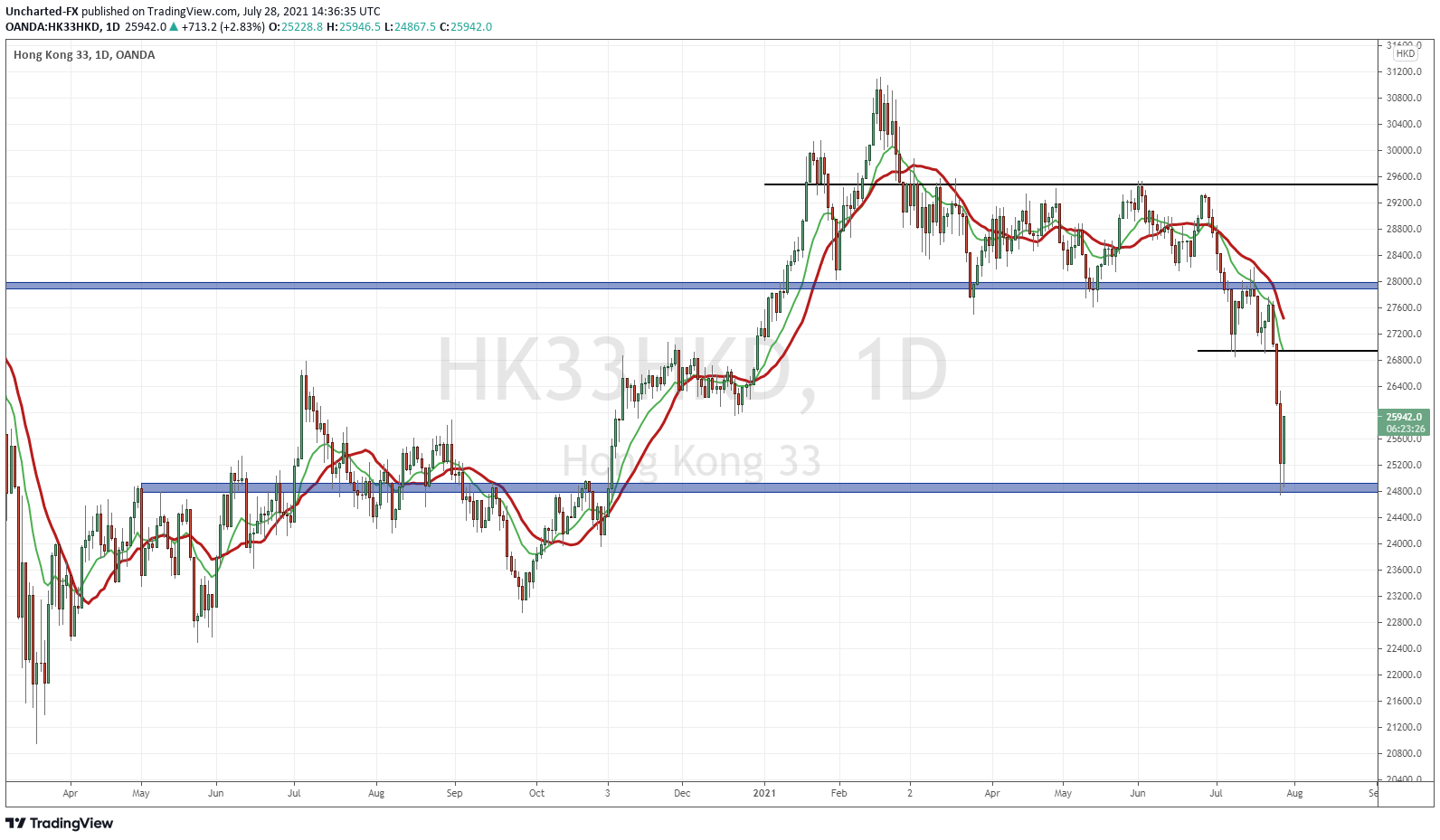

While US markets were popping recently, Chinese markets were taking a hit. Both the Shanghai Composite Index, and the Hang Seng have been falling hard. Some relief today largely thanks to China’s own version of the Plunge Protection Team, but in the past two days we have seen a 4% per day draw down on the Hang Seng and even a 6% decline on the Shanghai Composite Index.

Both indices have now hit major support. I expect a bounce on China stocks (more on this below), and the fear to subside. The reversal still has some ways before we are out of the trouble zone, so I will keep my eyes on these indices.

You should too. Watch the Chinese markets. We are seeing a divergence between US and Chinese stocks. World equity markets have tended to rise together. What this means is either Chinese stock markets will have to catch up, in other words, rebound hard (trade the China 50, Emerging Markets, or the Hang Seng if you can), OR US markets will drop to catch up to Chinese stock markets. It leads back to the big question: what market leads and what lags especially since Chinese markets are open first on a weekly basis before the US markets.

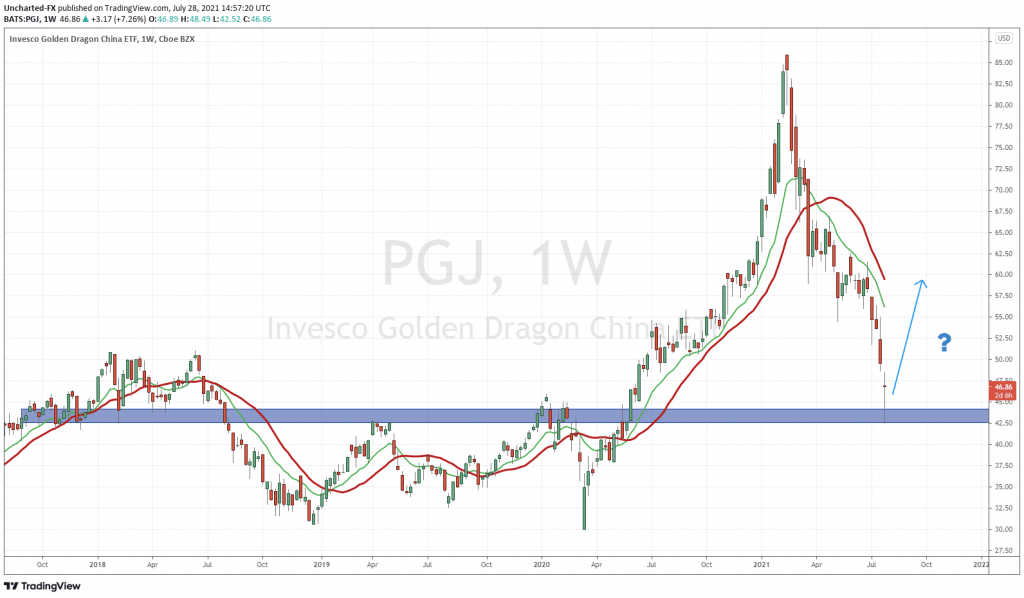

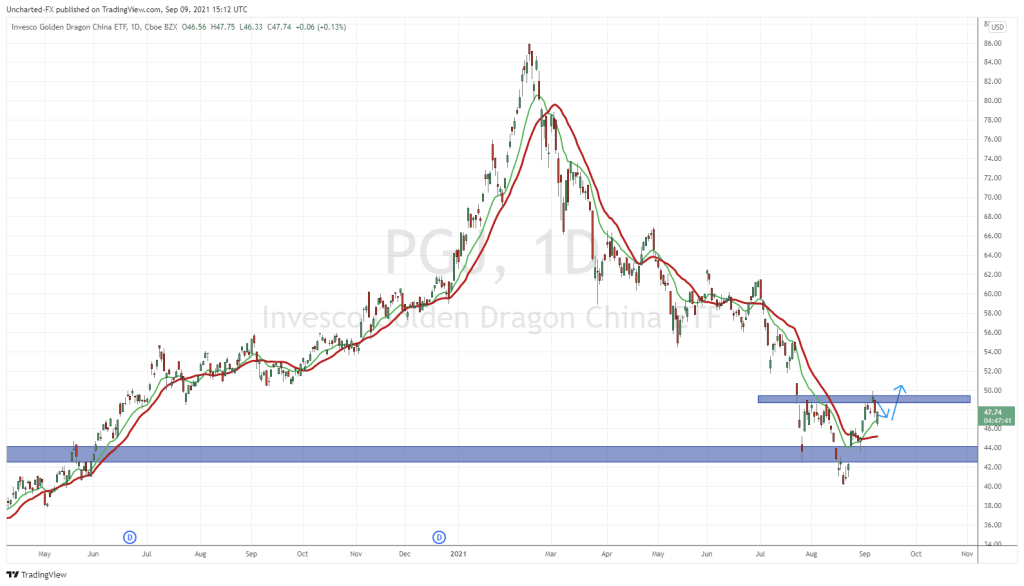

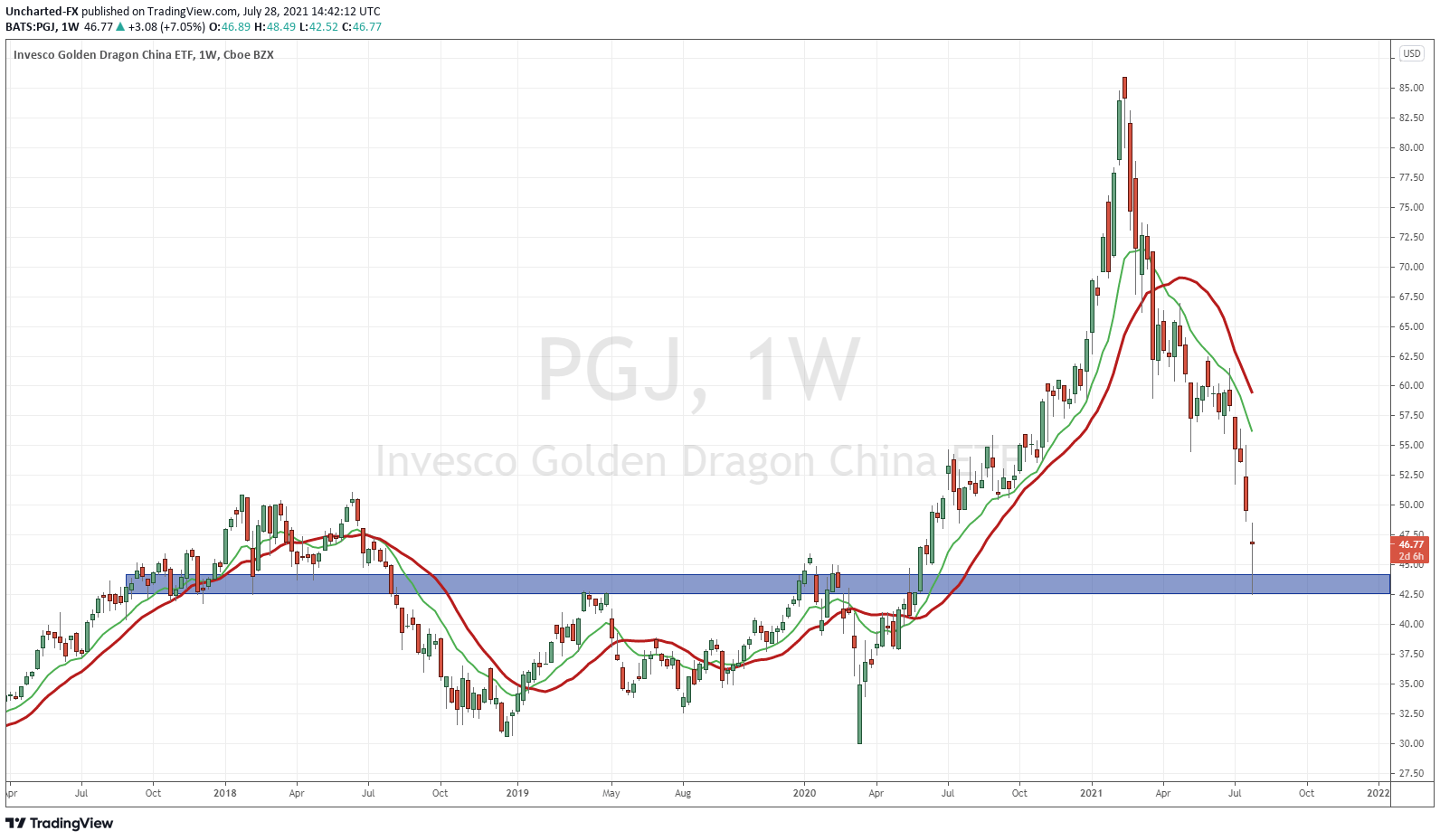

I want to keep all of my readers and members of our Discord channel ahead of the curve, so I want you to all watch this chart going forward. The Golden Dragon Index or the ticker PGJ. A really cool name if I say so myself. This index is composed of all US listed companies that are headquartered or incorporated in China. It recently has suffered the largest 2 day loss since 2008. So yes, there is some reason to be a bit cautious.

PGJ has hit a major flip zone (an area that has been both support and resistance). Buyers are stepping in. Expect to see a bounce in Chinese stocks such as BABA, JD, TME etc. We will watch to see if a true reversal pattern triggers. But so far, it is off to a good start!

In a trading week where we have major earnings, and the Federal Reserve, we must also add geopolitical risk. The US and China resumed high-level talks on Monday. If you recall, back in March 2021, the Chinese delegates had a heated argument with the new Biden team up in Alaska. The meeting this week did not go too well. It was ‘tense’ and Chinese delegates said the relationship with the US is “ now in a stalemate and faces serious difficulties”. Apparently the Chinese had a list of issues and demands for the US. Some have used the word “threats”.

This geopolitical risk is not going anywhere, and I think this leads to Stock Market volatility down the road. Right now everyone is focused on the Fed and Inflation either being transitory or not, as well as earnings and forward guidance. Ray Dalio has warned about this Thucydides trap, when a declining power is feeling threatened by a rising power. In human history, over 70% of past Thucydides Trap situations have led to shooting wars. The US and China are already in a technology war, a financial war, a trade war…hopefully we do not go into a shooting/cyber war. I have read many geopolitical books on this relationship, and I must say I am worried about the future between these two super-powers. But that will be a post for some other day…or you can read my rants on my social media.